Press release

Disposable Gloves Manufacturing Plant Setup 2026: Complete DPR with Process Flow, Machinery & Profitability

The global disposable gloves manufacturing industry is witnessing robust growth driven by the rapidly expanding healthcare, foodservice, pharmaceutical, and industrial sectors and increasing demand for single-use personal protective equipment. At the heart of this expansion lies a critical product category-disposable gloves. As industries worldwide transition toward stricter hygiene protocols and governments enforce workplace safety mandates, establishing a disposable gloves manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and PPE investors seeking to capitalize on this growing and essential market.Market Overview and Growth Potential

The global disposable gloves market demonstrates a strong growth trajectory, valued at USD 19.80 Billion in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach USD 44.33 Billion by 2034, exhibiting a robust CAGR of 9.4% from 2026-2034. This sustained expansion is driven by increasing awareness of hygiene, rising concerns about health and safety across industries such as healthcare, food processing, and pharmaceuticals, and the growing adoption of disposable gloves in response to global health events.

Disposable gloves are single-use protective gloves manufactured from materials such as latex, nitrile, vinyl, and polyethylene. They are designed for short-term use to protect hands from contaminants, chemicals, biological agents, and infectious materials. Latex gloves are known for their excellent elasticity, comfort, and tactile sensitivity, while nitrile gloves offer superior puncture resistance and chemical protection. Vinyl gloves are a cost-effective option for low-risk tasks, and polyethylene gloves are commonly used for basic food handling applications. Since these gloves are discarded after use, they play a vital role in preventing cross-contamination and maintaining safety standards in controlled environments.

The disposable gloves market is witnessing robust demand due to the rising need for hygiene and infection control across multiple industries. As per UNICEF, between 2015 and 2024, an additional 1.6 billion people were provided with basic hygiene services, with global coverage rising from 66% to 80%. Government regulations and workplace safety standards across various industries are reinforcing the adoption of disposable gloves, while global industrial growth-especially in emerging markets-is further accelerating demand across laboratories, cleaning services, and manufacturing sectors.

Request for a Sample Report: https://www.imarcgroup.com/disposable-gloves-manufacturing-plant-project-report/requestsample

Plant Capacity and Production Scale

The proposed disposable gloves manufacturing facility is designed with an annual production capacity ranging between 500 Million-1 Billion Pairs per Year, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to cater to diverse market segments-from healthcare and medical services to foodservice, pharmaceuticals, laboratories, and cleaning and janitorial services ensuring steady demand and consistent revenue streams across multiple industry verticals.

Financial Viability and Profitability Analysis

The disposable gloves manufacturing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

Gross Profit Margins: 20-30%

Net Profit Margins: 8-15%

These margins are supported by stable demand across healthcare, foodservice, pharmaceutical, and industrial sectors, value-added personal protective equipment positioning, and the critical nature of disposable gloves in infection control and workplace safety applications. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established manufacturers looking to diversify their product portfolio in the protective equipment segment.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a disposable gloves manufacturing plant is primarily driven by:

Raw Materials: 60-70% of total OpEx

Utilities: 15-20% of OpEx

Other Expenses: Including labor, packaging, transportation, maintenance, depreciation, and taxes

Raw materials constitute the largest portion of operating costs, with nitrile/latex compound and coagulants being the primary input materials. Establishing long-term contracts with reliable nitrile/latex compound suppliers helps mitigate price volatility and ensures consistent raw material supply, which is critical given that polymer compound procurement represents the most significant cost factor in disposable gloves manufacturing.

Capital Investment Requirements

Setting up a disposable gloves manufacturing plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to nitrile/latex compound and coagulant suppliers. Proximity to target markets will help minimize distribution costs. The site must have robust infrastructure, including reliable transportation, utilities, and waste management systems. Compliance with local zoning laws and environmental regulations must also be ensured.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers specialized manufacturing equipment essential for production. Key machinery includes:

• Dipping tanks and mold immersion systems for continuous coating of glove formers with nitrile or latex compound

• Coagulation tanks for applying calcium nitrate or other coagulants to initiate uniform glove film formation

• Drying and curing ovens for vulcanizing and strengthening the glove material to achieve required tensile properties

• Glove stripping machines for automatically removing finished gloves from heated ceramic or aluminium formers

• Tensile strength testers and pinhole detection equipment for quality verification of glove integrity and barrier performance

• Packaging machines for automatic boxing, cartonization, and palletizing of finished glove products

• Sterilization units for medical-grade gloves requiring ethylene oxide or gamma radiation sterilization

• Effluent treatment systems for managing wastewater from latex and nitrile processing and ensuring environmental compliance

Civil Works: Building construction, factory layout optimization, and infrastructure development designed to enhance workflow efficiency, ensure workplace safety, and minimize contamination risk throughout the production process. The layout should be optimized with separate areas for raw material storage, former cleaning and preparation zone, coagulation unit, dipping and film formation section, curing and drying ovens, stripping area, quality control laboratory, packaging line, finished goods warehouse, utility block, effluent treatment area, and administrative block.

Other Capital Costs: Pre-operative expenses, machinery installation costs, regulatory compliance certifications, initial working capital requirements, and contingency provisions for unforeseen circumstances during plant establishment.

Speak to Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=9555&flag=C

Major Applications and Market Segments

Disposable glove products find extensive applications across diverse market segments, demonstrating their versatility and critical importance:

Healthcare and Medical: Disposable gloves are used extensively for medical examinations, surgical procedures, and infection control protocols in healthcare settings to prevent contamination and cross-contamination between patients and healthcare workers.

Foodservice and Hospitality: Gloves are used in food handling and preparation to ensure hygiene and prevent contamination from foodborne pathogens in restaurants, catering services, and food production facilities worldwide.

Pharmaceutical Industry: Used in pharmaceutical manufacturing, research, and laboratory settings to maintain cleanliness and prevent contamination during drug production or the handling of sensitive chemicals and compounds.

Laboratory and Research: In laboratories and research facilities, disposable gloves are essential for safely handling biological samples, chemicals, and other hazardous materials while protecting workers from exposure.

Cleaning and Janitorial Services: In the cleaning industry, disposable gloves are used to protect workers from exposure to cleaning agents, dirt, and debris while maintaining effective sanitation standards across facilities.

Why Invest in Disposable Gloves Manufacturing?

Several compelling factors make disposable gloves manufacturing an attractive investment opportunity:

Increasing Hygiene and Safety Awareness: Growing global awareness of hygiene, particularly in healthcare and food industries, continues to drive strong demand for disposable gloves to ensure protection and prevent the spread of infectious diseases.

Essential Protective Gear in Healthcare: Disposable gloves are a critical and mandatory component of infection control protocols in healthcare settings, protecting both healthcare workers and patients from cross-contamination across all medical procedures.

Adoption Across Diverse Industries: Beyond healthcare, the rising adoption of disposable gloves in foodservice, pharmaceuticals, laboratories, and cleaning services ensures consistent and diversified demand across multiple industry segments.

Economic and Practical Choice: With affordability, ease of use, and effective protection, disposable gloves provide a practical and economical solution for personal hand protection across both developed and emerging economies.

Regulatory Compliance and Standardization: Stringent regulations in food safety, healthcare, and industrial environments mandate the use of protective gloves, creating sustained demand for disposable gloves that comply with health and safety standards.

Import Substitution Opportunities: Emerging economies such as India, China, and Southeast Asian nations are expanding local manufacturing capacity to reduce dependence on imported disposable gloves, creating significant opportunities for domestic producers.

Sustainability-Driven Innovation: The growing focus on eco-friendly manufacturing and biodegradable materials is opening new market opportunities for glove manufacturers who invest in sustainable production technologies and environmentally responsible sourcing.

Manufacturing Process Excellence

The disposable gloves manufacturing process involves several precision-controlled stages:

• Raw Material Selection: High-quality nitrile rubber, natural rubber latex, vinyl, or polyethylene polymers are sourced and verified against industry standards for consistency and performance

• Preparation of Glove Molds: Ceramic or aluminium glove formers are thoroughly cleaned, inspected, and preheated to ensure uniform coating and proper glove formation

• Coagulation: Preheated formers are dipped into a coagulant solution such as calcium nitrate to promote uniform film formation upon subsequent latex or nitrile dipping

• Dipping: Coagulated formers are immersed into the prepared glove compound, forming a thin, even film of the glove material across the entire former surface

• Curing and Drying: Coated formers pass through high-temperature curing and drying ovens to vulcanize and strengthen the glove material, achieving required tensile and elasticity properties

• Stripping: Cured gloves are automatically stripped from the formers using mechanical or water-assisted stripping systems for continuous production flow

• Inspection and Packaging: Finished gloves undergo quality inspection including pinhole detection and tensile testing, followed by automated packaging, boxing, and palletizing for distribution

Buy Now:

https://www.imarcgroup.com/checkout?id=9555&method=2175

Industry Leadership

The global disposable gloves industry is led by established protective equipment manufacturers with extensive production capabilities and diverse application portfolios. Key industry players include:

• Ansell Ltd

• Top Glove Corporation Bhd

• Hartalega Holdings Berhad

• Supermax Corporation Berhad

• Kossan Rubber Industries Bhd

• Ammex Corporation

• Kimberly-Clark Corporation

• Sempermed USA, Inc.

• MCR Safety

These companies serve diverse end-use sectors including healthcare and medical services, foodservice and hospitality, pharmaceuticals, laboratories and research facilities, and cleaning and janitorial services, demonstrating the broad market applicability of disposable glove products.

Recent Industry Developments

October 2025: Shield Scientific launched two high-performance gloves in its chemical protection range designed to improve comfort, fit, and usability for workers in cleanrooms and industrial environments. The updated protective apparel addresses heat stress and mobility while maintaining rigorous barrier performance against hazardous chemicals and particulates, compliant with industry safety standards for extended wear in demanding applications.

April 2025: INTCO Medical launched Syntex Synthetic Disposable Latex Gloves, offering high elasticity, puncture and chemical resistance, and a natural-latex feel without allergy risks. Compliant with FDA, EU CE, and ASTM standards, Syntex supports sustainable, deforestation-free sourcing and ESG-focused procurement, serving healthcare, food processing, and industrial sectors globally.

Conclusion

The disposable gloves manufacturing sector presents a strategically positioned investment opportunity at the intersection of workplace safety, infection control, and global hygiene advancement. With favorable profit margins ranging from 20-30% gross profit and 8-15% net profit, strong market drivers including rising hygiene awareness, expanding healthcare infrastructure, stringent regulatory mandates across industries, and growing demand for sustainable protective equipment, establishing a disposable gloves manufacturing plant offers significant potential for long-term business success and sustainable returns. The combination of essential protective applications, critical role in healthcare infection control, diversified end-use demand across foodservice and industrial sectors, and import substitution opportunities in emerging economies creates an attractive value proposition for serious PPE investors committed to quality manufacturing and operational excellence.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers create a lasting impact. The company excels in understanding its clients' business priorities and delivering tailored solutions that drive meaningful outcomes. IMARC Group provides a comprehensive suite of market entry and expansion services, including market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Disposable Gloves Manufacturing Plant Setup 2026: Complete DPR with Process Flow, Machinery & Profitability here

News-ID: 4375405 • Views: …

More Releases from IMARC Group

Baby Food Manufacturing Plant (DPR) 2026: Industry Trends, CapEx/OpEx and Market …

The global baby food manufacturing industry is witnessing robust growth driven by the rapidly expanding infant nutrition sector and increasing demand for safe, nutritionally balanced, and ready-to-consume food products for infants and toddlers. At the heart of this expansion lies a critical product category-baby food. As families worldwide transition toward convenient and scientifically formulated feeding solutions and governments strengthen programs promoting infant and child nutrition, establishing a baby food manufacturing…

Binding Wire Production Project Report 2026: Capital Investment, Operating Cost …

The global construction materials industry is experiencing steady growth driven by ongoing construction activities, rising infrastructure development, increasing use of reinforced concrete structures, and consistent demand from manufacturing and fabrication industries. At the core of these developments lies an essential construction fastening material-binding wire. As urbanization accelerates worldwide and infrastructure investment intensifies, establishing a binding wire production plant presents a strategically compelling business opportunity for steel products manufacturers and construction…

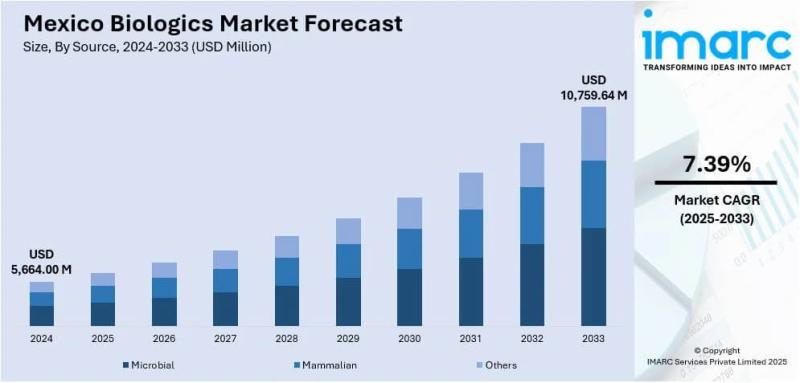

Mexico Biologics Market Size, Share, Industry Trends, Growth Factors and Forecas …

IMARC Group has recently released a new research study titled "Mexico Biologics Market Size, Share, Trends and Forecast by Source, Product, Disease, Manufacturing, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico biologics market size was valued at USD 5,664.00 Million in 2024. It is expected to grow at a…

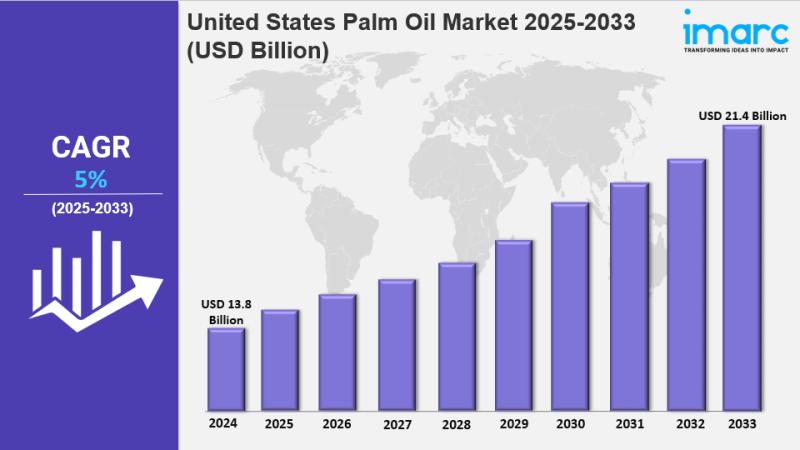

United States Palm Oil Market Size to Surpass USD 21.4 Billion by 2033 | At CAGR …

IMARC Group has recently released a new research study titled "United States Palm Oil Market Report by Application (Household Cooking, Food and Beverages, Oleo Chemicals, Personal Care, Animal Feed, Bio-Fuel), and Region 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The United States palm oil market reached a size of USD 13.8 Billion in…

More Releases for Disposable

Disposable Medical Sensors Market: Advancing Patient Monitoring with Cutting-Edg …

"In recent years, the global Disposable Medical Sensors Market has witnessed a dynamic shift, influenced by changing consumer preferences, technological advancements, and a growing emphasis on sustainability. The Research report on Disposable Medical Sensors Market presents a complete judgment of the market through strategic insights on future trends, growth factors, supplier landscape, demand landscape, Y-o-Y growth rate, CAGR, pricing analysis. It also provides and a lot of business…

Disposable Incontinence Products Market: "Disposable Incontinence Products to Re …

Disposable Incontinence Products Market Scope:

Key Insights : Disposable Incontinence Products Market size was valued at USD 12.4 billion in 2022 and is poised to grow from USD 13.33 billion in 2023 to USD 23.77 billion by 2031, growing at a CAGR of 7.50% during the forecast period (2024-2031).

Access the full 2024 Market report for a comprehensive understanding @https://www.skyquestt.com/report/disposable-incontinence-products-market

In-Depth Exploration of the global Disposable Incontinence Products Market: This report…

Disposable Medical Stopcock Market Streamlining Healthcare: The Advantages of Di …

Disposable Medical Stopcock Market worth $1.51 Bn by 2031 - Exclusive Report by InsightAce Analytic Pvt. Ltd.

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Disposable Medical Stopcock Market by Type (4-Way Stopcock, 3-Way Stopcock, 2-Way Stopcock, And Others) By Application (Hospitals, Clinics, Others), Trends, Industry Competition Analysis, Revenue and Forecast To 2031."

According to the latest research by InsightAce Analytic, the Global Disposable Medical…

Know Everything About Disposable Blood Bag: Importance of Disposable Blood Bag

Systems for collecting, storing, transporting, and transfusing human blood and products obtained from it are available as disposable biomedical goods called blood bag systems. Hospitals, blood banks, government initiatives, and NGOs all use disposable blood bags to store blood donations that have been received.

To reduce the importation of blood components from Western nations, government-funded programs in some Asian countries are concentrating on developing blood separation technology. The need for blood…

Disposable Toothbrush Market

Disposable toothbrush

Disposable toothbrush is usually smaller in size, cheaper, and used only once before it is discarded. Usually, it comes in pre-pasted form with the toothpaste already on the toothbrush in smaller quantities. All one need is water to activate the paste and start using it.

This type of toothbrush is perfect for traveling, camping, military, airlines, and hospitality. The disposable toothbrush is also good for those who have braces. Choosing…

Disposable Nitrile Gloves Market analysis report- with Leading players, Applicat …

Disposable Nitrile Gloves Market

The Disposable Nitrile Gloves Market is defined by the presence of some of the leading competitors operating in the market, including the well-established players and new entrants, and the suppliers, vendors, and distributors. The report also analyzes the development proposals and the feasibility of new investments. The Disposable Nitrile Gloves Market report has been collated in order to provide guidance and direction to the companies and individuals interested…