Press release

Inditrade Capital and Robocash Group sign MoU to join efforts in India

The Indian financial company Inditrade Capital and Robocash Group announced the conclusion of a Memorandum of Understanding (MoU) to establish an independent NBFC business “Inditrade-Robocash” that will provide short-term consumer lending in India.Last week, the Indian financial company Inditrade Capital and the international holding Robocash Group signed the MoU to work together in the lending market in India and launch an independent non-banking financial company “Inditrade-Robocash”. The company will provide personal financing and issue short-term loans to individuals ranging between USD 140 to USD 705 (INR 10,000 to INR 50,000).

Both companies have a longstanding expertise in the alternative lending market facilitating financial inclusion mainly focusing on the population underserved by banks. The new company Inditrade-Robocash will work predominantly online and imply automated scoring and lending processes. According to estimates, the potential of the market is over USD 7 billion (INR 50,000 crore). The company expects to become a leader in its segment in the period of 3-5 years.

Making the announcement, Mr. Sudip Bandyopadhyay, Group Chairman of Inditrade Group of Companies said, “Our focus as always is on Financing Progress by servicing underserved segments of the Indian population through inclusive and organized financing. Our partnership with Robocash Group enables us to serve a large part of Indian population which is salaried or self employed with low earnings and in need of finance for a short duration. The expertise of Robocash in this sector proved by the dynamics in the emerging markets like Russia, Kazakhstan, the Philippines, Indonesia and Vietnam supported by back-end AI technologies coupled with our understanding of the Indian market make us ideal partners to service this segment”.

Speaking about the forthcoming expansion and partnership with Inditrade, Mr. Sergey Sedov, CEO of Robocash Group said, “India has one of the largest salaried and self-employed populations in the world. However, while it is a relatively untapped and lucrative market, it is also quite challenging. Inditrade with its 25 years of experience in the Indian market and also lending experience is the ideal partner to navigate Inditrade-Robocash in becoming the preferred partner for short-term loans to the salaried and self employed Indians.”

According to the terms of the Memorandum, Inditrade (including its subsidiaries/ associates) will hold 50.1 percent and Robocash Pte Ltd incorporated within the Robocash Group company will hold 49.9 percent in Inditrade-Robocash, the independent NBFC dedicated for the business. Inditrade and Robocash will invest in the company in proportion to their shareholding.

--

Notes for Editors:

Robocash Group is an international financial group operating in the segments of consumer alternative lending and marketplace funding in Europe and Asia. The company develops robotic financial solutions represented by lending services in Russia, Kazakhstan, Spain, the Philippines, Indonesia and Vietnam and Latvia-based p2p investment platform operating across the EU and Switzerland. The group develops products completely in-house with implementation of artificial intelligence, machine learning and data-driven technologies providing precise and comprehensive risk management that proved their efficiency for this business.

https://robo.cash/about

Inditrade holds 25 years of experience in the Indian markets and also small lending experience providing products in Micro Finance, Agri Commodity Finance, and SME/ MSME finance business that brings in significant domain knowledge and terrain experience to the business. Inditrade is predominantly into areas of servicing unserviced and underserved segments of the population. Its other businesses including the soon to be launched Affordable Housing Loans are structured on the same theme of impact lending.

http://www.inditrade.com/

Robocash Group

Duntes iela 23A, Riga, Latvia

Presscontact:

Olga Davydova

Head of Media Relations

E-Mail: pr@robo.cash

Tel.: +371 67 660 860

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Inditrade Capital and Robocash Group sign MoU to join efforts in India here

News-ID: 1431693 • Views: …

More Releases from Robocash Group

Online customers in Asia prefer Asian-made gadgets

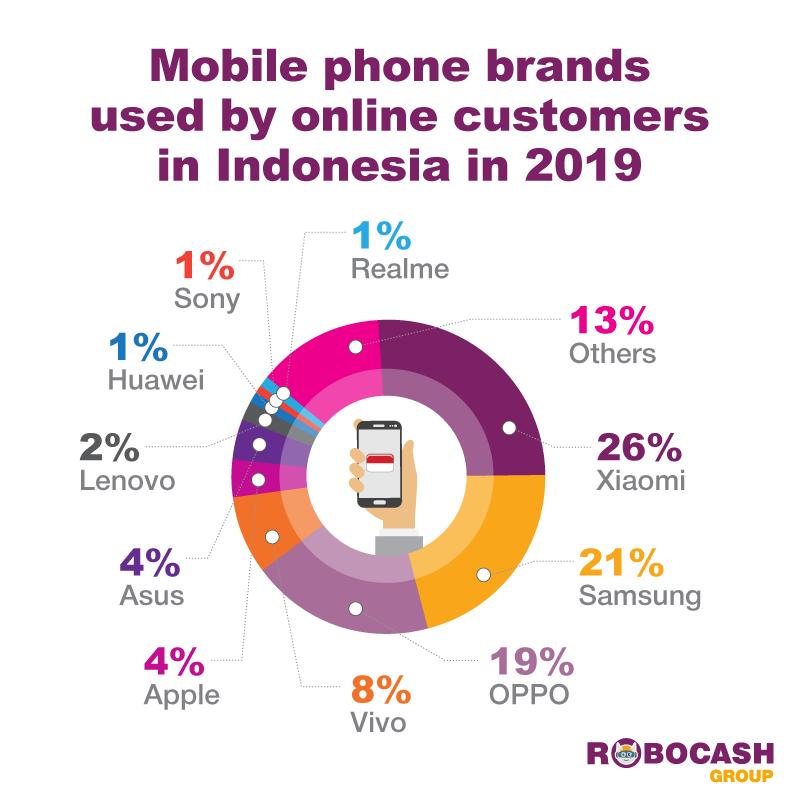

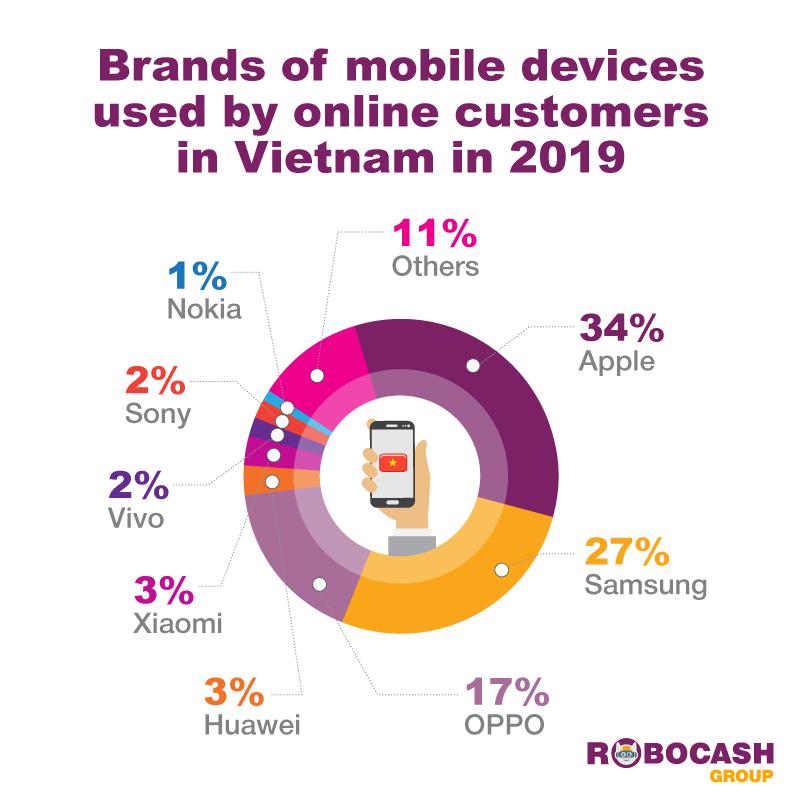

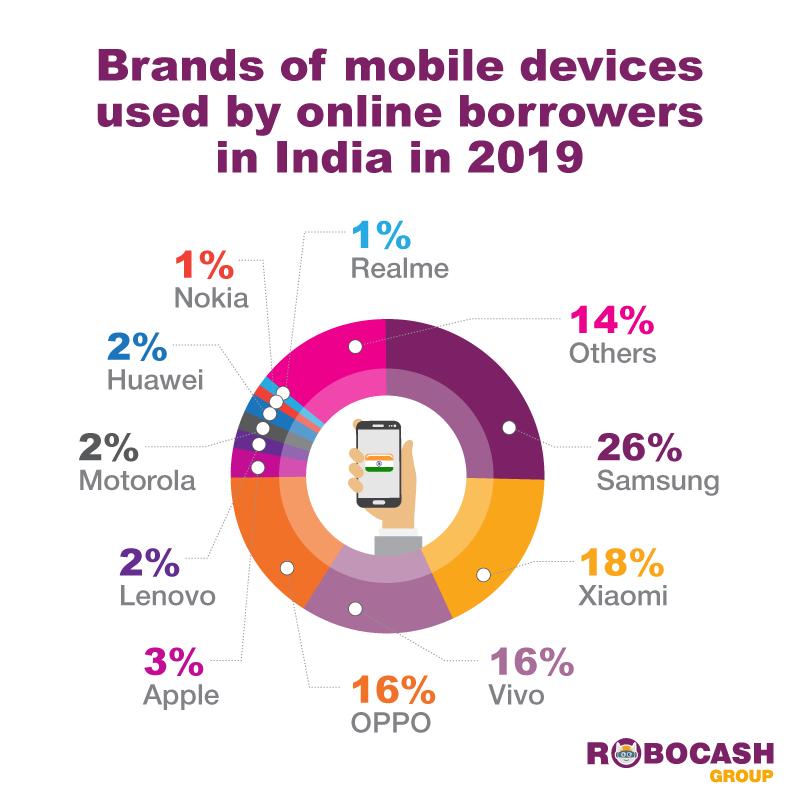

Samsung is one of the most popular mobile phone brands among customers of online financing services in the Philippines, Indonesia, Vietnam and India. Mobile devices made in China like Xiaomi, Vivo, OPPO are taking second and third places by the popularity in these four countries. At the same time, Apple is leading in Vietnam only. These are the findings of the study conducted by the international financial holding Robocash Group.

The…

Online customers in Indonesia prefer Xiaomi, Samsung and OPPO

66% of customers who used online services providing funding facility in Indonesia prefer smartphones of the three mobile brands. Thus, 26% of customers use Xiaomi mobile devices. Samsung (21%) and OPPO (19%) take second and third places, respectively. These are the findings of the study conducted by the international financial holding Robocash Group. The figures have been based on the data of more than 78 thousands unique customers who have…

One-third of online customers in Vietnam prefer Apple

34% of customers of online services providing personal financing in Vietnam prefer Apple mobile devices. Samsung takes second place with 27% of customers using its smartphones. OPPO follows with 17%. With the overall share of 78% split by these three companies, other brands are lagging significantly. These are the findings of the international holding Robocash Group after studying the data of more than 337 thousands unique customers who have used…

Online borrowers in India mostly use Samsung, Vivo, Xiaomi and OPPO

76% of customers applying for personal loans online in India prefer smartphones of the four mobile phone brands. Samsung is leading with 26% of customers using its devices. It is followed by Vivo (18%), Xiaomi (16%) and OPPO (16%). These figures have been based on the data of more than 156 thousands unique customers of the alternative lending holding Robocash Group in India who used the company’s local lending service…

More Releases for Inditrade

Microfinance Market to Hit USD 281.9 Billion by 2025 | Annapurna Finance, BRI, B …

The global microfinance market size is estimated at US$ 228.8 billion in 2023 and is predicted to advance at a high-value CAGR of 11% to reach a valuation of US$ 650 billion by 2033.This robust growth is driven by increasing financial inclusion efforts, digital adoption, and government initiatives targeting underserved populations, particularly in rural and low-income areas. The market is benefiting from a surge in demand for microloans, savings, and…

Microfinance Market Expected to Reach $650 Billion by 2033, Reveals Latest Indus …

The size of the microfinance market is projected to be US$ 228.8 billion in 2023 and is expected to grow at a high-value CAGR of 11% to reach US$ 650 billion in valuation by 2033.

Microfinance is a dynamic and innovative sector within the financial services industry, with the primary goal of addressing financial inclusion and alleviating poverty among underserved populations around the world. Microfinance, also known as 'banking for the…

Online Microfinance Market to Witness Revolutionary Growth by 2030 | Ant Group C …

Global "Online Microfinance Market" Research report is an in-depth study of the market Analysis. Along with the most recent patterns and figures that uncovers a wide examination of the market offer. This report provides exhaustive coverage on geographical segmentation, latest demand scope, growth rate analysis with industry revenue and CAGR status. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of…