Press release

Robocash Group launched an Islamic fintech service in Indonesia

The financial holding Robocash Group has recently stepped into the sector of Islamic finance. In close collaboration with the Indonesian partner Reliance Finance, the company launched a new fintech service providing personal financing in full compliance with the Shariah law. Together, the companies aim to contribute to the development of the Islamic fintech and enhance access to finance for the Muslim population in Indonesia following the Islamic Shariah principles.Robocash Group has recently announced stepping into the industry of Islamic finance. The new fintech service named as “Reliance Syariah” is the tenth for the financial holding originated in Russia. It has been developed from the ground up in a strategic partnership with the financing company Reliance Finance and close consultation with Sharia Supervisory Board in Indonesia. The potential audience of the service amounts to millions of the Indonesian who live according to the Shariah principles and cannot access to standard financial services.

According to the Islamic Finance Development Report, the global Islamic finance industry largely supported by digitalization will reach US$ 3.8 trillion in assets by 2023 from US$ 2.4 trillion in 2017. At the same time, fintech ventures are considered as key to the industry growth. Comprising companies that provide financing, insurance, real estate and other types of services within the Islamic finance industry, the fintech sector is expected to reach US$ 188 billion in assets by 2023. However, most countries are lagging behind in Shariah adoption in fintech. For example, with the largest Muslim population in the world, Indonesia is only on the 6th place in the Islamic Finance Country Index 2018.

In the announcement on the launch of the new service, Sergey Sedov, Chief Executive Officer of Robocash Group said, “We are very positive about the future of financial technologies in Indonesia. The overall digital adoption and initiatives supporting the industry will surely allow the country to see further exponential market growth. At the same time, we are excited to bring in our technologies to the market of Islamic finance and contribute to its further development. Committed to our mission to quickly meet the financial needs of customers, we have strengthened our robotic solutions by the local expertise of Reliance Finance to provide the best user experience.”

To access the service, customers need to fill in a short application form and provide only an identity card (KTP) and a selfie. Altogether, the technology-enabled application process, artificial intelligence and fraud detection filters applied in scoring ensure offering advances up to USD 715 (IDR 10,000,000) in a few minutes after the application.

--

About

Robocash Group is an international financial group operating in the segments of consumer alternative lending and marketplace funding in Europe and Asia. The company develops robotic financial services providing lending to customers in Russia, Kazakhstan, Spain, the Philippines, Indonesia, Vietnam and India and operates its own EU-based investment platform. The group develops products completely in-house using artificial intelligence, machine learning and data-driven technologies to provide precise and comprehensive risk management, comfort and speed for customers and efficiency for business.

https://robocash.group/

Robocash Group

Duntes iela 23A, Rīga, LV-1005

Press contact:

Olga Davydova

Head of Media Relations

E-mail: pr@robo.cash

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Robocash Group launched an Islamic fintech service in Indonesia here

News-ID: 1694224 • Views: …

More Releases from Robocash Group

Online customers in Asia prefer Asian-made gadgets

Samsung is one of the most popular mobile phone brands among customers of online financing services in the Philippines, Indonesia, Vietnam and India. Mobile devices made in China like Xiaomi, Vivo, OPPO are taking second and third places by the popularity in these four countries. At the same time, Apple is leading in Vietnam only. These are the findings of the study conducted by the international financial holding Robocash Group.

The…

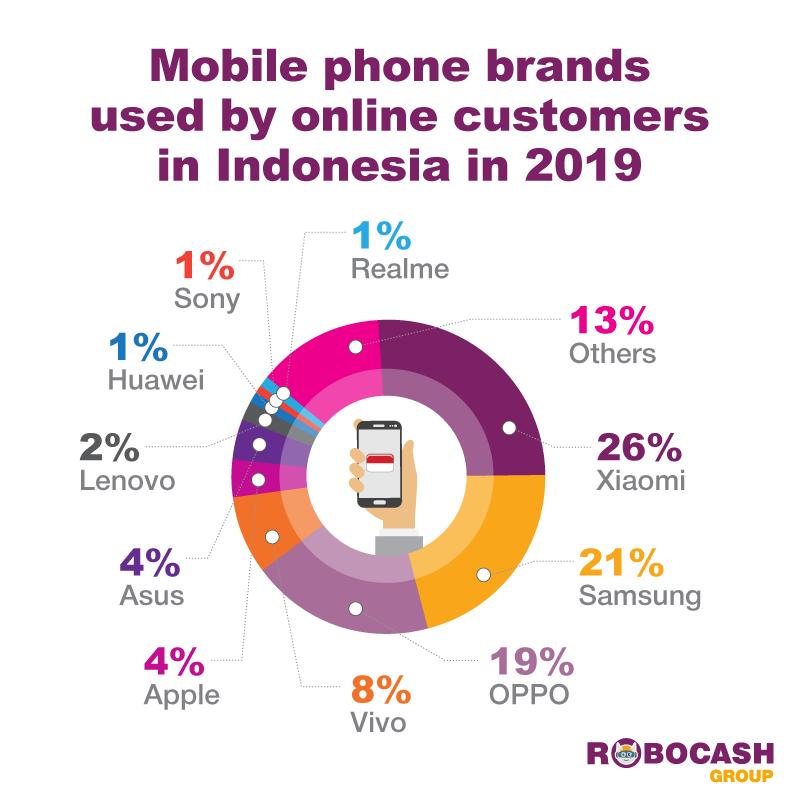

Online customers in Indonesia prefer Xiaomi, Samsung and OPPO

66% of customers who used online services providing funding facility in Indonesia prefer smartphones of the three mobile brands. Thus, 26% of customers use Xiaomi mobile devices. Samsung (21%) and OPPO (19%) take second and third places, respectively. These are the findings of the study conducted by the international financial holding Robocash Group. The figures have been based on the data of more than 78 thousands unique customers who have…

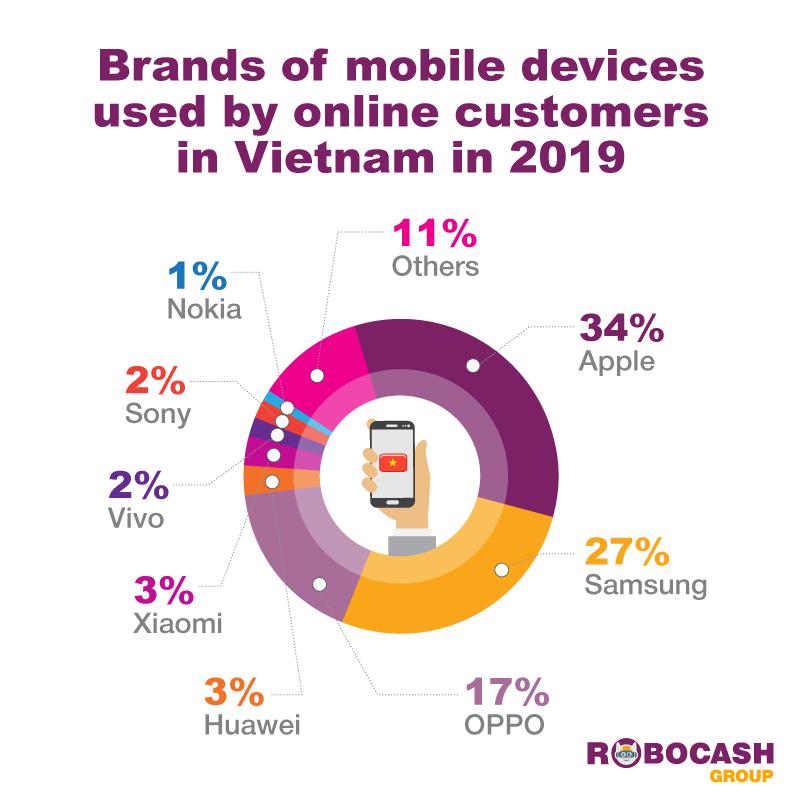

One-third of online customers in Vietnam prefer Apple

34% of customers of online services providing personal financing in Vietnam prefer Apple mobile devices. Samsung takes second place with 27% of customers using its smartphones. OPPO follows with 17%. With the overall share of 78% split by these three companies, other brands are lagging significantly. These are the findings of the international holding Robocash Group after studying the data of more than 337 thousands unique customers who have used…

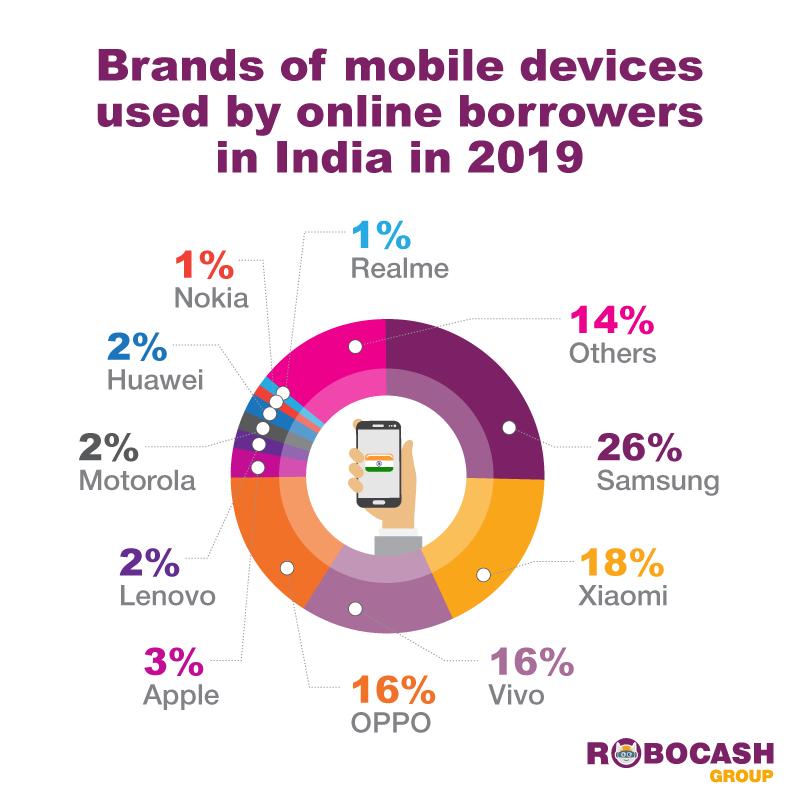

Online borrowers in India mostly use Samsung, Vivo, Xiaomi and OPPO

76% of customers applying for personal loans online in India prefer smartphones of the four mobile phone brands. Samsung is leading with 26% of customers using its devices. It is followed by Vivo (18%), Xiaomi (16%) and OPPO (16%). These figures have been based on the data of more than 156 thousands unique customers of the alternative lending holding Robocash Group in India who used the company’s local lending service…

More Releases for Islamic

Islamic Finance Market is Booming Worldwide | Citibank, HSBC Bank, Dubai Islamic …

The latest report on the "Islamic Finance Market To 2028" by the AMA Research includes an analysis of various factors such as size, share, growth factors, sales, demand, revenue, trade, forecast, and global companies analysis. The report provides a detailed examination of the current status of factors such as supply chain management, niche markets, distribution channels, trade, supply and demand, and production capability across different countries to provide a more…

Takaful Insurance Market Is Booming Worldwide | Islamic Insurance, Allianz, Qata …

Latest Study on Industrial Growth of Takaful Insurance Market 2023-2028. A detailed study accumulated to offer Latest insights about acute features of the Takaful Insurance market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future trends and developments…

Islamic Finance Market To See Extraordinary Growth | Jordan Islamic Bank, Bahrai …

The Latest research study released by HTF MI “Worldwide Islamic Finance Market” with 100+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint and status. Understanding the segments helps in identifying the importance of different factors that aid the market growth. Some of the Major Companies covered in this Research…

Islamic Finance Market Is Thriving Worldwide with Dubai Islamic Bank, Citibank, …

Global Islamic Finance Market Report 2020 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Islamic Finance Market. Some of the key players profiled in the study are Citibank, HSBC Bank, Dubai Islamic Bank,…

Islamic Financing Market Is Booming Worldwide | Al Rajhi Bank, Abu Dhabi Islamic …

Latest Study on Industrial Growth of Global Islamic Financing Market 2019-2025. A detailed study accumulated to offer Latest insights about acute features of the Islamic Financing market. The report contains different market predictions related to market size, revenue, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future trends…

Islamic Fashion Becomes Effortless Thanks to SHUKR Islamic Clothing

While the competition for Islamic clothing is strong, SHUKR Islamic Clothing continues to distinguish itself by showing Muslim women they do not have to substitute modesty for style.

The rise of hijab fashion bloggers and Muslim targeted clothing trends raises a question many modest dressers (Muslims especially) have been struggling with: are modesty and beauty able to co-exist? Thanks to SHUKR Islamic Clothing, one of the leading names in creating…