Press release

The affirmative ascension of True Fleet in France continues in April

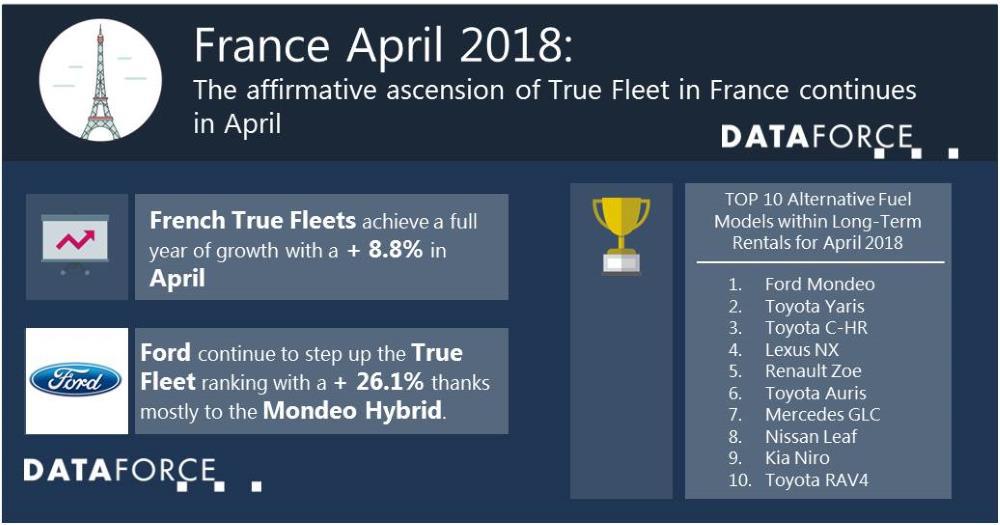

Frankfurt am Main -- French True Fleets hit a full year growth milestone in April and currently show no overt signs of stopping at the moment. Total Market for France in April stood at a healthy 187,000 registrations, a + 9.0% in terms of growth. The private channel with a 15.5% growth was the biggest contributor, both in terms of growth and volume, but True Fleets certainly pitched in with its own + 8.8% and, unlike the Private Market, has maintained the positive growth for 12 months now. Special Channels finished down 0.5%, but this is not a bad thing for an obviously positive market less in need of the tactical registrations that the channel predominantly provides.Brand performance

On a top 10 OEM level the overall performance belies the facts that for some it was not so great a month. Peugeot retook the top spot it lost to Renault in March and this came from a 20.1% surge over April 2016 figures, thanks unsurprisingly to the SUVs. The 3008 which was already pretty established last April pushed its registrations up by 27.5% and the 5008 hit its eighth straight month of 4 digit registration volume in True Fleet.

Already mentioned Renault were relegated to the 2nd spot with Citroën taking the final podium place of 3rd, while VW in 4th also struggled to reap any major benefit from the overall upswing. Ford in 5th though was a different story, continuing to muscle its way up the rankings it secured the 5th spot with a + 26.1% and its 8th month of positive growth. Its shining star at the moment is definitely the Mondeo and the Hybrid version no less, so while Fiesta had a good month the Mondeo’s was stellar with a + 409.3%. No doubt the other side of English Channel would certainly like to be getting some of their French counterparts’ growth percentages. The Germans took the next three places with Audi in 6th, followed closely (only 27 registrations) by Mercedes in 7th while BMW slipped 2 places from April 2017 into 8th.

The final two were actually the biggest growers inside the top 10 for April. Fiat recorded a + 42.1% with the 500 and 500X leading their charge. Toyota was #1 in terms of growth with a + 47.7%, their surge led by the Yaris, C-HR, Auris and Aygo, with Hybrids (apart for Aygo) dominating those registrations. It does seem that French True Fleet is really embracing the Hybrid drivetrain, whether this is due to bonus-malus, in preparation for stricter emissions or a bit of both, the fuel type is up 82.5% for April or 45.5% YTD (year-to-date).

True Fleets sub channel: Long Term Rentals

The sub channel of Long Term Rentals (LLD - Location Longue Durée) in France continues its growth in 2018 up by 16.1% YTD, while the continuing stream of offers from leasing companies alongside the convenience that LTR provides, means we are unlikely to see this trend abate just yet. Not unusually the French manufacturers play their role but it also seems that foreign players are pushing the channel growth and with some significant gains year-to-date.

Inside the top 10 there appears to be four brands that are currently on the ascension, Ford has delivered the highest growth with a + 58.1%, while home brand Peugeot follows with a + 51.2%. Fiat was the next highest with a + 50.7% while the German (albeit French-owned) brand of Opel managed a + 38.6%. The top models from each of these brands were a mixed bag in terms of vehicle segments, Peugeot unsurprisingly was riding the SUV trend – 3008, Ford was successful in the Middle Class – Mondeo, Fiat was playing its strength in the Mini Car – 500 and Opel was driven by the French love for the Small Car – Corsa.

(632 words; 3,583 characters)

Publication by indication of source (DATAFORCE) and author (as listed below) only

DATAFORCE – Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Gabriel Juhas

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Germany

Phone: +49 69 95930-250

Fax: +49 69 95930-333

Email: gabriel.juhas@dataforce.de

www.dataforce.de

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The affirmative ascension of True Fleet in France continues in April here

News-ID: 1060649 • Views: …

More Releases from Dataforce Verlagsgesellschaft für Business Informationen mbH

What is the Dataforce Sales channel outlook for 2021?

Following a contraction of around 26% in 2020 things can only get better. But how fast will the recovery be and what is the outlook for the channels?

Slow start, rev up

We expect the first half year of 2021 to remain rather challenging. Strict Containment measures will probably need to be maintained into spring, which will weigh down economic sentiment. At the same time, early 2021 may not be the best…

Generation change at Dataforce: Marc A. Odinius now sole owner and Managing Dire …

The long-standing Managing Director Marc Odinius has acquired all shares of the Dataforce Verlagsgesellschaft für Business Informationen mbH and is now Managing Director and sole owner of the Company.

Mission of Dataforce

As to the mission of the automotive data- and market-research company, with 87 Employees, counting 27 different nationalities who reside in Frankfurt, Rome and Beijing, Odinius stated: Dataforce is always in search of unique information which will make the automotive…

UK True Fleet continues to contract, finishing Q2 without a positive month

Now with the first half of the year having gone by in a blur of negative growth we can only hope that the second half will bring some more positive momentum especially around the plate change month in September. UK True Fleet produced a - 7.2% in June which leaves the channel down 6.2% year-to-date (YTD). The Private Market was also in the red with a 4.8% which…

Swiss car market turns into the red on sharp contraction in June

In June 2019 new passenger car registrations in Switzerland were down sharply on the same month last year. Nearly 28,000 registered passenger cars represent an overall market decline of 11.2%. Registrations of light commercial vehicles fell even more sharply (11.9%).

Weak June causes passenger car market to fall below previous year's level

Both the Private Market ( 13.9%) and the commercial market ( 8.4%) can look back on a weak…

More Releases for Fleet

Fleet Tracking and Logistics Market is thriving worldwide by 2027 | Top Key Play …

Fleet Tracking and Logistics Market research is an intelligence report with meticulous efforts undertaken to study the right and valuable information. The data which has been looked upon is done considering both, the existing top players and the upcoming competitors. Business strategies of the key players and the new entering market industries are studied in detail. Well explained SWOT analysis, revenue share and contact information are shared in this report…

Fleet Management Consulting Service Market will reach USD 39.94 Billion by 2032 …

The global fleet management size is expected to grow USD 39.94 Billion by 2032 from USD 21.6 Billion in 2021, at a Compound Annual Growth Rate (CAGR) of 10.5% during the forecast period.

The presence of various key players in the ecosystem has led to a competitive and diverse market. The market include a high growth rate for the adoption of cloud computing and analytics, declining hardware and IoT connectivity costs,…

Fleet Management Solution Market: Start managing fleet data, access and update i …

The report "Global Fleet Management Solution Market By Deployment Model (On-premise, and On-Demand Hybrid), By Solution (Asset Management, Information Management, Driver Management, Safety and Compliance Management, Risk Management, Operations Management, and other Solutions), By End User (Transportation, Energy, Construction, Manufacturing, and Other End Users), and Region - Global Forecast to 2029". Gradually adopting transportation by businesses to enhance their offerings this results in considerable rise over the past few years…

Fleet Management Market Insights | Key players: ARI Fleet Management, Azuga, Che …

According to recent research "Fleet Management Market by Solution (Operations Management, Vehicle Maintenance and Diagnostics, Performance Management, Fleet Analytics and Reporting), Service (Professional and Managed), Deployment Type, Fleet Type, and Region - Global Forecast to 2023", the global fleet management market size is expected to grow from USD 15.9 billion in 2018 to USD 31.5 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 14.7% during the forecast…

Fleet software comm.fleet: Effective cost control for fleet managers

Relief for fleet managers: identify the cost drivers of the company and take appropriate actions with the fleet management software comm.fleet

The adoption of a multifunctional controlling system is an indispensable prerequisite for an effective and systematic management of all company fleet costs. Be it a question of planning enhancement and control, budgeting coordination or the execution and analysis of a target-performance comparison with the purpose of a perfect fleet administration,…

Fleet Specialisation-Cover 4 Fleet Insurance Investigate Future Fleet Trends

Victoria, London ( openpr ) June 10, 2011 - Economically driven by the need to immerse their resources in core activities, companies will turn to fleet outsourcing options. Even in the case of fleet contract hire, there are case studies which are dramatic in the current economic environment.

Take the case study of Fraikin , which was originally established in France in 1944 and is today the biggest commercial…