Press release

Transformer Oil Manufacturing Plant Setup - 2026, Market Trends, Machinery, Business Plan and ROI

The global energy infrastructure underpinning modern civilization depends fundamentally on electrical power transmission and distribution systems that span thousands of kilometres, connecting generation facilities to billions of end consumers across industrial, commercial, and residential sectors worldwide. At the heart of these critical networks lies transformer technology-massive electrical equipment that steps voltage up or down efficiently across substations, and within every transformer operates an indispensable consumable: transformer oil. This extremely pure insulating fluid serves as both the primary electrical insulator preventing catastrophic arc faults and the essential cooling medium dissipating heat from transformer cores and windings, while simultaneously protecting internal components against oxidation, corrosion, and partial discharge throughout decades of continuous operation. According to the International Energy Agency (IEA), Brazil alone recorded total electricity generation reaching 751,335 GWh in 2024, illustrating the enormous scale of power infrastructure requiring reliable insulating fluids. As rapid urbanization accelerates electricity consumption, renewable energy installations multiply requiring grid-connected transformer capacity, grid modernization and smart grid initiatives expand globally, EV charging networks proliferate, and rural electrification programs extend power access to underserved regions, establishing a transformer oil manufacturing plant represents a strategically compelling investment opportunity for petroleum processors, specialty chemical manufacturers, and infrastructure-focused investors seeking stable, government-backed demand across power generation, transmission and distribution utilities, renewable energy, railways, and industrial infrastructure sectors.Request for a Sample Report: https://www.imarcgroup.com/transformer-oil-manufacturing-plant-project-report/requestsample

Market Overview and Growth Potential

The global transformer oil market demonstrates robust and resilient growth fundamentals driven by sustained power infrastructure investment. Valued at USD 2.80 Billion in 2025, the market is projected by IMARC Group to reach USD 4.70 Billion by 2034, exhibiting a healthy CAGR of 5.9% from 2026 to 2034. This sustained expansion is primarily driven by rapid expansion of power transmission and distribution networks worldwide, rising global electricity demand driven by industrialization and urbanization, grid modernization initiatives replacing aging infrastructure with high-performance systems, and increasing deployment of renewable energy installations requiring substantial new transformer capacity.

Transformer oil is an extremely pure insulating fluid, principally utilized in power transformers and other high-voltage electrical equipment, performing the dual critical function of providing electrical insulation while simultaneously dissipating heat generated during transformer operation. Traditionally derived from mineral oils through refined petroleum processing, the industry is witnessing increasing adoption of bio-based and synthetic oil alternatives responding to environmental regulations and sustainability requirements. Transformer oil exhibits a carefully optimized array of properties essential for reliable long-term performance including high dielectric strength preventing electrical breakdown even under extreme voltage stress, excellent thermal conductivity enabling efficient heat transfer from windings and cores, low viscosity facilitating smooth circulation through transformer cooling systems, good oxidation stability maintaining oil quality over extended service periods, and minimal moisture affinity preventing moisture absorption that would compromise insulating performance. These properties collectively facilitate reliable cooling of transformer cores and windings while preventing electrical breakdown, and protect internal components against oxidation, corrosion, and partial discharge-thereby extending transformer lifespan and maintaining grid reliability under fluctuating load conditions and temperature variations throughout continuous operation.

The transformer oil industry is witnessing steady growth due to sustained investments in power transmission and distribution infrastructure worldwide. Rapid urbanization, industrial expansion, and increasing electricity consumption across developing and developed economies are driving demand for reliable transformers, thereby supporting consistent consumption of insulating oils throughout their operational life cycles. The shift toward renewable energy sources such as wind and solar is also accelerating transformer installations, particularly in grid-connected renewable projects requiring step-up transformers at generation sites and distribution transformers delivering power to end consumers. Increasing emphasis on high-performance, low-sulfur, and environmentally compliant transformer oils is influencing product innovation and formulation development across the industry. With grid modernization and the broader energy transition remaining long-term strategic priorities for governments and utilities globally, the transformer oil market is expected to maintain stable and sustained growth throughout the coming decade, creating consistent demand for manufacturers serving power infrastructure requirements.

Plant Capacity and Production Scale

The proposed transformer oil manufacturing facility is designed with an annual production capacity ranging between 30,000-60,000 MT, enabling substantial economies of scale in procurement, processing, and distribution while maintaining operational flexibility to serve diverse customer specifications and application requirements. This strategically calibrated capacity positions manufacturers to effectively serve power generation utilities requiring bulk transformer oil for large-scale substations, transmission and distribution companies maintaining extensive transformer fleets across national grids, renewable energy project developers installing wind and solar facilities with grid connection infrastructure, railway operators maintaining electric traction transformer systems, and industrial manufacturers requiring insulating fluids for factory power systems and switchgear-ensuring steady production utilization across multiple high-value segments.

Buy Now: https://www.imarcgroup.com/checkout?id=15603&method=2175

Financial Viability and Profitability Analysis

The transformer oil manufacturing business demonstrates healthy profitability potential under normal operating conditions and stable base oil pricing environments. The financial projections reveal attractive investment economics:

Gross Profit Margins: 20-30%

Net Profit Margins: 8-12%

These solid margins are supported by stable and growing demand tied directly to power infrastructure investment cycles ensuring predictable consumption volumes, the essential and non-discretionary nature of transformer oil as a critical consumable for electrical grid reliability and safety, long equipment life cycles requiring periodic oil replacement and top-up maintenance creating recurring demand streams, value-added processing transforming commodity base oils into high-specification technical products commanding premium pricing, and diversified end-use sectors spanning power generation, transmission utilities, renewable energy, railways, and industrial infrastructure reducing market concentration risk. The project demonstrates strong return on investment potential backed by proven vacuum distillation and hydro-treatment technologies, established international quality standards including IEC and ASTM specifications, government-driven grid expansion and rural electrification programs directly supporting demand, renewable energy deployment acceleration creating new transformer installations requiring fresh oil charges, and localization advantages favoring domestic suppliers offering faster delivery, technical support, and reduced logistics costs compared to imported alternatives.

Operating Cost Structure

Understanding the operating expenditure structure is critical for effective financial planning, base oil price risk management, and sustainable profitability. The cost structure for a transformer oil manufacturing plant is characterized by:

Raw Materials: 80-85% of total OpEx

Utilities: 5-10% of OpEx

Raw materials constitute the dominant portion of operating costs, with base oil-specifically naphthenic or paraffinic grade mineral oils-serving as the primary feedstock and most critical cost driver, accounting for the vast majority of material expenditure. High-quality base oil with appropriate viscosity characteristics, oxidation stability, and sulfur content specifications provides the foundation upon which finished transformer oil properties are built. Additional essential materials include antioxidants extending oil service life by preventing oxidative degradation during prolonged high-temperature operation, and passivators neutralizing dissolved copper ions that would otherwise catalyze oil deterioration-both critical additives ensuring finished product meets stringent dielectric performance standards. Establishing reliable supply relationships with petroleum refiners or specialty oil distributors, implementing effective procurement strategies to manage crude oil price volatility flowing through to base oil costs, and optimizing processing yields to minimize waste are absolutely essential for maintaining processing margins and managing the significant commodity price risk inherent in petroleum-derived product manufacturing.

Utility costs, representing 5-10% of operating expenses reflecting the moderate energy intensity of oil refining and treatment processes, encompass electricity for pumping systems, mixing equipment, and filtration units, thermal energy for vacuum distillation and hydro-treatment processes, and nitrogen or inert gas for dehydration and degassing operations essential for achieving the extremely low moisture content required in finished transformer oil. Additional operational expenses include skilled labor for process operation and quality control, maintenance programs ensuring equipment reliability and process precision, extensive quality control testing validating dielectric strength, viscosity, acidity, moisture content, and oxidation stability against international standards, transportation costs for inbound base oil deliveries and outbound finished product distribution to utility customers, packaging in specialized drums and bulk containers, equipment depreciation on specialized processing machinery, applicable taxes, and environmental compliance costs including waste oil disposal and emissions management. Implementing energy-efficient processing systems, optimizing vacuum distillation parameters to maximize yield, developing comprehensive preventive maintenance schedules, and maintaining rigorous quality management systems ensuring first-pass product conformance can significantly reduce costs while meeting the exacting performance specifications demanded by power utility customers.

Capital Investment Requirements

Establishing a transformer oil manufacturing plant requires substantial capital investment strategically distributed across several critical categories:

Land and Site Development: Selection of an optimal manufacturing location with strategic proximity to petroleum refiners or base oil suppliers ensuring reliable, cost-effective feedstock supply. The site must provide convenient access to major power utility customers, industrial zones, and renewable energy project sites. Essential infrastructure requirements include reliable transportation networks capable of handling bulk oil tanker deliveries, dependable utility supplies, and comprehensive environmental containment systems for oil storage and handling meeting petroleum industry safety standards.

Machinery and Equipment: The largest portion of capital expenditure is allocated to specialized petroleum processing equipment. Key machinery includes:

• Vacuum Distillation Units: Precision separation equipment refining base oil to remove impurities and achieve target viscosity specifications under controlled vacuum conditions

• Solvent Extraction Systems: Equipment removing undesirable compounds from base oil through selective solvent processing for improved performance characteristics

• Hydro-Treating Reactors: Catalytic processing units removing sulfur, nitrogen, and other contaminants from base oil improving oxidation stability and dielectric performance

• Oil Filtration and Dehydration Units: High-precision systems removing particulates and trace moisture to achieve the extremely low contamination levels required for electrical insulation applications

• Laboratory Testing and Dielectric Strength Analyzers: Sophisticated quality control instrumentation validating finished product meets IEC and ASTM international standards for electrical insulation performance

Civil Works: Manufacturing facilities including processing halls with appropriate safety containment and ventilation systems, bulk oil storage tanks with secondary containment meeting petroleum safety standards, quality control laboratories equipped with dielectric strength testers, viscometers, oxidation stability testing equipment, and moisture analyzers, and comprehensive utility infrastructure including electrical systems, thermal fluid heating, inert gas supply, and wastewater treatment facilities ensuring complete environmental compliance.

Other Capital Costs: Pre-operative expenses including feasibility studies, detailed petroleum process engineering design, machinery installation and commissioning, operator training on specialized oil treatment processes, environmental permits and petroleum handling regulatory approvals, initial working capital covering base oil inventory and additive stocks, and contingency provisions for process optimization and market-driven capacity adjustments during plant establishment.

Major Applications and Market Segments

Transformer oil finds critical applications across diverse power infrastructure segments demonstrating its indispensable role in modern energy systems:

Power Generation and Transmission: Utilized in power and distribution transformers for winding insulation, heat dissipation, and preventing electrical faults in substations and grid networks forming the backbone of national electricity infrastructure.

Renewable Energy Infrastructure: Thermal management and insulation of wind turbine step-up transformers and solar power collection transformers are ensured by transformer oil, delivering renewable energy steadily and reliably to the grid.

Industrial Manufacturing: Employed by industrial transformers and switchgear systems within manufacturing facilities to maintain safe operation of heavy equipment and provide uninterrupted power supply critical to continuous production processes.

Railways and Transportation: Railway electric traction transformers utilize transformer oil for cooling electrical loads and managing temperature cyclical changes inherent in intermittent traction power demands across rail networks.

End-use industries spanning power generation, transmission and distribution utilities, renewable energy, railways, and industrial infrastructure all contribute to sustained and diversified demand providing revenue stability, reducing dependency on single market segments, and creating multiple growth opportunities for transformer oil manufacturers serving comprehensive insulating fluid requirements across the global energy transition.

Why Invest in Transformer Oil Manufacturing?

Several compelling strategic factors make transformer oil manufacturing an attractive and viable investment opportunity:

Essential Power Infrastructure Material: Transformer oil is an indispensable consumable for power infrastructure with demand closely linked to electricity consumption growth and power grid development, ensuring consistent long-term requirement across substations, industrial power systems, and distributed generation facilities.

Stable Demand with Long Equipment Life Cycles: Owing to the requirement for periodic oil replacement, regular testing protocols, and standard maintenance practices for transformers, there is continuous and predictable consumption across utilities and industrial customers throughout transformer operational lifespans.

Energy Transition Alignment: Ever-increasing renewable energy installations, expanding EV charging networks, and comprehensive grid upgrade programs are driving global transformer deployments, directly increasing demand for fresh insulating oil charges.

Government and Utility Investments: National grid expansion projects, rural electrification programs, smart grid modernization initiatives, and energy security strategies are all factors directly increasing demand for transformer oil across developing and developed economies.

Localization and Supply Security: Utilities increasingly prefer reliable local suppliers delivering quality transformer oil with faster response times, reducing dependence on imports, minimizing logistics costs, and ensuring uninterrupted supply for critical maintenance operations.

Ask an Analyst: https://www.imarcgroup.com/request?type=report&id=15603&flag=C

Industry Leadership

The global transformer oil manufacturing industry is led by established companies with extensive production capabilities, specialized technical expertise, and diverse product portfolios. Key industry players include:

• Cargill

• Sinopec Corp

• Nynas AB

• Total Energies

• Dow

• HP Lubricants

• Apar Industries Limited

• Powerlink Oil Refinery Ltd

• Wacker Chemie AG

• Calumet Specialty Products Partners, L.P.

These companies serve end-use sectors including power generation, transmission and distribution utilities, renewable energy, railways, and industrial infrastructure, demonstrating the broad market applicability and sustained commercial viability of transformer oil manufacturing across diverse geographical markets and critical infrastructure applications worldwide.

Recent Industry Developments

July 2025: Ergon inaugurated its first transformer oil technology center in Asia at Merak, Indonesia, located within the Dover Chemical terminal complex. The facility underscores Ergon's investment in research, development, and technical services for premium dielectric fluids in the region, aimed at supporting rising energy demands and ensuring reliable transformer oil solutions that enhance grid performance, reliability, and long-term energy security.

May 2025: Redox Ltd acquired 100% ownership of Molekulis Pty Ltd and Molekulis Limited, a specialist in specialty and transformer oils. The deal supports Redox's growth strategy by broadening its customer base in Australia and New Zealand, strengthening supplier partnerships, and expanding its specialty oils portfolio-reflecting continued industry consolidation and strategic investment in transformer oil capabilities.

Conclusion

The transformer oil manufacturing sector presents a strategically positioned investment opportunity at the intersection of essential power infrastructure, global energy transition, and grid modernization. With solid profit margins of 20-30% gross profit and 8-12% net profit, strong and diversified demand across power generation, transmission utilities, renewable energy, railways, and industrial infrastructure, favorable market growth projections with 5.9% CAGR reaching USD 4.70 Billion by 2034, and proven manufacturing technologies delivering products to exacting international standards, establishing a transformer oil manufacturing plant offers significant potential for sustainable business success and attractive long-term returns. The combination of essential power infrastructure positioning ensuring non-discretionary demand, government-driven grid expansion and rural electrification programs, renewable energy deployment accelerating transformer installations globally, stable recurring demand from periodic oil replacement cycles, moderate raw material concentration risk managed through reliable sourcing partnerships, localization advantages favoring domestic suppliers, and the indispensable role of transformer oil in maintaining electrical grid safety and reliability creates a compelling value proposition for petroleum processors, specialty chemical manufacturers, and infrastructure-focused investors committed to serving critical insulating fluid requirements supporting global power infrastructure development and the sustained energy transition.

About IMARC Group

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its clients' business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Transformer Oil Manufacturing Plant Setup - 2026, Market Trends, Machinery, Business Plan and ROI here

News-ID: 4374828 • Views: …

More Releases from IMARC Group

Global Organic Food Market to Grow at a CAGR of 10.42% during 2025-2033, Driven …

Market Overview

The global organic food market was valued at USD 230.1 Billion in 2024 and is projected to reach USD 587.0 Billion by 2033, growing at a CAGR of 10.42% during the forecast period of 2025-2033.

Study Assumption Years

• Base Year: 2024

• Historical Year/Period: 2019-2024

• Forecast Period: 2025-2033

Market Key Takeaways

• Current Market Size: USD 230.1 Billion in 2024

• CAGR: 10.42%

• Forecast Period: 2025-2033

• North America dominates driven by health consciousness and mainstream retail adoption.

• Organic fruits and vegetables…

Electric Motor Manufacturing Plant Cost 2026: Detailed Project Report and Raw Ma …

The global electric motor manufacturing industry stands as a fundamental enabler of modern electrification, automation, and sustainable energy systems worldwide, positioned at the intersection of industrial transformation, electric vehicle revolution, and renewable energy infrastructure development. As electromagnetic devices converting electrical energy into mechanical motion, electric motors represent indispensable components across virtually every sector of modern economy-from powering industrial machinery and electric vehicles to enabling home appliances and robotics systems. This…

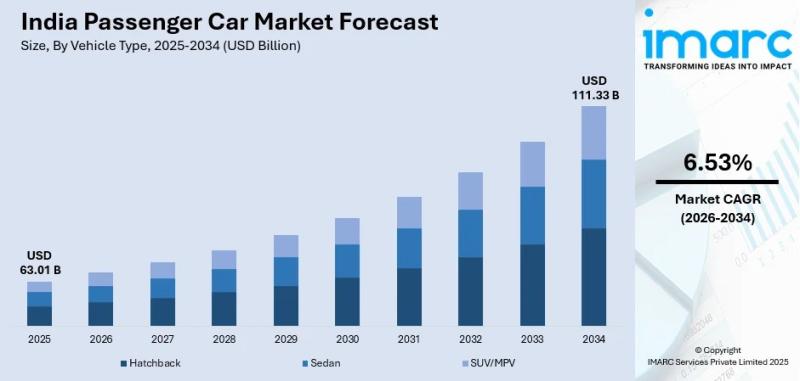

India Passenger Car Market to Reach USD 111.33 Bn by 2034 at 6.53% CAGR Driven b …

India Passenger Car Market 2026-2034

According to IMARC Group's report titled "India Passenger Car Market Size, Share, Trends and Forecast by Vehicle Type, Fuel Type, Transmission Type, Price Segment, and Region, 2026-2034", The report offers a comprehensive analysis of the industry, including India passenger car market analysis, trends, share, and regional insights.

How Big is the India Passenger Car Industry?

The India passenger car market size was valued USD 63.01 Billion in 2025.…

Cables Manufacturing Plant Setup DPR Report 2026: Financial Viability and Profit …

Cables Manufacturing Plant Project Report 2026: A Comprehensive Investment Guide:

The global cables manufacturing industry is experiencing sustained and robust growth, driven by rapid urbanisation, large-scale infrastructure development, accelerating electrification of transportation, and the worldwide expansion of renewable-energy grids. At the heart of this expansion lies an indispensable product-electrical cables-that form the circulatory system of modern power distribution, telecommunications, and industrial automation networks.

As governments invest heavily in smart-grid upgrades, metro…

More Releases for Transformer

Mobile Transformer Market

Mobile Transformer Market size is estimated to be USD 5.45 Billion in 2024 and is expected to reach USD 9.78 Billion by 2033 at a CAGR of 6.9% from 2026 to 2033.

What are the potential factors contributing to the growth of the mobile transformer market?

The mobile transformer market is experiencing significant growth due to several key factors. Firstly, the increasing demand for reliable and efficient power supply in remote and…

Transformer Oil Market, Transformer Oil Market Size, Transformer Oil Market Shar …

The Transformer Oil Market research report consists of a detailed study of the market and the market dynamics that are related to the same. The in-depth data on the development of the market is presented in the Research report. Not only this but also the detailed data on the performance of the market for the forecast period are presented in the Transformer Oil Market research report. The performance analysis is…

Signal Transformer Market Estimated to a Hike in Growth By Signal Type: Audio Tr …

Acumen Research and Consulting has announced the addition of the "Signal Transformer Market” report to their offering.

The Signal Transformer Market Report 2018 is an in depth study analyzing the current state of the Signal Transformer Market. It provides brief overview of the market focusing on definitions, market segmentation, end-use applications and industry chain analysis. The study on Signal Transformer Market provides analysis of China market covering the industry trends, recent…

Southeast Asia Transformer market :Global Demand Analysis & Opportunity Outlook …

Abstract:

The Southeast Asia Transformer market size is $XX million USD in 2018 with XX CAGR from 2014 to 2018, and it is expected to reach $XX million USD by the end of 2024 with a CAGR of XX% from 2019 to 2024.

Request For Free Sample@ https://www.kennethresearch.com/sample-request-10071643

This report is an essential reference for who looks for detailed information on Southeast Asia Transformer market. The report covers data on Southeast Asia…

Global Transformer Cores Market Forecast 2018-2025 Sanbian Sci-Tech, Wujiang Tra …

Market study on Global Transformer Cores 2018 Research Report presents a professional and complete analysis of Global Transformer Cores Market on the current market situation.

Report provides a general overview of the Transformer Cores industry 2018 including definitions, classifications, Transformer Cores market analysis, a wide range of applications and Transformer Cores industry chain structure. The 2018's report on Transformer Cores industry offers the global Transformer Cores development history, development trends…

Transformer Oil Market by Type (Mineral Oil-Based, Silicone Oil-Based, Bio-based …

Transformer oil market sales to reach $3.4 billion by 2020, with the mineral oil-based transformer oil segment to maintain its dominance until 2020. In 2014, the consumption of transformer oils was 1,437.8 million litres across the globe, which is expected to increase at 6.3% from 2015 to 2020.

Transformer oils are electrical insulating oils stable at high temperature, which serves two important functions in a transformer, viz., suppression of arcing and…