Press release

BMI: Regaining Momentum - Global Oil Market Review Q310

As with Q2, the third quarter started with encouraging oil market strength, which then dissipated rapidly. If anything, oil market fundamentals improved, with demand assumptions rising. The US driving season was disappointing, but the real damage was done as macroeconomic uncertainty crept back into the market and investors turned their backs on oil. Ongoing eurozone economic woes, fresh China jitters and a general sense of macroeconomic fragility meant that oil prices were dragged lower with equities and currencies. We remained convinced that there would be a belated rally, as the world heads towards winter in a higher-demand quarter. Thus far, our confidence has been rewarded by a recovery that began in September and accelerated into October.Demand projections for 2010 continued to firm up during the third quarter, with some upgrades coming through for 2011, even though the jury is out regarding the strength and sustainability of the economic recovery. After rising steadily in the first half of the year, OPEC volumes appear to have levelled out in Q3. The organisation has done and said little to change the supply/demand landscape, although some members at the October 14 ministerial gathering were arguing the case for a US$100/bbl target to compensate for the weakening of the US dollar that is undermining their revenues.

According to the International Energy Agency (IEA) in its October 2010 monthly Oil Market Report (OMR), OECD end-August commercial oil inventories stood at 2,790mn bbl, their highest level since August 1998. However, a very significant fall looks to have been recorded in September - a period when a small stock rise is the norm. With demand having strengthened and supply having stalled, a continuation of this inventory trend could support an oil price recovery throughout Q4.

September saw global oil supply fall by some 150,000 barrels per day (b/d), according to the IEA. Non-OPEC producers saw volumes fall during the month, while a modest increase in OPEC production failed to compensate. Crude oil supply from OPEC averaged 29.3mn b/d in September (IEA estimate), up 40,000b/d on the previous month. Much of this increase, however, reflects Iraqi output gains, with the 11 core members actually reducing supply by some 150,000b/d. Quota compliance of around 54% is a definite improvement on the year's low of around 50%, even if well short of the 59% historical OPEC 'norm'.

Non-OPEC supply in September fell by just 20,000b/d, with the US hurricane season doing little to disrupt output. During the third quarter, non-OPEC supply was fairly stable when compared with Q2 - and not significantly above the Q1 level. Output of around 52.6mn b/d in Q3 compares with 52.7mn b/d in Q2 and 52.3mn b/d in the opening quarter of the year. September volumes are put at 52.4mn b/d.

Given positive demand-side developments, a capping of recent supply growth and some evidence of a fall in stock levels, it is hardly surprising that the end of Q3 saw oil prices gain ground. At the time of our July 2010 quarterly oil price report, the OPEC basket was just below US$73/bbl. It reached almost US$79/bbl in early August, before collapsing to less than US$70/bbl later in the month. September then saw a steady increase from around US$72/bbl to US$77/bbl, with momentum being retained into early October and the OPEC price reaching US$80/bbl by the time this report was written.

Quarterly Trends

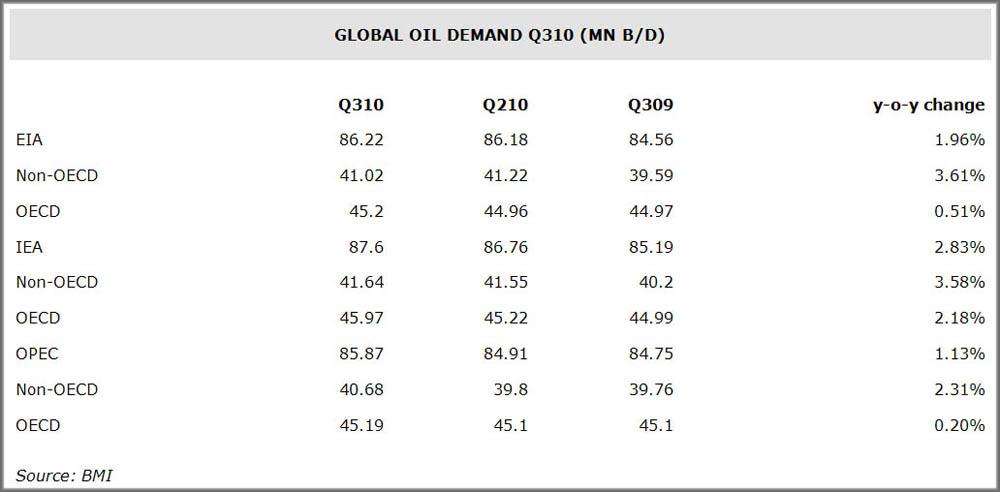

The Energy Information Administration (EIA) in its October 2010 monthly report suggested that Q310 global oil demand was 86.22mn b/d, compared with 86.18mn b/d in Q210 and 84.56mn b/d in Q309 (+1.96% y-o-y). Non-OECD demand is reported at 41.02mn b/d, compared with 41.22mn b/d in the previous quarter and 39.59mn b/d in Q309 (+3.61% y-o-y). The OECD states saw a 0.24mn b/d quarter-on-quarter rise in consumption during Q310, with demand amounting to 45.20mn b/d. In Q309, OECD demand was 44.97mn b/d, based on EIA data.

According to the Paris-based IEA, Q310 global consumption averaged 87.60mn b/d, compared with 86.76mn b/d in Q210 and 85.19mn b/d in Q309. The y-o-y change was put at +2.83%. OECD demand in Q310 is reported at 45.97mn b/d, compared with 45.22mn b/d in Q210 and 44.99mn b/d in Q309. Non-OECD consumption in Q310 was reportedly up 3.58% y-o-y at 41.64mn b/d. In Q210, non-OECD consumption was 41.55mn b/d.

OPEC's October 2010 monthly oil report puts Q310 global oil demand at 85.87mn b/d, up from 84.91mn b/d during the previous quarter and up from 84.75mn b/d in Q309 (+1.13%). OECD demand is said to have risen by 0.2% y-o-y to 45.19mn b/d, with North American consumption higher by 0.4%. Non-OECD demand was up 2.31% y-o-y to 40.68mn b/d, according to the OPEC data.

The EIA Q310 estimates suggest that non-OPEC oil supply was 51.43mn b/d, compared with the Q210 level of 51.48mn b/d and the 50.49mn b/d recorded in Q309 (+1.86% y-o-y). Russia, the US and China were significant contributors to the supply increase. OPEC output for Q310 is put at 35.06mn b/d (including natural gas liquids), up from 34.69mn b/d in Q210 and the 34.24mn b/d delivered in the third quarter of 2009.

Global Q310 production based on IEA data averaged 87.04mn b/d. This compares with 86.76mn b/d in Q210. The non-OPEC element for the most recent quarter is 52.57mn b/d, easing lower from 52.74mn b/d in Q2. Overall OPEC volumes, including gas liquids, are said to have risen from 34.01mn b/d to 34.47mn b/d between Q210 and Q310.

OPEC itself states that non-OPEC oil supply averaged 52.03mn b/d in Q310. OPEC crude output was assessed at 29.12mn b/d during the quarter, with the cartel pumping an average of 29.08mn b/d in September.

BMI’s Oil and Gas reports feature independent 10-year forecasts for oil and gas and LNG, covering all major indicators including reserves, production, consumption, refining capacity, prices, export volumes and values.

The reports cover all key global developments influencing company strategy and market dynamics in all significant producer and consumer states. At its heart are BMI's proprietary five- and 10-year country forecasts. Given the close connections between the oil and gas and power industries and broader macroeconomic prospects, the analysis and forecasts are closely integrated with BMI's Country Risk and Power services.

Business Monitor International: United States Oil and Gas Report Q3 2010:

http://www.reports-research.com/market-surveys/united-states-report-2010-p-116968.html

Business Monitor International: Further Energy Market Data and Reports:

http://www.reports-research.com/market-surveys/market-surveys-business-monitor-international-limited-energy-raw-materials-mrp-358-530.html

markt-studie.de, founded in 2002 has emerged as a leading online portal for market surveys and market research in German speaking areas. Four years later the English language portal reports-research.com was introduced due to the extraordinary success of the portal. Again one year later estudio-mercado.es - the Spanish spoken portal - was founded. The objective of the three portals is to competently and efficiently support consultants and decision makers in management, sales and marketing in the search for worldwide market research. Prospective buyers can look into more than 60,000 market surveys from more than 200 international publishers, current market data for more than 6,000 branches worldwide, 10,000 company profiles as well as a free-of-charge research and recommendation service for individual market research.

reports-research.com

c/o dynamic technologies GmbH

Siegburger Str. 233

50679 Köln

Germany

Manuel Bravo Sanchez (CEO)

info@reports-research.com

or

Tel ++49 (0)221 677 897 32

Fax ++49 (0)221 677 897 34

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release BMI: Regaining Momentum - Global Oil Market Review Q310 here

News-ID: 150913 • Views: …

More Releases from dynamic technologies Gmbh, Köln, Germany

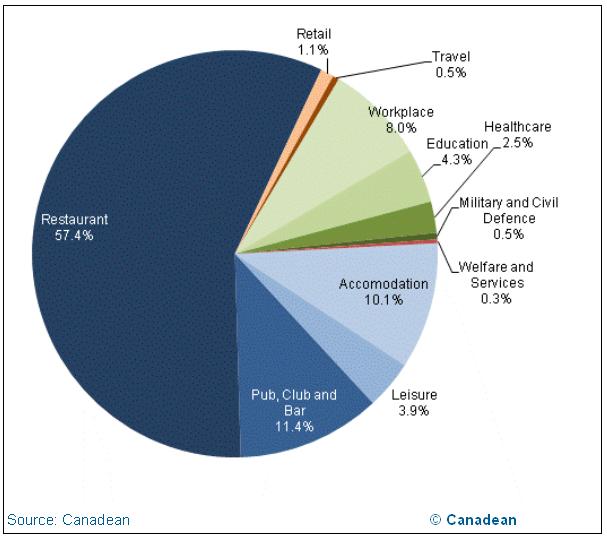

Canadean: New Zealand - The Future of Foodservice to 2016

The New Zealand foodservice market recorded a CAGR of 1.43% during the review period. Per capita sales increased at a review period CAGR of 0.38%. In 2011, the profit sector contributed 92.1% to the country’s total foodservice sales and posted a per capital sales CAGR of 0.33%. Growth in the profit sector is attributable to the growth in the restaurant channel which grew by a CAGR of 1.56%. In…

yStats.com: South Korea B2C E-Commerce Report 2011 published on reports-research …

The latest South Korea B2C E-Commerce Report 2011, compiled by Hamburg-based market research firm yStats.com features important B2C E-Commerce facts and figures on South Korea. In addition to revenue figures, market shares and customers, the report also covers general online use, the latest trends and major competitors.

In 2010, the number of internet users in South Korea rose to more than 35 million. Growth rates were very low in the last…

yStats.com: Turkey Top 100 E-Commerce Players 2011 published on reports-research …

The latest and highly informative Turkey Top 100 E-Commerce Players 2011 ranking, compiled by the Hamburg-based market research firm yStats com, presents the 100 most successful players on the Turkish E-Commerce market. Turkey’s top 100 E-Commerce players have been ranked based on local unique visitor numbers from September 2011.

The yStats com ranking highlights important details about competitors in the Turkish E-Commerce sector, shareholders, business models, product ranges, local and…

GlobalData: Wind Power - Global Market Size, Turbine Market Share, Installation …

Wind Power - Global Market Size, Turbine Market Share, Installation Prices, Regulations and Investment Analysis to 2020 is the latest report from GlobalData, the industry analysis specialists that offer comprehensive information and understanding of the Global Wind Power market.

The research provides an understanding of the technology, key drivers and challenges in the global wind power market. It also provides historical and forecast data to 2020 for installed capacity and power…

More Releases for OPEC

CBRN Protection Suits Market Size, Share Projections 2031 by Key Manufacturer-CQ …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲: According to Verified Market Reports analysis, the global CBRN Protection Suits Market size was valued at USD 6.1 Billion in 2023 and is projected to reach USD 10.4 Billion by 2030, growing at a CAGR of 5.7% during the forecasted period 2024 to 2031.

What is the current outlook for the CBRN Protection Suits Market?

The CBRN (Chemical, Biological, Radiological, and Nuclear) Protection Suits Market is expected to experience…

Lightweight Protective CBRN Oversuit Market Report 2023 | In Depth Analysis With …

The latest competent intelligence report published by SMI with the title "An increase in demand and Opportunities for Lightweight Protective CBRN Oversuit Market 2023″ provides a sorted image of the Lightweight Protective CBRN Oversuit industry by analysis of research and information collected from various sources that have the ability to help the decision-makers in the global market to play a significant role in making a gradual impact on the global…

UXO Detection Market Advanced Technologies with Growth Trends by 2027 - Vallon G …

Rise in military technology development to safeguard the lives of troops deployed in active combat zones is significantly driving the growth of the UXO detection market across the world. Technologies such as AI and detection through drones, etc. are being deployed to increase the scanning efficiency of detectors.

UXO Detection Market Forecast to 2027 - COVID-19 Impact and Global Analysis By System Type (Hardware, Software) and Geography

Get Sample PDF Copy at…

An Overview on Global Oil and Gas Market 2019-2025| Prominent Players Exxon Mobi …

The oil and gas sector, which is considered the world's largest sector in terms of dollar value globally, is a global powerhouse that employs hundreds of thousands of workers globally and earns billions of dollars annually worldwide. In regions with major NOCs, these oil and gas companies are so important that they often donate significant amounts to national GDP.

Leading Players of Global Oil and Gas Market:

• OPEC

• Exxon Mobil

• Petro China

• Chevron

• Total

• Sinopec

• Royal Dutch Shell

• Gazprom

• Rosneft

Request…

Oil & Gas Pumps Market - The demand for OPEC crude is projected to increase to n …

Definition

Oil & gas pumps are used in process of extracting oil and gas resources, in processing or in delivering as per the requirement. The centrifugal pump is the most common type of pump used in the oil & gas industry. Other types of oil & gas pumps including positive displacement pumps, petrochemical pumps, oil transfer pumps, etc., are also finding large application in the oil and gas industry.

About the Report

The…

Europe’s Markets to Remain under Pressure, As Investors Await the G20 Summit a …

Europe’s investors’ eyes are on the G20 summit to be held from November 30 to December 1 in Argentina. Investors expect that some new arrangements might be worked out by the US and China that would hopefully help to break the trade impasse. The positive expectations are driven by the US President Donald Trump’s saying earlier that he intends to discuss the situation with the Chinese leader on the sidelines.

Another…