Press release

Turkey Trade Finance Market Report 2025, Share, Growth, Trends and Forecast Till 2033

The Turkey trade finance market size reached USD 703.56 Million in 2024 and is projected to reach USD 1,238.74 Million by 2033, growing at a CAGR of 5.82% during the forecast period 2025-2033. This growth is driven by expanding global trade, government export initiatives, and increasing demand for working capital and digital banking services. Banks and fintechs offer innovative products such as letters of credit and factoring, enhancing accessibility while managing risks amid market fluctuations and regulatory changes.Sample Request Link: https://www.imarcgroup.com/turkey-trade-finance-market/requestsample

Study Assumption Years

Base Year: 2024

Historical Year/Period: 2019-2024

Forecast Year/Period: 2025-2033

Turkey Trade Finance Market Key Takeaways

Current Market Size in 2024: USD 703.56 Million

CAGR: 5.82%

Forecast Period: 2025-2033

Turkey's exports grew by 1.97% in 2023 reaching around USD 356.9 billion, driving trade finance demand.

Over 696 active fintech companies are innovating across digital payments, blockchain, and trade finance.

Demand for secure, flexible trade finance instruments such as letters of credit and bank guarantees is rising due to economic volatility.

Government export promotion schemes and Turkish Eximbank benefits reduce financing costs and risks.

Cross-border trade complexities increase structured finance demand for SMEs and large enterprises alike.

Market Growth Factors

Turkey's strategic geographic location bridging Europe, Asia, and the Middle East enhances its role in global trade, with a 1.97% export growth to USD 356.9 billion in 2023. Major export sectors including automotive, textiles, machinery, and agriculture rely on trade finance tools like letters of credit and bank guarantees to secure cross-border transactions. Government initiatives such as export promotion schemes and Turkish Eximbank support facilitate lower financing costs and risk mitigation, fueling trade finance market expansion.

Digital transformation is pivotal, with over 696 fintech firms operating in digital payments, blockchain, and trade finance across Turkey. Traditional banks have integrated digital platforms accelerating credit processing, supply chain finance, and invoice discounting, while fintech startups offer automated credit assessments and blockchain-enabled settlements, reducing transaction times and improving risk management. Regulatory support for digital banking and e-invoicing further accelerates market adoption, benefiting SMEs and broadening market accessibility.

Economic uncertainties including inflation, currency volatility, and geopolitical risks are propelling demand for risk mitigation instruments like letters of credit, export credit insurance, and bank guarantees. Stable financing and hedging solutions address liquidity and operational stability challenges. Global disruptions and regional trade tensions drive companies toward structured trade finance solutions, with banks tailoring products to manage credit, political, and operational risks, ensuring trade finance remains central to Turkey's business environment.

Visit For More Update:https://www.imarcgroup.com/turkey-trade-finance-market

Market Segmentation

Finance Type Insights:

Structured Trade Finance: Provides secure, complex financing solutions tailored to manage risks amid evolving global supply chains.

Supply Chain Finance: Supports working capital needs by optimizing cash flow within supply chains.

Traditional Trade Finance: Includes conventional instruments such as letters of credit, widely used for international trade transaction security.

Offering Insights:

Letters of Credit: Key financial instruments ensuring payment security and risk coverage for cross-border transactions.

Bill of Lading: Documents facilitating the transfer of goods and payments.

Export Factoring: Financing solution enabling exporters to sell receivables for immediate cash flow.

Insurance: Provides risk mitigation against defaults and geopolitical uncertainties in trade.

Others: Additional trade finance offerings enhancing transaction flexibility and risk management.

Service Provider Insights:

Banks: Major providers offering a wide range of trade finance instruments and services.

Trade Finance Houses: Specialized firms facilitating trade transactions through structured finance products.

End User Insights:

Small and Medium Sized Enterprises (SMEs): Benefiting from digital platforms and fintech innovations improving access to trade finance.

Large Enterprises: Utilizing comprehensive trade finance solutions to support extensive international trade operations.

Regional Insights

The report identifies the regional markets as Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia. While the overall national market demonstrates strong growth with a 5.82% CAGR, the Marmara region, due to its economic centrality, is the dominant hub for trade finance activities, benefiting from substantial export levels and infrastructure conducive to trade financing.

Recent Developments & News

In August 2025, Turkey is set to expand its economic presence in Syria, with Turkish banks preparing to launch operations soon, according to Trade Minister Ömer Bolat. This move supports Turkish contractors involved in Syria's reconstruction and aims to strengthen trade, banking, insurance, and public finance cooperation between Turkey and Syria through coordination between their respective business councils, supported by TOBB and DEIK.

Key Players

Banks

Trade Finance Houses

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Turkey Trade Finance Market Report 2025, Share, Growth, Trends and Forecast Till 2033 here

News-ID: 4374528 • Views: …

More Releases from IMARC Group

Flexible Solar Panel Plant DPR 2026: Industry Trends, CapEx/OpEx and Market Grow …

Flexible solar panels are lightweight, bendable photovoltaic modules designed to generate electricity while offering versatility in installation on curved, portable, or weight-sensitive surfaces. Unlike conventional rigid panels, flexible solar panels are manufactured using thin-film technologies such as amorphous silicon (a-Si), copper indium gallium selenide (CIGS), or organic photovoltaic (OPV) materials deposited on flexible substrates like plastic or metal foil.

These panels are widely used in portable power systems, RVs, boats, tents,…

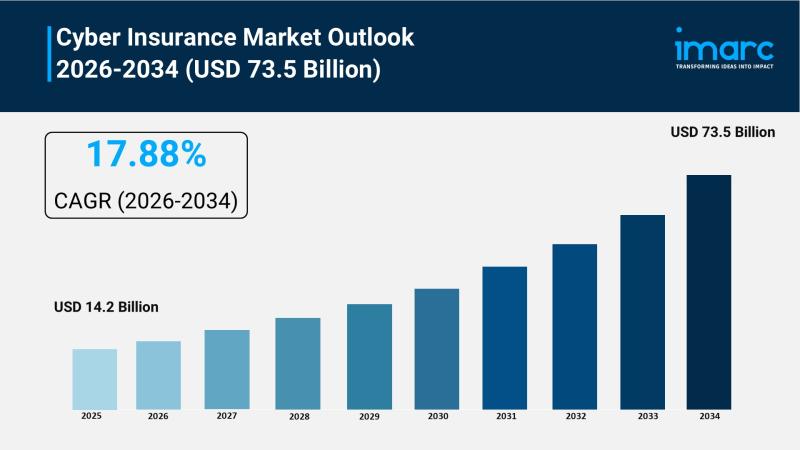

Cyber Insurance Market Size Worth USD 73.5 Billion, Globally, by 2034 at a CAGR …

Market Overview:

According to IMARC Group's latest research publication, "Cyber Insurance Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The global cyber insurance market size was valued at USD 14.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 73.5 Billion by 2034, exhibiting a CAGR of 17.88% from 2026-2034.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and…

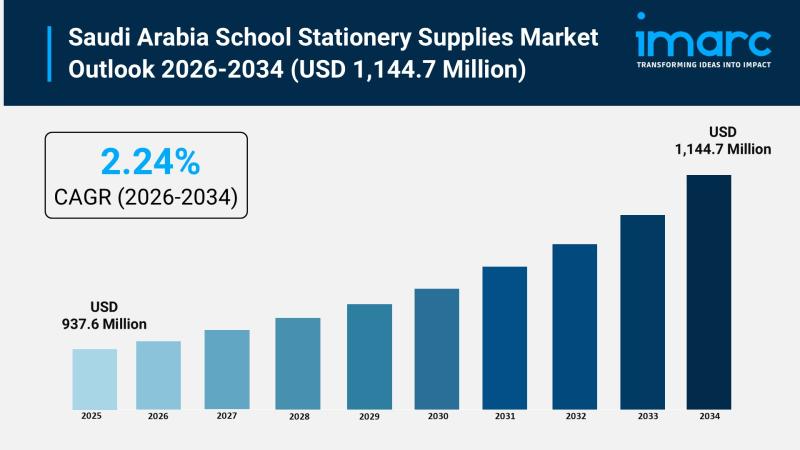

Saudi Arabia School Stationery Supplies Market Set to Surge to USD 1,144.7 Milli …

Saudi Arabia School Stationery Supplies Market Overview

Market Size in 2025: USD 937.6 Million

Market Size in 2034: USD 1,144.7 Million

Market Growth Rate 2026-2034: 2.24%

According to IMARC Group's latest research publication, "Saudi Arabia School Stationery Supplies Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia school stationery supplies market size reached USD 937.6 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,144.7 Million…

Private Equity Market Size to Surpass USD 1,751.6 Billion by 2034 | At CAGR 8.29 …

Private Equity Market Overview:

The global Private Equity Market was valued at USD 855.4 Billion in 2025 and is forecast to reach USD 1,751.6 Billion by 2034, growing at a CAGR of 8.29% during 2026-2034. This growth is driven by rising demand for alternative investments offering higher returns, increased institutional investor activity, technological advancements in investment analysis, and expanding focus on high-growth sectors including technology, healthcare, and renewable energy.

The private equity…

More Releases for Turkey

Hair Transplant in Turkey - Why Turkey is the Top Destination

Hair Transplant in Turkey have surged in popularity as a highly effective solution for combating hair loss. With numerous advancements in technology and a growing number of international options, individuals are increasingly seeking detailed information about the procedure, its costs, expected results, and the best locations for treatment. This comprehensive guide delves deep into everything you need to know about hair transplants, including cost considerations, what to expect before and…

Government Fitness Services Initiatives Turkey | Turkey Active Knowledge Partner …

August 2021 | Turkey News

The shift of the millennial generation to healthier lifestyle has brought the importance of physical exercise to the fore driving the demand for fitness centers over the last decade.

Customer Mindset or Fitness: Majority of the population in Turkey, irrespective of age groups participate actively in regular physical activities such as walking, cycling & gymming in public parks, fitness centers or at home. Around 80.0% of the…

Turkey Power Sector Analysis

The power sector in Turkey is a highly evolved and efficient sector, being supported by an extremely favorable and facilitative government policy and regulatory regime. The power sector is divided into three sub-sectors in Turkey, namely the generation, transmission and distribution sectors.

The power generation sector in Turkey is fully competent to meet the domestic demand. Furthermore, the country is also capable of supplying electricity to neighboring nations in Europe and…

Agrochemicals Market in Turkey

ReportsWorldwide has announced the addition of a new report title Turkey: Agrochemicals: Market Intelligence (2016-2021) to its growing collection of premium market research reports.

The report “Turkey: Agrochemicals: Market Intelligence (2016-2021)” provides market intelligence on the different market segments, based on type, active ingredient, formulation, crop, and pest. Market size and forecast (2016-2021) has been provided in terms of both, value (000 USD) and volume (000 KG) in the report. A…

Cigarettes in Turkey, 2016

ReportsWorldwide has announced the addition of a new report title Cigarettes in Turkey, 2016 to its growing collection of premium market research reports.

"Cigarettes in Turkey, 2016" is an analytical report by GlobalData that provides extensive and highly detailed current and future market trends in the Turkish market. The report offers Market size and structure of the overall and per capita consumption based upon a unique combination of industry research, fieldwork,…

SOCAR TURKEY and STAR Refinery once again supporting the CEE & Turkey Refining a …

22nd August 2016 – The World Refining Association and SOCAR Turkey today announced that top management team from SOCAR Turkey and STAR Refinery will be present at the 19th Annual CEE and Turkey Refining and Petrochemicals Conference, taking place in Izmir, Turkey from the 19th – 21st of September 2016.

The event will host 40 decision makers from major operators in the region such as Tüpras, Petkim, Rompetrol, OMV Petrom,…