Press release

Chocolate Manufacturing Plant Setup Cost Analysis (DPR) 2026: Complete Investment Guide

The global chocolate manufacturing industry is witnessing robust growth driven by the rapidly expanding confectionery sector and increasing demand for premium and specialty chocolate products. At the heart of this expansion lies a beloved consumer product: chocolate. As consumer preferences transition toward artisanal varieties, organic ingredients, and innovative flavor combinations, establishing a chocolate manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and food industry investors seeking to capitalize on this growing and indulgent market.Market Overview and Growth Potential

The global chocolate market demonstrates strong growth trajectory, valued at USD 167.0 Billion in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach USD 219.9 Billion by 2034, exhibiting a robust CAGR of 2.8% from 2026-2034. This sustained expansion is driven by rapidly expanding middle-class populations, increasing demand for premium and dark chocolate variants, rising gifting culture, and expanding consumption in developing economies.

Chocolate is a processed confectionery product manufactured from roasted and ground cacao beans combined with sugar, milk solids, and other ingredients. It appears as solid bars, molded shapes, filled pralines, or coating compounds with varying cocoa content and flavor profiles. Chocolate contains cocoa mass, cocoa butter, sugar, milk powder (for milk chocolate), lecithin as an emulsifier, and vanilla or other flavorings, making it a versatile product used in direct consumption, baking, desserts, and confectionery applications. Due to its rich taste, mood-enhancing properties from compounds like theobromine and phenylethylamine, and cultural significance in celebrations and gifting, it enjoys universal appeal across demographics. Its shelf stability, portability, and diverse product formats make it a preferred indulgence in both developed and emerging markets.

The chocolate market is witnessing robust demand due to the rising preference for premium artisanal products, organic and ethically sourced ingredients, and innovative flavor combinations. Urban populations increasingly seeking sophisticated taste experiences particularly in dark chocolate, single-origin varieties, and sugar-free alternatives are driving large-scale product innovation. According to consumer behavior studies, premiumization trends and health-conscious formulations are reshaping the global chocolate industry. Consumer-led movements toward fair trade certification, sustainable cocoa sourcing, and transparency in ingredient origins further strengthen market prospects.

Request for a Sample Report: https://www.imarcgroup.com/chocolate-manufacturing-plant-project-report/requestsample

Plant Capacity and Production Scale

The proposed chocolate manufacturing facility is designed with an annual production capacity ranging between 5,000 - 10,000 MT per year, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to cater to diverse market segments from mass-market chocolate bars and seasonal products to premium artisanal chocolates, organic variants, and specialty confections ensuring steady demand and consistent revenue streams across multiple consumer categories.

Financial Viability and Profitability Analysis

The chocolate manufacturing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

Gross Profit Margins: 35-45%

Net Profit Margins: 15-20%

These margins are supported by stable demand across confectionery and gifting segments, premium product positioning opportunities, and the discretionary yet consistent nature of chocolate consumption. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established food manufacturers looking to diversify their product portfolio in the confectionery sector.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a chocolate manufacturing plant is primarily driven by:

Raw Materials: 70-80% of total OpEx

Utilities: 5-10% of OpEx

Other Expenses: Including labor, packaging, quality control, transportation, maintenance, depreciation, and taxes

Raw materials constitute the largest portion of operating costs, with cocoa beans (or cocoa mass and cocoa butter), sugar, milk powder, and specialty ingredients being the primary inputs. Establishing long-term contracts with reliable cocoa suppliers and commodity hedging strategies helps mitigate price volatility and ensures consistent raw material supply, which is critical given that cocoa price fluctuations represent the most significant cost factor in chocolate manufacturing.

Capital Investment Requirements

Setting up a chocolate manufacturing plant requires substantial capital investment across several critical categories:

Land and Site Development

Selection of an optimal location with strategic proximity to cocoa processing facilities and ingredient suppliers. Proximity to target urban markets will help minimize distribution costs and maintain product freshness. The site must have robust infrastructure, including reliable transportation, climate-controlled storage capabilities, and waste management systems. Compliance with local zoning laws, food safety regulations, and environmental standards must also be ensured.

Machinery and Equipment

The largest portion of capital expenditure (CapEx) covers specialized manufacturing equipment essential for production. Key machinery includes:

• Cocoa bean cleaning and roasting systems with temperature control

• Winnowing machines for shell removal and nib separation

• Grinding and refining equipment for cocoa mass production

• Conching machines for flavor development and texture refinement

• Tempering systems for proper cocoa butter crystallization

• Molding equipment with cooling tunnels for bar production

• Enrobing machines for coating and covering applications

• Depositing systems for filled chocolates and pralines

• Cooling and wrapping equipment with humidity control

• Quality control laboratory with fat content and particle size analyzers

• Metal detection and weight checking systems

• Climate-controlled storage for cocoa butter and finished products

• Packaging lines for wrapping, boxing, and sealing operations

Civil Works

Building construction, factory layout optimization, and infrastructure development designed to enhance workflow efficiency, ensure workplace safety, meet stringent hygiene standards, and maintain temperature and humidity control throughout the production process. The layout should be optimized with separate areas for raw material storage, roasting section, grinding and refining zone, conching area, tempering and molding hall, enrobing station, cooling tunnel, packaging area, quality control laboratory, finished goods warehouse with climate control, utility block, and administrative offices. Food-grade finishes and controlled environment systems are essential.

Other Capital Costs

Pre-operative expenses, machinery installation costs, regulatory compliance certifications (FDA, FSSAI, BRC, organic certifications), initial working capital requirements, recipe development and product testing, and contingency provisions for unforeseen circumstances during plant establishment.

Major Applications and Market Segments

Chocolate products find extensive applications across diverse market segments, demonstrating their versatility and universal appeal:

Retail Chocolate Bars

Primary sales through supermarkets, convenience stores, and specialty shops offering dark chocolate, milk chocolate, white chocolate, and flavored varieties for direct consumption.

Premium and Artisanal Chocolates

Specialized applications in gift boxes, seasonal collections, single-origin products, and handcrafted pralines targeting premium consumer segments and gifting occasions.

Industrial Chocolate

Supply to bakeries, confectionery manufacturers, ice cream producers, and food service operations requiring chocolate coatings, chunks, chips, and compound preparations.

Seasonal and Novelty Products

Applications in holiday-themed chocolates, character-shaped products, limited editions, and promotional items aligned with cultural celebrations and marketing campaigns.

Health-Focused Variants

Products including sugar-free chocolates for diabetics, organic certified options, high-cocoa dark chocolate variants, and functional chocolates with added nutrients or superfoods.

End-use channels include retail distribution, e-commerce platforms, hospitality and food service, corporate gifting, and export markets, all of which contribute to sustained market demand.

Buy now: https://www.imarcgroup.com/checkout?id=7404&method=2175

Why Invest in Chocolate Manufacturing?

Several compelling factors make chocolate manufacturing an attractive investment opportunity:

Universal Consumer Appeal

Chocolate serves as a beloved confectionery product with cross-cultural acceptance, making it indispensable across celebrations, gifting occasions, and everyday indulgence, ensuring consistent baseline demand.

Premiumization Trends

Consumer populations increasingly seeking artisanal quality, ethical sourcing, and sophisticated flavor experiences-particularly in dark chocolate and single-origin varieties-are driving margin expansion opportunities through premium positioning.

Innovation Opportunities

The product's versatility enables endless variations in cocoa content, flavor combinations, texture profiles, and functional additions, offering significant differentiation potential and brand building opportunities.

Growing Health Consciousness

Rising awareness of dark chocolate's antioxidant properties, mood-enhancing compounds, and potential cardiovascular benefits positions high-cocoa products favorably in health-conscious consumer segments.

Cultural and Seasonal Demand

Deeply embedded gifting traditions during festivals, celebrations, Valentine's Day, and other occasions create predictable seasonal demand spikes supporting production planning and revenue visibility.

Export Market Potential

Emerging economies expanding local manufacturing to supply growing domestic markets while developed markets seek unique origins and artisanal products create opportunities for both domestic sales and export revenue.

Emotional Connection

Chocolate's strong association with pleasure, comfort, celebration, and indulgence creates powerful brand loyalty and repeat purchase behavior enhancing long-term customer value.

Manufacturing Process Excellence

The chocolate manufacturing process involves several precision-controlled stages:

• Bean Selection and Cleaning: Cocoa beans are inspected, cleaned, and sorted to remove foreign materials

• Roasting: Beans are roasted at controlled temperatures to develop chocolate flavor and facilitate shell removal

• Winnowing: Roasted beans are cracked and winnowing machines separate shells from cocoa nibs

• Grinding: Nibs are ground into cocoa mass (cocoa liquor) through friction and heat generation

• Mixing: Cocoa mass is blended with sugar, milk powder (for milk chocolate), cocoa butter, and other ingredients according to recipe formulation

• Refining: The mixture passes through refining rolls to reduce particle size creating smooth texture

• Conching: Extended mixing and aeration at controlled temperatures develops flavor complexity and improves mouthfeel

• Tempering: Precise heating and cooling cycles create stable cocoa butter crystals for proper snap and gloss

• Molding/Enrobing: Tempered chocolate is deposited into molds or used for coating centers

• Cooling: Products pass through cooling tunnels for crystallization and solidification

• Packaging: Finished chocolates are wrapped, boxed, and prepared for distribution

Industry Leadership

The global chocolate industry is led by established multinational corporations with extensive production capabilities and diverse brand portfolios. Key industry players include:

• Mars, Incorporated

• Mondelēz International

• Nestlé S.A.

• Ferrero Group

• The Hershey Company

• Lindt & Sprüngli

• Barry Callebaut AG

These companies serve diverse consumer segments across mass-market products, premium chocolate brands, seasonal specialties, and industrial chocolate supply, demonstrating the broad market applicability of chocolate products.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=7404&flag=C

Recent Industry Developments

August 2024: Ferrero Group announced investment of EUR 300 million in sustainable cocoa sourcing programs across West Africa, establishing farmer training centers and implementing blockchain traceability systems to ensure ethical supply chain transparency.

October 2024: Lindt & Sprüngli launched a new premium line of single-origin dark chocolates featuring beans from specific estates in Ecuador and Madagascar, targeting sophisticated consumers seeking terroir-driven chocolate experiences comparable to fine wines.

Conclusion

The chocolate manufacturing sector presents a strategically positioned investment opportunity at the intersection of confectionery tradition, premiumization trends, and evolving consumer preferences. With favorable profit margins ranging from 35-45% gross profit and 15-20% net profit, strong market drivers including rising middle-class populations with discretionary spending power, growing demand for premium and artisanal products, expanding health-conscious dark chocolate consumption, and supportive consumer trends favoring ethical sourcing and transparency, establishing a chocolate manufacturing plant offers significant potential for long-term business success and sustainable returns. The combination of universal product appeal, innovation opportunities across formats and flavors, strong cultural associations with celebration and gifting, and growing premiumization in emerging markets creates an attractive value proposition for serious food industry investors committed to quality manufacturing, brand building, and operational excellence.

About IMARC Group

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its clients' business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201-971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Chocolate Manufacturing Plant Setup Cost Analysis (DPR) 2026: Complete Investment Guide here

News-ID: 4374715 • Views: …

More Releases from IMARC Group

Urea Production Plant Cost 2026: Comprehensive Project Report and Market Outlook

The global urea production industry stands as a critical pillar of agricultural infrastructure and food security systems worldwide, positioned at the intersection of nitrogen fertilizer manufacturing, crop yield optimization, and global nutritional supply chains. As the most widely used synthetic nitrogen fertilizer globally, urea provides concentrated nutrient delivery supporting agricultural productivity across diverse crops, climates, and farming systems. This comprehensive guide provides an authoritative exploration of the technical, financial, and…

Saffron Processing Plant Cost (DPR) 2026: CapEx/OpEx Analysis with Profitability …

Saffron, widely recognized as the most expensive spice in the world, is derived from the dried red stigmas of the Crocus sativus flower. Renowned for its distinct aroma, vivid color, and exceptional culinary and medicinal properties, saffron has cemented its position as a high-value agricultural commodity with significant global demand. Each flower yields only three stigmas, requiring vast manual labor to harvest and process, which contributes to its premium market…

Irish Whiskey Market: Premium Spirit Positioning and Export-Led Consumption Mome …

Market Overview

The global Irish whiskey market was valued at USD 5.7 Billion in 2025 and is forecasted to reach USD 10.0 Billion by 2034, exhibiting a CAGR of 6.18% during the forecast period 2026-2034. The market growth is driven by rising premiumization trends, increasing demand for craft spirits, a growing cocktail culture, and strong off-trade sales. The industry also benefits from heritage-driven branding and expanding global consumer interest.

Study Assumption Years

• Base…

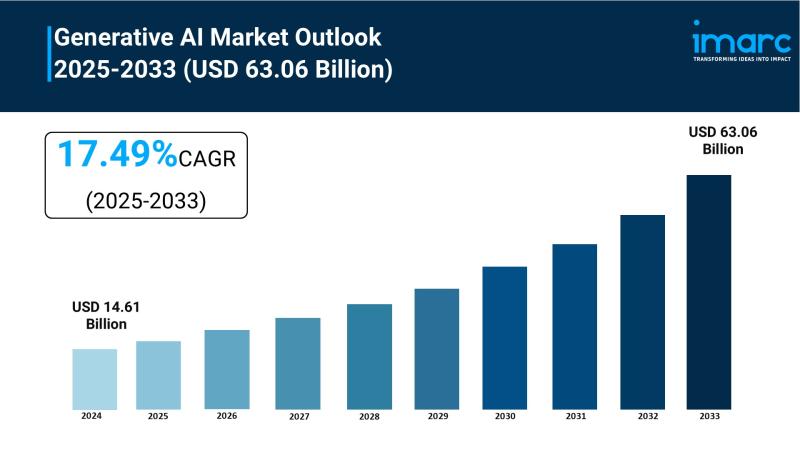

Generative AI Market to Reach USD 63.06 Billion by 2033, Growing at a CAGR of 17 …

Market Overview:

The generative AI market is experiencing rapid growth, driven by Surging Enterprise Adoption Across Industries, Cloud Infrastructure and API Accessibility and Government Funding and National AI Strategies. According to IMARC Group's latest research publication, "Generative AI Market : Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033" The global generative AI market size was valued at USD 14.61 Billion in 2024. Looking forward, IMARC Group estimates the market…

More Releases for Chocolate

Bean-to-bar Chocolate Market Players Gaining Attractive Investments: Dandelion C …

The Latest Study Published by HTF MI Research on the "Bean-to-bar Chocolate Market'' evaluates market size, trend and forecast to 2030. The Bean-to-bar Chocolate market study includes significant research data and evidences to be a practical resource document for managers and analysts is, industry experts and other key people to have an easily accessible and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges as well…

Bean-to-bar Chocolate Market Outlook 2031 Findings By Key Players-Taza Chocolate …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- According to 𝐌𝐑𝐈, the global Bean-to-bar Chocolate Market size in terms of revenue was valued at around USD XX.X billion in 2023 and is expected to reach a value of 𝐔𝐒𝐃 𝐗𝐗.𝐗 𝐛𝐢𝐥𝐥𝐢𝐨𝐧 𝐛𝐲 𝟐𝟎𝟑𝟏, growing at a 𝐂𝐀𝐆𝐑 𝐨𝐟 𝐫𝐨𝐮𝐠𝐡𝐥𝐲 𝐗𝐗.𝐗% 𝐟𝐫𝐨𝐦 𝟐𝟎𝟐𝟒 𝐭𝐨 𝟐𝟎𝟑𝟏. The global Bean-to-bar Chocolate market is projected to grow at a significant growth rate due to several driving factors.

The market for bean-to-bar chocolate is expanding significantly due…

Chocolate Ingredients Market by Type (Milk, Cocoa, Lecithin, Flavors, Others), C …

Data Bridge Market Research analyses that the global chocolate ingredients market to account USD 9.20 billion by 2028 and growing at a CAGR of 4.25% in the forecast period of 2021-2028.

Chocolate Ingredients market research report provides data and information about the scenario of ABC industry which makes it easy to be ahead of the competition in today's speedily altering business environment. Analytical study of this market report aids in formulating…

Sea Salt Chocolate Market Seeking Excellent Growth | GODIVA, Skellings Chocolate …

The latest 125+ page survey report on Global Sea Salt Chocolate Market is released by HTF MI covering various players of the industry selected from global geographies like North America Country (United States, Canada), South America, Asia Country (China, Japan, India, Korea), Europe Country (Germany, UK, France, Italy), Other Country (Middle East, Africa, GCC). A perfect mix of quantitative & qualitative Market information highlighting developments, industry challenges that competitors are…

Milk Chocolate Market ||Ezaki Glico, Kinder Chocolate, Blommer Chocolate, Godiva …

Zion Market Research published a new 110+ pages industry research "Global Milk Chocolate Market Is Expected To Reach Around USD 90.65 Billion By 2025" is exhaustively researched and analyzed in the report to help market players to improve their business tactics and ensure long-term success. The authors of the report have used easy-to-understand language and uncomplicated statistical images but provided thorough information and detailed data on the Global Milk Chocolate…

Dark Chocolate Market By Type (70% Cocoa Dark Chocolate, 75% Cocoa Dark Chocolat …

Global Dark Chocolate Market Analysis

According to Verified Market Research, The Global Dark Chocolate Market was valued at USD 44.09 Billion in 2018 and is projected to reach USD 83.34 Billion by 2026, growing at a CAGR of 8.26% from 2019 to 2026.

What is Dark Chocolate?

Dark chocolate is chocolate without milk solids added and has a more prominent chocolate taste than milk chocolate and hence the dark chocolate is more prone…