Press release

Baby Food Manufacturing Plant (DPR) 2026: Industry Trends, CapEx/OpEx and Market Growth

The global baby food manufacturing industry is witnessing robust growth driven by the rapidly expanding infant nutrition sector and increasing demand for safe, nutritionally balanced, and ready-to-consume food products for infants and toddlers. At the heart of this expansion lies a critical product category-baby food. As families worldwide transition toward convenient and scientifically formulated feeding solutions and governments strengthen programs promoting infant and child nutrition, establishing a baby food manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and food processing investors seeking to capitalize on this growing and essential market.Market Overview and Growth Potential

The global baby food market demonstrates a strong growth trajectory, valued at USD 56.19 Billion in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach USD 84.08 Billion by 2034, exhibiting a robust CAGR of 4.6% from 2026-2034. This sustained expansion is driven by rising awareness of infant nutrition, increasing working-parent households, higher disposable incomes, and growing demand for safe, nutritionally balanced, and ready-to-consume infant food products.

Baby food refers to specially designed products intended to cover the nutritional requirements of infants and toddlers in a way that is safe and convenient during their growth and development. They are made from a mix of natural ingredients such as cereals, fruits, vegetables, milk solids, pulses, and essential micronutrients to deliver balanced nutrition. Different types of baby food are available in the market including infant cereals, purees, mashed foods, ready-to-eat meals, and powdered formulations that facilitate ease of consumption and digestion. These products are highly controlled in terms of hygiene, safety, and quality, guaranteeing nutrient retention, high digestibility, and long shelf life.

The baby food market is witnessing robust demand due to rapid urbanization, changing family structures, and time-constrained lifestyles across developed and developing economies. Rising female workforce participation is further supporting market expansion, as working parents seek safe, reliable, and nutritionally balanced baby food products. According to the World Economic Forum, global women's workforce participation reached 41.2% in 2024, with significant increases observed in traditionally male-dominated sectors. Favorable government initiatives and public health programs promoting infant and child nutrition play a significant role in expanding market reach, particularly in developing regions.

Plant Capacity and Production Scale

The proposed baby food manufacturing facility is designed with an annual production capacity ranging between 10,000-20,000 MT per Year, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to cater to diverse market segments-from infant cereals and weaning foods to fruit and vegetable purees, fortified baby meals, and nutritional supplements for toddlers-ensuring steady demand and consistent revenue streams across multiple product categories.

Request for a Sample Report: https://www.imarcgroup.com/baby-food-manufacturing-plant-project-report/requestsample

Financial Viability and Profitability Analysis

The baby food manufacturing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

Gross Profit Margins: 25-35%

Net Profit Margins: 8-12%

These margins are supported by stable demand across infant nutrition, healthcare, retail, and institutional childcare sectors, value-added specialty food positioning, and the critical nature of baby food in supporting infant growth and development. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established food manufacturers looking to diversify their product portfolio in the infant nutrition segment.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a baby food manufacturing plant is primarily driven by:

Raw Materials: 60-70% of total OpEx

Utilities: 10-15% of OpEx

Other Expenses: Including labor, packaging, transportation, maintenance, depreciation, and taxes

Raw materials constitute the largest portion of operating costs, with cereals, milk powder, and vitamins being the primary input materials. Establishing long-term contracts with reliable cereal and dairy suppliers helps mitigate price volatility and ensures consistent raw material supply, which is critical given that cereal and milk powder procurement represents the most significant cost factor in baby food manufacturing.

Capital Investment Requirements

Setting up a baby food manufacturing plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to cereal, milk powder, and vitamin suppliers. Proximity to target retail and institutional markets will help minimize distribution costs. The site must have robust infrastructure, including reliable transportation, utilities, and waste management systems. Compliance with local zoning laws, food safety regulations, and environmental regulations must also be ensured.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers specialized manufacturing equipment essential for production. Key machinery includes:

• Washers and cleaning systems for thorough sanitization of raw materials including cereals, fruits, and vegetables before processing

• Cookers and thermal processing equipment for controlled cooking and sterilization of baby food ingredients to ensure safety and nutrient retention

• Mixers and blending systems for combining ingredients into uniform, nutritionally balanced formulations across product variants

• Homogenizers for achieving smooth, consistent texture in purees and liquid baby food products suitable for infant consumption

• Dryers and spray drying equipment for moisture reduction and production of powdered baby food formulations with extended shelf life

• Filling and packaging machines for precise filling of pouches, jars, boxes, and cartons under hygienic conditions

• Fortification systems for adding vitamins, minerals, and essential micronutrients to meet specific infant nutritional requirements

• Quality control laboratory equipment for nutritional content analysis, microbiological testing, and safety verification throughout production

Civil Works: Building construction, factory layout optimization, and infrastructure development designed to enhance workflow efficiency, ensure workplace safety, and maintain the highest food hygiene standards throughout the production process. The layout should be optimized with separate areas for raw material storage and cleaning, thermal processing zone, blending and homogenization unit, drying section, fortification area, filling and packaging line, quality control laboratory, finished goods warehouse, utility block, effluent treatment area, and administrative block.

Other Capital Costs: Pre-operative expenses, machinery installation costs, food safety and regulatory compliance certifications, initial working capital requirements, and contingency provisions for unforeseen circumstances during plant establishment.

Speak to Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=9753&flag=C

Major Applications and Market Segments

Baby food products find extensive applications across diverse market segments, demonstrating their versatility and critical importance:

Infant Nutrition Industry: Used for producing nutritionally balanced cereals, purees, and fortified foods specifically designed to support the healthy growth and cognitive development of infants and toddlers across all developmental stages.

Healthcare and Pediatric Sector: Supports carefully managed dietary needs in hospitals, pediatric clinics, and public nutrition programs where precise nutritional composition and food safety compliance are essential for vulnerable infant populations.

Retail and E-commerce Channels: Convenient, hygienically packaged baby food products are distributed through organized retail formats and rapidly expanding e-commerce platforms, enhancing product accessibility for urban consumer families.

Institutional Childcare Facilities: Standardized, nutritionally consistent feeding solutions are supplied to daycare centers, early learning institutions, and childcare facilities requiring reliable, safe, and easily prepared infant food options.

Why Invest in Baby Food Manufacturing?

Several compelling factors make baby food manufacturing an attractive investment opportunity:

Rising Focus on Infant Health: Growing awareness among parents regarding early-life nutrition is driving strong demand for scientifically formulated baby food products that support optimal infant growth and developmental milestones.

Convenience for Working Parents: Ready-to-feed and easy-to-prepare baby food products reduce meal preparation time while ensuring nutritional adequacy, making them indispensable for the increasing number of dual-income working parent households globally.

Strict Quality and Safety Standards: Controlled manufacturing under rigorous food safety regulations ensures consistent nutrient composition, hygiene, and compliance, building strong consumer trust and brand credibility in the infant nutrition segment.

Product Innovation Opportunities: Significant scope exists for organic, allergen-free, fortified, and region-specific baby food formulations, enabling manufacturers to differentiate their offerings and capture premium market segments.

Scalable Production Model: Automated processing and packaging technologies allow efficient scaling of production with controlled operating costs, supporting strong unit economics as capacity utilization increases.

Government Support and Policy Alignment: Government-led infant nutrition programs, public health initiatives, and subsidies promoting child health and development further strengthen market prospects and create favorable conditions for baby food manufacturers.

Import Substitution Opportunities: Emerging economies such as India, China, and Southeast Asian nations are expanding local baby food manufacturing to reduce dependence on imported products, creating significant market opportunities for domestic producers.

Manufacturing Process Excellence

The baby food manufacturing process involves several precision-controlled stages:

• Raw Material Cleaning and Sorting: Cereals, fruits, vegetables, milk powder, and other ingredients are thoroughly washed, inspected, and sorted to remove impurities and ensure consistent input quality

• Thermal Processing or Cooking: Raw materials are cooked under controlled temperature and pressure conditions to achieve proper texture, eliminate harmful microorganisms, and retain maximum nutritional value

• Blending and Homogenization: Cooked ingredients are blended and homogenized to produce smooth, uniform formulations with consistent taste, texture, and nutritional composition across every batch

• Drying or Pureeing: Blended products are either dried using spray or drum drying techniques to produce powder formulations, or processed into smooth purees for pouch and jar packaging

• Fortification: Essential vitamins, minerals, and micronutrients are added to the formulation to meet specific infant nutritional requirements as defined by regulatory and pediatric guidelines

• Quality Testing: Comprehensive nutritional analysis, microbiological safety testing, and sensory evaluation are conducted to verify product quality and regulatory compliance before packaging

• Hygienic Packaging: Finished baby food products are filled into pouches, jars, boxes, or cartons under strictly controlled hygienic conditions and sealed for safe storage, transport, and retail distribution

Industry Leadership

The global baby food industry is led by established food and nutrition manufacturers with extensive production capabilities and diverse product portfolios. Key industry players include:

• Nestle

• Abbott

• Danone

• Anand Milk Union Limited

• Mead Johnson Nutrition India / Reckitt Benckiser

• Manna Foods

These companies serve diverse end-use sectors including the infant nutrition industry, healthcare and pediatric nutrition sector, retail and e-commerce food segment, and institutional childcare facilities, demonstrating the broad market applicability of baby food products.

Buy Now:

https://www.imarcgroup.com/checkout?id=9753&method=2175

Recent Industry Developments

September 2025: Little Spoon, a direct-to-consumer baby and kids' food brand, launched nationally at Target across six aisles and seven categories. The rollout includes 23 products spanning baby food, refrigerated pouches, and frozen meals, emphasizing clean ingredients, rigorous safety testing, and stage-based nutrition designed for modern families.

June 2025: Petite Palates, a women- and minority-owned baby food brand, launched two shelf-stable, savory infant meals featuring lentils, chickpeas, and greens. The plant-based products are high in protein, fiber, and iron, free from added sugar, and are expanding distribution across select retailers and direct-to-consumer channels.

Conclusion

The baby food manufacturing sector presents a strategically positioned investment opportunity at the intersection of infant nutrition, food processing innovation, and global child health advancement. With favorable profit margins ranging from 25-35% gross profit and 8-12% net profit, strong market drivers including rising parental focus on infant nutrition, growing working-parent households, expanding e-commerce accessibility, and supportive government programs promoting child health, establishing a baby food manufacturing plant offers significant potential for long-term business success and sustainable returns. The combination of essential nutritional applications, critical role in infant growth and development, expanding product innovation opportunities across organic and fortified segments, and import substitution potential in emerging economies creates an attractive value proposition for serious food processing investors committed to quality manufacturing and regulatory excellence.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers create a lasting impact. The company excels in understanding its clients' business priorities and delivering tailored solutions that drive meaningful outcomes. IMARC Group provides a comprehensive suite of market entry and expansion services, including market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Baby Food Manufacturing Plant (DPR) 2026: Industry Trends, CapEx/OpEx and Market Growth here

News-ID: 4375390 • Views: …

More Releases from IMARC Group

Binding Wire Production Project Report 2026: Capital Investment, Operating Cost …

The global construction materials industry is experiencing steady growth driven by ongoing construction activities, rising infrastructure development, increasing use of reinforced concrete structures, and consistent demand from manufacturing and fabrication industries. At the core of these developments lies an essential construction fastening material-binding wire. As urbanization accelerates worldwide and infrastructure investment intensifies, establishing a binding wire production plant presents a strategically compelling business opportunity for steel products manufacturers and construction…

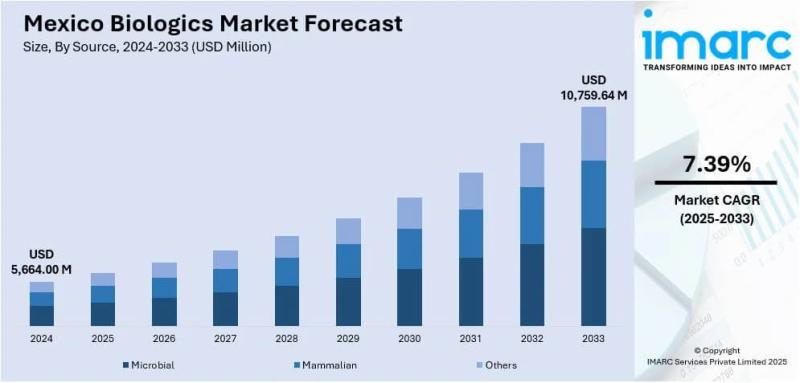

Mexico Biologics Market Size, Share, Industry Trends, Growth Factors and Forecas …

IMARC Group has recently released a new research study titled "Mexico Biologics Market Size, Share, Trends and Forecast by Source, Product, Disease, Manufacturing, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico biologics market size was valued at USD 5,664.00 Million in 2024. It is expected to grow at a…

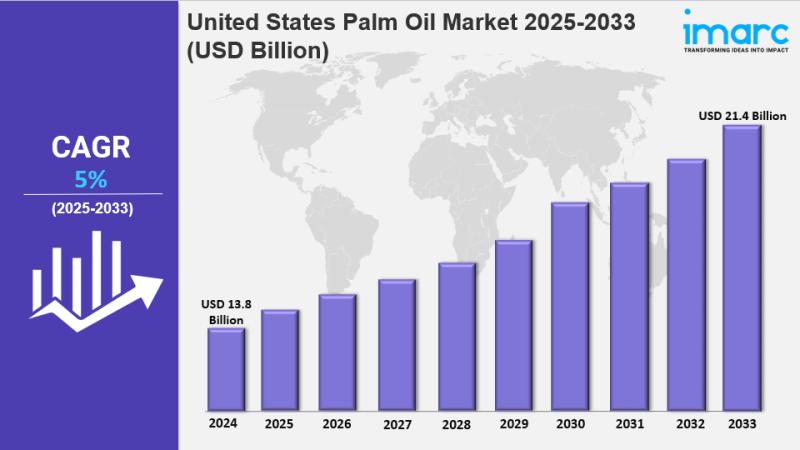

United States Palm Oil Market Size to Surpass USD 21.4 Billion by 2033 | At CAGR …

IMARC Group has recently released a new research study titled "United States Palm Oil Market Report by Application (Household Cooking, Food and Beverages, Oleo Chemicals, Personal Care, Animal Feed, Bio-Fuel), and Region 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The United States palm oil market reached a size of USD 13.8 Billion in…

Fiber Optic Cable Manufacturing Plant Cost Report 2026: Complete Investment Guid …

The global telecommunications infrastructure industry is experiencing unprecedented growth driven by significant expansion of broadband infrastructure, rising investments in 5G networks, increasing deployment of data centers, and growing demand for high-speed communication across telecom, enterprise, and smart city projects. At the core of these developments lies the fastest data transmission medium-fiber optic cables. As digital transformation accelerates worldwide and connectivity becomes essential for economic development, cloud adoption, and emerging technologies,…

More Releases for Baby

Baby Safety Products Market Analysis By Top Keyplayers - Baby Stroller and Pram, …

The "Baby Safety Products Market" is expected to reach USD xx.x billion by 2031, indicating a compound annual growth rate (CAGR) of xx.x percent from 2024 to 2031. The market was valued at USD xx.x billion In 2023.

Growing Demand and Growth Potential in the Global Baby Safety Products Market, 2024-2031

Verified Market Research's most recent report, "Baby Safety Products Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2023-2030," provides…

Baby Mats Market Is Booming Worldwide | Busy Baby, Mothercare, Baby Einstein

Advance Market Analytics published a new research publication on "Baby Mats Market Insights, to 2027" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Baby Mats market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

Baby Mats Market 2019 - Baby Care, Bright Starts, Lollaland, Baby Mushroom, Baby …

Global Baby Mats Market 2019-2024:

According to the Global Baby Mats Market report, the market is expected to reach the value of $XX million at the end of the forecast period of 2019 – 2025, showing good progress, rising at a CAGR of XX%. The global Baby Mats Market report covers a detailed analysis of the Baby Mats Market including the various parameters on which the Baby Mats Market…

Baby Carriers Market 2019 By Baby Bjorn, Chicco, Ergobaby, Evenflo, Infantino, T …

Global Baby Carriers Market 2019-2024:

According to the Global Baby Carriers Market report, the market is expected to reach the value of $XX million at the end of the forecast period of 2019 – 2024, showing good progress, rising at a CAGR of XX%. The global Baby Carriers Market report covers a detailed analysis of the Baby Carriers Market including the various parameters on which the Baby Carriers Market is analyzed…

Baby Carriers Market is Booming Worldwide| Snuggy Baby, Balboa Baby, Beachfront …

Global and India Baby Carriers Market Research by Company, Type & Application 2013-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing capital structure of the Global and India Baby Carriers Market. Some of the key players profiled in…

Baby Carriers Market Report 2018 Companies included Baby Bjorn, Chicco, Ergobaby …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com *********

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides…