Press release

Women in the Philippines apply for financing more than twice as often as men

Women apply for alternative financing solutions nearly more than twice as frequent as men, according to own statistics of Robocash Group in the Philippines. At the same time, with an opportunity to visit offline outlets, 61% of all customers prefer to apply online that corresponds with the overall activity of Filipinos on the Internet.The Philippines has been the first market in Southeast Asia for the international financial holding Robocash Group. Since the launch in October 2017, its affiliated lending company Robocash Finance Corp. has served more than 400 thousand customers.

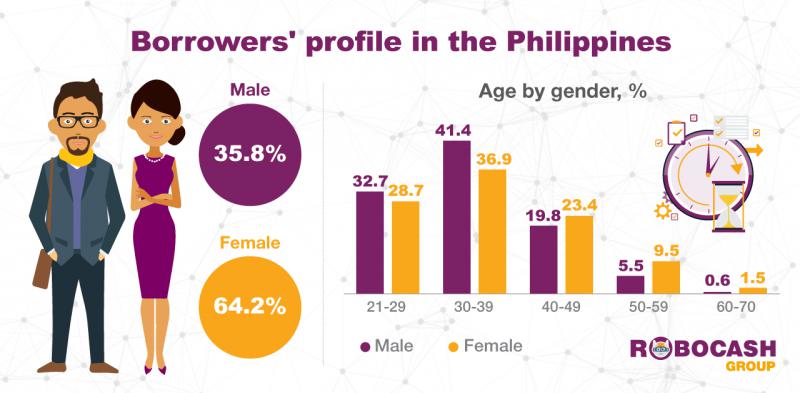

In overall, the own figures of Robocash Group in the Philippines correspond with the recent report “Digital 2019” stating that Filipinos are the first in the world by the time per day spent online. With an opportunity to visit offline outlets, 61% of all customers of Robocash.ph prefer applying online. Remarkable is that 90% of them use mobile Internet to access the service. It is the highest rate compared to figures of other companies of Robocash Group in Southeast Asia. Then, similar to the overall predominance of female online transactions in the Philippines (12% vs. 8%), Robocash figures show that women apply for an advance almost more than twice as often as men do. Thus, 64% of all applicants are women.

The largest number of customers are in the age of 30-39 years (39%) and 21-29 years (30%). Predominantly, they work in private companies (63%). Far less customers are freelancers (15%) and government employees (7%). An average income amounts to PHP 25,053 (~USD 480). Most commonly, granted financing serves as additional business capital, helps customers to pay for emergency and daily allowances, pay bills or cover education expenses.

Commenting on the findings, Sergey Sedov, Founder and CEO at Robocash Group said, “Communicating closely with customers, we clearly see the gaps in access to banks and financial services. Despite distinct improvements in this direction, there are still many people without full and fast access to financing. Nevertheless, we are positive about the contribution of digital adoption to inclusive growth both in the Philippines and throughout Southeast Asia. Fintech has already become a game changer for the region”.

---

About:

Robocash Group is an international financial group operating in the segments of consumer alternative lending and marketplace funding in Europe and Asia. The company develops robotic financial services providing lending to customers in Russia, Kazakhstan, Spain, the Philippines, Indonesia, Vietnam and India and operates its own EU-based investment platform. The group develops products completely in-house using artificial intelligence, machine learning and data-driven technologies to provide precise and comprehensive risk management, comfort and speed for customers and efficiency for business.

https://robocash.group/

Robocash Group

Duntes iela 23A, Rīga, Latvia, LV-1005

Presscontact:

Olga Davydova

Head of Media Relations

pr@robo.cash

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Women in the Philippines apply for financing more than twice as often as men here

News-ID: 1748962 • Views: …

More Releases from Robocash Group

Online customers in Asia prefer Asian-made gadgets

Samsung is one of the most popular mobile phone brands among customers of online financing services in the Philippines, Indonesia, Vietnam and India. Mobile devices made in China like Xiaomi, Vivo, OPPO are taking second and third places by the popularity in these four countries. At the same time, Apple is leading in Vietnam only. These are the findings of the study conducted by the international financial holding Robocash Group.

The…

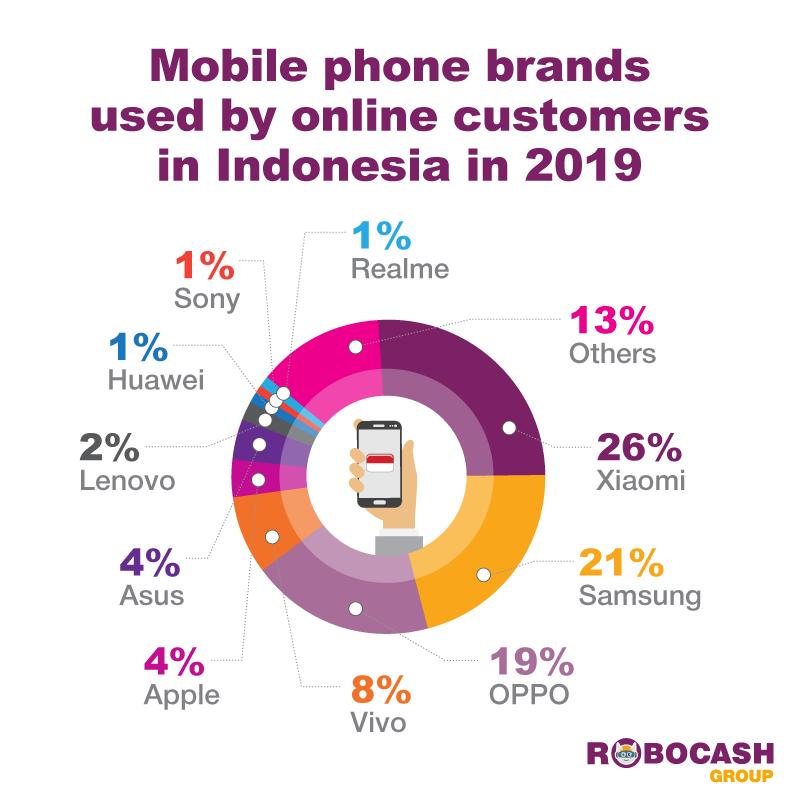

Online customers in Indonesia prefer Xiaomi, Samsung and OPPO

66% of customers who used online services providing funding facility in Indonesia prefer smartphones of the three mobile brands. Thus, 26% of customers use Xiaomi mobile devices. Samsung (21%) and OPPO (19%) take second and third places, respectively. These are the findings of the study conducted by the international financial holding Robocash Group. The figures have been based on the data of more than 78 thousands unique customers who have…

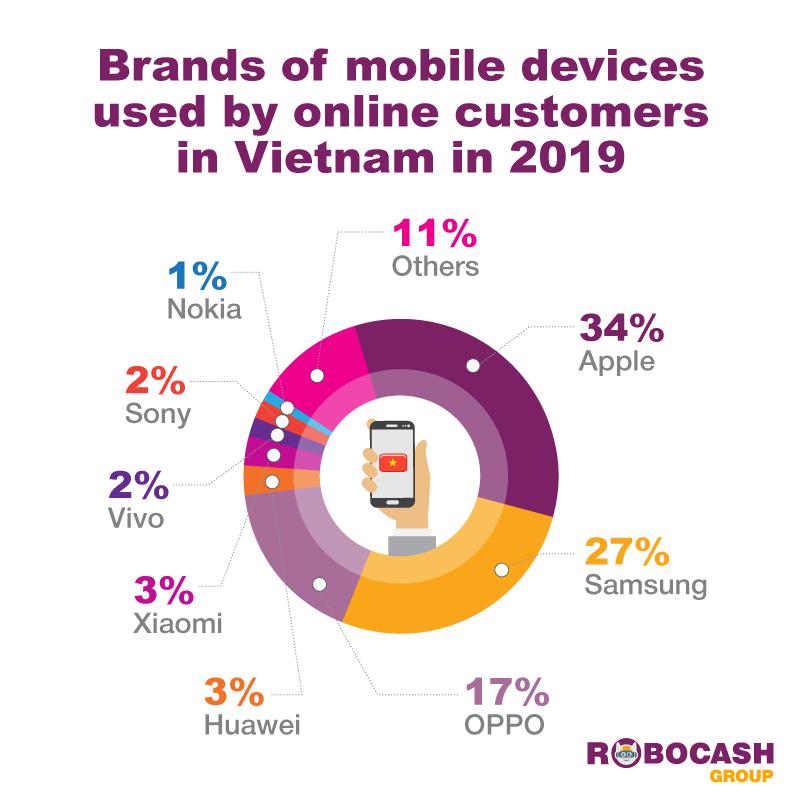

One-third of online customers in Vietnam prefer Apple

34% of customers of online services providing personal financing in Vietnam prefer Apple mobile devices. Samsung takes second place with 27% of customers using its smartphones. OPPO follows with 17%. With the overall share of 78% split by these three companies, other brands are lagging significantly. These are the findings of the international holding Robocash Group after studying the data of more than 337 thousands unique customers who have used…

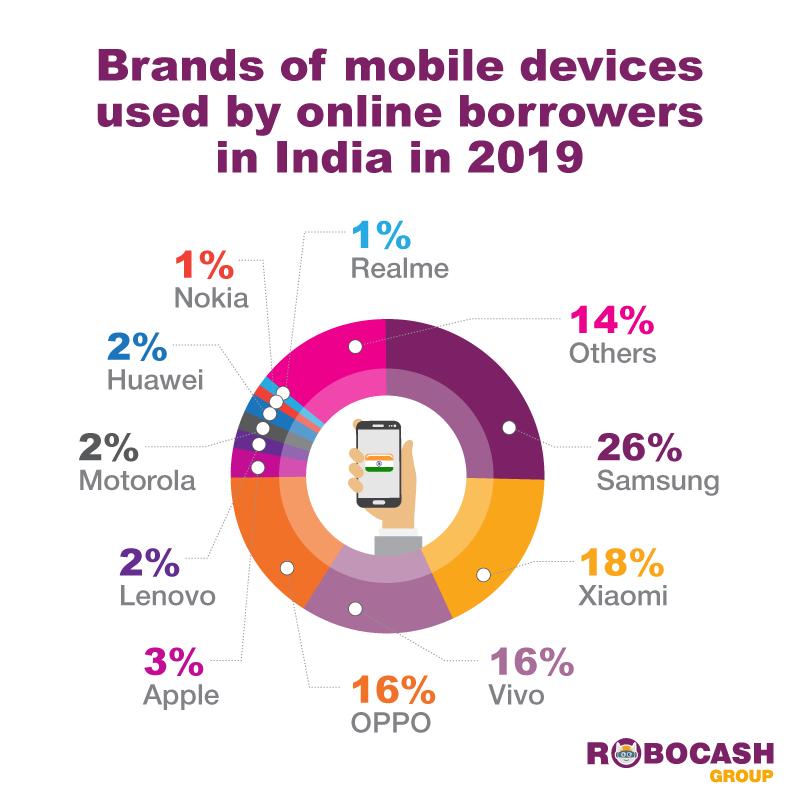

Online borrowers in India mostly use Samsung, Vivo, Xiaomi and OPPO

76% of customers applying for personal loans online in India prefer smartphones of the four mobile phone brands. Samsung is leading with 26% of customers using its devices. It is followed by Vivo (18%), Xiaomi (16%) and OPPO (16%). These figures have been based on the data of more than 156 thousands unique customers of the alternative lending holding Robocash Group in India who used the company’s local lending service…

More Releases for Philippines

Philippines Contact Cement Market

Market Overview

Contact cement is a flexible acrylic adhesive that may be used on rubber, wood, bond tile, leather, metal, Formica, and most plastics. It stays flexible after curing and makes an excellent shoe glue. Contact cement may be applied to almost anything, although it works best on nonporous materials that conventional adhesives cannot adhere together.

Plastics, veneers, rubber, glass, metal, and leather all react well to contact cement. It is…

Philippines Quick Service Restaurants Market Size Is Likely To Reach Around $7.9 …

The Philippines quick service restaurants market has been continuously improvising in terms of product offerings, number of outlets, hospitality and other perks regarding prices that attracts a higher number of customers. Over the years, the Filipinos, specifically the millennials, have been open to different types of innovative food products due to increase in influence of westernization among the target customers. Considering this customer perception, some of the key players in…

Major Players in Philippines Auto Finance Market | Auto Loan Market Philippines …

Rising Innovation: Innovative digital startups such as iChoose.ph are reshaping the challenging car shopping and financing process into a quick and easy experience for customers in Philippines. It is expected that these will create an auto finance ecosystem in which digital aggregators increasingly control the sales and financing process. Car dealerships are expected to increasingly bring the experience of car shopping online by range of ways such as providing…

Philippines E-Commerce Logistics Market | Competitors in E-Commerce Logistics Ph …

Key Findings

Singapore-headquartered e-commerce player Shopee launched an in-app, live-streaming platform in the Philippines through which sellers can build a following to promote their products and offer discounts to viewers. This platform proved to be a success during the pandemic as it recorded 30m live stream views in April 2020.

E-commerce players can look forward to collaborate with brick-and-mortar retailers to provide consumers low-cost delivery options, as has been done in other…

Philippines Used Car Market

Philippines Used Car Market is expected to Gain Momentum from the Emergence of more Organized Players in the future along with Covid incited Surge in Demand: Ken Research

The used car market structure in Philippines is expected to be consolidated in the future as the market share of players selling vehicles via organized channel is expected to surge. This will be mainly on account of transparent and fair used car dealings/trading…

Philippines Quick Service Restaurants Market Booming Segments; Investors Seeking …

Philippines Quick Service Restaurants Market by Food Type, and Nature: Philippines Opportunity Analysis and Industry Forecast, 2019–2026,” The Philippines quick service restaurants market size was valued at $4.6 billion in 2018, and is expected to reach $7.9 billion by 2026, registering a CAGR of 6.9% from 2019 to 2026.The burger/sandwich segment was the highest contributor to the market, with $1.7billion in 2018, and is estimated grow at a CAGR of…