Press release

Silica Sand Processing Plant Cost DPR & Unit Setup - 2026: Capex, Opex and ROI Evaluation

Silica sand, a granular material predominantly composed of silicon dioxide (SiO2), stands as one of the most critical industrial raw materials across global manufacturing and infrastructure sectors. Originating from weathered quartz-rich rocks, processed silica sand is characterized by high chemical purity, controlled grain size distribution, a high melting point, and excellent hardness - properties that make it indispensable in applications ranging from glass manufacturing and foundry casting to construction materials and hydraulic fracturing.As industries worldwide scale operations and governments accelerate infrastructure spending, the demand for high-quality processed silica sand continues to gain substantial momentum. For investors and entrepreneurs seeking a lucrative opportunity in the industrial minerals space, establishing a silica sand processing plant presents a compelling business case backed by strong market fundamentals, healthy profitability, and long-term demand visibility.

IMARC Group's report, "Silica Sand Processing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," offers a comprehensive guide for establishing a plant. The silica sand processing plant setup report offers insights into the process, financials, capital investment, expenses, ROI, and more for informed business decisions.

Request Sample: https://www.imarcgroup.com/silica-sand-processing-plant-project-report/requestsample

Market Overview and Growth Potential

The global silica sand market has demonstrated robust growth, underpinned by expanding construction activities, rising glass consumption across residential, automotive, and solar applications, and increasing demand from foundry and energy sectors. The global silica sand market was valued at USD 25.4 Billion in 2025 and is projected to reach USD 38.3 Billion by 2034, growing at a CAGR of 4.7% from 2026 to 2034. This growth trajectory is supported by multiple converging megatrends, including rapid urbanization, infrastructure modernization, renewable energy expansion - particularly in solar PV glass manufacturing - and sustained demand from hydraulic fracturing operations in unconventional oil and gas extraction.

For reference, the U.S. Census Bureau reported that construction spending during August 2025 was estimated at a seasonally adjusted annual rate of USD 2,169.5 Billion, underscoring the scale of infrastructure investment driving silica sand consumption. Additionally, rising investments in water treatment infrastructure and environmental remediation projects are contributing to steady demand for high-purity filtration-grade silica sand.

Plant Capacity and Production Scale

The proposed silica sand processing facility is designed with an annual production capacity ranging between 200,000 to 500,000 MT, enabling significant economies of scale while maintaining operational flexibility to serve diverse market segments. The processing operations primarily involve drying, screening, and milling - complemented by washing, classification, and beneficiation to meet stringent end-user specifications for particle size, sphericity, and chemical composition. This scalable capacity positions the plant to serve end-use industries including glass, foundry, construction, ceramics, chemicals, and energy, ensuring diversified revenue streams and reduced market concentration risk.

Financial Viability and Profitability Analysis

The silica sand processing project demonstrates strong profitability potential under normal operating conditions. Gross profit margins typically range between 30-40%, supported by stable downstream demand and the ability to deliver value-added products tailored to specific industrial applications. Net profit margins are projected at 15-20%, reflecting a healthy return after accounting for depreciation, taxation, and operational overheads. The financial projections for the proposed project are developed based on realistic assumptions related to capital investment, operating costs, production capacity utilization, pricing trends, and demand outlook - providing a comprehensive view of the project's financial viability, ROI, profitability, and long-term sustainability.

Operating Cost Structure

The operating cost structure of a silica sand processing plant is primarily driven by raw material consumption and utility expenses. Key cost components include:

• Raw Materials (Raw Silica Sand): Approximately 40-50% of total operating expenditure (OpEx), making raw material sourcing and long-term supplier contracts critical for cost optimization and price stability.

• Utilities (Electricity, Water, Steam): Approximately 20-30% of OpEx, reflecting the energy-intensive nature of drying, screening, and beneficiation processes.

• Other Expenses: Transportation, packaging, salaries and wages, depreciation, taxes, and repairs and maintenance account for the remaining operational costs.

By the fifth year of operations, total operational costs are expected to increase due to inflation, market fluctuations, and potential rises in key material costs. Strategic cost management through long-term supplier contracts, process optimization, and energy efficiency improvements will be essential to maintaining healthy margins.

Capital Investment Requirements

Establishing a silica sand processing plant involves significant capital expenditure across several key categories. Machinery costs account for the largest portion of total CapEx, with essential equipment including crushers, scrubbers, screens and classifiers, attrition cells, magnetic separators, flotation columns, dewatering filters and cyclones, fluidized bed dryers, and pneumatic loading systems. Land and site development - including charges for land registration, boundary development, and related expenses - forms a substantial part of the overall investment, ensuring a solid foundation for safe and efficient plant operations.

Additional capital requirements include civil works and other infrastructure development. The scale of production and level of automation will determine the total machinery investment, while site selection must prioritize proximity to raw silica sand sources, access to robust transportation networks and utilities, and compliance with local zoning laws and environmental regulations.

Speak to an Analyst: https://www.imarcgroup.com/request?type=report&id=7691&flag=C

Major Applications and Market Segments

Processed silica sand serves a diverse range of high-value industrial applications, including:

• Glass Manufacturing - float glass, container glass, and specialty glass production

• Foundry - molds, cores, and refractory coatings for metal casting

• Construction Materials - cement, concrete, and mortar additives

• Chemical Industry - silicon compounds, silicones, and industrial abrasives

• Filtration - water treatment, industrial filtration, and gas purification

• Energy - hydraulic fracturing for unconventional oil and gas extraction

These end-use sectors ensure broad demand diversification and resilience against sector-specific downturns.

Why Invest in Silica Sand Processing?

Critical Industrial Material: Silica sand serves as a key raw material across multiple industries including glass manufacturing, foundries, construction, chemicals, and filtration - positioning it as an essential input for industrial production, quality products, and process reliability.

Moderate but Defensible Entry Barriers: While less capital-intensive than high-tech industries, silica sand processing demands consistent particle size distribution, high purity levels, precise washing and beneficiation techniques, and long-term contracts with OEMs and industrial users - favoring experienced producers who can maintain quality and consistent pricing.

Megatrend Alignment: Growth in glass production, urban infrastructure, renewable energy, water treatment, and high-tech manufacturing is driving sustained demand for high-quality silica sand. Sectors like solar PV glass, specialty glass, and engineered construction materials are expanding rapidly on a global scale.

Policy and Infrastructure Support: Government initiatives in infrastructure development, renewable energy, urban housing, and domestic manufacturing - such as "Make in India" programs and industrial incentives - indirectly boost demand for high-purity silica sand.

Localization and Supply Chain Reliability: Industrial buyers and EPC contractors increasingly prefer local, dependable suppliers to reduce logistics costs, secure high-quality sand, and ensure uninterrupted supply - creating opportunities for regional producers with optimized operations and sourcing.

Buy Now: https://www.imarcgroup.com/checkout?id=7691&method=2175

Industry Leadership

Leading processors in the global silica sand industry include several multinational companies with extensive production capacities and diverse application portfolios. Key players include:

• Sibelco

• U.S. Silica Holdings, Inc.

• Covia Holdings LLC

• Quarzwerke Group

• Badger Mining Corporation

Conclusion

The silica sand processing industry presents a strategically attractive investment opportunity. The convergence of infrastructure expansion, renewable energy growth, and increasing industrial demand creates a favorable market environment for new entrants and capacity expansions. For investors seeking a data-driven, comprehensive investment blueprint.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Silica Sand Processing Plant Cost DPR & Unit Setup - 2026: Capex, Opex and ROI Evaluation here

News-ID: 4374748 • Views: …

More Releases from IMARC Group

Electric Car Manufacturing Plant Feasibility (DPR) 2026: CapEx/OpEx with Profita …

The global electric car manufacturing industry is witnessing robust growth driven by the rapidly expanding clean energy transition and increasing demand for sustainable transportation solutions. At the heart of this expansion lies a revolutionary mobility product: the electric car. As automotive markets transition toward zero-emission vehicles and advanced electric powertrains, establishing an electric car manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and automotive investors seeking to capitalize…

Neem Oil Processing Plant Project (DPR) 2026: Setup, Market Trends & Profitabili …

The global neem oil processing industry is witnessing robust growth driven by the rapidly expanding organic agriculture sector and increasing demand for natural pest control and wellness products. At the heart of this expansion lies a critical natural extract: neem oil. As agricultural regions transition toward sustainable farming practices and eco-friendly pest management methods, establishing a neem oil processing plant presents a strategically compelling business opportunity for entrepreneurs and agro-based…

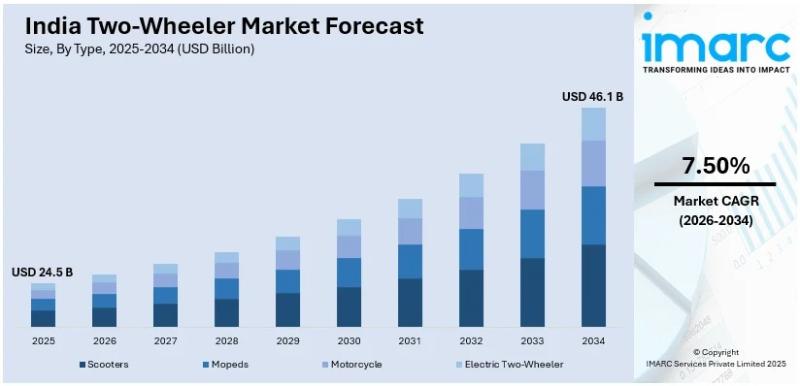

India Two-Wheeler Market to Hit USD 46.1 Billion by 2034: Driven by Premiumizati …

Source: IMARC Group | Category: Automotive

Report Introduction

According to IMARC Group's latest report titled "India Two-Wheeler Market Size, Share, Trends and Forecast by Type, Technology, Transmission, Engine Capacity, Fuel Type, End User, Distribution Channel, and Region, 2026-2034", this study offers a granular analysis of the industry's shift towards connected technologies and premiumization. The report covers critical market dynamics, including the impact of flexible ownership models like subscription services, the…

Chocolate Manufacturing Plant Setup Cost Analysis (DPR) 2026: Complete Investmen …

The global chocolate manufacturing industry is witnessing robust growth driven by the rapidly expanding confectionery sector and increasing demand for premium and specialty chocolate products. At the heart of this expansion lies a beloved consumer product: chocolate. As consumer preferences transition toward artisanal varieties, organic ingredients, and innovative flavor combinations, establishing a chocolate manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and food industry investors seeking to capitalize…

More Releases for Silica

Silica Suspension Particles Market Silica Suspension Particles Market

Silica Suspension Particles Market Size

The global market for Silica Suspension Particles was valued at US$ 793 million in the year 2024 and is projected to reach a revised size of US$ 1148 million by 2031, growing at a CAGR of 5.5% during the forecast period.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-14R15522/Global_Silica_Suspension_Particles_Market_Research_Report_2023

The growing demand for colloidal silica is driven by its wide application in various industries such as coatings, adhesives, electronics, construction and personal…

Washed Silica Sand Market worth $24 million by 2026 | Key players US Silica Hold …

According to recent market research the "Washed Silica Sand Market by Fe Content (>0.01%, ≤0.01%), Particle Size (≤0.4mm, 0.5mm - 0.7mm, >0.7mm), Application (Glass, Foundry, Oil well cement, Ceramic & Refractories, Abrasive, Metallurgy, Filtration) and Region - Global Forecast to 2026", size is projected to grow from USD 18 million in 2021 to USD 24 million by 2026, at a CAGR of 5.4% from 2021 to 2026. The market is…

Silica Flour Market 2028 | U.S. Silica Holdings Inc, Premier Silica LLC, SCR-Sib …

This detailed market study covers Silica Flour Market growth potentials which can assist the stake holders to understand key trends and prospects in Silica flour Market identifying the growth opportunities and competitive scenarios. The report also focuses on data from different primary and secondary sources, and is analyzed using various tools. It helps to gain insights into the market's growth potential, which can help investors identify scope and opportunities. The…

Industrial Silica Sand Market Growing Demand, Analysis by Key Players: Internati …

Advance Market Analytics released a comprehensive report of 200+ pages on 'Industrial Silica Sand' market with detailed analysis, forecast and strategies. The study covers key regions that includes North America, Europe, Asia-Pacific along with relevant country level break-up. Some of the important players from a wide list of coverage used under bottom-up approach are International Silica Industries Company Plc (Jordan), Superior Silica Sands LLC (United States), Saudi Emirates Pulverization Industries…

Industrial Silica Market to 2017 - 2025: Premier Silica LLC, International Silic …

Researchmoz added Most up-to-date research on "Industrial Silica Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2017 - 2025" to its huge collection of research reports.

Global Industrial Silica Market: Overview

Demand for fiberglass is high, due to its excellent functional and mechanical properties such as low weight and resistance to corrosion and heat. Thus, these resins are used in a wide range of end-user industries such as automotive.…

Global Industrial Silica Market by Top Key Players Profiled: Premier Silica LLC, …

Researchmoz added Most up-to-date research on "Global Industrial Silica Market by Top Key Players Profiled: Premier Silica LLC, International Silica Industries Company PLC and U.S. Silica Holdings Inc." to its huge collection of research reports.

Demand for fiberglass is high, due to its excellent functional and mechanical properties such as low weight and resistance to corrosion and heat. Thus, these resins are used in a wide range of end-user industries such…