Press release

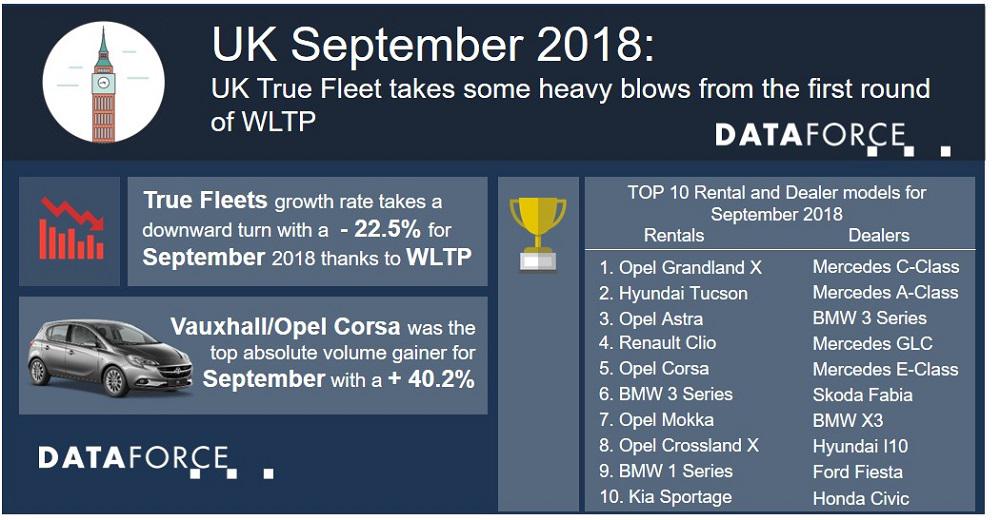

UK True Fleet takes some heavy blows from the first round of WLTP

UK True Fleet Market hit harshly from WLTP in September number plate change. Though 17 out of 20 OEMs were in the red and lost up to 67.6%, we still found some impressive expansions on model level.From Hurrah! to Bah! As WLTP hits hard for all channels of the Total Market in the UK. It certainly seems as no channel (or European market) has escaped an impact from the introduction and unfortunately in terms of True Fleet volume the UK seems to be the hardest hit. Down by 22.5% there were only 3 OEMs inside the top 20 that managed to grow under the heavy homologation burden placed on them. Private registrations were down 20.1% while Special Channels seemingly came off the lightest with a drop of only 18.3%. All this combined to leave the Total Market down to just below 339,000 registrations or 20.5% and while trying not to be too negative on the result it does need to be pointed out that September is a plate change month in the UK and historically alongside March, they are always the strongest months for the market.

Brand performance

OK, so as we mentioned above there were only 3 OEMs inside the top 20 able to capitalise in September with positive growth numbers, leaving the top 10 list with almost a who managed to be least effected feel. Vauxhall (Opel) took the True Fleet crown for September a one place jump over last year’s corresponding month, despite posting negative growth, with Mercedes and then Ford following up to finish out the podium places. BMW in 4th was our first OEM able to post an expansion in volume. Up by 12.0% the Munich manufacturer seemed more prepared than its German counterparts and thanks to some help from the 1 Series, 2 Series Active Tourer and the standard 2 Series they weathered the WLTP storm.

Next up came Nissan and Toyota before our 2nd positive OEM, Kia in 7th, managed to post a + 15.5% with the Stonic, Niro and Picanto all contributing healthy jumps in volume. Kia’s sister company Hyundai retained their 8th position while VW and Audi then rounded out the 10 and while not our usual style to point out negative results the Wolfsburg manufacturer did take the heaviest hit both in terms of volume and growth percentage loss. It dropped from 1st place in September 2017 to 9th suffering a 5-digit loss of volume or 67.6% in growth. Let’s hope October’s numbers bring some slightly more positive results. Final mention rightly goes to the last remaining top 20 OEM to grow in September and it was Fiat, jumping 9 places from last year and into rank number 13 it managed to post a super solid + 98.7%, just 17 registrations away from doubling its volume.

Models: Winner and Losers

With so many players taking a hit we wanted to look at both the biggest gainers and losers in terms of volume for the month and while the losers might have been a bit predictable the gainers were certainly a surprise.

Let’s start with the positives, top absolute volume gainer was the Vauxhall Corsa with a + 40.2%, followed by the Fiat 500 with + 209.1%. The 3rd Place went to the Grandland X perhaps somewhat by default as it was not available last year while its little brother the Crossland X took 4th with an impressive + 463.2%. The 5th Place went to the Ford Fiesta posting a solid + 68.3%.

Ok now the not so positive, the VW Golf was top of the list with a 83.1% and as last September’s number 1 Fleet car this was certainly a heavy hit. Audi A3 was 2nd with a 78.8%, closely followed by the Tiguan also with a - 78.8%. The Audi A4 was next in line with a 84.6% and notably dropped a staggering 71 places in the rankings while the Vauxhall Viva finished out the most negative 5 with a 84.4%.

(646 words; 3,514 characters)

DATAFORCE – Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Richard Worrow

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Germany

Phone: +49 69 95930-253

Fax: +49 69 95930-333

Email: richard.worrow@dataforce.de

www.dataforce.de

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release UK True Fleet takes some heavy blows from the first round of WLTP here

News-ID: 1346402 • Views: …

More Releases from Dataforce Verlagsgesellschaft für Business Informationen mbH

What is the Dataforce Sales channel outlook for 2021?

Following a contraction of around 26% in 2020 things can only get better. But how fast will the recovery be and what is the outlook for the channels?

Slow start, rev up

We expect the first half year of 2021 to remain rather challenging. Strict Containment measures will probably need to be maintained into spring, which will weigh down economic sentiment. At the same time, early 2021 may not be the best…

Generation change at Dataforce: Marc A. Odinius now sole owner and Managing Dire …

The long-standing Managing Director Marc Odinius has acquired all shares of the Dataforce Verlagsgesellschaft für Business Informationen mbH and is now Managing Director and sole owner of the Company.

Mission of Dataforce

As to the mission of the automotive data- and market-research company, with 87 Employees, counting 27 different nationalities who reside in Frankfurt, Rome and Beijing, Odinius stated: Dataforce is always in search of unique information which will make the automotive…

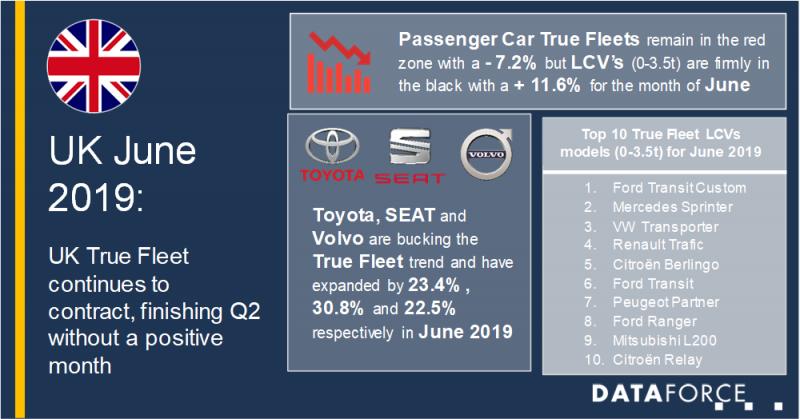

UK True Fleet continues to contract, finishing Q2 without a positive month

Now with the first half of the year having gone by in a blur of negative growth we can only hope that the second half will bring some more positive momentum especially around the plate change month in September. UK True Fleet produced a - 7.2% in June which leaves the channel down 6.2% year-to-date (YTD). The Private Market was also in the red with a 4.8% which…

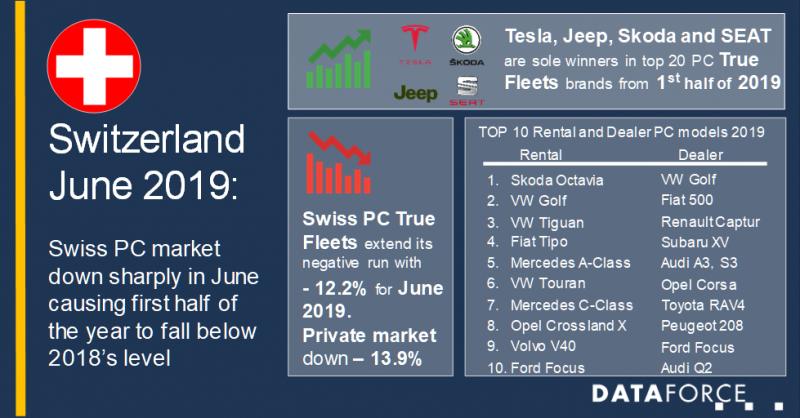

Swiss car market turns into the red on sharp contraction in June

In June 2019 new passenger car registrations in Switzerland were down sharply on the same month last year. Nearly 28,000 registered passenger cars represent an overall market decline of 11.2%. Registrations of light commercial vehicles fell even more sharply (11.9%).

Weak June causes passenger car market to fall below previous year's level

Both the Private Market ( 13.9%) and the commercial market ( 8.4%) can look back on a weak…

More Releases for Fleet

Fleet Tracking and Logistics Market is thriving worldwide by 2027 | Top Key Play …

Fleet Tracking and Logistics Market research is an intelligence report with meticulous efforts undertaken to study the right and valuable information. The data which has been looked upon is done considering both, the existing top players and the upcoming competitors. Business strategies of the key players and the new entering market industries are studied in detail. Well explained SWOT analysis, revenue share and contact information are shared in this report…

Fleet Management Consulting Service Market will reach USD 39.94 Billion by 2032 …

The global fleet management size is expected to grow USD 39.94 Billion by 2032 from USD 21.6 Billion in 2021, at a Compound Annual Growth Rate (CAGR) of 10.5% during the forecast period.

The presence of various key players in the ecosystem has led to a competitive and diverse market. The market include a high growth rate for the adoption of cloud computing and analytics, declining hardware and IoT connectivity costs,…

Fleet Management Solution Market: Start managing fleet data, access and update i …

The report "Global Fleet Management Solution Market By Deployment Model (On-premise, and On-Demand Hybrid), By Solution (Asset Management, Information Management, Driver Management, Safety and Compliance Management, Risk Management, Operations Management, and other Solutions), By End User (Transportation, Energy, Construction, Manufacturing, and Other End Users), and Region - Global Forecast to 2029". Gradually adopting transportation by businesses to enhance their offerings this results in considerable rise over the past few years…

Fleet Management Market Insights | Key players: ARI Fleet Management, Azuga, Che …

According to recent research "Fleet Management Market by Solution (Operations Management, Vehicle Maintenance and Diagnostics, Performance Management, Fleet Analytics and Reporting), Service (Professional and Managed), Deployment Type, Fleet Type, and Region - Global Forecast to 2023", the global fleet management market size is expected to grow from USD 15.9 billion in 2018 to USD 31.5 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 14.7% during the forecast…

Fleet software comm.fleet: Effective cost control for fleet managers

Relief for fleet managers: identify the cost drivers of the company and take appropriate actions with the fleet management software comm.fleet

The adoption of a multifunctional controlling system is an indispensable prerequisite for an effective and systematic management of all company fleet costs. Be it a question of planning enhancement and control, budgeting coordination or the execution and analysis of a target-performance comparison with the purpose of a perfect fleet administration,…

Fleet Specialisation-Cover 4 Fleet Insurance Investigate Future Fleet Trends

Victoria, London ( openpr ) June 10, 2011 - Economically driven by the need to immerse their resources in core activities, companies will turn to fleet outsourcing options. Even in the case of fleet contract hire, there are case studies which are dramatic in the current economic environment.

Take the case study of Fraikin , which was originally established in France in 1944 and is today the biggest commercial…