Press release

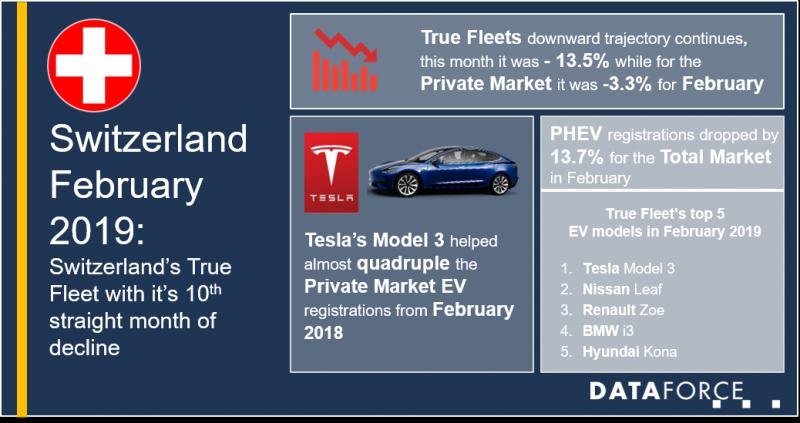

Switzerland’s True Fleet with its 10th straight month of decline

As in January, new passenger car registrations in Switzerland for February 2019 were lower than in the same month last year. Across all market segments, slightly more than 22,000 passenger cars were registered and as a result the overall market fell by 1.1%.Commercial registrations rose by 1.3% in February 2019, thus cushioning the overall market downturn to some extent. Nonetheless, it is worth taking a detailed look at the various commercial market segments in order to classify this development correctly: a little under 4,500 passenger cars were registered on companies. So, after a weak start to 2019, True Fleets had another drop, this time by 13.5% when compared to February 2018. Short-Term Rental registrations also fell by 6.9% and only tactical registrations on Dealership/ Manufacturers were positive, increasing by 27.7%, thereby representing the main growth driver within commercial registrations (same as in January).

Brand and Vehicle Segment Performance

With 610 registrations and a plus of 7.0% compared to the same month last year, Skoda not only ranked 1st in the True Fleet Market in February but has also taken the crown from a year-to-date perspective. Although the Skoda Octavia was again the most registered fleet model, it was unable to maintain the previous year's level (- 12.4%). However, the Karoq (+ 115.1%), Kodiaq (+ 97.6%) and Superb (+ 19.3%) all helped to compensate for this decline.

Volkswagen recorded a growth of 15.5% in February, but this was not enough to defend its leading position from January. Despite a significant decline of 19.8%, BMW remains the third-strongest brand within the True Fleet Market.

As already seen in January, True Fleet’s vehicle segment, Utilities, is bucking the trend seen in the market. The VW Transporter was once again the strongest growth driver within this segment, while the Peugeot Partner and the Ford Transit Custom by also managed to increase their registrations, finishing in the black.

Electric cars on the rise in the Private Market

Looking into the Private Market, electric cars recorded exceptional growth almost quadrupling the registrations from February 2018. This came mostly thanks to the first of the Tesla Model 3s with 195 registrations which were followed by the Hyundai Kona and the BMW i3.

On the other hand, the True Fleet EV Market was not able reach its comparative figures with registrations decreasing by 22.0%. Nonetheless, the tactical channels of Dealerships/Manufacturers compensated for this development (+ 140.0%), with the Renault Zoe, BMW i3 and Tesla Model 3 accounting for more than 61% of all registrations in this segment.

DATAFORCE – Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Christian Spahn

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Germany

Phone: +49 69 95930-265

Fax: +49 69 95930-333

Email: christian.spahn@dataforce.de

www.dataforce.de

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Switzerland’s True Fleet with its 10th straight month of decline here

News-ID: 1671914 • Views: …

More Releases from Dataforce Verlagsgesellschaft für Business Informationen mbH

What is the Dataforce Sales channel outlook for 2021?

Following a contraction of around 26% in 2020 things can only get better. But how fast will the recovery be and what is the outlook for the channels?

Slow start, rev up

We expect the first half year of 2021 to remain rather challenging. Strict Containment measures will probably need to be maintained into spring, which will weigh down economic sentiment. At the same time, early 2021 may not be the best…

Generation change at Dataforce: Marc A. Odinius now sole owner and Managing Dire …

The long-standing Managing Director Marc Odinius has acquired all shares of the Dataforce Verlagsgesellschaft für Business Informationen mbH and is now Managing Director and sole owner of the Company.

Mission of Dataforce

As to the mission of the automotive data- and market-research company, with 87 Employees, counting 27 different nationalities who reside in Frankfurt, Rome and Beijing, Odinius stated: Dataforce is always in search of unique information which will make the automotive…

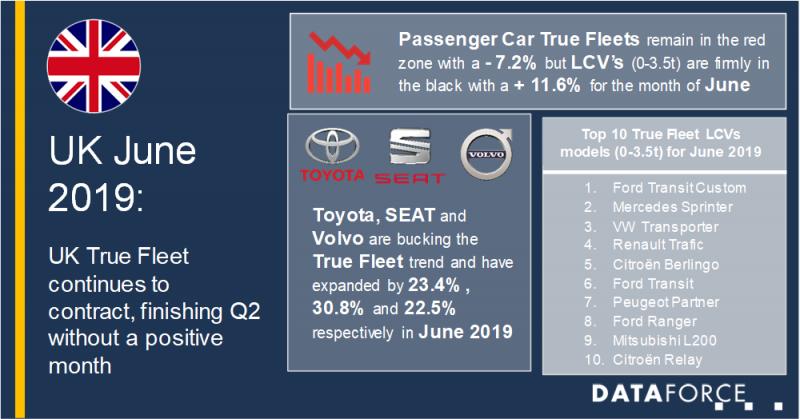

UK True Fleet continues to contract, finishing Q2 without a positive month

Now with the first half of the year having gone by in a blur of negative growth we can only hope that the second half will bring some more positive momentum especially around the plate change month in September. UK True Fleet produced a - 7.2% in June which leaves the channel down 6.2% year-to-date (YTD). The Private Market was also in the red with a 4.8% which…

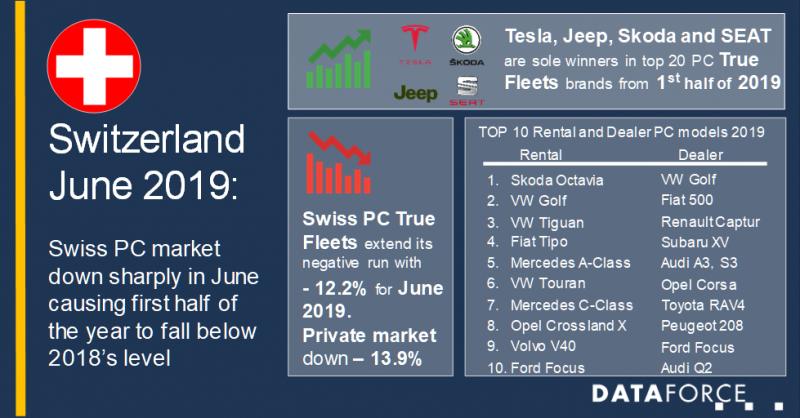

Swiss car market turns into the red on sharp contraction in June

In June 2019 new passenger car registrations in Switzerland were down sharply on the same month last year. Nearly 28,000 registered passenger cars represent an overall market decline of 11.2%. Registrations of light commercial vehicles fell even more sharply (11.9%).

Weak June causes passenger car market to fall below previous year's level

Both the Private Market ( 13.9%) and the commercial market ( 8.4%) can look back on a weak…

More Releases for Fleet

Fleet Tracking and Logistics Market is thriving worldwide by 2027 | Top Key Play …

Fleet Tracking and Logistics Market research is an intelligence report with meticulous efforts undertaken to study the right and valuable information. The data which has been looked upon is done considering both, the existing top players and the upcoming competitors. Business strategies of the key players and the new entering market industries are studied in detail. Well explained SWOT analysis, revenue share and contact information are shared in this report…

Fleet Management Consulting Service Market will reach USD 39.94 Billion by 2032 …

The global fleet management size is expected to grow USD 39.94 Billion by 2032 from USD 21.6 Billion in 2021, at a Compound Annual Growth Rate (CAGR) of 10.5% during the forecast period.

The presence of various key players in the ecosystem has led to a competitive and diverse market. The market include a high growth rate for the adoption of cloud computing and analytics, declining hardware and IoT connectivity costs,…

Fleet Management Solution Market: Start managing fleet data, access and update i …

The report "Global Fleet Management Solution Market By Deployment Model (On-premise, and On-Demand Hybrid), By Solution (Asset Management, Information Management, Driver Management, Safety and Compliance Management, Risk Management, Operations Management, and other Solutions), By End User (Transportation, Energy, Construction, Manufacturing, and Other End Users), and Region - Global Forecast to 2029". Gradually adopting transportation by businesses to enhance their offerings this results in considerable rise over the past few years…

Fleet Management Market Insights | Key players: ARI Fleet Management, Azuga, Che …

According to recent research "Fleet Management Market by Solution (Operations Management, Vehicle Maintenance and Diagnostics, Performance Management, Fleet Analytics and Reporting), Service (Professional and Managed), Deployment Type, Fleet Type, and Region - Global Forecast to 2023", the global fleet management market size is expected to grow from USD 15.9 billion in 2018 to USD 31.5 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 14.7% during the forecast…

Fleet software comm.fleet: Effective cost control for fleet managers

Relief for fleet managers: identify the cost drivers of the company and take appropriate actions with the fleet management software comm.fleet

The adoption of a multifunctional controlling system is an indispensable prerequisite for an effective and systematic management of all company fleet costs. Be it a question of planning enhancement and control, budgeting coordination or the execution and analysis of a target-performance comparison with the purpose of a perfect fleet administration,…

Fleet Specialisation-Cover 4 Fleet Insurance Investigate Future Fleet Trends

Victoria, London ( openpr ) June 10, 2011 - Economically driven by the need to immerse their resources in core activities, companies will turn to fleet outsourcing options. Even in the case of fleet contract hire, there are case studies which are dramatic in the current economic environment.

Take the case study of Fraikin , which was originally established in France in 1944 and is today the biggest commercial…