Press release

London and Monaco are Europe's Most Expensive Cities for Residential Property Buyers

London and Monaco are Europe’s most expensive cities for residential property buyers. Prices in the Baltics have risen to the same level as capitals such as Copenhagen, Berlin, Munich, Stockholm, Vienna, and Frankfurt.High rewards await property investors in some parts of Europe, according to the Global Property Guide, a residential real estate research organization (http://www.globalpropertyguide.com). Rental yields for apartments in several Eastern European capitals are above 10%.

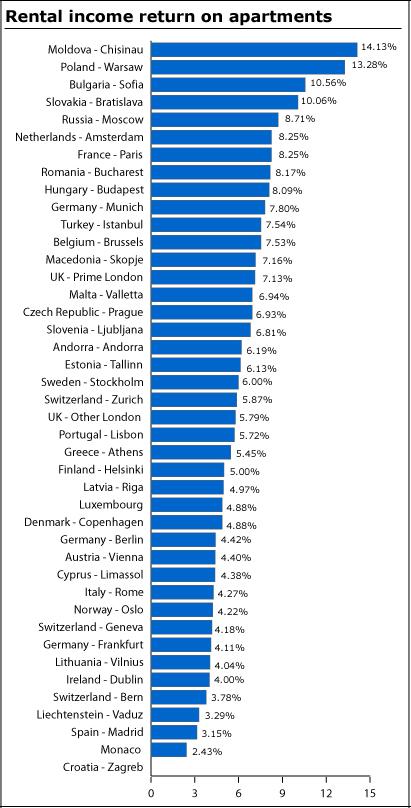

Rental apartments in Moldova’s capital city Chisinau can be expected to yield annual rental returns of around 14.13%; in Poland’s capital Warsaw, 13.28%; in Bulgaria’s capital Sofia, 10.56%; and in Slovakia’s capital Bratislava, 10.06%. The higher risks of Eastern Europe may be a factor in these returns (corruption, political instability, etc).

But risks are not the only factor. The Global Property Guide believes that the relatively recent arrival of the market economy, high interest rates, and relatively undeveloped mortgage markets, largely explain the low prices in the east. To illustrate, it would surely be hard to label the historic city of Bratislava, Slovakia, as a high-risk location, yet the rental income returns are excellent.

Western Europe generally suffers from another, different disadvantage: High taxation. There are high rental income returns to be earned in Amsterdam and Paris (8.25% in both), in Munich (7.80%) and Brussels (7.53%). But all four cities are high tax environments (but so too is Poland).

Property in Prime Central London returns surprisingly high rental yields, at 7.13%. Note that this “Prime” category encompasses relatively a narrow group of super-luxury apartments in absolutely prime areas (Belgravia, Chelsea, and Knightsbridge). The high returns in these select super-central locations contrast with the significantly lower rental yields (5.79%) available in Central London’s other luxury areas (Kensington, Bayswater, Notting Hill Gate, St Johns Wood, Highgate, Islington, Highbury, and Primrose Hill).

Europe’s most expensive cities

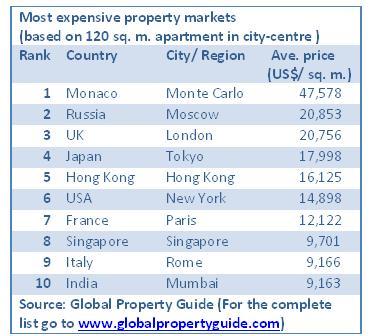

The tiny principality of Monaco is the most expensive location to buy an apartment in Europe at around €24,900 per square metre (sq. m.).

Closely on its tail is Prime Central London, where 120 sq. m. super-luxury apartments can cost £1,170,000 (€1,742,656) or £9,750 (€14,522) per sq. m.

Apartments of 120 sq. m. in other luxury areas of Central London are likely to cost £580,000 or £4,833 per sq. m. (€863,880 or €7,199). The large difference is explained by London’s highly segmented top-end market, with super-luxury apartments in absolutely prime areas commanding considerable premiums.

Paris and Amsterdam follow London. A 120 sq. m. apartment in either of these cities has an average purchase price of €800,000 (€6,667 per sq. m.).

Moscow is Europe’s sixth most expensive capital for buyers of residential property. And though apartments in Moscow can be rather rewarding for buyers in terms of rental income returns, investors should be aware of the high risks (purchases are cash-based, and the authorities can suddenly turn hostile).

Dublin makes an appearance among Europe’s most expensive cities in 10th place, with a high end 120 sq. m. apartment on average costing around €600,000.

The Baltics, till recently Europe’s hottest residential investment destination, are now expensive. A high-end apartment in Central Vilnius, Lithuania will cost on average around €3,792 per sq. m (€455,000 for 120 sq. m.).

Latvia follows closely with high-end apartments in Central Riga costing an average of €3,020 pr sq. m. Rental yields in the Baltics have also dropped to very low levels.

There are still some very inexpensive capitals in Europe. Berlin, in particular (€3,167 per sq. m.), is now experiencing inflows of foreign money in response to its relatively low prices.

Even less expensive are:

Slovakia’s Bratislava (€1,292 per sq. m.)

Poland’s Warsaw (€1,175 per sq. m.)

Macedonia’s Skopje (€1,125 per sq. m.)

Moldova’s Chisinau (€917 per sq. m.)

Rental returns cannot fall forever

As 2007 dawns, rental returns are lower in most locations than they have been for 20 or more years.

Nowhere in Europe are rents keeping pace with the continued strong rise in property prices. Residential real estate prices are at historical peaks in almost all countries in Europe, except Germany and Switzerland.

This is cause for concern. At the Global Property Guide, we informally consider a danger signal to be rental returns of around 4% or below.

Several European capitals offer rental income yields around or below this 4% level. In example is Madrid, where rental returns are now at only 3.15%. Rental yields in Monaco are the lowest in Europe at around 2.43%.

Access the report at:

http://globalpropertyguide.com//articleread.php?article_id=82&cid=

The Global Property Guide is a research publication and web site (http://www.globalpropertyguide.com) for the high net worth investor in residential property – providing information about the process and benefits of buying property in any country in the entire world.

Matthew Montagu-Pollock

632 867 4220

editor@globalpropertyguide.com

http://www.globalpropertyguide.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release London and Monaco are Europe's Most Expensive Cities for Residential Property Buyers here

News-ID: 14689 • Views: …

More Releases from Global Property Guide

Most expensive real estate markets in 2009

No surprise - Monte Carlo is No 1 in the Global Property Guide’s list of World’s Most Expensive Residential Real Estate Markets 2009, more than twice as expensive, at US$45,000 per square metre, as the runner up. [globalpropertyguide.com]

Battling for the number 2 position are prime central Moscow and London. Prime central Moscow’s US$20,853 per square metre price tag slightly outpaces core Prime London’s US$20,756 per square metre, though it…

World property market slide worsens

As financial markets tumble, the world’s housing markets have continued to slide during the year to end-Q2 2008. Inflation-adjusted house prices fell in 21 out of the 33 countries for which there is up-to-date published data.

The Baltics, the US, the UK and Ireland led the global decline during the year to end-Q2 2008, the latest date for which comprehensive global statistics are available.

The biggest house price declines…

The end of the global house price boom

Weighed down by the credit crunch and high inflation, the global house price boom has ended, according to the latest Global Property Guide survey of house price indicators.

Only 13 countries in which dwelling price indices are regularly published saw prices rise during the year to end Q1 2008, while 21 countries saw dwelling prices fall in real terms, i.e., after adjusting for inflation.

In most countries…

Gloomy days ahead for Asia’s housing markets

Asian property markets, though still relatively unaffected by the credit crunch, will soon be affected by inflation and higher interest rates, warns the Global Property Guide, because of rising food, fuel and other commodity prices.

“Higher food, fuel and other commodity prices affect the housing market negatively in several ways,” says Prince Christian Cruz, senior economist at the Global Property Guide.

“At the micro level, households may postpone their decision to…

More Releases for Europe

2019 Strategy Consulting Market Analysis | McKinsey, The Boston Consulting Group …

Strategy Consulting Market reports also offer important insights which help the industry experts, product managers, CEOs, and business executives to draft their policies on various parameters including expansion, acquisition, and new product launch as well as analyzing and understanding the market trends

Need for strategic planning in highly competitive environment and to develop business capabilities to meet & exceed the emerging requirements are the major drivers which help in surging…

Strategy Consulting Market 2025 | Analysis By Top Key Players: Booz & Co. , Rola …

Global Strategy Consulting Market 2019-2025, has been prepared based on an in-depth market analysis with inputs from industry experts. This report covers the market landscape and its growth prospects over the coming years. The report also includes a discussion of the key vendors operating in this market.

The key players covered in this study

McKinsey , The Boston Consulting Group , Bain & Company , Booz & Co. , Roland Berger Europe…

Digital Strategy Consulting Market is Thriving Worldwide with Deloitte, McKinsey …

A Digital Strategy is a form of strategic management and a business answer or response to a digital question, often best addressed as part of an overall business strategy. A digital strategy is often characterized by the application of new technologies to existing business activity and focus on the enablement of new digital capabilities to their business.

A new report as a Digital Strategy Consulting market that includes a comprehensive analysis…

Strategy Consulting Market 2019: By McKinsey, The Boston Consulting Group, Bain …

This report studies the global Strategy Consulting market, analyzes and researches the Strategy Consulting development status and forecast in United States, EU, Japan, China, India and Southeast Asia. This report focuses on the top players in global market, like

• McKinsey

• The Boston Consulting Group

• Bain & Company

• Booz & Co.

• Roland Berger Europe

• Oliver Wyman Europe

• A.T. Kearney Europe

• Deloitte

• Accenture Europe

Get Sample Report@ https://www.reporthive.com/enquiry.php?id=1247388&req_type=smpl&utm_source=AB

Market segment by Type, the product can be split into

• Operations Consultants

• Business Strategy Consultants

• Investment Consultants

• Sales and…

Strategy Consulting Market Analysis 2018: McKinsey, The Boston Consulting Group, …

Orbis Research Present’s “Global Strategy Consulting Market” magnify the decision making potentiality and helps to create an effective counter strategies to gain competitive advantage.

The global Strategy Consulting status, future forecast, growth opportunity, key market and key players. The study objectives are to present the Strategy Consulting development in United States, Europe and China.

In 2017, the global Strategy Consulting market size was million US$ and it is expected to reach million…

Influenza Vaccination Market Global Forecast 2018-25 Estimated with Top Key Play …

UpMarketResearch published an exclusive report on “Influenza Vaccination market” delivering key insights and providing a competitive advantage to clients through a detailed report. The report contains 115 pages which highly exhibits on current market analysis scenario, upcoming as well as future opportunities, revenue growth, pricing and profitability. This report focuses on the Influenza Vaccination market, especially in North America, Europe and Asia-Pacific, South America, Middle East and Africa. This…