Press release

Oral Rehydration Salt (ORS) Manufacturing Cost Analysis DPR 2026: CapEx/OpEx Analysis with Profitability Forecast

The global oral rehydration salt (ORS) manufacturing industry is witnessing robust growth driven by the rapidly expanding healthcare sector and increasing demand for effective dehydration management solutions. At the heart of this expansion lies a critical essential medicine-oral rehydration salt. As healthcare systems transition toward preventive care and community-based treatment approaches, establishing an ORS manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and pharmaceutical investors seeking to capitalize on this growing and life-saving market.Market Overview and Growth Potential

The global oral rehydration salt (ORS) market demonstrates strong growth trajectory, valued at USD 3.61 Billion in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach USD 7.52 Billion by 2034, exhibiting a robust CAGR of 8.5% from 2026-2034. This sustained expansion is driven by rising incidence of diarrheal diseases, increasing awareness of oral rehydration therapy, growing adoption of ORS in emergency healthcare settings, and expanding public health initiatives across developing economies.

Oral rehydration salt is a precisely formulated mixture of electrolytes and glucose designed to treat and prevent dehydration caused by diarrhea, vomiting, heat exposure, or excessive fluid loss. It appears as a white crystalline powder packaged in pre-measured sachets for reconstitution with potable water. ORS contains sodium chloride, potassium chloride, sodium citrate, and glucose in WHO-recommended proportions, making it an efficient fluid replacement therapy used in clinical, community, and home-care settings. Due to its proven efficacy, low cost, and ease of administration, it is included in the WHO Model List of Essential Medicines and is indispensable in global disease management programs.

The ORS market is witnessing robust demand due to the persistent burden of diarrheal diseases, which remain a leading cause of morbidity and mortality particularly among children under five years of age in low- and middle-income countries. Rising healthcare expenditure, expanding rural health infrastructure, and growing governmental distribution of essential medicines through public health programs are driving large-scale adoption. Government-led rehydration campaigns, WHO and UNICEF initiatives supporting ORS distribution, and national diarrheal disease control programs further strengthen market prospects.

Request for a Sample Report: https://www.imarcgroup.com/oral-rehydration-salt-manufacturing-plant-project-report/requestsample

Plant Capacity and Production Scale

The proposed ORS manufacturing facility is designed with an annual production capacity ranging between 50-200 million sachets (or 5,000-20,000 MT) per year, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to cater to diverse market segments-from public health programs and hospital procurement to retail pharmacy distribution, humanitarian aid, and sports rehydration applications-ensuring steady demand and consistent revenue streams across multiple healthcare verticals.

Financial Viability and Profitability Analysis

The ORS manufacturing business demonstrates healthy profitability potential under normal operating conditions.

The financial projections reveal:

Gross Profit Margins: 50-60%

Net Profit Margins: 20-30%

These margins are supported by stable demand across healthcare and public health sectors, essential medicine positioning, and the critical role of ORS in global disease management programs. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established pharmaceutical manufacturers looking to diversify their product portfolio in the essential medicines and nutraceuticals sector.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for an ORS manufacturing plant is primarily driven by:

Raw Materials: 40-50% of total OpEx

Utilities: 10-15% of OpEx

Raw materials constitute the largest portion of operating costs, with sodium chloride, glucose, potassium chloride, and sodium citrate being the primary input materials.

Establishing long-term contracts with reliable pharmaceutical-grade salt and glucose suppliers helps mitigate price volatility and ensures consistent raw material supply, which is critical given that sodium chloride price fluctuations represent the most significant cost factor in ORS manufacturing.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=9632&flag=C

Capital Investment Requirements

Setting up an ORS manufacturing plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to pharmaceutical-grade raw material suppliers and transportation networks. Proximity to target healthcare markets and government procurement agencies will help minimize distribution costs. The site must have robust infrastructure, including reliable utilities, cleanroom-grade facilities, and waste management systems. Compliance with local pharmaceutical manufacturing regulations, GMP guidelines, and environmental standards must also be ensured.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers specialized pharmaceutical manufacturing equipment essential for production. Key machinery includes:

• Precision weighing and batching systems for accurate electrolyte and glucose measurement

• High-shear mixing vessels for uniform blending of ORS powder constituents

• Granulation equipment for improving powder flowability and homogeneity

• Sieving and milling systems for achieving consistent particle size distribution

• Automated sachet filling and sealing machines for high-speed packaging operations

• Metal detection and checkweighing systems for product safety and quality assurance

• Quality control laboratory equipment for chemical assay and microbiological testing

• Cleanroom HVAC systems for maintaining pharmaceutical-grade manufacturing environments

Civil Works: Building construction, cleanroom facility development, and infrastructure optimization designed to meet pharmaceutical GMP standards, ensure product sterility, and minimize cross-contamination risks throughout the production process. The layout should be optimized with dedicated areas for raw material quarantine, weighing room, blending zone, granulation unit, sieving section, sachet filling line, packaging area, quality control laboratory, finished goods warehouse, utility block, and administrative offices.

Other Capital Costs: Pre-operative expenses, pharmaceutical license acquisition, WHO-GMP certification costs, regulatory compliance documentation, initial working capital requirements, and contingency provisions for unforeseen circumstances during plant establishment.

Buy now: https://www.imarcgroup.com/checkout?id=9632&method=2175

Major Applications and Market Segments

ORS products find extensive applications across diverse market segments, demonstrating their versatility and critical healthcare importance:

Pediatric Diarrheal Disease Management: Primary use for treating dehydration in children under five years caused by acute diarrheal illnesses, rotavirus infections, and cholera, where prompt rehydration therapy is essential for reducing mortality and preventing severe complications.

Adult Dehydration Treatment: Therapeutic applications for adults experiencing dehydration due to gastrointestinal infections, heat exhaustion, food poisoning, and post-surgical fluid loss in both hospital and home-care settings.

Emergency and Humanitarian Aid: Critical deployment in disaster relief operations, refugee camps, and epidemic outbreak responses where mass dehydration management requires large-scale ORS distribution through humanitarian organizations.

Sports and Athletic Rehydration: Growing adoption in sports nutrition and athletic recovery segments where electrolyte replacement formulations support performance, endurance, and rapid fluid replenishment during intense physical activity.

Geriatric Care: Specialized applications for elderly populations who are particularly vulnerable to dehydration due to reduced thirst sensation, multiple medications, and age-related physiological changes requiring careful electrolyte management.

Why Invest in ORS Manufacturing?

Several compelling factors make ORS manufacturing an attractive investment opportunity:

Essential Medicine Status: ORS is included in the WHO Model List of Essential Medicines and is recognized as one of the most cost-effective healthcare interventions globally, ensuring consistent institutional demand and government procurement across both developed and developing nations.

Rising Disease Burden: The persistent global burden of diarrheal diseases, which claim hundreds of thousands of lives annually-particularly among children in low-income countries-sustains strong and predictable long-term demand for ORS products.

Expanding Healthcare Infrastructure: Rapid growth of healthcare facilities, rural health centers, and community health worker programs in emerging economies significantly expands access points for ORS distribution and consumption.

Government Procurement and Subsidy Programs: National immunization and disease control programs, UNICEF procurement, and WHO-supported rehydration initiatives provide large, stable government purchasing channels for qualified ORS manufacturers.

Low Raw Material Complexity: The relatively straightforward formulation of ORS using widely available pharmaceutical-grade salts and glucose reduces supply chain complexity and raw material sourcing risks compared to more complex pharmaceutical products.

Import Substitution Opportunities: Emerging economies such as India, Bangladesh, Nigeria, and Ethiopia are prioritizing domestic ORS manufacturing to strengthen healthcare self-sufficiency and reduce dependence on imported essential medicines.

Pandemic and Epidemic Preparedness: Growing governmental emphasis on epidemic preparedness and strategic medical stockpiling creates significant opportunities for ORS manufacturers to secure long-term supply agreements with national health authorities.

Manufacturing Process Excellence

The ORS manufacturing process involves several precision-controlled stages:

• Raw Material Testing: Incoming pharmaceutical-grade raw materials including sodium chloride, glucose, potassium chloride, and sodium citrate undergo rigorous quality testing before release for production

• Weighing and Batching: Active ingredients are precisely weighed and measured according to WHO-recommended formulation ratios to ensure accurate electrolyte and glucose concentrations in every sachet

• Blending: Weighed constituents are transferred to high-shear mixing vessels and blended under controlled conditions to achieve complete homogeneity of the powder mixture

• Granulation and Sieving: Blended powder undergoes granulation and sieving processes to improve flowability, reduce segregation, and achieve uniform particle size distribution

• Sachet Filling: Granulated ORS powder is automatically filled into pre-formed sachets at precise weights using high-speed filling and sealing machines

• Packaging and Labeling: Sealed sachets are inspected, labeled with usage instructions in multiple languages, and packed into retail cartons or bulk shipping cases

• Quality Release: Finished product batches undergo final quality control testing including chemical assay, dissolution testing, and microbiological evaluation before market release

Industry Leadership

The global ORS manufacturing industry is led by established pharmaceutical and healthcare companies with extensive production capabilities and diverse distribution networks.

Key industry players include:

• FDC Limited

• Cipla

• Wallace Pharmaceuticals

• Zydus Cadila Healthcare Ltd

• Shereya Life Sciences

• Mankind Pharma

• Intas Pharmaceuticals Ltd.

• Sun Pharma

These companies serve diverse end-use sectors including pediatric care, adult healthcare, emergency medicine, sports nutrition, and geriatric care, demonstrating the broad market applicability of ORS products across global healthcare systems.

Recent Industry Developments

April 2024: FDC Limited expanded its Electral ORS product line with the introduction of flavored variants and ready-to-drink liquid ORS formulations targeting pediatric compliance and convenience. These innovations are designed to improve patient adherence to oral rehydration therapy by addressing palatability concerns, particularly among children who resist unflavored solutions, while maintaining WHO-recommended electrolyte concentrations for clinical efficacy.

Conclusion

The oral rehydration salt (ORS) manufacturing sector presents a strategically positioned investment opportunity at the intersection of essential medicines, public health infrastructure, and global disease management. With favorable profit margins ranging from 50-60% gross profit and 20-30% net profit, strong market drivers including persistent diarrheal disease burden, expanding government healthcare procurement programs, growing emergency preparedness investments, and supportive WHO and UNICEF health initiatives promoting ORS as the first-line rehydration therapy, establishing an ORS manufacturing plant offers significant potential for long-term business success and sustainable returns. The combination of essential medicine status, critical role in pediatric and adult dehydration management, expanding institutional demand, and import substitution opportunities in emerging economies creates an attractive value proposition for serious pharmaceutical investors committed to quality manufacturing and global health impact.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excel in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Oral Rehydration Salt (ORS) Manufacturing Cost Analysis DPR 2026: CapEx/OpEx Analysis with Profitability Forecast here

News-ID: 4393735 • Views: …

More Releases from IMARC Group

Edible Oil Manufacturing Plant DPR 2026: Cost Structure, Production Process & RO …

The global food and beverage industry is experiencing transformative growth driven by rising health-conscious consumer preferences, the expanding food processing industry, and increasing demand in emerging economies. At the forefront of this essential food ingredients revolution stands edible oil-a versatile fat derivative valued for its critical role in cooking, frying, food preparation, and as an ingredient in packaged foods across food and beverage, restaurant and catering, health and wellness, and…

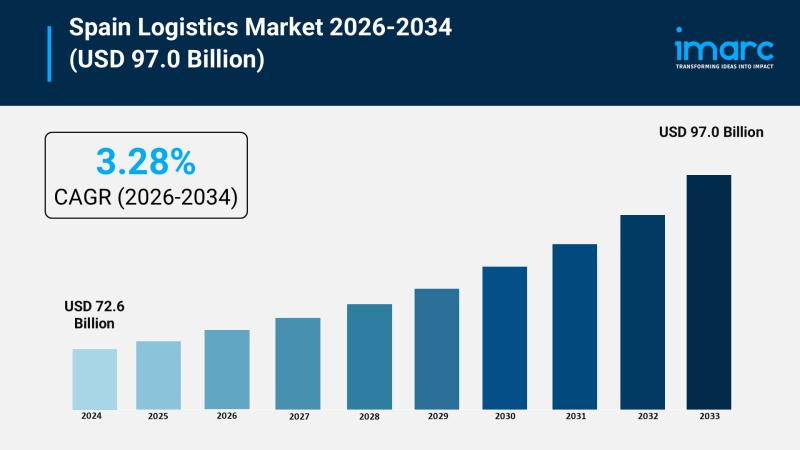

Spain Logistics Market Growth Forecast USD 72.6 Billion in 2025 to USD 97 Billio …

Market Overview

The Spain logistics market size reached USD 72.6 Billion in 2025 and is forecasted to grow to USD 97.0 Billion by 2034. The market is expected to expand at a CAGR of 3.28% during the forecast period 2026-2034. Driving factors include increasing e-commerce users, growing demand for warehousing, urban logistics, ongoing technological advancements, and rising focus on sustainability initiatives.

Study Assumption Years

• Base Year: 2025

• Historical Year/Period: 2020-2025

• Forecast Year/Period: 2026-2034

Spain Logistics Market…

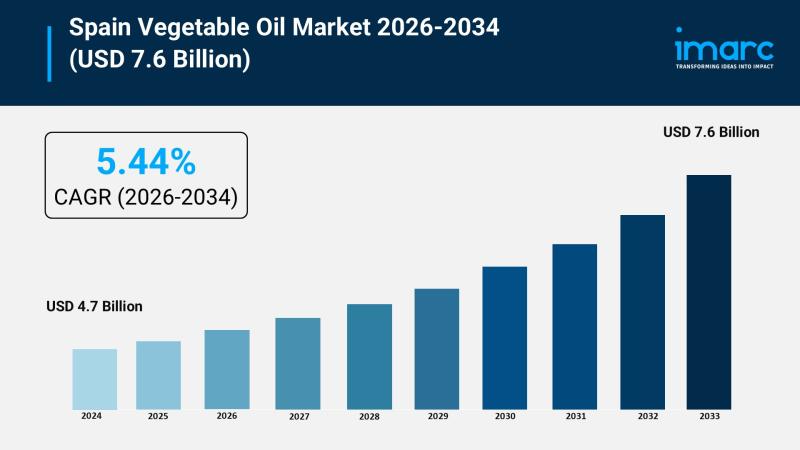

Spain Vegetable Oil Industry Growth Forecast USD 4.7 Billion in 2025 to USD 7.6 …

Market Overview

The Spain vegetable oil market size reached USD 4.7 Billion in 2025 and is expected to grow to USD 7.6 Billion by 2034, exhibiting a CAGR of 5.44% during the forecast period 2026-2034. The market growth is driven primarily by Spain's dominant production and cultural integration of olive oil, rising global demand for authentic oils, and increasing urban consumer preference for diverse, health-oriented oils. These factors collectively support the…

Fiber Optic Cable Manufacturing Plant DPR 2026: Investment Cost, Market Growth & …

The global telecommunications and digital infrastructure sector is experiencing transformative growth driven by the significant expansion of broadband infrastructure, rising investments in 5G networks, increasing deployment of data centers, and growing demand for high-speed communication across telecom, enterprise, and smart city projects. At the forefront of this digital connectivity revolution stands fiber optic cable-a critical communication medium valued for its ultra-high-speed data transfer, minimal signal loss, higher bandwidth, better security,…

More Releases for ORS

Global Orthopedic Power Smart: Schnecon Technology Innovations at ORS-CHINA 2025

The global orthopedic medical device market is on an accelerated trajectory of growth, driven by an aging population, an increasing prevalence of joint and spine-related disorders, and a relentless pursuit of technological innovation. Within this dynamic landscape, the tools and technologies used in surgical procedures are evolving at a remarkable pace, with a clear trend toward smarter, more precise, and more integrated solutions. It is in this context of a…

Prefeasibility Report on an ORS Manufacturing Plant Setup by IMARC Group

Setting up an oral rehydration salt (ORS) manufacturing facility necessitates a detailed market analysis alongside granular insights into various operational aspects, including unit processes, raw material procurement, utility provisions, infrastructure setup, machinery and technology specifications, workforce planning, logistics, and financial considerations.

IMARC Group's report titled "Oral Rehydration Salt (ORS) Manufacturing Plant Project Report 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" offers a comprehensive guide…

ORS Manufacturing Plant Cost Breakdown: Detailing Setup Layout and Business Plan

Setting up an oral rehydration salt (ORS) manufacturing facility necessitates a detailed market analysis alongside granular insights into various operational aspects, including unit processes, raw material procurement, utility provisions, infrastructure setup, machinery and technology specifications, workforce planning, logistics, and financial considerations.

IMARC Group's report titled "Oral Rehydration Salt (ORS) Manufacturing Plant Project Report 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" offers a comprehensive guide…

How to Establish a Successful ORS Manufacturing Plant

Setting up an oral rehydration salt (ORS) manufacturing facility necessitates a detailed market analysis alongside granular insights into various operational aspects, including unit processes, raw material procurement, utility provisions, infrastructure setup, machinery and technology specifications, workforce planning, logistics, and financial considerations.

IMARC Group's report titled "Oral Rehydration Salt (ORS) Manufacturing Plant Project Report 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" offers a comprehensive guide…

ORS Manufacturing Plant Report: Market Overview, Setup, Costs and Revenue Insigh …

IMARC Group's "Oral Rehydration Salt (ORS) Manufacturing Plant Project Report 2024: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" report provides a comprehensive guide on how to successfully set up an oral rehydration salt (ORS) manufacturing plant. The report offers clarifications on various aspects, such as unit operations, raw material requirements, utility supply, infrastructural needs, machinery models, labor necessities, transportation timelines, packaging costs, etc.

In…

Oral Rehydration Salts (ORS) Market Analysis and Future Prospects for 2030

The world of the oral rehydration salts (ors) market is a complex and ever-evolving landscape, shaped by consumer demands and technological advancements. In this report, we delve into the depths of this market to provide a profound and comprehensive analysis, catering to a diverse audience that includes manufacturers, suppliers, distributors, and investors. Our primary goal is to empower industry stakeholders with invaluable insights to make informed decisions in a rapidly…