Press release

Electric Motor Manufacturing Plant Cost 2026: Detailed Project Report and Raw Material Requirements

The global electric motor manufacturing industry stands as a fundamental enabler of modern electrification, automation, and sustainable energy systems worldwide, positioned at the intersection of industrial transformation, electric vehicle revolution, and renewable energy infrastructure development. As electromagnetic devices converting electrical energy into mechanical motion, electric motors represent indispensable components across virtually every sector of modern economy-from powering industrial machinery and electric vehicles to enabling home appliances and robotics systems. This comprehensive guide provides an authoritative exploration of the technical, financial, and strategic dimensions of establishing an electric motor manufacturing plant, leveraging current market intelligence and industry insights to support informed investment decision-making in this strategically vital and rapidly evolving electromechanical engineering sector.Market Overview and Growth Potential

The electric motor manufacturing sector is experiencing robust and sustained growth driven by powerful, interconnected market forces that reflect fundamental transformations in transportation electrification, industrial automation, energy efficiency imperatives, and global sustainability objectives. The industry's expansion is propelled by several critical factors:

• Rising industrial automation across manufacturing sectors globally

• Growing demand in automotive sector driven by electric vehicle adoption

• Expansion of renewable energy systems requiring motor-generators

• Heightened adoption of electric vehicles transforming transportation

• Energy efficiency regulations promoting high-efficiency motor technologies

• Industrial modernization in developing economies

The global electric motor market was valued at USD 119.02 Billion in 2025, establishing a massive foundation reflecting the sector's pervasive importance across industrial, automotive, commercial, and residential applications. According to comprehensive market analysis, the industry is projected to reach USD 159.70 Billion by 2034, exhibiting a CAGR of 3.3% during 2026-2034. This solid growth trajectory reflects electric motors' expanding role in electrification trends, automation advancement, and energy efficiency improvement across virtually all economic sectors.

The market expansion is fundamentally driven by the revolutionary transformation toward electric mobility. The rising adoption of electric vehicles (EVs) is creating explosive demand for traction motors, power electronics, and associated electromechanical systems. Electric vehicles require sophisticated motor designs achieving high power density, exceptional efficiency, precise torque control, and compact packaging-driving continuous innovation and substantial manufacturing capacity expansion in automotive-grade electric motors.

Simultaneously, growth in renewable energy infrastructure, particularly wind and solar power systems, is increasing demand for motors in energy conversion and generation applications. Wind turbines utilize large electric generators (essentially motors operated in reverse), while solar tracking systems employ precision motors optimizing panel orientation. These renewable energy applications create significant opportunities for specialized motor manufacturers with expertise in harsh environment operation, high reliability, and advanced control systems.

Industrial automation and modernization, particularly in developing economies, are creating substantial opportunities for precision-engineered motors in robotics systems, conveyor applications, and automated machinery. According to IBEF (India Brand Equity Foundation), the manufacturing sector is recognized as an important factor in the economic growth of India, contributing approximately 16-17% of GDP. This industrial expansion drives demand for diverse motor types including AC induction motors for general industrial drives, servo motors for precision positioning, stepper motors for controlled motion, and brushless DC motors for high-efficiency applications.

Furthermore, rapid urbanization and expanding manufacturing sectors are supporting motor demand across industrial, commercial, and residential applications. Modern retail and e-commerce platforms are facilitating distribution of small motors for household appliances (air conditioners, refrigerators, washing machines), HVAC systems, and commercial equipment, providing additional market stimulus supporting industry growth across multiple customer segments and application categories.

IMARC Group's report, "Electric Motor Manufacturing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," offers a comprehensive guide for establishing a plant. The electric motor manufacturing plant cost report offers insights into the process, financials, capital investment, expenses, ROI, and more for informed business decisions.

Plant Capacity and Production Scale

An electric motor manufacturing plant operates as a sophisticated electromechanical production facility fabricating motors through precision assembly of electromagnetic components including stators, rotors, windings, bearings, and housings. The production methodology represents a technically intensive operation involving electromagnetic design optimization, precision machining and stamping, automated winding processes, careful assembly ensuring mechanical balance and electrical performance, and rigorous testing verifying specifications.

The proposed manufacturing facility is designed with an annual production capacity ranging between 1-2 million units, enabling substantial economies of scale while maintaining operational flexibility to accommodate diverse motor types, power ratings, and customer specifications across industrial, automotive, and consumer applications.

The facility produces electric motors for multiple application categories and end-use sectors:

• Automotive industry: Traction motors for electric vehicles and hybrids, auxiliary motors for power steering, braking systems, cooling fans, and window actuators

• Industrial automation: Drive motors for conveyors, pumps, compressors, machine tools, material handling equipment, and industrial machinery

• Renewable energy: Generator/motor systems for wind turbines, solar tracking actuators, and energy storage applications

• Household appliances: Motors for air conditioners, refrigerators, washing machines, vacuum cleaners, and kitchen appliances

• Robotics and precision motion: Servo motors for robotic manipulators, stepper motors for 3D printers and CNC machines, brushless motors for drones

Production capacity planning must account for diverse motor types requiring different manufacturing processes (AC induction, DC brushed/brushless, synchronous, servo, stepper), wide power range from fractional horsepower to hundreds of kilowatts requiring scalable production systems, customer-specific customization supporting OEM requirements, stringent quality requirements particularly for automotive and aerospace applications, and continuous production optimization balancing efficiency with flexibility across varying product mix.

Request for a Sample Report: https://www.imarcgroup.com/electric-motor-manufacturing-plant-project-report/requestsample

Financial Viability and Profitability Analysis

The electric motor manufacturing business presents compelling financial characteristics rooted in the transformation of electromagnetic materials and precision components into value-added electromechanical products serving essential functions across modern economy. The project demonstrates healthy profitability potential under normal operating conditions, with gross profit margins typically ranging between 25-35% and net profit margins of 10-15%, supported by stable industrial demand, automotive sector growth, and precision engineering value proposition.

The financial projections developed for this project incorporate comprehensive analysis of capital investment requirements across land acquisition near industrial clusters or automotive manufacturing regions, specialized facility construction meeting electromagnetic compatibility requirements and quality standards, significant equipment procurement including automated winding machines, stamping presses for laminations, vacuum impregnation systems, dynamic balancing equipment, comprehensive testing rigs, and automated assembly lines, utilities infrastructure supporting substantial electrical power for testing and compressed air for pneumatic equipment, and working capital for component inventory (copper wire, steel laminations, magnets, bearings) and finished goods supporting customer delivery schedules.

Operating cost modeling addresses raw material expenses dominated by copper wire for motor windings (typically 70-80% of operating costs), representing the single largest cost component given copper's combination of excellent electrical conductivity and significant commodity price volatility requiring strategic procurement management. Electrical steel laminations for stator and rotor cores constitute the next major material cost, with specialized silicon steel grades minimizing magnetic losses and supporting motor efficiency.

Additional critical components include permanent magnets (particularly rare-earth magnets for high-performance motors), bearings ensuring smooth rotation and long operational life, aluminum or steel housings providing mechanical protection and heat dissipation, insulation materials preventing electrical breakdown, and various fasteners, terminals, and auxiliary components completing motor assemblies.

Utilities constitute 10-15% of operating expenses, with electricity consumption for motor testing (energizing completed motors verifying performance), compressed air for pneumatic tools and equipment, cooling systems for heat-intensive processes like vacuum impregnation, and water for cooling systems representing ongoing costs inherent to electromechanical manufacturing operations.

Additional operating costs encompass labor expenses for skilled technicians performing winding operations, assembly workers, quality control specialists conducting electrical and mechanical tests, maintenance personnel servicing precision equipment, and engineering staff supporting continuous improvement, maintenance of sophisticated production equipment including CNC winding machines, automated assembly systems, and testing equipment requiring regular calibration, quality control costs including electrical testing equipment, dynamometers for performance verification, and dimensional inspection tools, environmental compliance addressing waste management for insulation materials and cleaning solvents, safety training and equipment for electrical and mechanical hazards, and packaging materials protecting motors during shipment.

These detailed financial models provide stakeholders with transparent visibility into project economics, including comprehensive capital expenditure (CapEx) breakdowns particularly addressing automation levels and testing capabilities, operating expenditure (OpEx) structures with critical emphasis on copper procurement strategies given dominant cost position and commodity price volatility, income projections across industrial, automotive, consumer, and renewable energy customer segments, expected return on investment (ROI), net present value (NPV) calculations, payback period analysis, and long-term profitability trajectories under various copper pricing, automotive demand, and industrial activity scenarios.

Operating Cost Structure

Understanding the operating cost structure is fundamental to effective business planning and margin management in electric motor manufacturing. The cost architecture reflects copper-intensive windings, precision component requirements, and the electromechanical assembly nature of operations.

Key Raw Materials Include:

• Copper wire: Electromagnetic windings providing motor functionality, representing 70-80% of operating costs as dominant material component

• Steel laminations: Thin electrical steel sheets stamped and stacked forming stator and rotor cores, minimizing eddy current losses

• Bearings: Precision ball or roller bearings enabling smooth rotor rotation with minimal friction

• Permanent magnets: Rare-earth magnets (neodymium-iron-boron) or ferrite magnets providing magnetic field in permanent magnet motors

• Housings: Aluminum or steel enclosures providing mechanical protection, heat dissipation, and mounting features

• Insulation materials: Varnishes, slot liners, and insulating films preventing electrical breakdown between windings and grounded components

Utilities and Process Requirements:

Utility consumption supports manufacturing operations and comprehensive testing, covering electricity for motor performance testing (substantial power required energizing motors under load), production equipment operation, lighting and HVAC, compressed air for pneumatic tools, automated assembly equipment, and cleaning operations, cooling water for vacuum impregnation ovens and heat-generating processes, and potentially natural gas for heating in curing ovens.

Additional operating costs encompass:

• Transportation: Component delivery from specialized suppliers (copper wire, laminations, magnets, bearings) and finished motor distribution to OEM customers, distributors, or end users

• Packaging: Protective packaging preventing damage during shipment, including cartons, foam cushioning, moisture barriers, and palletization

• Salaries and wages: Skilled winding technicians (critical specialized labor), assembly workers, quality control technicians conducting electrical tests, maintenance technicians servicing precision equipment, and engineering staff optimizing designs

• Depreciation: On substantial capital investments in automated winding equipment, stamping presses, vacuum impregnation systems, balancing machines, and comprehensive testing facilities

• Quality control: Electrical testing equipment measuring resistance, inductance, no-load current, locked-rotor characteristics, dynamometers for performance testing, vibration analyzers, and dimensional inspection tools

• Certifications: Testing and certification costs for efficiency standards (IE3, IE4), safety certifications (UL, CE, CCC), and industry-specific approvals

• Research and development: Ongoing investment in motor design optimization, new motor technologies (e.g., switched reluctance motors), and application-specific customization

Raw material procurement strategies represent the most critical success factor given copper wire's dominant cost position (70-80% of OpEx) and commodity price volatility significantly impacting profitability. Strategic considerations include establishing relationships with copper wire manufacturers or metal traders, implementing hedging strategies through futures markets managing copper price risk, optimizing winding designs minimizing copper usage while maintaining performance, exploring aluminum windings for selected applications where weight savings justify reduced conductivity, maintaining strategic copper inventory balancing carrying costs against price volatility and supply security, and developing supplier diversification strategies managing supply chain risks.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=7662&flag=C

Capital Investment Requirements

Establishing an electric motor manufacturing plant requires substantial capital investment reflecting the precision equipment requirements, automation potential, and comprehensive testing facilities essential for quality electromechanical production.

Capital Expenditure Components:

• Land and Site Development Costs: Land acquisition in industrial zones near automotive clusters, electronics manufacturing regions, or logistics hubs, with adequate space for production, component storage, finished goods warehousing, and future expansion

• Civil Works Costs: Industrial facility construction including production floors with adequate floor loading for heavy equipment, quality control laboratories, testing facilities with electromagnetic shielding if required, component storage areas with climate control for sensitive materials (magnets, insulation), and administrative offices

• Machinery Costs: Largest portion of CapEx representing sophisticated production and testing technology

• Other Capital Costs: Testing equipment, quality systems, initial component inventory, employee training, certifications

Site Selection Considerations:

Strategic location selection must evaluate several critical factors:

• Easy access to key raw materials particularly copper wire from metal fabricators, electrical steel laminations from steel processors, magnets from specialty suppliers, and bearings from bearing manufacturers, optimizing component logistics

• Proximity to target markets especially automotive manufacturing clusters for traction motor applications, industrial machinery manufacturers for drive motor integration, appliance manufacturers for consumer motor applications, minimizing finished product transportation and supporting just-in-time delivery

• Robust infrastructure including reliable electrical power for motor testing (substantial power consumption during performance verification), transportation networks (road, rail access), and telecommunications supporting customer technical interface

• Compliance with local zoning laws and environmental regulations governing industrial manufacturing, electromagnetic emissions, noise from testing operations, and waste management

• Labor availability particularly skilled technicians for winding operations (specialized craft requiring training), assembly workers, quality control specialists with electrical testing expertise, and engineering talent for motor design

• Space for future expansion accommodating capacity increases, new motor product lines, or vertical integration opportunities

Essential Machinery Requirements:

High-quality, specialized production equipment represents the technical foundation:

• Winding machines: Automated or semi-automated equipment precisely winding copper wire onto stator and rotor components, critical for consistent electrical performance

• Stamping presses: High-speed presses cutting electrical steel into lamination shapes, with progressive dies enabling high-volume production

• Vacuum impregnation units: Systems impregnating motor windings with varnish under vacuum, filling air gaps improving insulation and heat transfer

• Balancing machines: Dynamic balancing equipment minimizing rotor imbalance preventing vibration during operation

• Testing rigs: Comprehensive testing systems measuring electrical parameters (resistance, inductance, no-load current), performance characteristics (torque, speed, efficiency), and conducting endurance tests

• Automated assembly lines: Robotic or semi-automated systems assembling stators, rotors, bearings, housings, and completing motor assemblies with consistent quality

Supporting infrastructure includes CNC machining centers for housing fabrication and shaft machining, painting/coating equipment for corrosion protection and aesthetic finish, laser marking systems for product identification and traceability, electromagnetic compatibility (EMC) testing chambers if producing motors for sensitive applications, climate-controlled storage for temperature-sensitive components (magnets losing performance above curie temperature), material handling systems including conveyors and automated storage/retrieval, and comprehensive quality control laboratory with electrical testing equipment, dimensional inspection tools, and metallurgical analysis capabilities.

Civil works costs encompass industrial building construction with reinforced floors supporting heavy stamping presses and testing equipment, production areas with adequate ceiling height for overhead cranes, segregated storage for different component types, quality control laboratories with stable environmental conditions, testing facilities potentially requiring acoustic insulation for noise control, maintenance workshops with specialized tools, and administrative areas housing engineering, sales, and management functions. Other capital costs include comprehensive testing and quality equipment representing significant investment, employee training programs particularly for specialized winding operations, safety equipment and systems, initial certifications (ISO 9001, industry-specific quality standards), substantial initial component inventory, and contingency reserves.

Manufacturing Process Overview

The electric motor production process involves sophisticated sequential operations designed to fabricate electromagnetic components and assemble them into functional motors meeting performance specifications:

Unit Operations Involved:

• Stator fabrication: Electrical steel laminations stamped from coil stock, stacked and bonded forming stator core, slots prepared for winding insertion

• Rotor fabrication: Rotor laminations stamped and assembled onto shaft, squirrel cage conductors cast (induction motors) or magnets installed (permanent magnet motors)

• Winding: Copper wire precisely wound into coils, inserted into stator slots following specific winding patterns achieving desired electromagnetic characteristics

• Insulation: Slot liners installed, end windings secured, comprehensive insulation ensuring electrical isolation between phases and from grounded components

• Vacuum impregnation: Motor windings impregnated with epoxy or polyester varnish under vacuum, filling air voids improving heat transfer and mechanical strength

• Assembly: Bearings pressed onto rotor shaft, rotor inserted into stator maintaining precise air gap, end bells attached, terminal box installed

• Balancing: Rotor dynamically balanced removing material or adding balance weights minimizing vibration

• Testing and quality inspection: Comprehensive electrical testing (resistance, inductance, insulation resistance, hi-pot testing), performance testing (no-load current, locked-rotor characteristics, efficiency), vibration testing

• Final packaging: Protective packaging, labeling with specifications and certifications, preparation for shipment

Quality Assurance Criteria:

Comprehensive quality control systems must monitor incoming component quality verifying lamination dimensions, copper wire specifications, bearing quality, process parameters throughout winding ensuring turn counts and resistance values, assembly tolerances maintaining critical air gap dimensions, electrical performance through comprehensive testing protocols, and mechanical characteristics including vibration levels and acoustic noise.

Technical Tests:

Laboratory and production testing includes electrical resistance measurement of phase windings, inductance verification, insulation resistance testing (megger testing), hi-potential (hi-pot) testing verifying insulation integrity under overvoltage conditions, no-load testing measuring current and power consumption without mechanical load, locked-rotor testing determining starting characteristics, efficiency testing across load range (critical for energy-efficient motor certifications), vibration analysis, acoustic noise measurement, and thermal testing verifying temperature rise under rated load.

Major Applications and Market Segments

Electric motor manufacturing serves multiple essential applications across diverse industrial and consumer categories:

Primary Applications:

• Electric vehicles: Traction motors providing propulsion, auxiliary motors for steering, braking, cooling systems

• Industrial drives: Pumps, compressors, fans, conveyors, machine tools, material handling equipment

• HVAC systems: Air conditioning compressors, circulation fans, ventilation equipment for commercial and residential buildings

• Home appliances: Refrigerator compressors, washing machine motors, vacuum cleaners, kitchen appliances

• Robotics: Servo motors enabling precision positioning, stepper motors for controlled motion

• Renewable energy: Generator systems for wind turbines, tracking motors for solar panels

End-Use Industries:

• Automotive: Electric vehicles, hybrid vehicles, conventional vehicle auxiliary systems

• Industrial machinery: Manufacturing equipment, processing systems, material handling

• Building systems: HVAC, elevators, pumps, ventilation

• Consumer appliances: White goods, power tools, household equipment

• Robotics and automation: Industrial robots, automated guided vehicles, precision positioning systems

• Renewable energy: Wind power, solar tracking, energy storage systems

The diversity of applications creates multiple revenue opportunities and market positioning strategies, from high-volume commodity motors for appliances to high-margin precision motors for robotics and electric vehicles commanding premium pricing based on performance, efficiency, and reliability specifications.

Why Invest in Electric Motor Manufacturing?

Multiple strategic factors converge to make electric motor manufacturing an exceptionally attractive investment proposition:

✓ Rising Demand for EVs and Industrial Automation: Increasing adoption of electric vehicles and automated industrial systems is driving explosive market growth, with automotive electrification creating particularly strong demand for high-performance traction motors.

✓ Growing Industrialization and Infrastructure Development: Expanding industrial activities and infrastructure projects boost motor applications across sectors, with manufacturing sector contributing 16-17% of GDP in developing economies like India, driving sustained industrial motor demand.

✓ Product Diversification Opportunities: Wide range of motor types including AC induction, DC brushed/brushless, synchronous, servo, and stepper motors offers opportunities for market expansion across diverse applications and customer segments.

✓ Scalable Production: Manufacturing facilities can be scaled efficiently meeting growing global demand through modular capacity expansion and automation implementation.

✓ High Market Value and Margins: Precision-engineered motors command premium pricing offering attractive profitability (Gross: 25-35%, Net: 10-15%), particularly for automotive-grade, servo, and specialty applications.

✓ Energy Efficiency Regulations: Global standards mandating high-efficiency motors (IE3, IE4 standards) create opportunities for manufacturers offering compliant products while obsoleting older inefficient designs.

✓ Technology Leadership Opportunities: Continuous innovation in motor design, materials (rare-earth magnets), and control electronics creates competitive advantages for technology-forward manufacturers.

✓ Critical Infrastructure Role: Electric motors represent essential components across modern economy ensuring consistent demand independent of economic cycles.

✓ Renewable Energy Growth: Expansion of wind and solar infrastructure creates substantial demand for generator/motor systems supporting global energy transition.

Industry Leadership

The global electric motor manufacturing industry features several established leaders with extensive production capacities:

Leading Electric Motor Manufacturers:

• ABB Ltd.

• Siemens AG

• WEG S.A.

• Nidec Corporation

• Regal Rexnord Corporation

• Mitsubishi Electric Corporation

• Toshiba Corporation

These major manufacturers operate large-scale facilities serving end-use sectors including automotive, industrial machinery, home appliances, robotics, HVAC systems, and renewable energy applications across global markets. Their market presence demonstrates the scalability and profitability potential of professional electric motor manufacturing operations supporting diverse applications and international distribution networks.

Buy Now: https://www.imarcgroup.com/checkout?id=7662&method=2175

Latest Industry Developments

The electric motor sector continues to experience product innovation and market expansion:

• November 2025: Yamaha Motor launched two new electric scooters in India: the AEROX E, a premium in-house electric sport scooter, and the EC-06, developed with River Mobility for wider audience. These launches support Yamaha's EV strategy and carbon neutrality goals, enhancing presence in India's electric vehicle market.

• March 2025: UK-based Advanced Electric Machines (AEM) launched the HDRM300C, a second-generation, magnet-free heavy-duty electric motor for commercial vehicles. Featuring advanced coil compression, enhanced thermal management, and improved speed, it offers over 80% conductor slot fill, higher efficiency, and easier installation.

These developments underscore industry trends toward electric vehicle market expansion with manufacturers launching new EV products across multiple segments, technological innovation particularly in magnet-free motor designs reducing dependency on rare-earth materials and supply chain risks, efficiency improvement through advanced manufacturing techniques like enhanced coil compression achieving 80%+ conductor slot fill, and thermal management advancement enabling higher power density and improved reliability supporting demanding automotive and commercial vehicle applications.

Conclusion

The electric motor manufacturing sector presents an exceptionally compelling investment opportunity characterized by strong market fundamentals driven by electrification megatrends, industrial automation advancement, energy efficiency imperatives, and attractive profitability potential supported by precision engineering value proposition and diverse application portfolio.

For entrepreneurs and businesses seeking to participate in the essential electromechanical infrastructure enabling modern electrification, automation, and sustainable energy systems, electric motor manufacturing offers a proven pathway to creating substantial value while contributing to transportation transformation, industrial productivity enhancement, energy efficiency improvement, and global sustainability objectives. The sector's robust fundamentals, supported by electrification megatrends, proven manufacturing technologies, diverse application opportunities spanning automotive to industrial to consumer markets, and continuous innovation in motor design and materials, ensure continued market relevance and attractive opportunities for well-planned and professionally executed manufacturing ventures delivering consistent quality, technological leadership, and operational excellence across diverse electromechanical applications.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Services:

• Plant Setup

• Factoring Auditing

• Regulatory Approvals, and Licensing

• Company Incorporation

• Incubation Services

• Recruitment Services

• Marketing and Sales

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Electric Motor Manufacturing Plant Cost 2026: Detailed Project Report and Raw Material Requirements here

News-ID: 4374821 • Views: …

More Releases from IMARC Group

Global Organic Food Market to Grow at a CAGR of 10.42% during 2025-2033, Driven …

Market Overview

The global organic food market was valued at USD 230.1 Billion in 2024 and is projected to reach USD 587.0 Billion by 2033, growing at a CAGR of 10.42% during the forecast period of 2025-2033.

Study Assumption Years

• Base Year: 2024

• Historical Year/Period: 2019-2024

• Forecast Period: 2025-2033

Market Key Takeaways

• Current Market Size: USD 230.1 Billion in 2024

• CAGR: 10.42%

• Forecast Period: 2025-2033

• North America dominates driven by health consciousness and mainstream retail adoption.

• Organic fruits and vegetables…

Transformer Oil Manufacturing Plant Setup - 2026, Market Trends, Machinery, Busi …

The global energy infrastructure underpinning modern civilization depends fundamentally on electrical power transmission and distribution systems that span thousands of kilometres, connecting generation facilities to billions of end consumers across industrial, commercial, and residential sectors worldwide. At the heart of these critical networks lies transformer technology-massive electrical equipment that steps voltage up or down efficiently across substations, and within every transformer operates an indispensable consumable: transformer oil. This extremely pure…

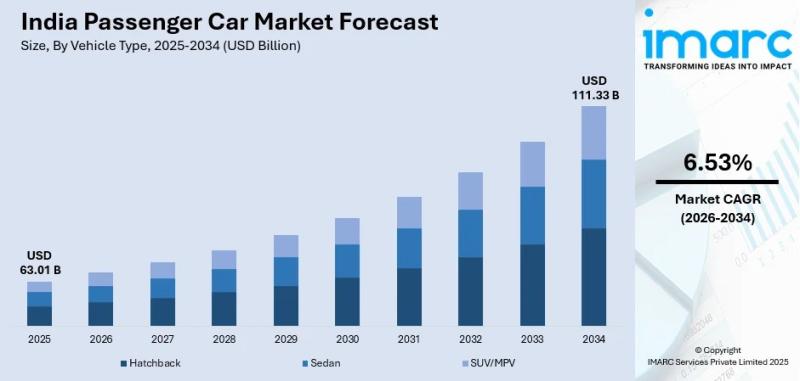

India Passenger Car Market to Reach USD 111.33 Bn by 2034 at 6.53% CAGR Driven b …

India Passenger Car Market 2026-2034

According to IMARC Group's report titled "India Passenger Car Market Size, Share, Trends and Forecast by Vehicle Type, Fuel Type, Transmission Type, Price Segment, and Region, 2026-2034", The report offers a comprehensive analysis of the industry, including India passenger car market analysis, trends, share, and regional insights.

How Big is the India Passenger Car Industry?

The India passenger car market size was valued USD 63.01 Billion in 2025.…

Cables Manufacturing Plant Setup DPR Report 2026: Financial Viability and Profit …

Cables Manufacturing Plant Project Report 2026: A Comprehensive Investment Guide:

The global cables manufacturing industry is experiencing sustained and robust growth, driven by rapid urbanisation, large-scale infrastructure development, accelerating electrification of transportation, and the worldwide expansion of renewable-energy grids. At the heart of this expansion lies an indispensable product-electrical cables-that form the circulatory system of modern power distribution, telecommunications, and industrial automation networks.

As governments invest heavily in smart-grid upgrades, metro…

More Releases for Electric

Electrical Isolators Market 2023: Mitsubishi Electric, Orient Electric, Schneide …

The Electrical Isolators Market size (volume and value) and industry chain structure published by The Insight Partners through its high quality database which is a valuable source of guidance and direction for companies and individual interested in the industry.

An electrical isolator is a material in which electric current does not flow freely. The atoms of the insulator have tightly bound electrons which cannot readily move. Other materials, semiconductors and conductors…

Electric Motors for Electric Vehicle Market by Manufacturers: Hitachi Automotive …

Electric Motors for Electric Vehicle Market research report analyzes and studies the Electric Motors for Electric Vehicle Market's production, value, financial status, and capacity. It also provides information about market share and development plans during the projected period. Moreover, the Electric Motors for Electric Vehicle Market research report provides data about key manufacturers and focuses on the market competition landscape by analyzing the market by application, product type, and region.

Click…

Thermal Overload Relay Market 2021 Precise Outlook - ABB, Schneider Electric, Ea …

Global Thermal Overload Relay Market Size, Status and Forecast 2021

The Global Thermal Overload Relay Market report offers in-depth information and comprehensive analysis of the market. It provides a complete overview of the market with detailed insights on key aspects including the current market situation, potential size, volume, and dynamics of the market. This research report makes a thorough assessment of the COVID-19 pandemic and its impact on the current market…

Global Electric Motors for Electric Vehicles Market 2025 | MAHLE GmbH, Protean E …

Researchmoz added Most up-to-date research on "Global Electric Motors for Electric Vehicles Market Insights, Forecast to 2025" to its huge collection of research reports.

This report presents the worldwide Electric Motors for Electric Vehicles market size (value, production and consumption), splits the breakdown (data status 2013-2018 and forecast to 2025), by manufacturers, region, type and application.

This study also analyzes the market status, market share, growth rate, future trends, market drivers, opportunities…

Yokogawa Electric, General Electric Profiled in Smart Factory Solutions Market 2 …

Global Smart Factory Solutions Market which focuses on effective strategies of the business framework. It highlights the recent market trends stringent energy regulations and growing pressure to conform to energy efficiency. The research methods and tools used to analyze the studies are both primary and secondary research.

This market research report on analyzes the growth prospects for the key vendors operating in this market space including Siemens, ABB, Honeywell International, Yokogawa…

Global Quartz Heat Lamps Market 2017 : Indu Electric Gerber, Schneider Electric, …

The Market Research Store report offers majority of the latest and newest industry data that covers the overall market situation along with future prospects for Quartz Heat Lamps market around the globe. The research study includes significant data and also forecasts of the global market which makes the research report a helpful resource for marketing people, analysts, industry executives, consultants, sales and product managers, and other people who are in…