Press release

Islamic Financing Market Is Booming Worldwide | Al Rajhi Bank, Abu Dhabi Islamic Bank, Dubai Islamic Bank, Emirates NBD

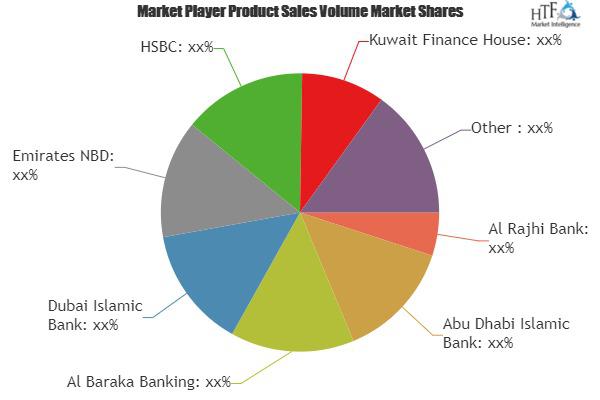

Latest Study on Industrial Growth of Global Islamic Financing Market 2019-2025. A detailed study accumulated to offer Latest insights about acute features of the Islamic Financing market. The report contains different market predictions related to market size, revenue, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future trends and developments of the market. It also examines the role of the leading market players involved in the industry including their corporate overview, financial summary and SWOT analysis.The Major Players Covered in this Report: Al Rajhi Bank, Abu Dhabi Islamic Bank, Al Baraka Banking, Dubai Islamic Bank, Emirates NBD, HSBC, Kuwait Finance House, NBAD, NCB, Qatar International Islamic Bank & Samba Financial Group

To get Complete SAMPLE of the report, please click @: @: https://www.htfmarketreport.com/sample-report/1862066-global-islamic-financing-market-1

This study also covers company profiling, specifications and product picture, sales, market share and contact information of various regional, international and local vendors of Global Islamic Financing Market. The market opposition is frequently developing greater with the rise in scientific innovation and M&A activities in the industry. Additionally, many local and regional vendors are offering specific application products for varied end-users. The new merchant applicants in the market are finding it hard to compete with the international vendors based on reliability, quality and modernism in technology.

Sharia prohibits riba, or usury, defined as interest paid on all loans of money. Investment in businesses that provide goods or services considered contrary to Islamic principles (e.g. pork or alcohol) is also haraam ("sinful and prohibited").

In 2018, the global Islamic Financing market size was xx million US$ and it is expected to reach xx million US$ by the end of 2025, with a CAGR of xx% during 2019-2025.

This report focuses on the global Islamic Financing status, future forecast, growth opportunity, key market and key players. The study objectives are to present the Islamic Financing development in United States, Europe and China.

Read Detailed Index of full Research Study at @ https://www.htfmarketreport.com/reports/1862066-global-islamic-financing-market-1

The titled segments and sub-section of the market are illuminated below:

In-depth analysis of Global Islamic Financing market segments by Types: , Banking Assets, Sukuk Outstanding, Islamic Funds' Assets & Takaful Contributions

In-depth analysis of Global Islamic Financing market segments by Applications: Individual, Commercial, Government & International

Major Key Players of the Market: Al Rajhi Bank, Abu Dhabi Islamic Bank, Al Baraka Banking, Dubai Islamic Bank, Emirates NBD, HSBC, Kuwait Finance House, NBAD, NCB, Qatar International Islamic Bank & Samba Financial Group

Regional Analysis for Global Islamic Financing Market:

North America (United States, Canada and Mexico)

Europe (Germany, France, UK, Russia and Italy)

Asia-Pacific (China, Japan, Korea, India and Southeast Asia)

South America (Brazil, Argentina, Colombia etc.)

Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa)

Furthermore, the years considered for the study are as follows:

Historical year – 2013-2017

Base year – 2018

Forecast period** – 2018 to 2023 [** unless otherwise stated]

**Moreover, it will also include the opportunities available in micro markets for stakeholders to invest, detailed analysis of competitive landscape and product services of key players.

Buy this research report @ https://www.htfmarketreport.com/buy-now?format=1&report=1862066

Research Methodology

Primary Research:

The primary sources involves the industry professionals from the Global Islamic Financing industry including the management organizations, processing administrations, analytics service providers of the industry’s value chain. All primary sources were interviewed to gather and validate qualitative & quantitative information and determine the future prospects.

In the general primary research process undertaken for this study, the primary sources – industry experts such as CEOs, marketing director, vice presidents, technology & origination directors, founders and related key executives from various key companies and organizations in the Global Islamic Financing in the industry have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

Secondary Research:

In the Secondary research crucial information about the industries value chain, total pool of key players, and application areas. It also assisted in market segmentation according to industry trends to the bottom-most level, geographical markets and key developments from both market and technology oriented perspectives.

Guidance of the Global Islamic Financing market report:

- Detailed considerate of Islamic Financing market-particular drivers, Trends, constraints, Restraints, Opportunities and major micro markets.

- Comprehensive valuation of all prospects and threat in the Global Islamic Financing market.

- In depth study of industry strategies for growth of the Islamic Financing market-leading players.

- Islamic Financing market latest innovations and major procedures.

- Favorable dip inside Vigorous high-tech and market latest trends remarkable the Market.

- Conclusive study about the growth conspiracy of Islamic Financing market for forthcoming years.

What to Expect from this Report On Islamic Financing Market:

1. A comprehensive summary of several area distributions and the summary types of popular products in the Islamic Financing Market.

2. You can fix up the growing databases for your industry when you have info on the cost of the production, cost of the products, and cost of the production for the next future years.

3. Thorough Evaluation the break-in for new companies who want to enter the Islamic Financing Market.

4. Exactly how do the most important companies and mid-level companies make income within the Market?

5. Complete research on the overall development within the Islamic Financing Market that helps you elect the product launch and overhaul growths.

Enquire for customization in Report @ https://www.htfmarketreport.com/enquiry-before-buy/1862066-global-islamic-financing-market-1

Detailed TOC of Islamic Financing Market Research Report-

- Islamic Financing Introduction and Market Overview

- Islamic Financing Market, by Application [Individual, Commercial, Government & International]

- Islamic Financing Industry Chain Analysis

- Islamic Financing Market, by Type [, Banking Assets, Sukuk Outstanding, Islamic Funds' Assets & Takaful Contributions]

- Industry Manufacture, Consumption, Export, Import by Regions (2013-2018)

- Industry Value ($) by Region (2013-2018)

- Islamic Financing Market Status and SWOT Analysis by Regions

- Major Region of Islamic Financing Market

i) Global Islamic Financing Sales

ii) Global Islamic Financing Revenue & market share

- Major Companies List

- Conclusion

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Europe or Asia.

HTF Market Report is a wholly owned brand of HTF market Intelligence Consulting Private Limited. HTF Market Report global research and market intelligence consulting organization is uniquely positioned to not only identify growth opportunities but to also empower and inspire you to create visionary growth strategies for futures, enabled by our extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist you for making goals into a reality. Our understanding of the interplay between industry convergence, Mega Trends, technologies and market trends provides our clients with new business models and expansion opportunities. We are focused on identifying the “Accurate Forecast” in every industry we cover so our clients can reap the benefits of being early market entrants and can accomplish their “Goals & Objectives”.

Contact US :

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

Phone: +1 (206) 317 1218

sales@htfmarketreport.com

Connect with us at

https://www.linkedin.com/company/13388569/

https://www.facebook.com/htfmarketintelligence/

https://twitter.com/htfmarketreport

https://plus.google.com/u/0/+NidhiBhawsar-SEO_Expert?rel=author

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Islamic Financing Market Is Booming Worldwide | Al Rajhi Bank, Abu Dhabi Islamic Bank, Dubai Islamic Bank, Emirates NBD here

News-ID: 1747257 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

E-book Subscription Services Market to See Revolutionary Growth: Scribd , Rakute …

The latest study released on the Global E-book Subscription Services Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The E-book Subscription Services study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider…

AI Safety Market Hits New High | Major Giants Microsoft AI, IBM Research

The latest study released on the Global AI Safety Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The AI Safety study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

Bespoke Lifestyle Communities Market to Witness Unprecedented Growth by 2033

HTF MI Research's most recent study of the global Bespoke Lifestyle Communities market assesses the market's size, trends, and projections through 2033. In order to provide managers, analysts, industry experts, and other key personnel with a ready-to-access, self-analyzed study to help understand market trends, growth drivers, opportunities, and upcoming challenges as well as about competitors, the Bespoke Lifestyle Communities market study includes extensive research data and proofs.

Key Players in This…

AI-Enabled Winter Wellness Platforms Market: Regaining Its Glory | Google Fit, W …

The latest analysis of the worldwide AI-Enabled Winter Wellness Platforms Market by HTF MI Research evaluates the market's size, trends, and forecasts through 2033. AI-Enabled Winter Wellness Platforms Market study includes extensive research data and proofs to give managers, analysts, industry experts, and other key personnel a ready-to-access, self-analyzed study to help understand market trends, growth drivers, opportunities, and upcoming challenges as well as about competitors.

Key Players in This Report…

More Releases for Islamic

Islamic Finance Market is Booming Worldwide | Citibank, HSBC Bank, Dubai Islamic …

The latest report on the "Islamic Finance Market To 2028" by the AMA Research includes an analysis of various factors such as size, share, growth factors, sales, demand, revenue, trade, forecast, and global companies analysis. The report provides a detailed examination of the current status of factors such as supply chain management, niche markets, distribution channels, trade, supply and demand, and production capability across different countries to provide a more…

Takaful Insurance Market Is Booming Worldwide | Islamic Insurance, Allianz, Qata …

Latest Study on Industrial Growth of Takaful Insurance Market 2023-2028. A detailed study accumulated to offer Latest insights about acute features of the Takaful Insurance market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future trends and developments…

Islamic Finance Market To See Extraordinary Growth | Jordan Islamic Bank, Bahrai …

The Latest research study released by HTF MI “Worldwide Islamic Finance Market” with 100+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint and status. Understanding the segments helps in identifying the importance of different factors that aid the market growth. Some of the Major Companies covered in this Research…

Islamic Finance Market Is Thriving Worldwide with Dubai Islamic Bank, Citibank, …

Global Islamic Finance Market Report 2020 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Islamic Finance Market. Some of the key players profiled in the study are Citibank, HSBC Bank, Dubai Islamic Bank,…

Islamic Fashion Becomes Effortless Thanks to SHUKR Islamic Clothing

While the competition for Islamic clothing is strong, SHUKR Islamic Clothing continues to distinguish itself by showing Muslim women they do not have to substitute modesty for style.

The rise of hijab fashion bloggers and Muslim targeted clothing trends raises a question many modest dressers (Muslims especially) have been struggling with: are modesty and beauty able to co-exist? Thanks to SHUKR Islamic Clothing, one of the leading names in creating…

World Islamic Finance Conference – reveals challenges and opportunities of Isl …

Global Islamic Finance is growing tremendously (20% annually). Islamic Finance products are progressively moving to the mainstream, becoming increasingly competitive with conventional financial products.

This rise up questions on how to develop Islamic Money Markets; how to facilitate liquidity management by Central Banks; need for deep knowledge about regulatory challenges of Islamic Finance in UK and Continental Europe or what are the predictions and conditions for Islamic Retail Banking expansion in…