Press release

Softpro Signs Fifth Third Bank to FraudOne Software Suite

The Softpro Group announced today that its holistic fraud detection software suite FraudOne has been successfully implemented by Fifth Third Bank, a leading financial services company. "We are happy with the implementation of Softpro’s FraudOne software suite," states Debbie Kossuth, vice president, Director of Bank Protection for Fifth Third Bank. "The first few days in production have proven FraudOne to be an effective system."Promise kept: Check Processing security at a new level

Fifth Third Bank was looking for a solution to take the necessary precautions required to secure the paper-based payment process and prevent losses from check fraud in a truly cost-effective manner. The Bank identified Softpro’s holistic solution suite, FraudOne, while looking for a vendor that focuses on secure and efficient check processing. Fifth Third Bank contacted some of Softpro’s customers who said Softpro provides significant cost savings and loss avoidance.

Debbie Kossuth continues: "Softpro’s support in project implementation was great. FraudOne’s performance and Softpro’s expertise in the field has been tremendous. We were also able to learn best practices through the vital exchange within Softpro’s User Group."

Best Practice will be shared in Softpro’s User Group

The Bank will share its experience within Softpro’s user group which regularly exchanges best practices in secure check processing. Softpro’s Angela Bardowell, who is leading the user group: "I am very pleased that Fifth Third Bank has agreed to share their experience among the risk management experts within our group. The features in the FraudOne product address compliance as well as performance and quality results in a way that Fifth Third Bank no longer needs to search for a needle in a haystack to find items which may require investigation." FraudOne was initially conceived in cooperation with a consortium of the largest U.S. banks. The solution is considered by many of the US Tier 1 banks to be a "best practice industry initiative" for secure check processing and has been successfully deployed at many of the world's largest financial institutions since its inception.

Billions of paper checks are still written every year

Latest figures about check usage in the United States published from the Bank of International Settlements in 2009 indicate that more than 28 billion checks were written in the year 2007. The average citizen in the United States was issuing 93.5 checks in 2007. In the same year 57.4 checks per capita were issued in France, 38.8 in Canada and 26.2 in the United Kingdom. The relative importance of checks as a payment instrument in value of transactions was outstandingly high in Singapore (74.7%), the United States (52.4%) and Canada (33.5%).

For financial institutions worldwide, check processing and clearing is a significant cost factor in the payment process. The challenge for the financial institutions is to reduce the processing costs and enhance the level of security of the process at the same time. To achieve both there is an ongoing paradigm shift in IT: Systems that target a single type of risk are unable to effectively identify the relevant items and additionally produce a high number of non-fraud suspects that cost time and money to process. FraudOne consequently addresses this need with holistic approach known as "Combined Risk Score".

About Fifth Third Bank

Fifth Third Bancorp is a diversified financial services company headquartered in Cincinnati, Ohio. The Company has $116 billion in assets, operates 16 affiliates with 1,308 full-service Banking Centers, including 99 Bank Mart® locations open seven days a week inside select grocery stores and 2,356 ATMs in Ohio, Kentucky, Indiana, Michigan, Illinois, Florida, Tennessee, West Virginia, Pennsylvania, Missouri, Georgia and North Carolina. Fifth Third operates four main businesses: Commercial Banking, Branch Banking, Consumer Lending, and Investment Advisors. Fifth Third also has a 49% interest in Fifth Third Processing Solutions, LLC. Fifth Third is among the largest money managers in the Midwest and, as of March 31, 2009, had $166 billion in assets under care, of which it managed $23 billion for individuals, corporations and not-for-profit organizations. Investor information and press releases can be viewed at www.53.com. Fifth Third’s common stock is traded on the NASDAQ® National Global Select Market under the symbol “FITB.” Member FDIC.

About SOFTPRO

The SOFTPRO Group is the worldwide leading vendor of systems for capture and verification of handwritten signatures. The company is based in Boeblingen, Germany with local subsidiaries in North America (Bear, Delaware), the United Kingdom (London), and Asia-Pacific (Singapore).

The group currently employs an international staff of over 60 people, enabling more than 200 companies worldwide to streamline their document and transaction workflows.

With its "eSign Workflow" product line, SOFTPRO provides solutions for securing the authenticity and integrity of documents within electronic processes, such as those required for legal contracts. For this purpose, a unique signature technology is used to extract and evaluate both the static and dynamic (biometric) characteristics of handwritten signatures.

SOFTPRO’s "Fraud Prevention Solutions" portfolio provides a holistic approach to detecting and preventing fraud in paper-based processes (such as payment transactions), as well as increasing operational efficiency using signature management and verification solutions.

Among SOFTPRO’s customers are American Express, Bank of America, Barclays, Chase, Citigroup, Discover Financial, Fifth Third, SEB, Standard Bank of South Africa, UBS and Wachovia.

Since 2002, the offer to secure electronic documents with handwritten signatures extended the customer portfolio of SOFTPRO to other industries such as banking and insurance, telecommunication, health and pharmacuticals, retail, government, automotive and logistics.

Frost & Sullivan, one of the leading growth consulting companies worldwide, presented SOFTPRO GmbH with its "Customer Service Leadership Award 2007" for having excelled in serving its customers and gaining superior customer satisfaction levels. This award recognizes the company that has gained the best insights into customer needs and product demands.

SOFTPRO's partners include: A2iA, Adobe, Betasystems, Disoft, Fujitsu Gateway, Gijima AST, Gizmotech, HP, IBM, Lenovo, Microsoft, Motion Computing, Siemens, Toshiba, TeleCash (First Data), Unisys and Wacom.

Please contact us for additional information:

SOFTPRO GmbH

Joerg-M. Lenz

Manager PR

mailto:joerg.lenz@softpro.de

Wilhelmstrasse 34

71034 Boeblingen

Germany

Phone: +49 7031 6606 0

Fax: +49 7031 6606 66

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Softpro Signs Fifth Third Bank to FraudOne Software Suite here

News-ID: 96959 • Views: …

More Releases from SOFTPRO GmbH

CeBIT 2014: Softpro Partner Olivetti shares many Best Practice Cases for E-Signi …

Olivetti is demonstrating its solution portfolio in the E-Signing booth area in hall 3 at the stands of its partners Wacom (E29) and Softpro (D30). The document management specialists from Italy will be sharing their expertise based on many successful E-Signing Projects completed in recent months.

Two years ago Olivetti received broad attention at CeBIT when showing its Olipad Graphos in the Softpro booth. The Olipad Graphos was the world's first…

CeBIT 2014: Samsung presents Softpro Signature Solutions

During CeBIT 2014 the Signature Professionals of Softpro are demonstrating trustworthy signing on tablets and smartphones with appropriate apps like SignDoc Mobile and Sign2Phone at the main booth of Samsung.

The signature experts were invited by the world's largest provider of mobile devices to display their solutions in the "Finance" section of the stand in Hall 2 (B30). A dedicated focus will be the consultation of Samsung's business visitors about methods…

Cintas Deploys Paperless Delivery Enabled by SOFTPRO E-signatures

SignDoc Software Enables Secure Signing of Electronic Forms on a tablet computer with Adobe Reader and LiveCycle ES

SOFTPRO today announced that Cintas Corporation, the leading supplier of uniform services, has deployed an automated electronic process for capturing customer signatures remotely. The environmentally friendly solution is enabled by SOFTPRO’s SignDoc software which captures a customer’s electronic signature on a tablet PC and securely binds it to the electronic PDF form via…

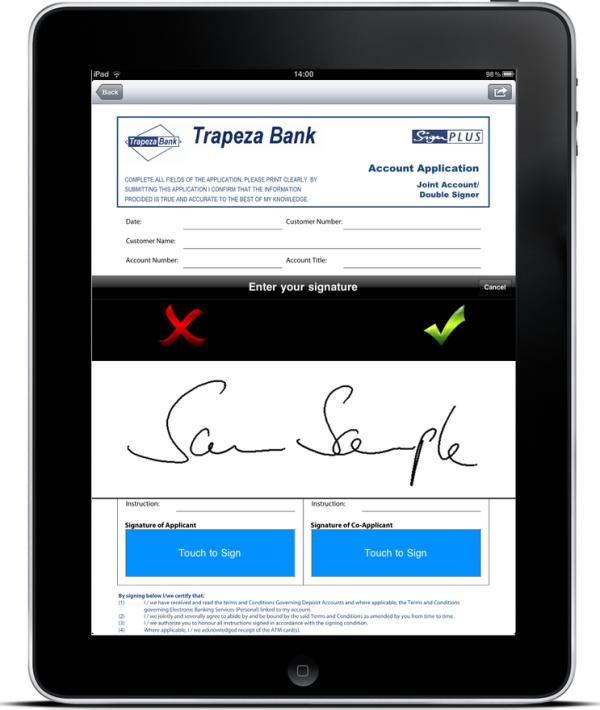

iPads Business Value Increases through E-Signing

Opportunities for Apple’s iPad and other tablets in the business world are becoming more and more versatile. Until recently, tablets were mostly used for showcasing products, but they are capable of more. For example, it is now possible to display and fill out electronic documents on tablets. At the DMS EXPO in Stuttgart from the September 20-22, SOFPTRO will introduce the building block that completes the process – a robust…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…