Press release

The term of loans correlates with gender of borrowers

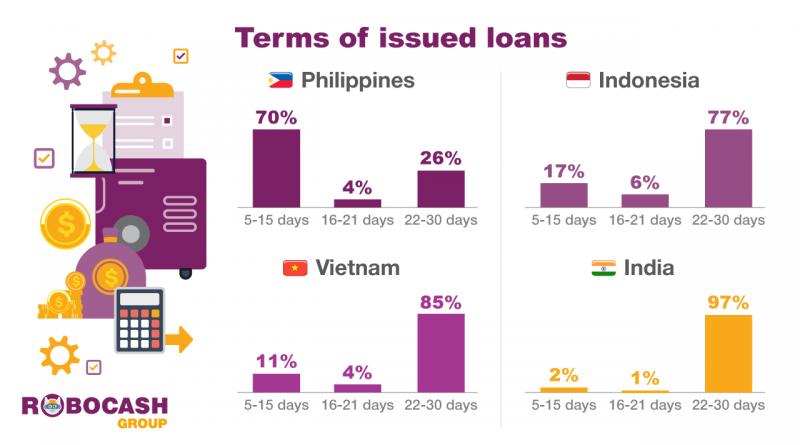

According to the study conducted by Robocash Group in India, Vietnam, Indonesia and the Philippines, most customers take loans for a period of 22 to 30 days. In Vietnam, India and Indonesia the share of such borrowers amounts to 85%, 97% and 77% respectively. In the Philippines, this period is requested by 26% of customers, while loans for up to 15 days are in demand among 70% of customers.The financial holding revealed the ratio of men and women among its borrowers. According to the findings, men prevail in the number of customers in India (87%), Vietnam (72%) and Indonesia (58%). In the Philippines, men comprise only 32% of customers compared to 68% of women. At the same time, these countries have a comparable ratio of men and women among the population. According to The World Factbook, last year, this ratio was 1.08/1 in India and 1.01/1 — in the Philippines.

The analysts of the company see two reasons for that. First, India and Vietnam have lower Internet penetration compared to Indonesia and the Philippines. Recent findings state that India has only 41% of the population active on the Internet, Vietnam — 55%, Indonesia — 56% and the Philippines — 71%. “With higher Internet penetration, we see an increase in the number of women using the Internet as a means of shopping, earnings and financial transactions,” — experts say.

Moreover, in Indonesia and the Philippines distinguished for low access to banks due to the territorial fragmentation, women tend to show greater independence when the access to other opportunities to cover existing family and personal financial gaps is limited.

At the same time, there is a direct correlation of the difference in gender with other characteristics of issued loans. In particular, it affects the terms of loans. Thus, loans for a period of 22 to 30 days are most popular in India (97%), Vietnam (85%) and Indonesia (77%). The lowest demand in these terms is in the Philippines (26%), while loans for up to 15 days are requested by 70% of customers there. The reason is that women, who are more inclined to consume here and now, are at the same time more pragmatic than men. Thus, women try to close existing liabilities as quickly as possible.

ROBOCASH GROUP

Duntes iela 23A, Rīga, LV-1005

Presscontact

Alyona Sedova

Public Relations Manager

a.sedova@robo.cash

pr@robo.cash

Robocash Group is an international financial group operating in the segments of consumer alternative lending and marketplace funding in Europe and Asia. The company develops robotic financial services providing lending to customers in Russia, Kazakhstan, Spain, the Philippines, Indonesia, Vietnam and India and operates the own EU-based p2p investment platform. The group develops products completely in-house using artificial intelligence, machine learning and data-driven technologies to provide precise and comprehensive risk management, comfort and speed for customers and efficiency for business.

robocash.group/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The term of loans correlates with gender of borrowers here

News-ID: 1775589 • Views: …

More Releases from Robocash Group

Online customers in Asia prefer Asian-made gadgets

Samsung is one of the most popular mobile phone brands among customers of online financing services in the Philippines, Indonesia, Vietnam and India. Mobile devices made in China like Xiaomi, Vivo, OPPO are taking second and third places by the popularity in these four countries. At the same time, Apple is leading in Vietnam only. These are the findings of the study conducted by the international financial holding Robocash Group.

The…

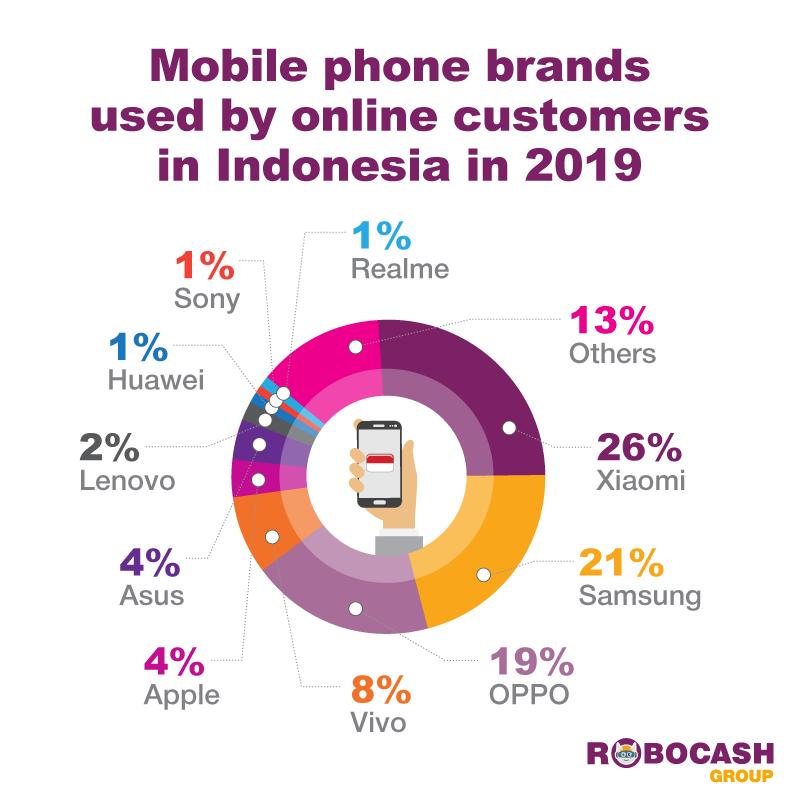

Online customers in Indonesia prefer Xiaomi, Samsung and OPPO

66% of customers who used online services providing funding facility in Indonesia prefer smartphones of the three mobile brands. Thus, 26% of customers use Xiaomi mobile devices. Samsung (21%) and OPPO (19%) take second and third places, respectively. These are the findings of the study conducted by the international financial holding Robocash Group. The figures have been based on the data of more than 78 thousands unique customers who have…

One-third of online customers in Vietnam prefer Apple

34% of customers of online services providing personal financing in Vietnam prefer Apple mobile devices. Samsung takes second place with 27% of customers using its smartphones. OPPO follows with 17%. With the overall share of 78% split by these three companies, other brands are lagging significantly. These are the findings of the international holding Robocash Group after studying the data of more than 337 thousands unique customers who have used…

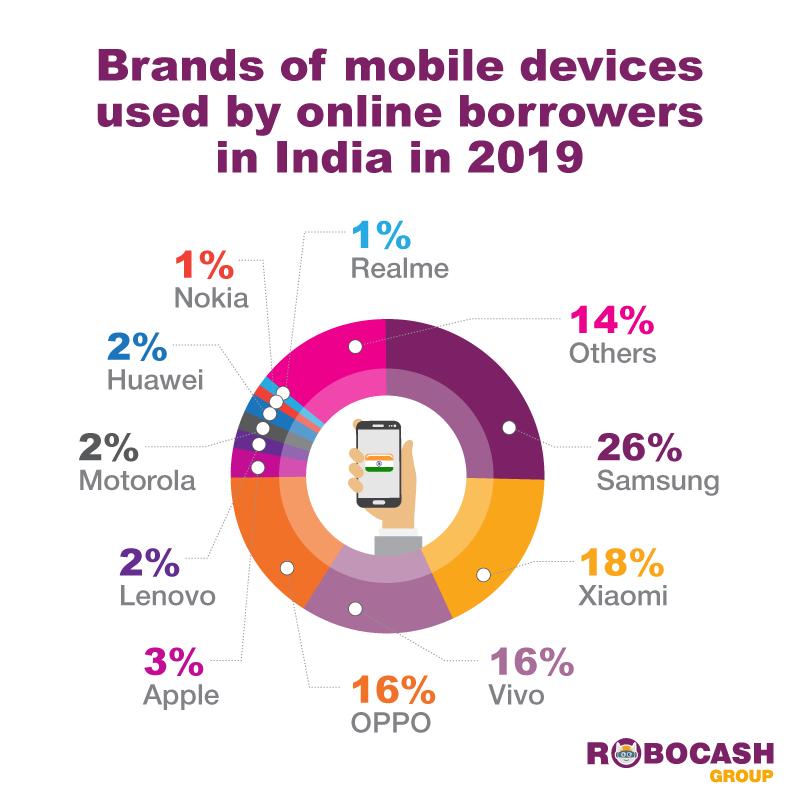

Online borrowers in India mostly use Samsung, Vivo, Xiaomi and OPPO

76% of customers applying for personal loans online in India prefer smartphones of the four mobile phone brands. Samsung is leading with 26% of customers using its devices. It is followed by Vivo (18%), Xiaomi (16%) and OPPO (16%). These figures have been based on the data of more than 156 thousands unique customers of the alternative lending holding Robocash Group in India who used the company’s local lending service…

More Releases for Philippines

Philippines Contact Cement Market

Market Overview

Contact cement is a flexible acrylic adhesive that may be used on rubber, wood, bond tile, leather, metal, Formica, and most plastics. It stays flexible after curing and makes an excellent shoe glue. Contact cement may be applied to almost anything, although it works best on nonporous materials that conventional adhesives cannot adhere together.

Plastics, veneers, rubber, glass, metal, and leather all react well to contact cement. It is…

Philippines Quick Service Restaurants Market Size Is Likely To Reach Around $7.9 …

The Philippines quick service restaurants market has been continuously improvising in terms of product offerings, number of outlets, hospitality and other perks regarding prices that attracts a higher number of customers. Over the years, the Filipinos, specifically the millennials, have been open to different types of innovative food products due to increase in influence of westernization among the target customers. Considering this customer perception, some of the key players in…

Major Players in Philippines Auto Finance Market | Auto Loan Market Philippines …

Rising Innovation: Innovative digital startups such as iChoose.ph are reshaping the challenging car shopping and financing process into a quick and easy experience for customers in Philippines. It is expected that these will create an auto finance ecosystem in which digital aggregators increasingly control the sales and financing process. Car dealerships are expected to increasingly bring the experience of car shopping online by range of ways such as providing…

Philippines E-Commerce Logistics Market | Competitors in E-Commerce Logistics Ph …

Key Findings

Singapore-headquartered e-commerce player Shopee launched an in-app, live-streaming platform in the Philippines through which sellers can build a following to promote their products and offer discounts to viewers. This platform proved to be a success during the pandemic as it recorded 30m live stream views in April 2020.

E-commerce players can look forward to collaborate with brick-and-mortar retailers to provide consumers low-cost delivery options, as has been done in other…

Philippines Used Car Market

Philippines Used Car Market is expected to Gain Momentum from the Emergence of more Organized Players in the future along with Covid incited Surge in Demand: Ken Research

The used car market structure in Philippines is expected to be consolidated in the future as the market share of players selling vehicles via organized channel is expected to surge. This will be mainly on account of transparent and fair used car dealings/trading…

Philippines Quick Service Restaurants Market Booming Segments; Investors Seeking …

Philippines Quick Service Restaurants Market by Food Type, and Nature: Philippines Opportunity Analysis and Industry Forecast, 2019–2026,” The Philippines quick service restaurants market size was valued at $4.6 billion in 2018, and is expected to reach $7.9 billion by 2026, registering a CAGR of 6.9% from 2019 to 2026.The burger/sandwich segment was the highest contributor to the market, with $1.7billion in 2018, and is estimated grow at a CAGR of…