Press release

Fiber Optic Cable Manufacturing Plant DPR 2026: Investment Cost, Market Growth & ROI

The global telecommunications and digital infrastructure sector is experiencing transformative growth driven by the significant expansion of broadband infrastructure, rising investments in 5G networks, increasing deployment of data centers, and growing demand for high-speed communication across telecom, enterprise, and smart city projects. At the forefront of this digital connectivity revolution stands fiber optic cable-a critical communication medium valued for its ultra-high-speed data transfer, minimal signal loss, higher bandwidth, better security, immunity to electromagnetic interference, and longer service life compared to conventional metallic cables. As governments and private telecom companies prioritize fiber deployment to offer next-generation connectivity and build cloud computing ecosystems, establishing a fiber optic cable manufacturing plant presents a strategically compelling business opportunity for telecommunications infrastructure investors, cable manufacturers, and digital technology developers seeking to capitalize on the expanding market for high-performance communication networks with reliable data transmission, scalable deployment, and consistent performance across broadband, 5G, data center, and smart city applications worldwide.IMARC Group's report, "Fiber Optic Cable Manufacturing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," offers a comprehensive guide for establishing a manufacturing plant. The fiber optic cable manufacturing plant report offers insights into the manufacturing process, financials, capital investment, expenses, ROI, and more for informed business decisions.

Request for a Sample Report: https://www.imarcgroup.com/fiber-optic-cable-manufacturing-plant-project-report/requestsample

Market Overview and Growth Potential

The global fiber optic cable market demonstrates exceptional growth trajectory, valued at USD 7.21 Billion in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach USD 15.91 Billion by 2034, exhibiting a strong CAGR of 9.2% from 2026-2034. This sustained expansion is fueled by the significant expansion of broadband infrastructure, rising investments in 5G networks, increasing deployment of data centers, and growing demand for high-speed communication across telecom, enterprise, and smart city projects worldwide.

Fiber optic cables are the fastest data transmission media whose principle is passing data through thin glass or plastic fibers as light pulses. These cables enable ultra-high-speed data transfer with minimal or no signal loss, making them the backbone of modern communication networks. A standard fiber optic cable has a core, cladding, protective coatings, strength members, and an outer jacket that is specially designed to last long and to keep the signal intact. Fiber optic cables are mainly categorized by the type of light propagation, and they are further classified according to the distance and bandwidth requirements into single-mode and multi-mode variants. They are predominantly used in telecom, broadband internet, data centers, cable TV, military communication systems, and factory automation. Fiber optic cables, when compared to metallic ones, provide higher bandwidth, better security, immunity to electromagnetic interference, and longer service life, thus supporting digital infrastructure development as a main pillar.

The fiber optic cable sector is growing continuously due to rapid digital transformation, the establishment of 5G networks, and increasing investments in technologies that use large amounts of data. According to the International Telecommunication Union (ITU), in 2025, 5G networks were estimated to reach 55% of the global population, signaling strong progress in advanced mobile connectivity. Accelerating 5G rollout is directly boosting demand for fiber optic cables, which form the backbone of high-speed network infrastructure. Both governments and private telecom companies are putting fiber deployment as their priority to offer the next generation of connectivity, smart infrastructure, and to build cloud computing ecosystems. Market momentum is getting stronger due to increasing internet accessibility, demand for video streaming, and enterprise networking getting more sophisticated.

Plant Capacity and Production Scale

The proposed fiber optic cable manufacturing facility is designed with an annual production capacity ranging between 50,000-100,000 fiber-km per year, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to serve diverse market segments-from telecommunications networks to data centers, FTTH and broadband infrastructure, and defense and industrial communication-ensuring steady demand and consistent revenue streams across multiple distribution channels serving the expanding global digital infrastructure market.

Financial Viability and Profitability Analysis

The fiber optic cable manufacturing business demonstrates strong profitability potential under normal operating conditions. The financial projections reveal healthy margins supported by stable demand and value-added applications:

• Gross Profit Margins: 30-40%

• Net Profit Margins: 12-18%

These margins position fiber optic cable manufacturing among the higher-profitability ventures in the technology manufacturing sector, supported by rapid expansion of digital infrastructure, technological superiority over conventional copper wires, strong long-term demand visibility from data consumption growth and 5G rollout, scalable manufacturing model for modular capacity expansion, and export potential from global demand for fiber optic cables optimizing capacity utilization.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a fiber optic cable manufacturing plant reflects balanced resource allocation:

• Raw Materials: 60-70% of total OpEx

• Utilities: 10-15% of OpEx

• Other Expenses: Including labor, packaging, transportation, maintenance, quality control, depreciation, and taxes

Optical fiber constitutes the primary raw material cost driver at 60-70% of operating expenses, representing moderate to high intensity compared to other cable manufacturing sectors. Additional key inputs include HDPE (high-density polyethylene) and FRP (fiber reinforced polymer). The balanced cost structure combined with premium pricing for high-performance digital infrastructure components creates favorable profit margins, positioning fiber optic cable manufacturing as an attractive venture with significant value captured through technological superiority, consistent quality, and growing market demand across telecom, data center, broadband, and defense communication applications.

Buy Now: https://www.imarcgroup.com/checkout?id=11966&method=2175

Capital Investment and Project Economics

Establishing a fiber optic cable manufacturing plant requires comprehensive capital investment covering land acquisition, site preparation, civil works, machinery procurement, and working capital. Machinery costs account for the largest portion of total capital expenditure, with essential equipment including fiber drawing towers, coating systems, buffering lines, stranding machines, jacketing lines, and optical testing equipment. Operating costs in the first year cover raw materials, utilities, depreciation, taxes, packing, transportation, and repairs and maintenance. By the fifth year, total operational costs are expected to increase substantially due to factors such as inflation, market fluctuations, potential rises in the cost of key materials, supply chain disruptions, rising consumer demand, and shifts in the global economy.

The capital investment depends on plant capacity, technology selection, and location. This investment covers land acquisition, site preparation, and necessary infrastructure. Equipment costs represent a significant portion of capital expenditure. The scale of production and automation level will determine the total cost of machinery. Raw material expenses, including optical fiber, HDPE, and FRP, are a major part of operating costs. Long-term contracts with reliable suppliers help mitigate price volatility and ensure consistent material supply. Costs associated with land acquisition, construction, and utilities (electricity, water, steam) must be considered in the financial plan. Ongoing expenses for labor, maintenance, quality control, and environmental compliance must be accounted for. A detailed financial analysis, including income projections, expenditures, and break-even points, must be conducted to secure funding and formulate a clear financial strategy.

Major Applications and End-Use Industries

Fiber optic cables serve multiple critical applications across diverse sectors:

• Telecommunications Networks: Fiber optic cables are responsible for the transmission of high-speed voice and data over large distances with very little loss, thus guaranteeing the dependability and ability to grow of the network

• Data Centers: High bandwidth and low latency features are permitting data transfer in and out of data centers simultaneously, covering both hyperscale and enterprise data centers

• FTTH and Broadband Infrastructure: Fiber cables form the backbone of last-mile connectivity, enabling high-speed internet access for residential and commercial users

• Defense and Industrial Communication: The use of fiber optic cables for defense and industrial communication is due to very secure and interference-free transmission, suitable for mission-critical applications and industrial automation

Why Invest in Fiber Optic Cable Manufacturing?

Several compelling factors make fiber optic cable manufacturing an attractive investment opportunity:

• Rapid Expansion of Digital Infrastructure: The ongoing investments in digital infrastructure, including telecom, broadband, and smart city projects, are fueling continuous demand for fiber optic cables across global markets

• Technological Superiority: Fiber optic cables are far superior to conventional copper wires in terms of speed, bandwidth, and signal quality, creating consistent preference among network operators and infrastructure developers

• Strong Long-Term Demand Visibility: The unstoppable market growth is guaranteed by increasing data consumption, cloud adoption, and 5G rollout driving sustained need for fiber deployment globally

• Scalable Manufacturing Model: The growth of production lines can be done in a modular way to cater to increasing volume demands and to the diversification of product portfolios

• Export Potential: The demand for fiber optic cables all over the world gives manufacturers a chance to sell internationally and to optimize their capacity utilization across multiple markets

Manufacturing Process Overview

The fiber optic cable manufacturing process involves several critical stages ensuring signal performance and cable durability. The process begins with preform preparation or procurement where the optical glass preform is created or sourced. Fiber drawing involves heating the preform and drawing it into thin glass fibers of precise diameter. Coating and curing applies protective polymer layers to preserve fiber integrity.

Buffering adds additional protective layers for mechanical strength. Stranding organizes multiple fibers into structured cable configurations. Sheathing applies the outer jacket providing environmental protection using HDPE or FRP materials. Testing and quality inspection verifies optical performance, signal attenuation, and mechanical properties. Finally, packaging prepares the finished cables for distribution, with comprehensive quality control throughout ensuring consistent signal transmission, bandwidth performance, and regulatory compliance across all telecommunications and industrial applications.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=11966&flag=C

Industry Leadership and Key Players

The global fiber optic cable industry features several established multinational companies with extensive production capacities and diverse application portfolios. Leading manufacturers include Corning Inc., CommScope Holding Company Inc., Sumitomo Electric Industries Ltd., Prysmian Group, and Furukawa Electric, all serving end-use sectors across telecom operators, data centers, infrastructure developers, and the industrial users segment. These industry leaders demonstrate the viability and scalability of fiber optic cable manufacturing operations serving global markets with consistent signal performance, advanced technology, and regulatory compliance.

Recent Developments and Market Dynamics

Recent industry developments highlight growing market momentum. In July 2025, Prysmian announced investments in Relativity Networks, marking a strategic move toward next-generation fiber optic cable innovation. The initiative followed a March 2025 agreement covering production and global deployment of hollow-core optical fiber and cable, targeting ultra-low latency, AI acceleration, quantum networking, high-frequency trading, and sustainable, high-performance data center networks. In March 2025, Furukawa Electric Co., Ltd. introduced a unified global fiber optic cable business brand, Lightera, at the OFC Conference in San Francisco. The move combined the Fiber Cable Division (Japan), OFS Fitel, LLC (OFS), and Furukawa Electric LATAM S.A. (FEL), targeting AI, data centers, 5G/6G, utilities, medical, aerospace, defense, and sensing markets.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fiber Optic Cable Manufacturing Plant DPR 2026: Investment Cost, Market Growth & ROI here

News-ID: 4393718 • Views: …

More Releases from IMARC Group

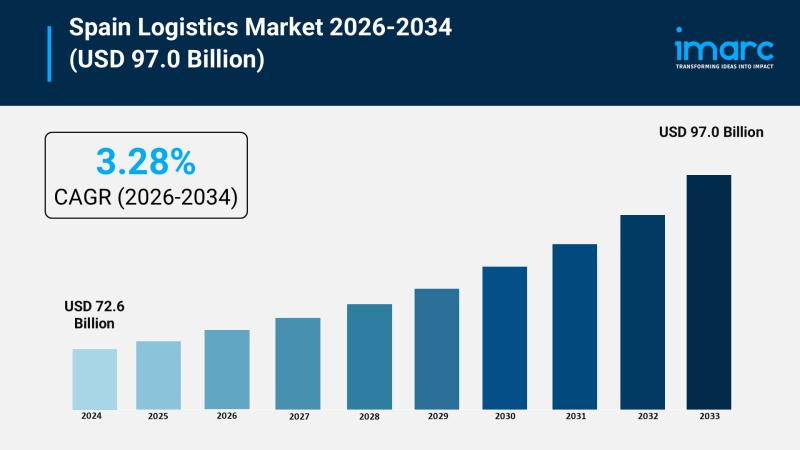

Spain Logistics Market Growth Forecast USD 72.6 Billion in 2025 to USD 97 Billio …

Market Overview

The Spain logistics market size reached USD 72.6 Billion in 2025 and is forecasted to grow to USD 97.0 Billion by 2034. The market is expected to expand at a CAGR of 3.28% during the forecast period 2026-2034. Driving factors include increasing e-commerce users, growing demand for warehousing, urban logistics, ongoing technological advancements, and rising focus on sustainability initiatives.

Study Assumption Years

• Base Year: 2025

• Historical Year/Period: 2020-2025

• Forecast Year/Period: 2026-2034

Spain Logistics Market…

Oral Rehydration Salt (ORS) Manufacturing Cost Analysis DPR 2026: CapEx/OpEx Ana …

The global oral rehydration salt (ORS) manufacturing industry is witnessing robust growth driven by the rapidly expanding healthcare sector and increasing demand for effective dehydration management solutions. At the heart of this expansion lies a critical essential medicine-oral rehydration salt. As healthcare systems transition toward preventive care and community-based treatment approaches, establishing an ORS manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and pharmaceutical investors seeking to capitalize…

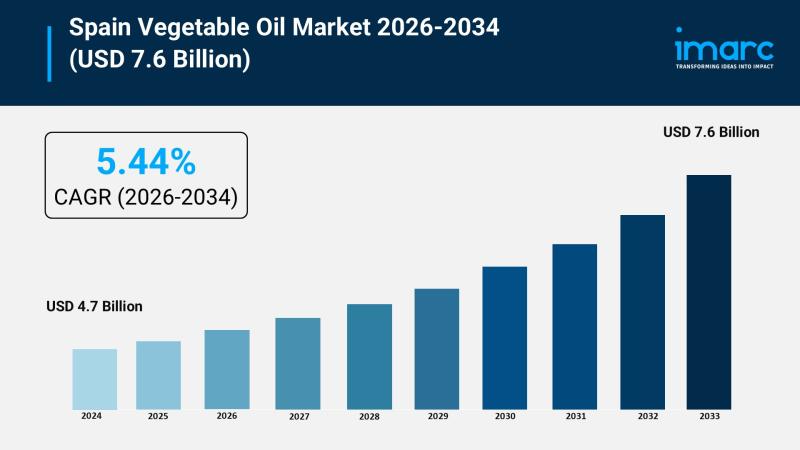

Spain Vegetable Oil Industry Growth Forecast USD 4.7 Billion in 2025 to USD 7.6 …

Market Overview

The Spain vegetable oil market size reached USD 4.7 Billion in 2025 and is expected to grow to USD 7.6 Billion by 2034, exhibiting a CAGR of 5.44% during the forecast period 2026-2034. The market growth is driven primarily by Spain's dominant production and cultural integration of olive oil, rising global demand for authentic oils, and increasing urban consumer preference for diverse, health-oriented oils. These factors collectively support the…

Asphalt Manufacturing Plant DPR 2026: Investment Cost, Market Growth & ROI

The global asphalt manufacturing industry is witnessing robust growth driven by the expanding road infrastructure projects, rising urbanization, and increasing investments in highway construction and maintenance across public and private sectors. At the heart of this expansion lies a critical construction material-asphalt. As governments across emerging and developed economies prioritize transportation infrastructure to support economic development, logistics efficiency, and urban mobility, establishing an asphalt manufacturing plant presents a strategically compelling…

More Releases for Fiber

Fiber Laser Market Forecast to 2028 COVID-19 Impact and Global Analysis By Type …

The fiber laser market was valued at US$ 2286.16 million in 2021 and is projected to reach US$ 4,765.43 million by 2028; it is expected to grow at a CAGR of 11.1% from 2021 to 2028.

Automotive production is constantly rising across the world, particularly in Asian and European countries, which is driving the demand for fiber lasers. Most automotive manufacturers are rapidly turning to fiber lasers to resolve their manufacturing…

Pea Fiber Market Inclinations Exhibit Growing Demand during the Period until 202 …

The new report on the pea fiber market provides estimations of the size of the global market and share and size of key regional markets during the historical period of 2014 – 2018. This highly favorable growth of the pea protein creates a highly conducive environment for the associated pea fiber market, which is expected to exhibit a promising CAGR of ~8% during the forecast period (2019-2029. The business intelligence…

Optical Fiber and Optical Fiber Cables Market

Optical Fibers and Optical Fiber Cables Market describes its growth, size, share, Forecast and trends to 2025

Optical Fibers and Optical Fiber Cables Market Production and Demand Analysis 2019 to 2025

Optical Fibers and Optical Fiber Cables Market 2019 Manufacturing Analysis and Development Forecast to 2025

Optical Fibers and Optical Fiber Cables Market 2019: Recent Study Including Growth Factors, Regional Drivers, Forecast 2025

Optical Fibers and Optical Fiber Cables Market Insights 2019, Global and…

Aramid Fiber Market (Para-Aramid Fiber, Meta-Aramid Fiber) by Type, Application …

The aramid fiber market (http://www.rnrmarketresearch.com/aramid-fiber-market-by-type-para-aramid-fiber-meta-aramid-fiber-and-application-security-protection-frictional-material-tire-rubber-reinforcement-optical-fiber-electrical-insulation-aeros-market-report.html) is projected to grow from USD 3.28 billion in 2018 to USD 5.78 billion by 2024, at a CAGR of 9.9%. The increasing demand for lightweight materials for automotive components owing to stringent environmental and emission regulations is expected to drive the market in the automotive industry. In addition, the demand for lightweight and flexible materials for body armor, firefighting equipment, bulletproof vests, helmets, and…

Fiber-optic couplers Market Segmentation By Type Y Fiber-optic Couplers, T Fiber …

Fiber-optic couplers market: Market Overview

Due to increasing reliance of organizations on IT, the demand for robust, agile and cost effective IT infrastructure is growing rapidly and supporting the Fiber-optic couplers market. The fabric-optic couplers market is expanding rapidly as the telecom services providers in this modern era are moving towards fiber based networking services. Increasing advancements in the telecom industry are one of the major factors driving the growth of…

Fiber Laser Market 2025 - Global Analysis and Forecasts by Type (Infrared Fiber …

The "Global Fiber Laser Market Analysis to 2025" is a specialized and in-depth study of the fiber laser industry with a focus on the global market trend. The report aims to provide an overview of global fiber laser market with detailed market segmentation by type, application and geography. The global fiber laser market is expected to witness high growth during the forecast period. The report provides key statistics on the…