Press release

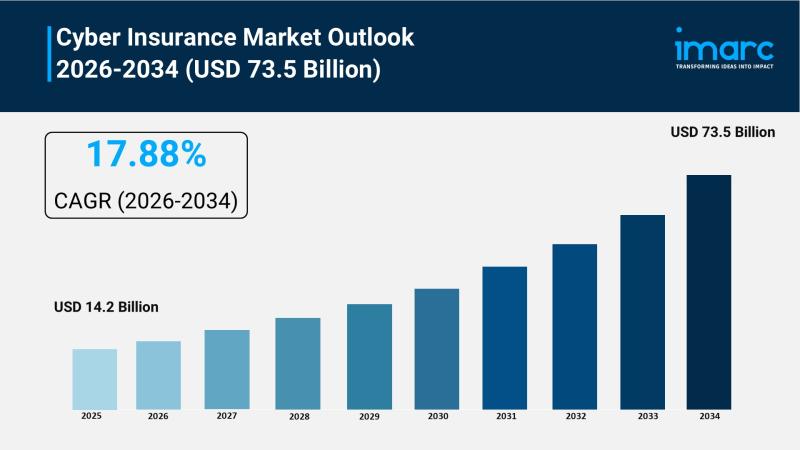

Cyber Insurance Market Size Worth USD 73.5 Billion, Globally, by 2034 at a CAGR of 17.88%

Market Overview:According to IMARC Group's latest research publication, "Cyber Insurance Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The global cyber insurance market size was valued at USD 14.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 73.5 Billion by 2034, exhibiting a CAGR of 17.88% from 2026-2034.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

How AI is Reshaping the Future of Cyber Insurance Market

● AI enhances cyber insurance underwriting by processing risk assessments faster and more accurately, with 63% of insurance companies implementing or planning AI operations, reducing manual evaluation time by 40%.

● Machine learning algorithms analyze threat intelligence data to predict cyber risk exposure, helping insurers provide tailored coverage that addresses specific vulnerabilities across different industries and organization sizes.

● AI-powered tools enable insurers to monitor policyholder cybersecurity postures in real-time, providing continuous risk scoring similar to credit scores, allowing for dynamic premium adjustments based on security improvements.

● Coalition's Active Cyber Policy uses AI to provide explicit coverage for AI-related security events, including deepfake-enabled fraud and AI-caused security failures, with $31 million returned to policyholders through AI-driven clawback efforts in 2024.

● Insurers leverage AI analytics to detect fraud patterns and process claims more efficiently, reducing claim settlement time by 25-30% while improving accuracy in identifying legitimate versus fraudulent cyber incident claims.

Download a sample PDF of this report: https://www.imarcgroup.com/cyber-insurance-market/requestsample

Key Trends in the Cyber Insurance Market

● Rising Sophistication of Cyber Threats: The increasing complexity of cyberattacks is driving demand for comprehensive coverage. Microsoft's 2024 Digital Defense Report reveals over 600 million daily cyber attacks on its customers. Ransomware incidents increased by 74% in 2023 compared to 2022, with the average cost per incident reaching $4.91 million, prompting businesses to seek robust financial protection.

● Identity Security as Insurance Requirement: Insurers are mandating stronger identity security protocols before providing coverage. A Delinea study found that 40% of insurers now require least privilege access controls, with 95% of American companies enhancing identity security protocols to secure or maintain cyber insurance coverage.

● AI-Driven Threat Landscape: Cybercriminals are leveraging generative AI for highly personalized phishing attacks, malicious code generation, and deepfake technology to bypass security measures. The Open Worldwide Application Security Project (OWASP) ranked prompt injection as the number one AI security risk in 2025, driving specialized coverage needs.

● Regulatory Compliance Driving Adoption: Stringent data protection regulations like GDPR in Europe and CCPA in California are compelling businesses to adopt cyber insurance. The California Consumer Privacy Act and New York Department of Financial Services requirements are encouraging comprehensive risk management strategies, with regulatory fines pushing policy adoption across industries.

● Premium Rate Stabilization: After nearly tripling in 2021-2022, cyber insurance premium rates decreased by an average of 17% in 2023, creating a buyer-friendly market. Rates further reduced by 5% in 2024, with flat to slightly downward movement expected if current claim trends continue, making coverage more accessible to businesses of all sizes.

Growth Factors in the Cyber Insurance Market

● Escalating Cyberattacks Globally: Cybercrimes affected 53.35 million individuals in the U.S. during H1 2022, with 82% of Middle East and Turkey organizations experiencing at least one cybersecurity incident between 2022-2024. In the UK, 32% of companies experienced cyber incidents in 2023, jumping to 69% for larger firms, driving urgent demand for financial protection.

● Digital Transformation Acceleration: The widespread adoption of IoT devices, cloud computing, and remote work has expanded attack surfaces. Australia leads in IoT usage with 96% of companies using IoT in operations, while cyberattacks on U.S. utilities rose by nearly 70% in 2024, highlighting critical infrastructure vulnerabilities and insurance needs.

● Financial Impact of Data Breaches: The cost of data breaches reached an average of $4.88 million in 2024, a 10% increase from the previous year. The CrowdStrike outage in July 2024 cost insurers around $1.5 billion in payouts, demonstrating the significant financial exposure businesses face without adequate cyber coverage.

● Innovative Coverage Solutions: Insurers are expanding policy offerings to include AI-related security events, SEC cybersecurity disclosure requirements, and ransomware negotiation services. WTW's CyCore Asia facility provides up to $15 million coverage specifically designed for Hong Kong and Singapore companies, addressing region-specific cyber threats.

● Strategic Partnerships Enhancing Value: Collaborations between insurers and cybersecurity firms are creating comprehensive protection packages. Chubb partnered with NetSPI in December 2023 for U.S. and Canada policyholders, while F-Secure and Allianz Partners launched integrated cyber security suites, combining protection and insurance in 2023.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=3826&flag=E

Leading Companies Operating in the Global Cyber Insurance Industry:

● Allianz Group

● American International Group Inc.

● AON Plc

● AXA XL

● Berkshire Hathaway Inc.

● Chubb Limited (ACE Limited)

● Lockton Companies Inc.

● Munich ReGroup or Munich Reinsurance Company

● Lloyd's of London

● vZurich Insurance Company Limited

Cyber Insurance Market Report Segmentation:

Breakup By Component:

● Solution

● Services

Solution accounts for the majority of shares due to escalating need for comprehensive cybersecurity measures and proactive risk management strategies.

Breakup By Insurance Type:

● Packaged

● Stand-alone

Stand-alone dominates the market with around 68.3% market share, offering specialized coverage tailored to specific cyber risks and comprehensive protection against diverse cyber threats.

Breakup By Organization Size:

● Small and Medium Enterprises

● Large Enterprises

Large enterprises lead the market with around 73.8% market share, driven by their extensive digital infrastructure, international operations, and higher exposure to sophisticated cyber-attacks.

Breakup By End Use Industry:

● BFSI

● Healthcare

● IT and Telecom

● Retail

● Others

BFSI accounts for around 28.2% market share due to managing vast amounts of sensitive customer data, making it a prime target for cybercriminals and requiring robust cyber protection.

Breakup By Region:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

North America enjoys the leading position with over 36.9% market share, owing to strict regulatory adherence needs, cutting-edge digital infrastructure, elevated cyber threat incidence, and 58% of ransomware attacks recorded in Q2 2024.

Recent News and Developments in Cyber Insurance Market

● January 2025: TATA AIG introduced CyberEdge, an all-inclusive cyber insurance product for Indian companies, providing protection against cyber threats like forensic investigations, data recovery, and ransom payments, seeking to secure 25% of India's cyber insurance sector in five years.

● January 2025: WTW introduced CyCore Asia, a cyber insurance solution for Hong Kong and Singapore companies backed by QBE Insurance Group and AXA XL, providing coverage up to $15 million and tackling AI-heightened cyber threats.

● January 2025: Old Republic International established Old Republic Cyber, a new subsidiary to provide Cyber and Technology Errors & Omissions insurance solutions, marking the seventh specialty firm established over the last nine years.

● December 2024: HITRUST launched a cyber insurance consortium with Lloyd's of London, offering enhanced coverage and lower rates for HITRUST-certified organizations backed by globally recognized AA-rated insurers.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cyber Insurance Market Size Worth USD 73.5 Billion, Globally, by 2034 at a CAGR of 17.88% here

News-ID: 4374510 • Views: …

More Releases from IMARC Group

Flexible Solar Panel Plant DPR 2026: Industry Trends, CapEx/OpEx and Market Grow …

Flexible solar panels are lightweight, bendable photovoltaic modules designed to generate electricity while offering versatility in installation on curved, portable, or weight-sensitive surfaces. Unlike conventional rigid panels, flexible solar panels are manufactured using thin-film technologies such as amorphous silicon (a-Si), copper indium gallium selenide (CIGS), or organic photovoltaic (OPV) materials deposited on flexible substrates like plastic or metal foil.

These panels are widely used in portable power systems, RVs, boats, tents,…

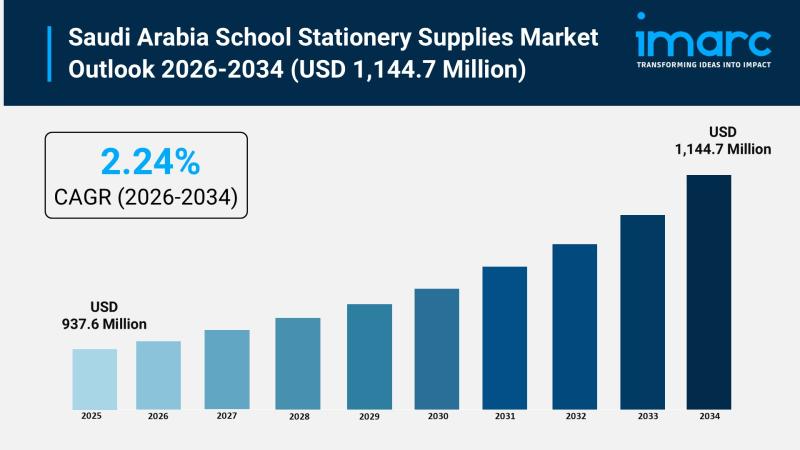

Saudi Arabia School Stationery Supplies Market Set to Surge to USD 1,144.7 Milli …

Saudi Arabia School Stationery Supplies Market Overview

Market Size in 2025: USD 937.6 Million

Market Size in 2034: USD 1,144.7 Million

Market Growth Rate 2026-2034: 2.24%

According to IMARC Group's latest research publication, "Saudi Arabia School Stationery Supplies Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia school stationery supplies market size reached USD 937.6 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,144.7 Million…

Private Equity Market Size to Surpass USD 1,751.6 Billion by 2034 | At CAGR 8.29 …

Private Equity Market Overview:

The global Private Equity Market was valued at USD 855.4 Billion in 2025 and is forecast to reach USD 1,751.6 Billion by 2034, growing at a CAGR of 8.29% during 2026-2034. This growth is driven by rising demand for alternative investments offering higher returns, increased institutional investor activity, technological advancements in investment analysis, and expanding focus on high-growth sectors including technology, healthcare, and renewable energy.

The private equity…

Generic Injectables Manufacturing Plant DPR - 2026: CapEx/OpEx Analysis with Pro …

The global generic injectables manufacturing industry is witnessing robust growth driven by the rapidly expanding healthcare sector and increasing demand for affordable, high-quality injectable pharmaceutical products. At the heart of this expansion lies a critical product category-generic injectables. As healthcare systems worldwide transition toward cost-effective treatment solutions and governments prioritize universal healthcare access, establishing a generic injectables manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and pharmaceutical investors…

More Releases for Cyber

Cyber Insurance Market to Expand Rapidly, Fueled by Cyber Threats

According to the latest market research study published by P&S Intelligence, the global cyber insurance market is expected to witness significant growth, with a projected rise from USD 16.1 billion in 2024 to USD 65.2 billion by 2032, expanding at a robust CAGR of 19.3%.

This growth is driven by the increasing frequency of cyberattacks, such as data breaches and ransomware incidents, coupled with rising regulatory pressures on businesses to adopt…

Express your Cyber Attitude with Zeelool Cyber Punk Glasses

Zeelool follows the trend of fashion and launches a series of new and unique cyberpunk glasses, its unique futuristic design concept and sense of technology, perfectly interpreting the aesthetic connotation of cyberpunk culture, the frame uses neon transparent material and black lines intertwined, as if with the digital world constructed in cyberpunk novels, awakening the infinite reverie of people for the virtual reality and holographic technology.

Highlights of Cyberpunk Glasses:

…

Cyber Security Market Research Reports, Cyber Security Market Revenue, Issues an …

The Cyber security, also denoted to as IT security, emphasizes on maintenance computers, programs, networks, and data from unrestrained or spontaneous admittance. It contains network security, application security, endpoint security, identity administration, data security, cloud security, and infrastructure security. As the cyber threats have augmented at an alarming rate, security solutions have been achievement traction, worldwide. Solutions such as antivirus software and firewalls have grown-up in involvedness and recognized to…

Cyber Security Market Research Reports | Cyber Security Market Revenue | Future …

The Cyber security, also mentioned to as IT security, emphasizes on maintenance computers, programs, networks, and data from unrestrained or spontaneous admittance. It contains network security, application security, endpoint security, distinctiveness management, data security, cloud security, and infrastructure safekeeping. As cyber threats have augmented at an alarming rate, security solutions have been purchase traction, globally. Solutions such as antivirus software and firewalls have grown up in complexity and demonstrated to…

Market Research Reports Of Cyber Security | Cyber Security Market Growth Analysi …

Cyber security market is very fragmented & highly competitive market that comprises several global & regional players. Cyber Security is a key concern that helps the organizations to monitor, detect, report, and contradict cyber threats for maintaining data confidentiality. As the innovation is developing and new applications are coming into market, programmers are finding the new escape clauses and taking the significant & secret information's from the servers and selling…

Cyber Institute receives Best Cyber Security Education Initiative - USA

The Cyber Institute received the 2019 US Business News Best Cyber Security Education Initiative - USA for their programs to help reduce barriers into cybersecurity and STEM related careers by advancing traditional and non-traditional pathways; for women and minorities in particular. By increasing access to education, employment, and workforce development, we believe they will have greater opportunities for self-determination and self-reliance.

The Cyber Institute received the prestigious international US Business News…