Press release

Binding Wire Production Project Report 2026: Capital Investment, Operating Cost & Revenue Forecast

The global construction materials industry is experiencing steady growth driven by ongoing construction activities, rising infrastructure development, increasing use of reinforced concrete structures, and consistent demand from manufacturing and fabrication industries. At the core of these developments lies an essential construction fastening material-binding wire. As urbanization accelerates worldwide and infrastructure investment intensifies, establishing a binding wire production plant presents a strategically compelling business opportunity for steel products manufacturers and construction materials suppliers seeking to capitalize on urban development, housing demand, government-led construction initiatives, and the expanding need for quality reinforcement materials across building and infrastructure projects globally.IMARC Group's report, "Binding Wire Production Plant Setup Cost 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," offers a comprehensive guide for establishing a manufacturing plant. The binding wire production plant cost report offers insights into the manufacturing process, financials, capital investment, expenses, ROI, and more for informed business decisions.

Request for a Sample Report: https://www.imarcgroup.com/binding-wire-manufacturing-plant-project-report/requestsample

Market Overview and Growth Potential

The global binding wire market demonstrates steady growth trajectory, valued at USD 1.41 Billion in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach USD 2.14 Billion by 2034, exhibiting a consistent CAGR of 4.7% from 2026-2034. This sustained expansion is driven by steady construction activity growth, rising infrastructure development, increasing reinforced concrete structure use, and consistent manufacturing and fabrication industry demand.

Binding wire is thin, flexible steel wire manufactured by drawing mild steel wire rods into smaller diameters. It is mainly used in construction to tie reinforcement bars securely, ensuring proper alignment and stability during concrete placement. Binding wire is valued for high tensile strength, excellent ductility, ease of handling, and resistance to snapping under stress. It is typically supplied in coils or rolls and available in different thickness grades to suit varying structural and application requirements. Beyond construction, binding wire finds widespread use in fencing, packaging, agriculture, and industrial bundling where reliable fastening and flexibility are essential. Its versatility, durability, and cost-effectiveness make binding wire indispensable across multiple sectors, supporting heavy-duty construction activities and everyday industrial and agricultural operations worldwide.

The binding wire market grows steadily, supported by ongoing infrastructure expansion, rising housing demand, and government-led construction initiatives. The United Nations projects global population will reach 8.5 billion by 2030, with nearly 60% living in urban areas. By that time, around 3 billion people are expected to require new housing along with essential urban infrastructure and services. Similarly, large-scale development of highways, metro rail networks, industrial corridors, industrial parks, and commercial buildings sustains consistent binding wire demand across regions. Increasing steel consumption in construction, alongside growing focus on quality reinforcement and structural safety standards, further supports long-term market stability.

Plant Capacity and Production Scale

The proposed binding wire production facility is designed with an annual production capacity ranging between 20,000-40,000 MT per year, enabling economies of scale while maintaining operational flexibility. This capacity range allows producers to serve diverse market segments-from construction and infrastructure sectors to real estate development, manufacturing units, agricultural applications, and general industrial uses-ensuring steady demand and consistent revenue streams across multiple end-use sectors supporting structural reinforcement needs.

Financial Viability and Profitability Analysis

The binding wire production business demonstrates viable profitability potential under normal operating conditions. The financial projections reveal margins characteristic of commodity steel products:

• Gross Profit Margins: 10-15%

• Net Profit Margins: 3-6%

These margins reflect commodity product economics supported by consistent construction demand, simple manufacturing processes using proven wire drawing technology, stable raw material supply from steel producers, and wide application base reducing single-market dependency. The project demonstrates reasonable return on investment (ROI) potential, making it suitable for steel processors and construction materials manufacturers seeking volume-based businesses in essential building materials with predictable demand patterns.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a binding wire production plant is characterized by very high raw material intensity:

• Raw Materials: 85-90% of total OpEx

• Utilities: 5-8% of OpEx

• Other Expenses: Including labor, packaging, transportation, maintenance, depreciation, and taxes

Mild steel wire rod constitutes the dominant cost component at 85-90% of operating expenses, tied with Edible Oil for highest raw material intensity among all plants. The extremely high raw material proportion emphasizes critical importance of steel procurement expertise, wire rod price hedging strategies, and efficient drawing processes for maintaining viable economics in this commodity-driven business where success depends fundamentally on raw material sourcing capabilities and steel price management.

Buy Now: https://www.imarcgroup.com/checkout?id=8454&method=2175

Capital Investment Requirements

Setting up a binding wire production plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to steel mills or wire rod suppliers, target construction markets, and robust infrastructure including reliable transportation, utilities, and waste management systems suitable for steel processing operations.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers wire processing equipment. Key machinery includes:

• Wire drawing machines for diameter reduction

• Pay-off units for wire rod feeding

• Annealing furnaces for ductility enhancement

• Straightening machines for wire alignment

• Coilers for wire winding

• Weighing systems and packing units

Civil Works: Building construction, factory layout optimization, and infrastructure development designed for steel processing, ensuring efficient workflow from wire rod receiving through final packaging and dispatch.

Other Capital Costs: Pre-operative expenses, machinery installation costs, initial working capital for steel procurement, and contingency provisions for unforeseen circumstances during plant establishment.

Major Applications and Market Segments

Binding wire finds extensive applications across diverse construction and industrial sectors:

Construction and Infrastructure Sector: Binding wire is used extensively for securing reinforcement bars during RCC work, ensuring proper steel reinforcement positioning and alignment in structural concrete applications.

Real Estate Development: Ensures structural positioning and alignment in residential and commercial building projects, supporting quality construction and structural integrity requirements.

Agricultural Applications: Used for crop support systems, fencing installations, and bundling applications supporting agricultural operations and farm infrastructure development.

Industrial Packaging and Fabrication: Applied in bundling metal components and securing goods for transportation, providing flexible fastening solutions for industrial operations.

End-use sectors encompass construction and infrastructure, real estate development, manufacturing units, agriculture, and general industrial applications, all contributing to sustained demand.

Why Invest in Binding Wire Production?

Several compelling factors make binding wire production an attractive investment opportunity:

Consistent Construction Demand: Ongoing urban development and infrastructure projects ensure year-round demand for binding wire supporting continuous production and stable revenue streams.

Simple Manufacturing Process: Production involves proven wire drawing technology with limited operational complexity, enabling reliable manufacturing with manageable technical requirements.

Stable Raw Material Supply: Mild steel wire rods are widely available from integrated steel producers, ensuring consistent material supply for continuous production operations.

Scalable Production: Capacity can be increased by adding drawing lines with limited incremental investment, allowing flexible expansion aligned with market growth.

Wide Application Base: Demand spans construction, agriculture, and industrial sectors, reducing dependency on single end-use market and providing diversified revenue sources.

Manufacturing Process Excellence

The binding wire production process involves several controlled stages ensuring product quality and specifications:

• Wire Rod Pickling and Cleaning: Surface cleaning and scale removal from steel wire rods

• Wire Drawing: Multi-stage drawing through progressively smaller dies to reduce diameter

• Annealing: Heat treatment where required to improve ductility and flexibility

• Straightening: Wire alignment for proper handling characteristics

• Coiling: Wire winding into coils for packaging and transportation

• Inspection: Quality testing for tensile strength and dimensional specifications

• Packaging: Final packaging for distribution and market delivery

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=8454&flag=C

Industry Leadership

The global binding wire industry includes established steel processors serving construction materials markets. Industry participants range from integrated steel producers with wire divisions to specialized wire manufacturers focusing on construction applications across regional and international markets.

Recent Industry Developments

April 2025: Bansal Wire Industries expanded its Dadri stainless steel wire plant, increasing capacity from 2.2 lakh to 3.6 lakh MTPA, making it India's largest single-site facility. The plant, supporting advanced research and development, will produce stainless steel wires including specialized reinforcement wires, serving construction, automotive, and global markets, with 4.2 lakh MTPA targeted by first half of FY26.

March 2024: Lanka Special Steels launched flagship hot-dipped galvanized wire brands, 'Poultry 300' and 'Premium 100,' targeting the Indian market. Manufactured using premium raw materials in state-of-the-art certified facilities, the wires serve poultry, fencing, and industrial applications, offering durability over 25 years and supporting Lanka SSL's global expansion and export growth.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Binding Wire Production Project Report 2026: Capital Investment, Operating Cost & Revenue Forecast here

News-ID: 4375371 • Views: …

More Releases from IMARC Group

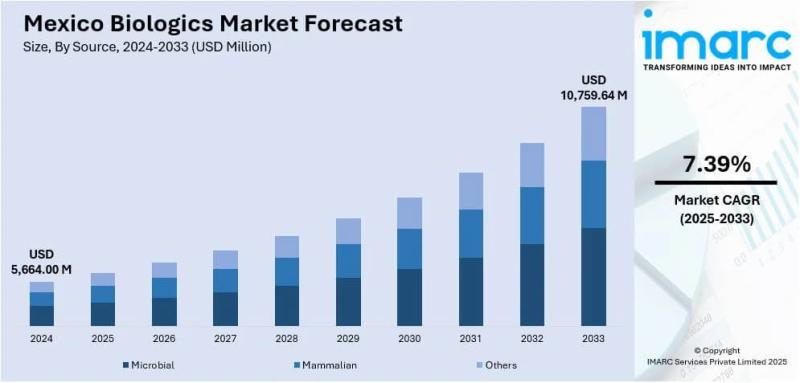

Mexico Biologics Market Size, Share, Industry Trends, Growth Factors and Forecas …

IMARC Group has recently released a new research study titled "Mexico Biologics Market Size, Share, Trends and Forecast by Source, Product, Disease, Manufacturing, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico biologics market size was valued at USD 5,664.00 Million in 2024. It is expected to grow at a…

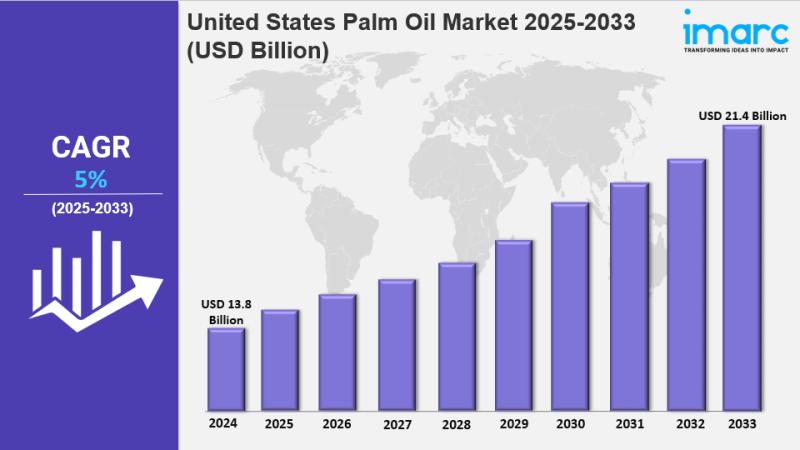

United States Palm Oil Market Size to Surpass USD 21.4 Billion by 2033 | At CAGR …

IMARC Group has recently released a new research study titled "United States Palm Oil Market Report by Application (Household Cooking, Food and Beverages, Oleo Chemicals, Personal Care, Animal Feed, Bio-Fuel), and Region 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The United States palm oil market reached a size of USD 13.8 Billion in…

Fiber Optic Cable Manufacturing Plant Cost Report 2026: Complete Investment Guid …

The global telecommunications infrastructure industry is experiencing unprecedented growth driven by significant expansion of broadband infrastructure, rising investments in 5G networks, increasing deployment of data centers, and growing demand for high-speed communication across telecom, enterprise, and smart city projects. At the core of these developments lies the fastest data transmission medium-fiber optic cables. As digital transformation accelerates worldwide and connectivity becomes essential for economic development, cloud adoption, and emerging technologies,…

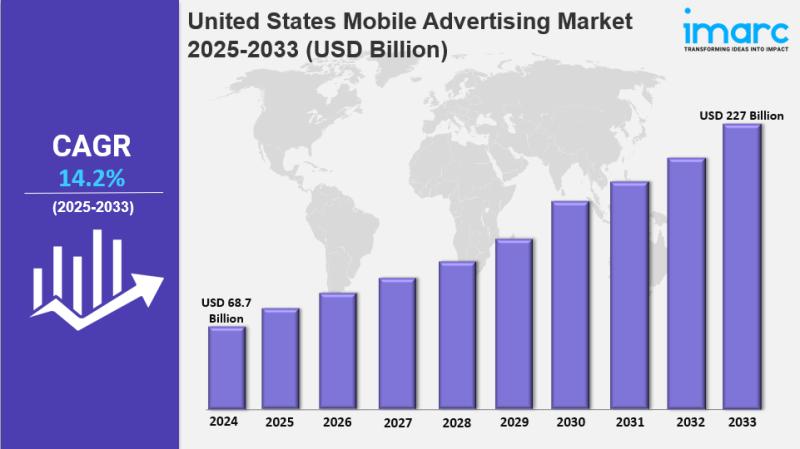

United States Mobile Advertising Market Size, Share And Growth Report 2033

IMARC Group has recently released a new research study titled "United States Mobile Advertising Market Report by Format Type (Search, Display, Video, Social Media, Websites, and Others), Industry Vertical (Retail and E-commerce, Media and Entertainment, Healthcare, BFSI, Education, Travel and Tourism, Automotive, and Others), and Region 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market…

More Releases for Wire

Understanding Wire Electrical Discharge Machining (Wire EDM)

Wire Electrical Discharge Machining (Wire EDM) is a highly accurate and reliable method for cutting electrically conductive materials. Favored in industries like aerospace, automotive, medical device manufacturing, and mold making, this process allows for extremely precise cuts that are nearly impossible to achieve with traditional mechanical methods.

What Is Wire EDM?

Wire EDM-short for wire electrical discharge machining-is a non-contact machining process that uses a thin, electrically charged wire to cut through…

Steel Wire Rod and Wire Market

Market Overview:

The global steel wire rod and wire market was valued at USD 174.5 billion in 2022 and is projected to rise at a compound annual growth rate (CAGR) of 5.6% to reach USD 269.5 billion by 2030.

The increasing popularity of electric vehicles presents a new market for steel wire. EVs require specific steel wire materials for applications including electric motors, charging stations, and battery components. As EV usage continues…

Steel Wire Market 2021 Analysis by Global Manufacturers – Heico Wire Group, Al …

The "Steel Wire" Market report offers qualitative and quantitative insights and a detailed analysis of market size & growth rate for all possible segments in the market. The Global Steel Wire Industry presents a market overview, product details, classification, and market concentration. The report also provides an in-depth survey of key players in the market which is based on various competitive intelligence parameters like company profiles, product picture and specification,…

Global Specialty Wire Sales Market 2018:2025 - MWS Wire, Torpedo Specialty Wire, …

The Specialty Wire Sales market research report is a comprehensive emphasizing study of the industry

The Global Specialty Wire Sales market 2018-2025 report offers a extensive and precise estimates and forecasts study of Specialty Wire Sales industry along with the analysis of essential features providing key industry insights to the readers. The Specialty Wire Sales market research report further delivers an methodical outlook of the industry by studying key components impacting…

- 3M, Alpha Wire, Amphenol, Belden Wire $ Cable

Global Multiconductor Cable Sales Market 2018-2025 Research Report

The Global Multiconductor Cable Sales Market 2018 Report contains in depth information major manufacturers, opportunities, challenges, and industry trends and their impact on the market forecast. Multiconductor Cable Sales market also provides data about the company and its operations. This report also provides information on the Pricing Strategy, Brand Strategy, Target Client, Distributors/Traders List offered by the company

The Multiconductor Cable Sales research report…

Specialty Wire 2017 Global Market Key Players – MWS Wire, Torpedo Specialty Wi …

Specialty Wire SWOT Analysis And Forecast 2022

This report studies Specialty Wire in Global market, especially in North America, China, Europe, Southeast Asia, Japan and India, with production, revenue, consumption, import and export in these regions, from 2012 to 2016, and forecast to 2022.

This report focuses on top manufacturers in global market, with production, price, revenue and market share for each manufacturer, covering

MWS Wire

Torpedo Specialty Wire

Specialty Wire and Cable (SWC)

LANOCO Specialty…