Press release

Battery Recycling Plant Setup 2026: Complete DPR with Process Flow, Machinery & Profitability

The global battery recycling industry is witnessing extraordinary growth driven by the rapidly expanding electric vehicle market and increasing demand for sustainable resource recovery solutions. At the heart of this expansion lies a critical circular economy imperative battery recycling. As industries and consumers transition toward responsible end-of-life battery management and critical mineral recovery, establishing a battery recycling plant presents a strategically compelling business opportunity for entrepreneurs and environmental investors seeking to capitalize on this growing and essential market.Market Overview and Growth Potential

The global battery recycling market demonstrates exceptional growth trajectory, valued at USD 17.96 Billion in 2025. According to comprehensive market analyses from multiple research firms, the market is projected to reach USD 32.68 Billion by 2034, exhibiting a robust CAGR of 6.88% from 2026-2034. This sustained expansion is driven by explosive electric vehicle adoption, accelerating volume of end-of-life batteries, strengthening regulatory mandates for Extended Producer Responsibility, and expanding critical mineral recovery requirements across developed and developing economies.

Battery recycling encompasses the systematic collection, processing, and material recovery from spent batteries including lead-acid, lithium-ion, nickel-metal hydride, and nickel-cadmium chemistries. The process involves discharging, dismantling, mechanical separation, and metallurgical recovery of valuable materials including lithium, cobalt, nickel, manganese, copper, aluminum, and lead. Modern battery recycling prevents hazardous materials from environmental contamination while recovering economically valuable critical minerals essential for manufacturing new batteries. Due to high metal recovery rates, resource conservation benefits, and alignment with circular economy principles, battery recycling represents a critical solution for sustainable resource management in the electrification era.

The battery recycling market is witnessing unprecedented demand due to the explosive growth in electric vehicle adoption. Each electric vehicle battery weighing 300-600 kilograms contains valuable materials including lithium, cobalt, nickel, and manganese worth hundreds to thousands of dollars. Regulatory enforcement through Extended Producer Responsibility programs, particularly in Europe and China, is mandating battery collection and recycling, creating strong policy frameworks supporting formal recycling infrastructure development.

Plant Capacity and Production Scale

The proposed battery recycling facility is designed with an annual processing capacity ranging between 10,000 - 20,000 MT, enabling economies of scale while maintaining operational flexibility. This capacity range allows processors to handle diverse battery chemistries from lead-acid automotive batteries to lithium-ion electric vehicle batteries, consumer electronics batteries, and industrial energy storage systems-ensuring steady feedstock supply and consistent revenue streams across multiple material recovery segments including metals extraction, plastic recovery, and electrolyte processing.

Request for a Sample Report: https://www.imarcgroup.com/battery-recycling-plant-project-report/requestsample

Financial Viability and Profitability Analysis

The battery recycling business demonstrates attractive profitability potential under normal operating conditions. The financial projections reveal:

Gross Profit Margins: 30-40%

Net Profit Margins: 12-18%

These margins are supported by high-value critical mineral recovery, stable demand across automotive and energy storage sectors, value generation from multiple recovered material streams, and the essential nature of battery recycling in electric vehicle supply chains. The project demonstrates strong return on investment (ROI) potential with break-even typically achieved within 3-5 years depending on capacity utilization and metal price dynamics, making it an attractive proposition for both new entrants and established recycling companies looking to expand into battery processing.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a battery recycling plant is primarily driven by:

Raw Materials (Battery Collection): 50-60% of total OpEx

Processing and Utilities: 20-25% of OpEx

Other Expenses: Including labor, chemicals for processing, transportation, maintenance, depreciation, regulatory compliance, and taxes

Battery collection and procurement constitute a significant portion of operating costs, with successful recyclers establishing collection networks through automotive dealerships, battery retailers, municipal programs, and OEM take-back systems. Processing costs including discharging, dismantling, shredding, separation, and metallurgical recovery represent the second major component. Chemical reagents for hydrometallurgical processing, energy consumption for pyrometallurgical operations, and maintaining environmental compliance systems contribute to operational expenditure, making process efficiency optimization critical for profitability.

Capital Investment Requirements

Setting up a battery recycling plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to major battery generation centers including automotive hubs, metropolitan areas, and battery manufacturing clusters. The site must have robust infrastructure including reliable power supply for energy-intensive processing, water availability for metallurgical operations, and compliance with stringent environmental zoning regulations. Proximity to metal refineries and battery manufacturers helps minimize logistics costs for recovered materials and finished products.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers specialized processing equipment essential for safe and efficient battery recycling. Key machinery includes:

- Battery discharge systems for safely depleting residual electrical charge before processing

- Dismantling stations and robotics for safe manual and automated battery component separation

- Industrial shredders for mechanical size reduction under controlled atmospheres preventing thermal events

- Magnetic separators for ferrous metal extraction from mixed battery material streams

- Eddy current separators for non-ferrous metal recovery including aluminum and copper

- Hydrometallurgical processing equipment including leaching tanks, filtration systems, and precipitation units

- Pyrometallurgical equipment including smelting furnaces for high-temperature metal recovery where applicable

- Solvent extraction and electrowinning systems for high-purity metal recovery from solution

- Advanced ventilation, scrubbing, and air filtration systems for safety and environmental compliance

- Wastewater treatment facilities for processing and recycling process water and managing effluents

Speak to Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=22382&flag=C

Civil Works: Building construction, facility layout optimization, and infrastructure development designed to enhance material flow efficiency, ensure workplace safety, and minimize handling complexities throughout the processing operation. The layout should be optimized with separate areas for battery receiving and storage, discharge area, manual dismantling zone, mechanical processing section, hydrometallurgical processing area, pyrometallurgical processing zone where applicable, recovered materials storage, hazardous waste containment, quality control laboratory, pollution control systems, administrative offices, and emergency response facilities.

Other Capital Costs: Pre-operative expenses, machinery installation and commissioning costs, environmental clearances and comprehensive regulatory compliance certifications, initial working capital requirements for establishing collection networks and inventory buildup, fire safety systems, emergency containment infrastructure, and contingency provisions for unforeseen circumstances during plant establishment and technology commissioning.

Major Applications and Market Segments

Battery recycling facilities serve extensive applications across diverse market segments, demonstrating their critical importance and revenue diversity:

Automotive Batteries: Primary revenue source through processing of both traditional lead-acid automotive batteries and increasingly, electric vehicle lithium-ion battery packs. Lead-acid batteries achieve recycling rates exceeding 99% with well-established processes, while EV batteries represent the fastest-growing segment with extremely high-value metal content including lithium, cobalt, nickel, and manganese worth thousands of dollars per battery pack.

Consumer Electronics: Processing of lithium-ion batteries from smartphones, laptops, tablets, power tools, and portable electronics. While individual unit value is lower than automotive batteries, the sheer volume and established collection networks through retailers create consistent revenue streams and material recovery opportunities.

Industrial and Energy Storage: Recovery of materials from industrial battery applications including forklifts, backup power systems, telecommunications infrastructure, and increasingly, grid-scale energy storage systems supporting renewable energy integration. These applications represent high-volume, high-value processing opportunities with growing demand as energy storage deployment accelerates.

Second-Life Applications: Some retired EV batteries retaining 70-80% capacity are suitable for repurposing in stationary energy storage before eventual recycling. Testing, refurbishment, and certification services for second-life battery systems represent additional revenue streams and extend battery lifecycle before material recovery.

Critical Minerals Recovery: Primary value creation through extraction and sale of battery-grade lithium carbonate, cobalt sulfate, nickel sulfate, manganese compounds, copper, aluminum, and graphite. Recovery rates and purity levels directly impact profitability, with hydrometallurgical processes achieving metal recovery rates exceeding 90-95% for critical minerals.

End-use industries include battery manufacturing, electric vehicle production, energy storage systems, consumer electronics manufacturing, metallurgical industries, and chemical processing, all requiring recycled battery materials to support circular economy objectives and supply chain security.

Why Invest in Battery Recycling?

Several compelling factors make battery recycling an exceptionally attractive investment opportunity:

Explosive Electric Vehicle Growth: EV sales surging from 17 million units in 2024 to projected 125 million by 2030 creates exponential growth in end-of-life battery volumes. Each EV battery weighing 300-600 kilograms requires processing, with battery mass entering recycling streams projected to exceed millions of tonnes annually by decade's end.

High-Value Critical Minerals: Battery recycling recovers extremely valuable materials commanding premium prices. Lithium carbonate, cobalt, and nickel from a single EV battery can be worth USD 1,000-3,000 or more depending on metal prices, offering exceptional revenue potential. Critical mineral supply security concerns further strengthen recovered material demand and pricing.

Supply Chain Security: Domestic battery recycling reduces dependence on imported critical minerals from geopolitically sensitive regions. Governments and automakers increasingly prioritizing local sourcing and circular supply chains, creating long-term contracted demand and pricing stability for recycled materials from established recyclers.

Regulatory Mandates: Europe requires 50% lithium recovery from old batteries by 2027 and 80% by 2031, with similar mandates emerging globally. China's standards demand lithium recovery ≥90% and nickel, cobalt, manganese ≥98%. Extended Producer Responsibility programs mandate manufacturers fund collection and recycling infrastructure, guaranteeing feedstock availability.

Circular Economy Alignment: Battery recycling directly enables circular economy by returning materials to manufacturing, reducing mining impacts, conserving resources, and lowering battery production carbon footprints. Corporate ESG commitments and consumer preferences for sustainability create strong market pull for recycled battery materials.

Low Current Recycling Rates: Current lithium-ion battery recycling rates remain below 5-10% globally for most chemistries except lead-acid, representing enormous untapped market opportunity. Infrastructure buildout required to handle projected battery volumes creates significant first-mover advantages and market positioning opportunities.

Technology Advancement: Direct recycling technologies, improved hydrometallurgical processes, and automation advances are increasing recovery rates, reducing costs, and improving economics. Closed-loop partnerships with battery manufacturers enable premium pricing for battery-grade recovered materials meeting stringent specifications.

Processing Technology Excellence

The battery recycling operation involves several precision-controlled stages optimized for maximum material recovery:

- Collection and Transportation: Batteries are collected from automotive dealerships, retailers, collection centers, EV manufacturers, and consumer drop-off locations, then transported under hazardous materials regulations to the processing facility with appropriate safety protocols

- Receiving and Sorting: Incoming batteries are weighed, documented, and sorted by chemistry type including lead-acid, lithium-ion, nickel-metal hydride, and nickel-cadmium for appropriate processing pathways

- Discharge and Safety Processing: Batteries undergo controlled electrical discharge in specialized equipment to eliminate residual charge and prevent thermal events during mechanical processing

- Manual Dismantling: Large battery packs, particularly from EVs, undergo manual or robotic disassembly to remove housing, separate modules, extract battery management systems, and recover high-value intact components

- Mechanical Processing: Battery cells undergo controlled shredding under inert atmospheres, followed by screening, magnetic separation, and eddy current separation to isolate ferrous metals, non-ferrous metals, and black mass containing cathode and anode materials

- Hydrometallurgical Processing: Black mass undergoes chemical leaching using acids or alkali solutions to dissolve target metals, followed by purification, solvent extraction, and precipitation to produce battery-grade metal compounds including lithium carbonate, cobalt sulfate, and nickel sulfate

- Material Refining and Sales: Recovered materials are refined to battery-grade specifications meeting customer quality requirements, packaged, and sold to battery manufacturers, cathode material producers, and metallurgical industries for reintegration into manufacturing supply chains

Industry Leadership

The global battery recycling industry is led by established recycling companies, battery manufacturers, and specialized technology providers with extensive processing capabilities and innovative recovery technologies. Key industry players include:

• Redwood Materials, Inc.

• Attero Recycling Pvt. Ltd.

• Green Li-ion

• Umicore N.V.

• Gravita India Ltd.

These companies serve diverse end-use sectors including automotive manufacturing, battery production, energy storage systems, consumer electronics, metallurgical processing, and government programs, demonstrating the broad market applicability and mission-critical nature of professional battery recycling services in the electric vehicle revolution.

Buy Now: https://www.imarcgroup.com/checkout?id=22382&method=2175

Recent Industry Developments

February 2025: Lithium Salvage secured USD 1.91 million in investment funding led by Northstar Ventures to develop a lithium-ion battery waste refinery in Sunderland, UK, demonstrating continued investor confidence in battery recycling infrastructure expansion.

January 2025: BatX Energies launched its Critical Minerals Extraction facility (HUB-1) in Uttar Pradesh, India, strengthening domestic battery recycling capacity and supporting India's goal of recycling 24 critical minerals essential for the green energy transition.

November 2024: U.S. Department of Energy announced USD 44.8 million funding for eight innovative projects focused on reducing electric vehicle battery recycling costs and enhancing resource efficiency as EV sales surpass four million units in the United States.

Conclusion

The battery recycling sector presents an exceptionally compelling investment opportunity at the intersection of electric vehicle revolution, critical mineral security, and circular economy transformation. With favorable profit margins ranging from 30-40% gross profit and 12-18% net profit, extraordinary market drivers including explosive EV growth (17 million units in 2024 to 125 million by 2030), extremely high-value critical mineral recovery (lithium, cobalt, nickel worth USD 1,000-3,000+ per battery pack), stringent regulatory mandates requiring 50-80% lithium recovery and 90-98% transition metal recovery rates, supply chain security imperatives reducing import dependence, and current recycling rates below 10% representing massive untapped opportunity, establishing a battery recycling plant offers exceptional potential for long-term business success and sustainable returns. The combination of mission-critical infrastructure supporting electric vehicle adoption, premium-value material recovery, expanding regulatory frameworks, technological advancement in direct recycling and hydrometallurgical processes, and strategic importance to automotive and battery manufacturers creates an extraordinarily attractive value proposition for serious investors committed to sustainable technology infrastructure and operational excellence.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excel in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Battery Recycling Plant Setup 2026: Complete DPR with Process Flow, Machinery & Profitability here

News-ID: 4377424 • Views: …

More Releases from IMARC Group

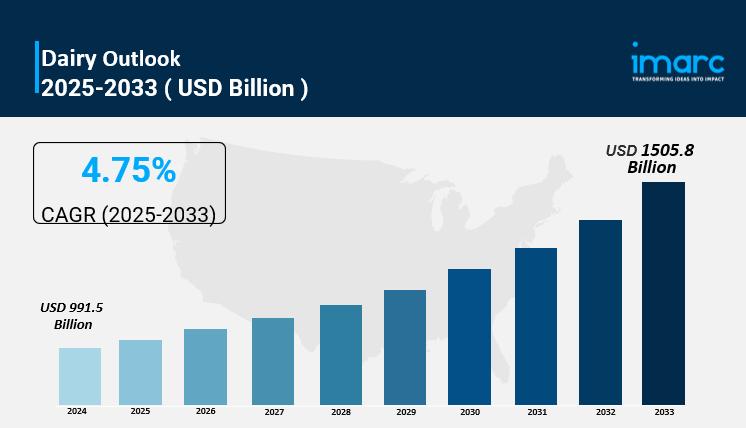

Dairy Market Size, Share, Industry Trends, Growth Factors and Forecast 2025-2033

IMARC Group, a leading market research company, has recently released a report titled "Dairy Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End-User, and Region, 2025-2033."The study provides a detailed analysis of the industry, including the Dairy market size, share, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Dairy Market Overview

The global dairy market size…

Plastic Pyrolysis Production Plant DPR 2026: Unit Setup, Cost and Requirements

The global plastic pyrolysis manufacturing industry is witnessing robust growth driven by the escalating plastic waste crisis and increasing demand for sustainable waste-to-energy solutions. At the heart of this expansion lies a critical waste valorization technology plastic pyrolysis. As industrial regions transition toward circular economy practices and advanced waste management systems, establishing a plastic pyrolysis manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and environmental technology investors seeking…

PVC Panel Manufacturing Plant Cost Report 2026: Business Plan, Setup Requirement …

The global construction and interior finishing industry is experiencing dynamic transformation driven by rising construction activities, increasing demand for cost-effective interior solutions, rapid urbanization, and growing preference for moisture-resistant building materials. At the forefront of this evolution stands PVC panel manufacturing-a specialized segment producing versatile, durable panels that combine aesthetic appeal with functional performance for wall cladding, suspended ceilings, partitions, and decorative interior applications. As construction activities accelerate worldwide and…

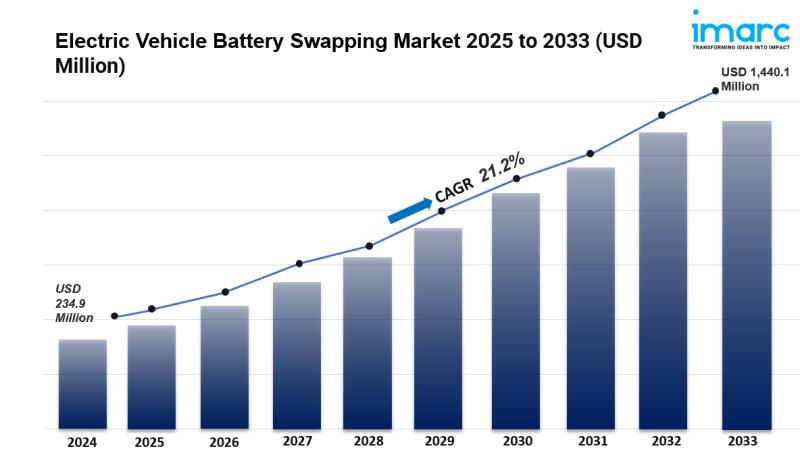

Electric Vehicle Battery Swapping Market is Expected to Grow USD 1,440.12 Millio …

Electric Vehicle Battery Swapping Market Overview:

The global electric vehicle battery swapping market was valued at USD 234.92 Million in 2024 and is projected to reach USD 1,440.12 Million by 2033, exhibiting a CAGR of 21.20% during the 2025-2033 forecast period. Growing demand for sustainable transportation, expanding electric vehicle adoption, and heightened need for time-efficient charging solutions are driving this growth. The electric vehicle battery swapping market size is expanding rapidly…

More Releases for Battery

Thin Film Micro Battery Market, By Rechargeability (Primary Battery, Secondary B …

The thin film micro battery market is expected to witness market growth at a rate of 30.9% in the forecast period of 2022 to 2029. Data Bridge Market Research report on thin film micro battery market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecast period while providing their impacts on the market's growth. The rise in the demand for the Internet of Things (IoT)…

Deep Cycle Gel Battery Market 2022 Analysis by Top Leading Players | Trojan Batt …

The Deep Cycle Gel Battery Market report offers qualitative and quantitative insights as well as a thorough examination of the market size and expansion rate of all potential market segments. The report has been put together using primary and secondary research methodologies, which offer an exact and detailed understanding of the Deep Cycle Gel Battery market. The Deep Cycle Gel Battery Market is projected to succeed at a CAGR of…

Global Power Energy Storage Battery Market 2019 - Lithium Ion Battery,All-vanadi …

Power Energy Storage Battery Market

The Global Power Energy Storage Battery Market 2019 Research Report incorporates a total and careful investigation of Power Energy Storage Battery industry covering diverse perspectives like market volume, piece of the overall industry, advertise techniques, Power Energy Storage Battery development patterns, assortment of uses, use volume, request and supply examination, creation limit and Power Energy Storage Battery industry cost structures amid Forecast period from…

Space Battery Market analysis report- with Leading players, Types Nickel-based B …

Space Battery Market

The Space Battery Market is defined by the presence of some of the leading competitors operating in the market, including the well-established players and new entrants, and the suppliers, vendors, and distributors. The report also analyzes the development proposals and the feasibility of new investments. The Space Battery Market report has been collated in order to provide guidance and direction to the companies and individuals interested in buying this…

Global EV Battery Recycling Market : Nickel–Cadmium Battery, Nickel–Metal Hy …

The EV Battery Recycling Market Research Report consists of all the essential information in regards to the global market. This report presents an in-depth analysis of various industry factors, such as the market trends, dynamics, production, estimates, industry development drivers, size, share, investigation, supply, forecast trends, sales, industry demand, as well as several other factors.

The Global EV Battery Recycling Market report has been generated leveraging a target amalgamation…

Global Lead Acid UPS Battery Market 2017 : Sebang Global Battery, CSB Battery, H …

Global Lead Acid UPS Battery Market 2016-2017

A market study based on the " Lead Acid UPS Battery Market " across the globe, recently added to the repository of Market Research, is titled ‘Global Lead Acid UPS Battery Market 2017’. The research report analyses the historical as well as present performance of the worldwide Lead Acid UPS Battery industry, and makes predictions on the future status of Lead Acid UPS Battery…