Press release

Asian residential property buyers beware

Asia’s real estate markets seem, on the surface, to have recovered from the Asian crisis and to be back on their feet. In fact the entire world has enjoyed a residential property boom over the past decade - Europe, the US, Australia and New Zealand have seen property prices soar.But in Asia the reality is quite different. Asia’s residential markets have performed poorly, according to a report released today by the Global Property Guide (http://globalpropertyguide.com//articleread.php?article_id=85&cid=4). Once the price rise figures are adjusted for inflation, Asia’s record looks poor. .

HOW ASIA’S RESIDENTIAL PROPERTY MARKETS HAVE PERFORMED SINCE THE PEAK (inflation-adjusted):

Hong Kong: still 61% below peak

Indonesia: still 50% below peak

Malaysia: still 10% below peak

Philippines: still 55% below peak

Singapore: still 37% below peak

South Korea: still 38% below peak

Thailand: still 10% below 1992 peak

“There have been few less profitable investments than Asian residential property over the past decade,” says Matthew Montagu-Pollock, publisher of the Global Property Guide (http://www.globalpropertyguide.com).

“And if the present construction boom continues across Asia, the next decade isn’t going to be much fun for property investors either.”

Rental yields are quite high in Indonesia, Thailand and the Philippines, while Asian countries benefit from strong economies. But their real estate markets’ rise has been limited, primarily by government mis-steps.

“Asian real estate markets would have been stronger had it not been for government mistakes,” says Prince Cruz, chief economist for the Global Property Guide. “If it is not a coup, a protest rally or runaway inflation, then it is government meddling in the housing markets that has killed performance”. Cruz’s study points to the housing markets of Singapore, Hong Kong and South Korea as victims of government subsidies and intervention, while the housing markets of the Philippines, Indonesia and Thailand have suffered from political instability.

Asian prices still far below peak levels

Despite gleaming reports of recovery, Asian house prices are still below their pre-Asian Crisis levels. In a report released today, Global Property Guide suggests that a combination of inflation, widespread subsidies of housing markets, political troubles, and overbuilding, have made the outcome in Asia quite different from other ‘boom’ markets. Asia’s present apparent property boom is a ‘construction boom – not a property boom’, it says, warning investors against following the tempting siren song of the real estate professionals.

When adjusted for inflation, the happy picture changes remarkably from the good news about property price rises.

Indonesia, for instance, is having a difficult time battling inflation. Corrected for inflation, Indonesia’s house prices actually fell 8.4% in 2005 and 7% y-o-y during 2Q 2006.

This year’s mild nominal price fall in Hong Kong (3.7%) is amplified by considering inflation. Hong Kong dwelling prices have actually fallen by 6% in real terms.

The (modest) apparent price rises in South Korea, Singapore and the Philippines actually become price falls, or are greatly moderated, once inflation is factored in.

For more information, please visit http://www.globalpropertyguide.com.

Global Property Guide

info@globalpropertyguide.com

http://www.globalpropertyguide.com

The Global Property Guide is a research publication and web site (http://www.globalpropertyguide.com) for the high net worth investor in residential property – providing information about the process and benefits of buying property in any country in the entire world.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Asian residential property buyers beware here

News-ID: 13157 • Views: …

More Releases from Global Property Guide

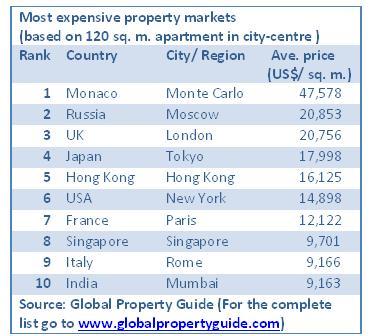

Most expensive real estate markets in 2009

No surprise - Monte Carlo is No 1 in the Global Property Guide’s list of World’s Most Expensive Residential Real Estate Markets 2009, more than twice as expensive, at US$45,000 per square metre, as the runner up. [globalpropertyguide.com]

Battling for the number 2 position are prime central Moscow and London. Prime central Moscow’s US$20,853 per square metre price tag slightly outpaces core Prime London’s US$20,756 per square metre, though it…

World property market slide worsens

As financial markets tumble, the world’s housing markets have continued to slide during the year to end-Q2 2008. Inflation-adjusted house prices fell in 21 out of the 33 countries for which there is up-to-date published data.

The Baltics, the US, the UK and Ireland led the global decline during the year to end-Q2 2008, the latest date for which comprehensive global statistics are available.

The biggest house price declines…

The end of the global house price boom

Weighed down by the credit crunch and high inflation, the global house price boom has ended, according to the latest Global Property Guide survey of house price indicators.

Only 13 countries in which dwelling price indices are regularly published saw prices rise during the year to end Q1 2008, while 21 countries saw dwelling prices fall in real terms, i.e., after adjusting for inflation.

In most countries…

Gloomy days ahead for Asia’s housing markets

Asian property markets, though still relatively unaffected by the credit crunch, will soon be affected by inflation and higher interest rates, warns the Global Property Guide, because of rising food, fuel and other commodity prices.

“Higher food, fuel and other commodity prices affect the housing market negatively in several ways,” says Prince Christian Cruz, senior economist at the Global Property Guide.

“At the micro level, households may postpone their decision to…

More Releases for Asia

Asia Private Equity Firm, Asia Private Equity Management, Asia Private Equity Se …

The private equity market in China has been rapidly growing in recent years. Private equity (PE) refers to the purchase of shares in a company that are not publicly traded on a stock exchange. PE firms typically target companies that are undervalued or in need of capital for growth, and aim to improve the company's operations and financial performance before selling it at a higher value.

https://boomingfaucet.com/

Asia Private Equity Consulting

E-mail:nolan@pandacuads.com

In China,…

South East Asia Business Jet Market And Top Key Players are Asia Corporate Jet, …

By 2022, the South East Asia Business Jet Markets estimated to reach US$ XX Mn, up from US$ XX Mn in 2016, growing at a CAGR of XX% during the forecast period. The Global Business Jet Market, currently at 21 million USD, contributes the highest share in the market and is poised to grow at the fastest rate in the future. The three broad categories of business jets are Small,…

LIXIL Asia Presents Asia Pacific Property Awards

Through its power brands GROHE and American Standard, LIXIL Asia signs a three-year deal to become the Headline Sponsor of the Asia Pacific Property Awards from 2019 until 2022.

23rd January 2019: The International Property Awards, first established in 1993, are open to residential and commercial property professionals from around the globe. They celebrate the highest levels of achievement by companies operating within the architecture, interior design, real estate and property…

PEOPLEWAVE WINS ASIA TECH PODCAST PITCHDECK ASIA 2019 AWARDS

15 January 2019, Singapore – Peoplewave, Asia’s leading data-driven HR technology company, won the Asia Tech Podcast (ATP) Pitchdeck Asia 2019 Awards, being awarded “Startup Most Likely to Succeed in 2019".

The 2019 Pitchdeck Asia Awards is an opportunity for the Asian Startup Ecosystem to shine a spotlight on some of its best startups. The awards were decided by a public vote. More than 7,200 votes were cast by registered LinkedIn…

Undersea Defence Technology Asia, UDT Asia 2011

Latest Military Diving Technologies featured in UDT Asia

Equipping Asia’s navies with the latest diving technology for asymmetric warfare and

operations

SINGAPORE, 17 October 2011 - Naval diving and underwater special operations is a field that is

seeing increased attention and investment amongst navies in Asia. Units such as the Indonesian Navy‟s KOPASKA, the Republic of Singapore Navy‟s Naval Diving Unit (NDU), the Royal Malaysian Navy‟s PASKAL are increasingly utilising specialised equipment for conducting…

Asia Diligence – Specialist Investigative Due Diligence for Asia & Beyond

Asia Diligence today announced the opening of its European Customer Services office in the United Kingdom. The office is to be managed by Steve Fowler and will focus on providing services to Asia Diligence’s European customers. Asia Diligence is also planning to open a US office in the near future, which will provide customer service to its US and North American clients.

Asked to comment on the move, Luke Palmer, the…