Press release

Bare Copper Wire Manufacturing Plant (DPR) 2026: Technical Requirements, Cost, and ROI Analysis

The global bare copper wire manufacturing industry is witnessing robust growth driven by the rapidly expanding electrical infrastructure sector and increasing demand for high-conductivity electrical conductors. At the heart of this expansion lies a critical electrical component: bare copper wire. As industrial regions transition toward advanced power transmission systems and renewable energy infrastructure, establishing a bare copper wire manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and metal processing investors seeking to capitalize on this growing and essential market.Market Overview and Growth Potential

Bare copper wire is an uninsulated electrical conductor produced by drawing refined copper through progressively smaller dies to achieve desired diameter specifications. It appears as a metallic conductor with high purity and excellent electrical conductivity properties. Bare copper wire contains high-grade copper (typically 99.9% purity), making it an efficient electrical conductor used primarily in power transmission lines, grounding systems, overhead conductors, and electrical equipment manufacturing. Due to its superior conductivity, it enables efficient electricity transmission with minimal energy loss and excellent corrosion resistance. Its high current-carrying capacity, mechanical strength, and compatibility with various electrical applications make it a preferred option in power infrastructure, industrial manufacturing, and telecommunications networks.

The bare copper wire market is witnessing robust demand due to the rising need for reliable electrical conductors that support power grid modernization and renewable energy integration. Industrial regions increasingly transitioning toward high-capacity transmission systems-particularly in power distribution, solar installations, wind farms, and smart grid infrastructure-are driving large-scale adoption. According to industry reports, global electricity demand is expected to grow by over 30% by 2040, requiring significant investment in transmission and distribution infrastructure. Government-led grid modernization programs, renewable energy mandates, and electrical safety standards further strengthen market prospects.

Request for a Sample Report: https://www.imarcgroup.com/bare-copper-wires-manufacturing-plant-project-report/requestsample

Plant Capacity and Production Scale

The proposed bare copper wire manufacturing facility is designed with an annual production capacity ranging between 30,000-50,000 MT, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to cater to diverse market segments from power utilities and electrical equipment manufacturers to construction contractors, telecommunications providers, and industrial automation applications-ensuring steady demand and consistent revenue streams across multiple industry verticals.

Financial Viability and Profitability Analysis

The bare copper wire manufacturing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

Gross Profit Margins: 12-15%

Net Profit Margins: 4-7%

These margins are supported by stable demand across electrical infrastructure and manufacturing sectors, essential commodity positioning, and the critical nature of bare copper wire in power transmission applications. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established metal processing companies looking to diversify their product portfolio in the electrical conductors sector.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a bare copper wire manufacturing plant is primarily driven by:

Raw Materials: 85-88% of total OpEx

Utilities: 4-6% of OpEx

Other Expenses: Including labor, packaging, transportation, maintenance, depreciation, and taxes

Raw materials constitute the largest portion of operating costs, with copper cathodes or copper rods being the primary input materials. Establishing long-term contracts with reliable copper refiners and metal suppliers helps mitigate price volatility and ensures consistent raw material supply, which is critical given that copper commodity price fluctuations represent the most significant cost factor in bare copper wire manufacturing.

Capital Investment Requirements

Setting up a bare copper wire manufacturing plant requires substantial capital investment across several critical categories:

Land and Site Development

Selection of an optimal location with strategic proximity to copper refineries and metal suppliers. Proximity to target electrical infrastructure markets will help minimize distribution costs. The site must have robust infrastructure, including reliable transportation, high-capacity power supply, and waste management systems. Compliance with local zoning laws and environmental regulations must also be ensured.

Machinery and Equipment

The largest portion of capital expenditure (CapEx) covers specialized manufacturing equipment essential for production. Key machinery includes:

• Continuous casting machines for producing copper rods from copper cathodes

• Wire drawing machines with multiple dies for progressive diameter reduction

• Annealing furnaces for softening copper and improving ductility

• Cooling systems for temperature control during drawing operations

• Tension control systems for maintaining uniform wire properties

• Spooling and coiling equipment for finished wire packaging

• Surface cleaning and polishing machinery for conductor preparation

• Diameter measurement and quality monitoring systems

• Straightening equipment for wire alignment

• Quality control laboratory equipment for conductivity and tensile strength testing

• Dust collection and fume extraction systems

• Waste copper recovery and recycling systems

Civil Works

Building construction, factory layout optimization, and infrastructure development designed to enhance workflow efficiency, ensure workplace safety, and minimize material handling complexities throughout the production process. The layout should be optimized with separate areas for raw material storage, continuous casting zone, wire drawing section, annealing area, quality control laboratory, finished goods warehouse with organized spooling systems, utility block, waste recovery area, and administrative block.

Other Capital Costs

Pre-operative expenses, machinery installation costs, regulatory compliance certifications, initial working capital requirements, and contingency provisions for unforeseen circumstances during plant establishment.

Major Applications and Market Segments

Bare copper wire products find extensive applications across diverse market segments, demonstrating their versatility and critical importance:

Power Transmission and Distribution

Primary use as overhead conductors in high-voltage transmission lines and distribution networks, particularly valuable in grid infrastructure, substation connections, and rural electrification projects where reliable electrical conductivity is essential.

Grounding and Earthing Systems

Specialized applications in electrical safety grounding, lightning protection systems, and equipment earthing where excellent conductivity and corrosion resistance are critical for safety and system protection.

Renewable Energy Infrastructure

Utilized in solar power installations, wind farm cabling, and energy storage systems, helping integrate renewable energy into electrical grids and supporting clean energy transition.

Electrical Equipment Manufacturing

Applications in transformer windings, motor coils, inductor cores, and electromagnetic equipment where high-purity copper conductivity is required for efficient energy conversion.

Telecommunications Infrastructure

Specialized applications in telephone lines, data transmission cables, and communication tower grounding systems where signal clarity and system reliability depend on conductor quality.

Industrial and Construction Applications

Used in industrial machinery wiring, building electrical systems, and construction projects requiring robust electrical connectivity and code compliance.

End-use industries include power utilities, electrical equipment manufacturers, construction contractors, telecommunications providers, renewable energy developers, and industrial automation sectors, all of which contribute to sustained market demand.

Buy now: https://www.imarcgroup.com/checkout?id=24176&method=2175

Why Invest in Bare Copper Wire Manufacturing?

Several compelling factors make bare copper wire manufacturing an attractive investment opportunity:

Essential Infrastructure Component

Bare copper wire serves as a critical electrical conductor supporting power transmission, distribution networks, and electrical safety systems, making it indispensable for modern electrical infrastructure and industrial operations.

Rising Electrical Infrastructure Investment

Industrial and developing regions increasingly investing in grid modernization, capacity expansion, and reliability improvements-particularly in Asia-Pacific, Africa, and Latin America-are driving large-scale adoption of copper conductors.

Superior Electrical Properties

The product's exceptional electrical conductivity, current-carrying capacity, and mechanical strength offer significant performance advantages and position it favorably against alternative conductor materials like aluminum.

Renewable Energy Growth

The product's effectiveness in solar installations, wind farms, and energy storage integration positions it as a preferred conductor in the global renewable energy transition, especially across regions with aggressive clean energy targets.

Government Support

Government-led infrastructure modernization programs, renewable energy mandates, and electrical safety standards further strengthen market prospects and support industry growth.

Import Substitution Opportunities

Emerging economies such as India, Southeast Asian nations, African countries, and Latin America are expanding local manufacturing as part of their strategy to reduce dependence on imported copper wire products, creating opportunities for domestic producers.

Urbanization and Industrialization

The urbanization agenda and increasing demand for reliable electricity in growing cities and industrial zones are expected to enhance long-term growth opportunities for electrical conductors.

Manufacturing Process Excellence

The bare copper wire manufacturing process involves several precision-controlled stages:

• Raw Material Reception: Copper cathodes or copper rods are received and quality verified for purity specifications

• Continuous Casting: Copper cathodes are melted and continuously cast into copper rods of specific diameters

• Wire Drawing: Copper rods are drawn through progressively smaller tungsten carbide dies to reduce diameter

• Annealing: Drawn wire is heat-treated in controlled atmosphere furnaces to restore ductility and reduce work hardening

• Final Drawing: Annealed wire undergoes final drawing passes to achieve precise diameter specifications

• Surface Treatment: Wire surface is cleaned and may be polished for specific applications

• Quality Testing: Finished wire is tested for electrical conductivity, tensile strength, and dimensional accuracy

• Spooling and Packaging: Wire is wound onto spools or coils according to customer specifications and packaged for transport

Industry Leadership

The global bare copper wire industry is led by established metal processing companies with extensive production capabilities and diverse application portfolios. Key industry players include:

• Hindalco Industries Limited

• Rajasthan Electric Industries

• Sterlite Technologies Limited

• Jiangxi Copper Company

• Nexans S.A.

• Prysmian Group

• Southwire Company

These companies serve diverse end-use sectors including power utilities, electrical equipment manufacturing, telecommunications infrastructure, renewable energy installations, and construction applications, demonstrating the broad market applicability of bare copper wire products.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=24176&flag=C

Recent Industry Developments

August 2024: Hindalco Industries announced a USD 200 million expansion of its copper wire manufacturing capacity in India to meet growing demand from renewable energy and electrical infrastructure sectors. The expansion includes state-of-the-art continuous casting and high-speed drawing lines designed to improve productivity and product quality.

May 2024: Prysmian Group invested in advanced copper wire production technology incorporating Industry 4.0 automation, real-time quality monitoring, and energy-efficient annealing systems, reducing production costs by 12% while improving conductor consistency and environmental performance.

Conclusion

The bare copper wire manufacturing sector presents a strategically positioned investment opportunity at the intersection of electrical infrastructure development, renewable energy expansion, and industrial growth. With favorable profit margins ranging from 12-15% gross profit and 4-7% net profit, strong market drivers including rising electricity demand, growing renewable energy installations, expanding grid modernization programs, and supportive government policies promoting infrastructure development and clean energy transition, establishing a bare copper wire manufacturing plant offers significant potential for long-term business success and sustainable returns. The combination of superior electrical conductivity, critical role in power transmission infrastructure, expanding urbanization and industrialization trends, and import substitution opportunities in emerging economies creates an attractive value proposition for serious metal processing investors committed to quality manufacturing and operational excellence.

About IMARC Group

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its clients' business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201-971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Bare Copper Wire Manufacturing Plant (DPR) 2026: Technical Requirements, Cost, and ROI Analysis here

News-ID: 4374762 • Views: …

More Releases from IMARC Group

Electric Car Manufacturing Plant Feasibility (DPR) 2026: CapEx/OpEx with Profita …

The global electric car manufacturing industry is witnessing robust growth driven by the rapidly expanding clean energy transition and increasing demand for sustainable transportation solutions. At the heart of this expansion lies a revolutionary mobility product: the electric car. As automotive markets transition toward zero-emission vehicles and advanced electric powertrains, establishing an electric car manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and automotive investors seeking to capitalize…

Silica Sand Processing Plant Cost DPR & Unit Setup - 2026: Capex, Opex and ROI E …

Silica sand, a granular material predominantly composed of silicon dioxide (SiO2), stands as one of the most critical industrial raw materials across global manufacturing and infrastructure sectors. Originating from weathered quartz-rich rocks, processed silica sand is characterized by high chemical purity, controlled grain size distribution, a high melting point, and excellent hardness - properties that make it indispensable in applications ranging from glass manufacturing and foundry casting to construction materials…

Neem Oil Processing Plant Project (DPR) 2026: Setup, Market Trends & Profitabili …

The global neem oil processing industry is witnessing robust growth driven by the rapidly expanding organic agriculture sector and increasing demand for natural pest control and wellness products. At the heart of this expansion lies a critical natural extract: neem oil. As agricultural regions transition toward sustainable farming practices and eco-friendly pest management methods, establishing a neem oil processing plant presents a strategically compelling business opportunity for entrepreneurs and agro-based…

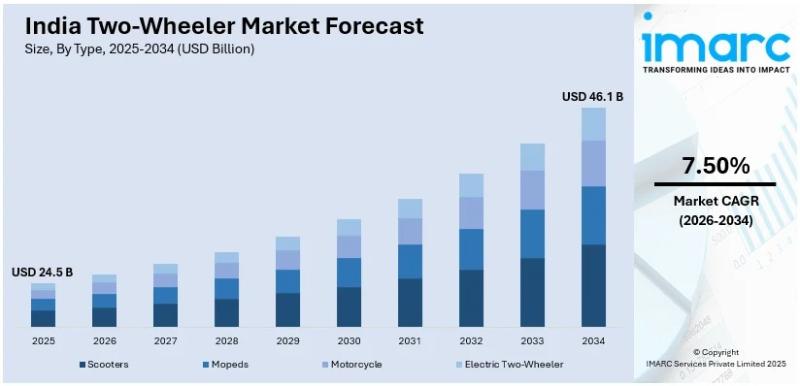

India Two-Wheeler Market to Hit USD 46.1 Billion by 2034: Driven by Premiumizati …

Source: IMARC Group | Category: Automotive

Report Introduction

According to IMARC Group's latest report titled "India Two-Wheeler Market Size, Share, Trends and Forecast by Type, Technology, Transmission, Engine Capacity, Fuel Type, End User, Distribution Channel, and Region, 2026-2034", this study offers a granular analysis of the industry's shift towards connected technologies and premiumization. The report covers critical market dynamics, including the impact of flexible ownership models like subscription services, the…

More Releases for Bare

Bare Metal Servers | Dedicated Hosting | Onlive Server

Onlive Server, a global leader in fully managed hosting and cloud infrastructure, announced the launch of its next generation Bare Metal platform today. A dedicated option that you don't share with anyone else. Unlike virtual private servers (VPS) or shared hosting, where resources like CPU, memory, and storage are divided among users, a bare metal system gives you full access to the hardware, ensuring better performance, control, and reliability. Without…

GaN Bare-die Market

GaN Bare-die Market Overview

Gallium nitride (GaN) transistors offer fundamental advantages over silicon. In particular, the higher critical electrical field makes it very attractive for power semiconductor devices with outstanding specific dynamic on-state resistance and smaller capacitances compared to silicon MOSFETs, which makes GaN HEMTs great for high speed switching applications. Gallium nitride transistors can then be operated with reduced dead-times which results in higher efficiency and enables passive cooling. Operation…

Bare Ceramic Substrate Market 2022 | Detailed Report

This report offers a detailed view about the challenging landscape of the international market. The exact and innovative information gave through this report helps organizations with getting mindful of the kinds of consumers, buyer's demand and preferences, their perspective, their purchasing aims, their reaction to a specific item, and their different tastes about the certain item already prevailing in the Bare Ceramic Substrate market. It includes a point-by-point illustration of…

Global bare metal cloud Market Overview Analysis

Stratistics MRC’s bare metal cloud Market report explains company profiling, key segments, market trends, top players and regional, country-level segments.

Bare metal cloud is a public cloud service alternative that is installed directly on hardware without the need for a virtualization setup. It is majorly deployed to enhance the storage capacity, conduct data-intensive computing operations, and to efficiently deliver latency-sensitive high-performance workloads across multiple platforms. A bare metal cloud server is…

How & When Did Bare Feet Become Taboo?

September 14, 2020 OFFICIAL PRESS RELEASE

LAS VEGAS,NV – Barefoot Is Legal (barefootislegal.org) founder Dave Kelman has written an article on the organization website regarding the origin on the “No Bare Feet” signs.

The article is located at: https://barefootislegal.org/how-when-did-bare-feet-become-taboo/

“It is time for Americans to know where these signs came from” Kelman shares.

The “No bare feet” and “No Shirt No Shoes No Service” signs have come up recently.…

Bare Metal Cloud Service Market - The Booming Bare Metal Cloud Service Marketpla …

According to a new market report published by Transparency Market Research, global bare metal cloud service market is expected to reach US$ 25,704.4 Mn by 2025. The market is projected to expand at a CAGR of 16.76 % during the forecast period from 2017 to 2025. According to the report, North America will continue to be at the forefront of global demand, with the market in the region growing at…