Press release

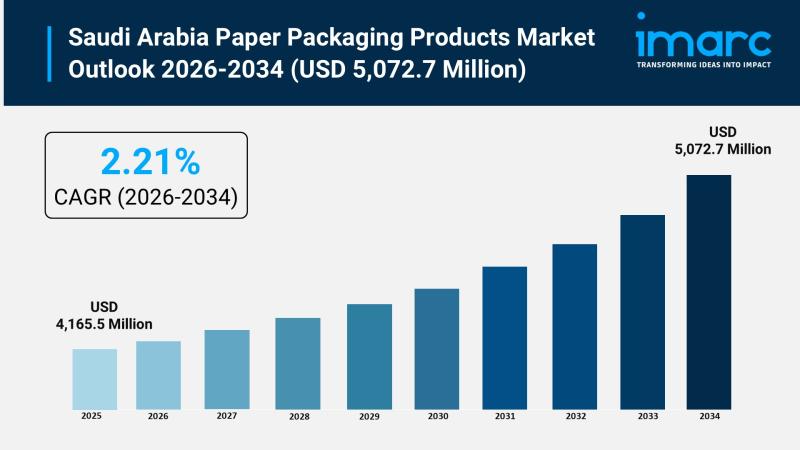

Saudi Arabia Paper Packaging Products Market Size To Exceed USD 5,072.7 Million By 2034 | CAGR of 2.21%

Saudi Arabia Paper Packaging Products Market OverviewMarket Size in 2025: USD 4,165.5 Million

Market Size in 2034: USD 5,072.7 Million

Market Growth Rate 2026-2034: 2.21%

According to IMARC Group's latest research publication, "Saudi Arabia Paper Packaging Products Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia paper packaging products market size reached USD 4,165.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 5,072.7 Million by 2034, exhibiting a growth rate (CAGR) of 2.21% during 2026-2034.

How AI is Reshaping the Future of Saudi Arabia Paper Packaging Products Market

● AI-powered quality control systems utilizing computer vision technology inspect packaging materials at unprecedented speeds, detecting defects, color inconsistencies, and structural anomalies in real-time, ensuring food safety compliance and maintaining halal certification standards across pharmaceutical and food production facilities throughout the Kingdom.

● Machine learning algorithms optimize production line efficiency by analyzing operational data patterns to predict equipment failures before they occur, reducing unplanned downtime significantly and enabling manufacturers to maintain consistent output while minimizing waste in corrugated box and folding carton production processes.

● Intelligent design software powered by AI enables packaging engineers to create optimized structural designs that minimize material usage while maintaining strength requirements, automatically calculating the most efficient cutting patterns for corrugated sheets and folding cartons to reduce waste and lower production costs across manufacturing facilities.

● Smart packaging solutions incorporating IoT sensors and AI analytics provide real-time monitoring of temperature, humidity, and product freshness during transportation through harsh desert conditions, ensuring product integrity for perishable goods and pharmaceuticals while enabling supply chain transparency and traceability throughout distribution networks.

● Advanced predictive analytics systems process historical sales data, seasonal trends, and market patterns to forecast demand accurately, allowing paper packaging manufacturers to optimize inventory levels, plan production schedules efficiently, and reduce storage costs while ensuring timely delivery to e-commerce and retail customers.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-paper-packaging-products-market/requestsample

How Vision 2030 is Transforming Saudi Arabia Paper Packaging Products Industry

Saudi Arabia's Vision 2030 is fundamentally transforming the paper packaging products industry by establishing sustainability, economic diversification, and local manufacturing as strategic priorities that drive unprecedented growth and innovation. The initiative's comprehensive plastic reduction regulations create sustained demand for paper-based packaging alternatives across food service, retail, and industrial sectors, positioning paper packaging as the preferred sustainable solution for businesses seeking regulatory compliance. Government programs like the Saudi Green Initiative and Middle East Green Initiative provide substantial funding, technical support, and regulatory frameworks that incentivize manufacturers to invest in advanced paper packaging production facilities, recycling infrastructure, and circular economy initiatives. The Regional Headquarters Program offers extensive tax exemptions to attract global paper converters and packaging technology providers, accelerating knowledge transfer and establishing Saudi Arabia as a regional manufacturing hub. Major investments in e-commerce infrastructure, food processing facilities, and pharmaceutical manufacturing create exponential demand for corrugated boxes, folding cartons, and specialized paper packaging solutions designed for modern supply chains. The Public Investment Fund's strategic financing of mega-projects requires massive volumes of construction-grade packaging materials, industrial containers, and protective packaging systems. Vision 2030's emphasis on tourism development through projects like NEOM, Qiddiya, and Red Sea initiatives generates demand for premium paper packaging in hospitality, retail, and food service applications. Ultimately, Vision 2030 elevates paper packaging as a cornerstone industry enabling sustainable economic transformation, creating thousands of manufacturing jobs, and positioning the Kingdom as a leader in environmentally responsible packaging solutions.

Saudi Arabia Paper Packaging Products Market Trends & Drivers:

Saudi Arabia's paper packaging products market is experiencing robust growth driven by aggressive government sustainability initiatives and plastic reduction policies implemented under Vision 2030's environmental framework. The Kingdom enacted comprehensive regulations targeting single-use plastics across retail, food service, and beverage sectors, creating immediate demand for paper-based alternatives including kraft bags, folding cartons, and corrugated containers. The Saudi Green Initiative and Middle East Green Initiative establish binding environmental targets that mandate businesses transition to biodegradable and recyclable packaging materials, with paper packaging meeting compliance requirements while offering superior sustainability credentials. The Ministry of Environment, Water and Agriculture enforces increasingly stringent packaging waste management regulations, implementing Extended Producer Responsibility frameworks expected to take effect fully, requiring manufacturers to finance collection and recycling infrastructure. These regulatory drivers fundamentally reshape packaging procurement decisions across industries, with food processors, retailers, and consumer goods manufacturers prioritizing paper packaging to avoid penalties while demonstrating environmental responsibility. The government provides substantial incentives including reduced tariffs on recycled paper imports, tax benefits for facilities incorporating recycling capabilities, and preferential procurement policies favoring sustainable packaging suppliers in government contracts. International partnerships bring advanced paper manufacturing technologies and expertise to Saudi facilities, enabling production of high-performance barrier-coated papers, moisture-resistant corrugated materials, and food-grade packaging that meets global quality standards while serving domestic demand.

The explosive growth of e-commerce and digital retail channels is significantly driving demand for paper packaging products across Saudi Arabia's rapidly modernizing economy. Online shopping penetration reached unprecedented levels, with same-day delivery services offered by major platforms creating sustained demand for lightweight yet durable corrugated mailers, reinforced shipping boxes, and protective packaging materials optimized for automated fulfillment centers. The Kingdom's e-commerce sector continues expanding rapidly, driven by young demographics, increasing internet penetration, and government digital transformation initiatives that position Saudi Arabia as the region's largest online retail market. Major e-commerce platforms and logistics providers invest heavily in fulfillment infrastructure throughout Riyadh, Jeddah, and Dammam, requiring massive volumes of standardized corrugated boxes designed for robotic handling systems, vision-guided sorting equipment, and high-speed packaging lines. The shift toward omnichannel retail strategies by traditional retailers drives demand for premium folding cartons featuring custom printing, brand storytelling elements, and unboxing experiences that enhance customer engagement and brand loyalty. Food delivery services experience exponential growth, creating specialized demand for grease-resistant kraft containers, insulated corrugated boxes, and eco-friendly paper bags that maintain food quality during transport while meeting consumer expectations for sustainable packaging. The Regional Headquarters Program attracts multinational consumer goods companies establishing Middle East operations in Saudi Arabia, bringing sophisticated packaging requirements for product launches, promotional campaigns, and export-oriented manufacturing that demand high-quality folding cartons, labels, and specialty papers meeting international branding standards.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=36709&flag=E

Saudi Arabia Paper Packaging Products Market Industry Segmentation:

The report has segmented the market into the following categories:

Product Type Insights:

● Corrugated Boxes

● Folding Cartons

● Paper Bags & Sacks

● Envelopes & Mailers

● Wrapping Paper

● Labels

Material Type Insights:

● Virgin Paper

● Recycled Paper

● Kraft Paper

● Coated Paper

End-Use Industry Insights:

● Food & Beverages

● Healthcare & Pharmaceuticals

● Personal Care & Cosmetics

● Consumer Electronics

● Retail & E-commerce

● Industrial & Chemicals

● Others

Breakup by Region:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Recent News and Developments in Saudi Arabia Paper Packaging Products Market

● January 2025: Gulf Print & Pack debuted in Riyadh, showcasing innovative paper packaging solutions and sustainable manufacturing technologies from suppliers representing numerous countries, reflecting the region's growing emphasis on eco-friendly packaging practices and modern production methodologies aligned with Vision 2030's environmental objectives and industrial diversification goals.

● February 2025: Zahrat Al Waha For Trading Company inaugurated an expanded printing and packaging production facility, significantly increasing manufacturing capacity to serve the diversifying Saudi industrial base with advanced capabilities including digital printing, automated finishing systems, and localized production solutions for domestic and export markets.

● May 2025: Saudi Print & Pack trade fair returned to Riyadh, featuring demonstrations of barrier-coating technologies and AI-driven quality inspection systems for paper packaging applications, bringing together international machinery suppliers and local converters to showcase innovations in sustainable workflow practices and smart manufacturing technologies.

● May 2025: United Carton Industries Company announced strategic plans for initial public offering on the Saudi Exchange, aiming to raise substantial capital to expand production capacity and meet accelerating demand for sustainable paper packaging solutions throughout the Kingdom and broader regional markets.

● April 2026: Saudi Paper & Packaging Expo is scheduled to return as a major industry platform, bringing together decision-makers, distributors, and manufacturers to showcase high-tech products and sustainable solutions, establishing itself as a critical networking venue for companies shaping the future of paper packaging in the rapidly evolving Saudi market.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Paper Packaging Products Market Size To Exceed USD 5,072.7 Million By 2034 | CAGR of 2.21% here

News-ID: 4374537 • Views: …

More Releases from IMARC Group

Turkey Trade Finance Market Report 2025, Share, Growth, Trends and Forecast Till …

The Turkey trade finance market size reached USD 703.56 Million in 2024 and is projected to reach USD 1,238.74 Million by 2033, growing at a CAGR of 5.82% during the forecast period 2025-2033. This growth is driven by expanding global trade, government export initiatives, and increasing demand for working capital and digital banking services. Banks and fintechs offer innovative products such as letters of credit and factoring, enhancing accessibility while…

Flexible Solar Panel Plant DPR 2026: Industry Trends, CapEx/OpEx and Market Grow …

Flexible solar panels are lightweight, bendable photovoltaic modules designed to generate electricity while offering versatility in installation on curved, portable, or weight-sensitive surfaces. Unlike conventional rigid panels, flexible solar panels are manufactured using thin-film technologies such as amorphous silicon (a-Si), copper indium gallium selenide (CIGS), or organic photovoltaic (OPV) materials deposited on flexible substrates like plastic or metal foil.

These panels are widely used in portable power systems, RVs, boats, tents,…

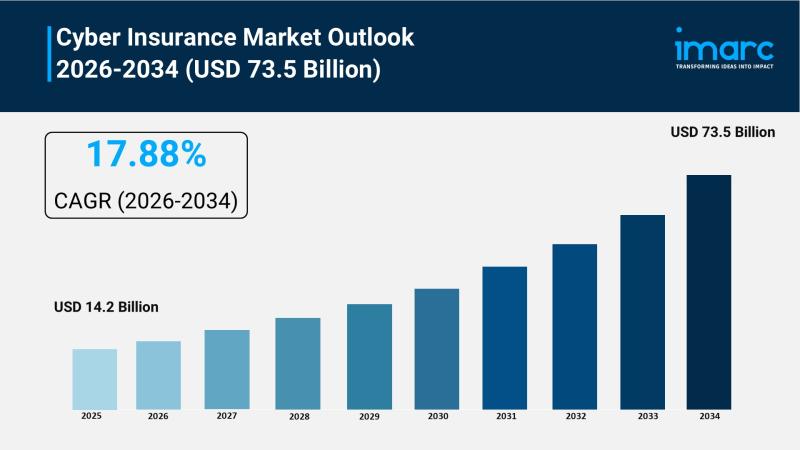

Cyber Insurance Market Size Worth USD 73.5 Billion, Globally, by 2034 at a CAGR …

Market Overview:

According to IMARC Group's latest research publication, "Cyber Insurance Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The global cyber insurance market size was valued at USD 14.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 73.5 Billion by 2034, exhibiting a CAGR of 17.88% from 2026-2034.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and…

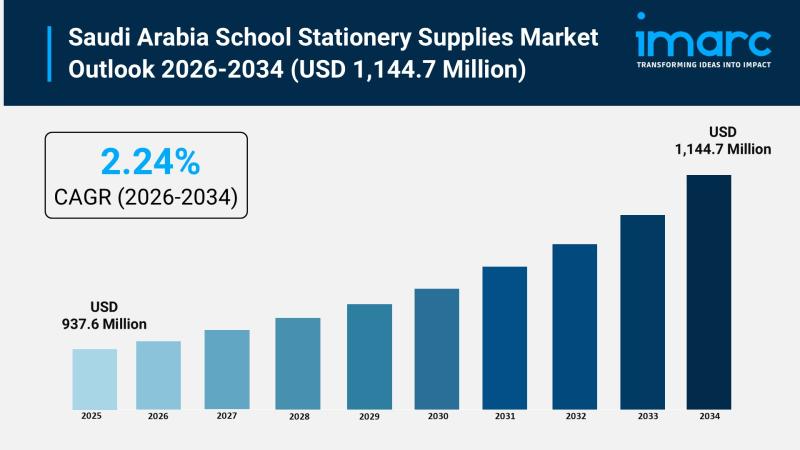

Saudi Arabia School Stationery Supplies Market Set to Surge to USD 1,144.7 Milli …

Saudi Arabia School Stationery Supplies Market Overview

Market Size in 2025: USD 937.6 Million

Market Size in 2034: USD 1,144.7 Million

Market Growth Rate 2026-2034: 2.24%

According to IMARC Group's latest research publication, "Saudi Arabia School Stationery Supplies Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia school stationery supplies market size reached USD 937.6 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,144.7 Million…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…