Press release

Cables Manufacturing Plant Setup DPR Report 2026: Financial Viability and Profitability Analysis

Cables Manufacturing Plant Project Report 2026: A Comprehensive Investment Guide:The global cables manufacturing industry is experiencing sustained and robust growth, driven by rapid urbanisation, large-scale infrastructure development, accelerating electrification of transportation, and the worldwide expansion of renewable-energy grids. At the heart of this expansion lies an indispensable product-electrical cables-that form the circulatory system of modern power distribution, telecommunications, and industrial automation networks.

As governments invest heavily in smart-grid upgrades, metro rail corridors, data centres, and green-energy transmission corridors, establishing a cables manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and industrial investors seeking to capitalise on this large, diversified, and continuously expanding market.

Plant Capacity and Production Scale:

The proposed cables manufacturing facility is designed with an annual production capacity ranging between 30,000-60,000 MT, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to serve a wide spectrum of end-use segments-from power transmission and distribution, building wiring, and industrial control systems to telecommunications, railway signalling, and marine applications-ensuring steady demand and consistent revenue streams across multiple high-value industry verticals.

View the Sample Report: https://www.imarcgroup.com/cables-manufacturing-plant-project-report/requestsample

Financial Viability and Profitability Analysis:

The cables manufacturing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

• Gross Profit Margins: 15-25%

• Net Profit Margins: 5-10%

These margins are supported by stable, recurring demand driven by ongoing infrastructure development, mandatory electrical-safety compliance across construction and industrial sectors, and the critical, non-discretionary nature of cable procurement in virtually every built environment. Value-added product lines -such as fire-resistant, halogen-free, armoured, and submarine cables-further strengthen margin profiles. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established metals or electrical-equipment manufacturers looking to diversify into the high-volume, essential-infrastructure segment.

Operating Cost Structure:

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a cables manufacturing plant is primarily driven by:

• Raw Materials: 80-85% of total OpEx

• Utilities: 5-10% of OpEx

Other Expenses: Including labour, packaging, logistics, maintenance, depreciation, and taxes

Raw materials constitute the dominant share of operating costs, with copper being the single largest input component. Aluminium serves as an alternative conductor material in certain cable categories, while polymeric insulation compounds (PVC, XLPE, and rubber), steel armour, and protective sheathing materials round out the material bill. Establishing long-term supply agreements with reputable copper and aluminium producers helps mitigate the commodity price volatility that represents the most significant cost variable in cables manufacturing. Utilities consumption is driven principally by the energy-intensive drawing, stranding, and extrusion processes that are fundamental to cable production.

Capital Investment Requirements:

Setting up a cables manufacturing plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to copper and aluminium supply corridors and major construction or industrial demand centres. Proximity to reliable logistics networks will minimise inbound raw-material and outbound finished-goods distribution costs. The site must feature robust infrastructure including high-capacity electrical supply, adequate water for cooling processes, and compliant waste-management and effluent-treatment systems. Adherence to local zoning laws, environmental regulations, and occupational health and safety standards must be ensured throughout.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers specialised heavy-duty manufacturing equipment essential for production. Key machinery includes:

• Wire-drawing machines for reducing copper or aluminium rod into fine-gauge conductor wires through a series of precision dies

• Stranding and bunching machines for twisting individual wires into multi-strand conductors with controlled lay length and compaction

• Conductor compacting and segmental-forming equipment for producing large-diameter, low-resistance conductor profiles used in high-voltage cables

• Insulation extrusion lines for applying PVC, XLPE, or rubber insulation compounds around conductors at high speed and precise thickness

• Cross-linking (curing) ovens or steam chambers for chemically cross-linking XLPE insulation to achieve superior thermal and electrical performance

• Screening and shield-application machines for depositing metallic or semiconducting screens around insulation for electrostatic field control

• Armour-laying and sheathing lines for applying steel wire or strip armour and PVC or polyethylene outer jackets for mechanical and moisture protection

• Drum-winding and coiling systems for neat, tension-controlled winding of finished cable onto reels or drums for dispatch

• Electrical testing and quality-assurance equipment including high-voltage DC/AC test sets, insulation-resistance meters, and conductor-resistance bridges for full cable certification

• Annealing furnaces for restoring ductility and conductivity to drawn copper wire after cold working

Civil Works: Building construction, heavy-floor-loading factory halls, overhead crane systems, and infrastructure development designed to enhance workflow efficiency, ensure workplace safety, and streamline material handling across the high-throughput production process. The layout should be optimised with clearly segregated zones for raw-material receiving and storage, wire drawing, stranding, insulation extrusion, cross-linking, screening, armour laying, sheathing, drum winding, quality-control laboratory, finished-goods warehousing, and administrative and engineering offices.

Other Capital Costs: Pre-operative expenses, heavy machinery installation and commissioning, regulatory and quality certifications (IEC, IS, BIS approvals, and third-party type-testing), initial working capital requirements -particularly significant given the high copper inventory value-and contingency provisions for unforeseen circumstances during plant establishment.

Major Applications and Market Segments:

Cables products find extensive applications across diverse market segments, demonstrating their versatility and critical importance:

Power Transmission and Distribution: High-voltage and medium-voltage cables form the backbone of overhead and underground power networks, carrying bulk electricity from generation assets to substations and onward to end consumers with minimal losses and maximum safety.

Building and Construction Wiring: LT (low-tension) power cables and fire-resistant or halogen-free cables are essential in residential, commercial, and industrial buildings for branch-circuit wiring, emergency lighting, and life-safety systems.

Industrial Automation and Control: Instrumentation, control, and signal cables connect sensors, PLCs, and actuators in factories, petrochemical plants, and process industries, ensuring reliable data transmission and precise operational control.

Telecommunications and Data Networks: Fibre-optic and copper data cables power broadband, 5G backhaul, and enterprise LAN/WAN networks, underpinning the digital connectivity that drives modern economies.

Railway and Metro Signalling: Specialised signal, traction-feeder, and fire-resistant cables are mandated in rail corridors for safe, uninterrupted train operation and passenger safety.

Renewable-Energy Infrastructure: Solar-panel interconnect cables, wind-turbine internal cables, and high-voltage DC (HVDC) export cables are critical components in solar farms, wind parks, and offshore energy platforms.

Marine and Offshore Applications: Submarine power cables, umbilicals, and shipboard electrical cables withstand extreme underwater and marine environments, serving oil and gas platforms, offshore wind farms, and naval vessels.

End-use sectors include power utilities, construction, industrial automation, telecommunications, railways, renewable energy, and marine industries, all of which contribute to sustained and diversified market demand.

Talk to Our Analyst - Get a Tailored Investment Plan: https://www.imarcgroup.com/request?type=report&id=8750&flag=C

Why Invest in Cables Manufacturing?

Several compelling factors make cables manufacturing an attractive investment opportunity:

• Massive Infrastructure Spending Cycle: Governments across developed and developing economies are committing trillions of dollars to smart grids, urban metro networks, national highway electrification, and data-centre buildouts-all of which are cable-intensive projects.

• Non-Discretionary, Recurring Demand: Cables are consumed in every new building, factory, substation, and telecommunications tower erected worldwide. Replacement cycles for aged underground cables add a substantial and predictable maintenance-driven demand layer.

• Electrification Megatrend: The global shift toward electric vehicles, electric heating, and electric industrial processes is fundamentally increasing cable demand at the distribution level, both in new installations and grid-upgrade projects.

• Renewable-Energy Integration: The rapid scaling of solar, wind, and offshore energy projects requires large volumes of specialised cables-from solar string cables to submarine HVDC export cables-creating a fast-growing, high-value product segment.

• Urbanisation and Smart-City Programmes: The world's accelerating shift toward urban living and the deployment of smart-city technologies (IoT sensors, EV charging networks, intelligent traffic systems) drive significant cable-consumption requirements.

• Import Substitution Opportunities: Many emerging economies-including India, Brazil, and nations across Southeast Asia and Africa-are actively promoting domestic cable manufacturing to reduce dependency on imports and strengthen local industrial capacity.

• Diversified Product Portfolio: A single manufacturing setup can produce a broad range of cable types-from low-voltage building cables to high-voltage transmission cables, control cables, and data cables-spreading risk and capturing demand across multiple sectors simultaneously.

• Strategic Resource Positioning: Copper is a finite, globally traded commodity. A well-positioned cables plant with secured supply contracts and efficient inventory management can convert raw-material price advantages into meaningful competitive and margin benefits.

Manufacturing Process Excellence:

The cables manufacturing process involves several precision-controlled stages:

• Raw-Material Receiving and Inspection: Copper or aluminium rod, insulation compounds, and auxiliary materials are received, certificate-checked, and stored in designated inventory areas

• Wire Drawing: Conductor rod is passed through a series of progressively smaller dies to reduce its cross-section into wire of the required gauge, with intermediate annealing to restore ductility

• Stranding: Individual wires are helically twisted together on stranding machines to form multi-strand conductors with the specified cross-sectional area and lay configuration

• Insulation Extrusion: The stranded conductor is passed through a polymer extrusion line where PVC, XLPE, or rubber insulation is applied at controlled temperature and speed to achieve uniform thickness and concentricity

• Cross-Linking (for XLPE cables): Extruded XLPE insulation is cured in a continuous vulcanisation (CV) tube or steam chamber to create the cross-linked molecular network that provides high-temperature and high-voltage capability

• Screening and Shielding: Semiconducting tapes or extruded layers and metallic screens (copper tape or wire) are applied around the insulation to contain electric fields and provide a return path for fault currents

• Core Assembly and Belting: For multi-core cables, individually insulated cores are laid together and, where required, belted with insulation tape or filled with a suitable compound

• Armour Laying: Steel wires or flat strips are helically wound around the cable core to provide mechanical protection against crushing, impact, and rodent attack

• Outer Sheathing: A final protective jacket of PVC, polyethylene, or low-smoke halogen-free compound is extruded over the armour to seal the cable against moisture ingress and environmental degradation

• Testing, Marking, and Dispatch: Finished cables undergo electrical insulation resistance, high-voltage withstand, and conductor-resistance tests; are marked with type, length, and manufacturer details; and are wound onto dispatch drums or coils

Industry Leadership:

The global cables industry is led by established manufacturers with extensive production capabilities, global distribution footprints, and diverse application portfolios. Key industry players include:

• Prysmian Group

• Nexans

• LS Cable & System

• Southwire Company

• Sumitomo Electric Industries

These companies serve diverse end-use sectors including power transmission and distribution, construction wiring, industrial automation, telecommunications, railways, renewable energy, and marine applications, demonstrating the broad and resilient market applicability of cables products.

Conclusion:

The cables manufacturing sector presents a strategically positioned investment opportunity at the intersection of global infrastructure buildout, the energy transition, and the fundamental electrification of the modern economy.

With favourable profit margins ranging from 15-25% gross profit and 5-10% net profit, powerful market drivers including record-high government infrastructure spending, binding renewable-energy targets, accelerating urbanisation, mandatory electrical-safety regulations, and non-discretionary replacement demand for ageing cable networks, establishing a cables manufacturing plant offers significant potential for long-term business success and sustainable returns.

The combination of diversified end-use applications, essential-product status, import-substitution tailwinds in emerging economies, and the ability to scale product lines from low-voltage building cables through to high-voltage transmission and submarine cables creates an attractive value proposition for serious industrial investors committed to quality manufacturing and operational excellence.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

How IMARC Can Help?

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cables Manufacturing Plant Setup DPR Report 2026: Financial Viability and Profitability Analysis here

News-ID: 4374800 • Views: …

More Releases from IMARC Group

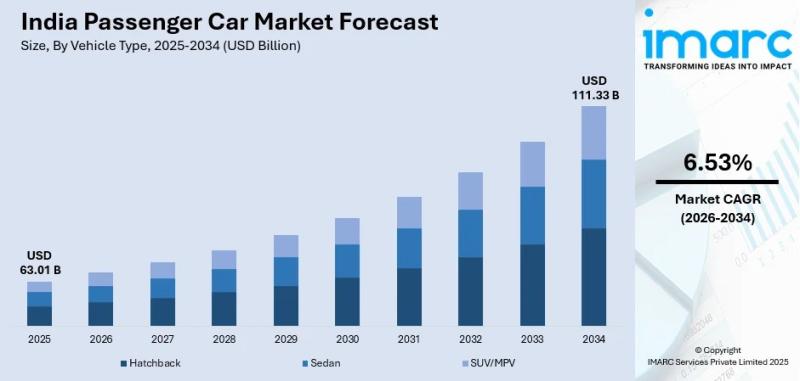

India Passenger Car Market to Reach USD 111.33 Bn by 2034 at 6.53% CAGR Driven b …

India Passenger Car Market 2026-2034

According to IMARC Group's report titled "India Passenger Car Market Size, Share, Trends and Forecast by Vehicle Type, Fuel Type, Transmission Type, Price Segment, and Region, 2026-2034", The report offers a comprehensive analysis of the industry, including India passenger car market analysis, trends, share, and regional insights.

How Big is the India Passenger Car Industry?

The India passenger car market size was valued USD 63.01 Billion in 2025.…

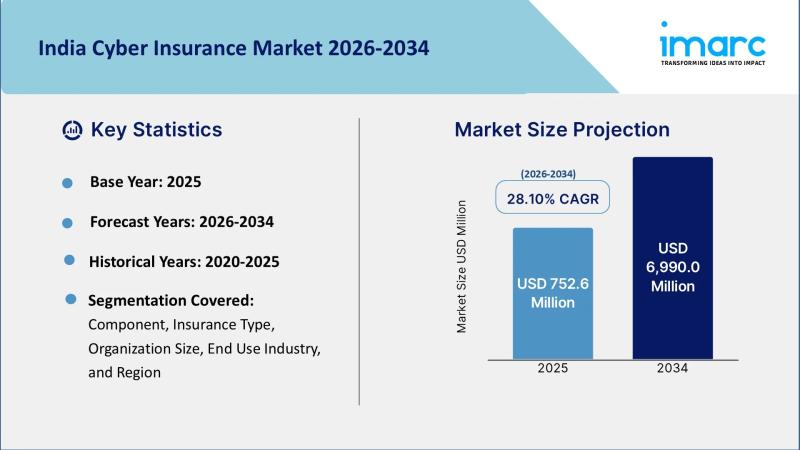

India Cyber Insurance Market to Hit USD 6,990 Mn by 2034 at 28.10% CAGR, Fueled …

Source: IMARC Group | Category: BFSI | Author: Tarang

Report Introduction

According to IMARC Group's latest report titled "India Cyber Insurance Market Size, Share, Trends and Forecast by Component, Insurance Type, Organization Size, End Use Industry, and Region, 2026-2034", this study offers a granular analysis of the country's rapidly evolving cybersecurity landscape and digital risk management sector. The study offers a profound analysis of the industry, cyber insurance market in india, size,…

Bare Copper Wire Manufacturing Plant (DPR) 2026: Technical Requirements, Cost, a …

The global bare copper wire manufacturing industry is witnessing robust growth driven by the rapidly expanding electrical infrastructure sector and increasing demand for high-conductivity electrical conductors. At the heart of this expansion lies a critical electrical component: bare copper wire. As industrial regions transition toward advanced power transmission systems and renewable energy infrastructure, establishing a bare copper wire manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and metal…

Electric Car Manufacturing Plant Feasibility (DPR) 2026: CapEx/OpEx with Profita …

The global electric car manufacturing industry is witnessing robust growth driven by the rapidly expanding clean energy transition and increasing demand for sustainable transportation solutions. At the heart of this expansion lies a revolutionary mobility product: the electric car. As automotive markets transition toward zero-emission vehicles and advanced electric powertrains, establishing an electric car manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and automotive investors seeking to capitalize…

More Releases for Cable

Cable Management Market by Type (Cable Trays, Cable Raceway, Cable Conduits, Cab …

The Cable Management Market would portray a significant CAGR by 2027, as per the latest report published by Allied Market Research.

Allied Market Research recently published a report, titled, “Cable Management Market by Type (Cable Trays, Cable Raceway, Cable Conduits, Cable Connectors &Glands, Cable Carriers, cable Lugs, Cable Junction Boxes, and Others), and End User (IT & Telecommunication, Commercial Construction, Energy, Manufacturing and Automation, Marine, Mining, Healthcare, and Others): Global Opportunity…

Automotive Control Cable Market 2019 Precise Outlook - SAB Cable, Allied Wire & …

Global Automotive Control Cable Market Report 2019-2025 provides insightful data about business strategies, qualitative and quantitative analysis of Global Market. The report also calls for market – driven results deriving feasibility studies for client needs. MarketInsightsReports ensures qualified and verifiable aspects of market data operating in the real- time scenario. The analytical studies are conducted ensuring client needs with a thorough understanding of market capacities in the real- time…

Cable & Accessories Industry - Nexans, General Cable Technologies, ABB, Brugg, P …

Electrical cable, an assembly of one or more wires which may be insulated, used for transmission of electrical power or signals

Wide array and volume of cable & accessories applications, high demand from residential to industrial applications and increasing power demand is expected to drive growth in cable and accessories market. Furthermore, Growth in rural electrification especially in the developing economies, growing use of cable & accessories in various industries and…

Global Submarine Cable Market 2017: General Cable, Nexans, Prysmian Group, Allie …

Submarine Cable Market Research Report 2017

In this report, the global Submarine Cable market is valued at USD XX million in 2016 and is expected to reach USD XX million by the end of 2022, growing at a CAGR of XX% between 2016 and 2022.

Geographically, this report split global into several key Regions, with sales (volume), revenue (value), market share and growth rate of Submarine Cable for these regions, from 2012…

Cable Management System Market (Cable Tray, Cable Ladder, Raceway, Cable Trunkin …

This report on the global cable management system market provides analysis for the period from 2014 to 2024, wherein 2015 is the base year and the years from 2016 to 2024 are the forecast period. Data for 2014 has been included as historical information. The report covers all the prevalent trends and technologies playing a major role in the growth of the cable management systems market over the forecast period…

Global Nuclear Power Cable Market 2016 : Qingdao Hanlan Cable, Jiangsu Shangshan …

A market study based on the "Nuclear Power Cable Market" across the globe, recently added to the repository of Market Research, is titled ‘Global Nuclear Power Cable Market 2016’. The research report analyzes the historical as well as present performance of the global Nuclear Power Cable market, and makes predictions on the future status of Nuclear Power Cable market on the basis of this analysis.

Get Free Sample Copy of Report…