Press release

Baby Formula Manufacturing Plant (DPR) 2026: CapEx/OpEx Analysis with Profitability Forecasts

The global baby formula manufacturing industry is witnessing robust growth driven by the rapidly expanding infant nutrition sector and increasing demand for high-quality infant feeding solutions. At the heart of this expansion lies a critical nutritional product: baby formula. As populations transition toward convenient infant feeding options and specialized nutritional formulations, establishing a baby formula manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and food industry investors seeking to capitalize on this growing and essential market.Market Overview and Growth Potential

Baby formula is a manufactured food product designed to feed infants and young children as a breast milk substitute or supplement. It appears as a powdered or liquid preparation formulated with proteins, fats, carbohydrates, vitamins, and minerals to meet the nutritional requirements of growing babies. Baby formula contains carefully balanced nutrients including whey proteins, casein, vegetable oils, lactose, prebiotics, probiotics, and essential micronutrients, making it a complete nutrition solution for infants from birth to 36 months. Due to its precise nutritional formulation, it supports healthy growth and development when breastfeeding is not possible or needs supplementation. Its standardized composition, shelf stability, and convenience make it a preferred option for infant feeding across diverse socioeconomic segments.

The baby formula market is witnessing robust demand due to the rising need for convenient and nutritionally complete infant feeding solutions that support working mothers and modern family lifestyles. Urban populations increasingly transitioning toward formula feeding particularly in Asia-Pacific, Middle East, and Latin America are driving large-scale adoption. According to global health statistics, rising maternal employment rates and changing lifestyle patterns contribute significantly to formula feeding adoption worldwide. Government-led maternal and child nutrition programs, fortification mandates, and food safety standards further strengthen market prospects.

Request for a Sample Report: https://www.imarcgroup.com/baby-formula-manufacturing-plant-project-report/requestsample

Plant Capacity and Production Scale

The proposed baby formula manufacturing facility is designed with an annual production capacity ranging between 15,000 MT, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to cater to diverse market segments from standard infant formulas and follow-on formulas to specialized products for premature infants, hypoallergenic formulas, and organic variants ensuring steady demand and consistent revenue streams across multiple consumer categories.

Financial Viability and Profitability Analysis

The baby formula manufacturing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

Gross Profit Margins: 30-45%

Net Profit Margins: 15-25%

These margins are supported by stable demand across infant nutrition segments, premium product positioning, and the essential nature of baby formula in modern parenting. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established food manufacturers looking to diversify their product portfolio in the infant nutrition sector.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a baby formula manufacturing plant is primarily driven by:

Raw Materials: 70-80% of total OpEx

Utilities: 5-10% of OpEx

Other Expenses: Including labor, packaging, quality testing, transportation, maintenance, depreciation, and taxes

Raw materials constitute the largest portion of operating costs, with dairy ingredients (whey protein concentrate, skim milk powder), vegetable oils, lactose, and vitamin-mineral premixes being the primary input materials. Establishing long-term contracts with reliable dairy suppliers and ingredient manufacturers helps mitigate price volatility and ensures consistent raw material supply, which is critical given that milk protein price fluctuations represent the most significant cost factor in baby formula manufacturing.

Capital Investment Requirements

Setting up a baby formula manufacturing plant requires substantial capital investment across several critical categories:

Land and Site Development

Selection of an optimal location with strategic proximity to dairy processing regions and quality ingredient suppliers. Proximity to target urban markets will help minimize distribution costs. The site must have robust infrastructure, including reliable transportation, high-quality water supply, and waste management systems. Compliance with local zoning laws, food safety regulations, and environmental standards must also be ensured.

Machinery and Equipment

The largest portion of capital expenditure (CapEx) covers specialized manufacturing equipment essential for production. Key machinery includes:

• Ingredient receiving and weighing systems with precision controls

• Mixing and blending vessels for wet and dry ingredient integration

• Pasteurization systems for heat treatment and microbial safety

• Homogenization equipment for uniform fat distribution

• Spray drying towers for powder production with controlled temperature

• Fluidized bed dryers for final moisture control

• Sifting and milling equipment for uniform particle size

• Nitrogen flushing and packaging lines for oxygen-sensitive product protection

• Quality control laboratory with microbiological and nutritional testing equipment

• Clean room facilities with controlled air filtration systems

• Automated can filling and sealing machines

• Metal detection and X-ray inspection systems

• Effluent treatment systems for managing dairy waste and ensuring environmental compliance

Civil Works

Building construction, factory layout optimization, and infrastructure development designed to enhance workflow efficiency, ensure workplace safety, meet stringent hygiene standards, and minimize contamination risks throughout the production process. The layout should be optimized with separate areas for raw material storage, ingredient preparation room, wet processing zone, spray drying unit, dry blending area, packaging hall, quality control laboratory, finished goods warehouse, utility block, effluent treatment facility, and administrative block. Food-grade finishes and cleanroom standards are essential.

Other Capital Costs

Pre-operative expenses, machinery installation costs, regulatory compliance certifications (FDA, FSSAI, CODEX), initial working capital requirements, clinical trials for specialized formulas, and contingency provisions for unforeseen circumstances during plant establishment.

Major Applications and Market Segments

Baby formula products find extensive applications across diverse market segments, demonstrating their versatility and critical importance:

Infant Formula (0-6 months)

Primary use as a complete nutrition source for newborns and young infants, particularly valuable when breastfeeding is not possible, insufficient, or needs supplementation due to medical or lifestyle factors.

Follow-On Formula (6-12 months)

Specialized applications for older infants transitioning to complementary feeding, providing balanced nutrition alongside solid foods during the weaning period.

Toddler Formula (12-36 months)

Nutritional support for young children requiring supplementary nutrition during rapid growth and development phases.

Specialized Formulas

Applications in hypoallergenic formulas for lactose intolerance, soy-based formulas for milk protein allergies, premature infant formulas with enhanced nutrients, anti-reflux formulas, and organic formulas catering to premium health-conscious segments.

Therapeutic Formulas

Medical nutrition products for infants with specific metabolic disorders, digestive issues, or developmental challenges requiring specially formulated nutrition.

End-use categories include retail distribution, hospital and healthcare facilities, online direct-to-consumer channels, and institutional procurement, all of which contribute to sustained market demand.

Buy now: https://www.imarcgroup.com/checkout?id=9750&method=2175

Why Invest in Baby Formula Manufacturing?

Several compelling factors make baby formula manufacturing an attractive investment opportunity:

Essential Infant Nutrition Segment

Baby formula serves as a critical nutritional product supporting infant health and development, making it indispensable for modern families where breastfeeding is not feasible or needs supplementation.

Rising Working Mother Population

Urban populations increasingly adopting formula feeding-particularly in developing economies with rising female workforce participation-are driving large-scale adoption of convenient infant nutrition solutions.

Premium Product Positioning

The product's ability to provide complete, scientifically formulated nutrition with added probiotics, DHA, and specialized ingredients offers significant competitive advantages and supports premium pricing strategies.

Demographic Dividend

Rising birth rates in developing countries combined with increasing middle-class populations with higher purchasing power create sustained long-term demand for quality infant nutrition products.

Government Support

Government-led maternal and child nutrition programs, fortification mandates, quality standards enforcement, and subsidy schemes for infant nutrition further strengthen market prospects and support industry growth.

Import Substitution Opportunities

Emerging economies such as India, China, Indonesia, Vietnam, and African nations are expanding local manufacturing as part of their strategy to reduce dependence on imported infant formula, creating opportunities for domestic producers.

Food Security and Health Alignment

The infant health agenda and increasing awareness about early childhood nutrition are expected to enhance long-term growth opportunities for scientifically formulated infant nutrition products.

Manufacturing Process Excellence

The baby formula manufacturing process involves several precision-controlled stages:

• Ingredient Reception: Raw materials including dairy proteins, oils, lactose, and micronutrients are received and quality tested

• Weighing and Batching: Ingredients are precisely weighed according to formulation specifications

• Wet Mixing: Liquid ingredients and powders are blended with water under controlled conditions

• Pasteurization: The mixture is heat-treated to ensure microbiological safety

• Homogenization: Fat globules are broken down for uniform distribution and improved digestibility

• Spray Drying: The liquid mixture is atomized and dried into fine powder using hot air

• Dry Blending: Heat-sensitive ingredients (vitamins, probiotics) are added post-drying

• Sifting and Quality Control: Product is sifted for uniform particle size and tested for specifications

• Nitrogen Flushing and Packaging: Formula is packaged in cans or sachets under nitrogen atmosphere to prevent oxidation

Industry Leadership

The global baby formula industry is led by established multinational corporations with extensive production capabilities and diverse product portfolios. Key industry players include:

• Nestlé S.A.

• Danone S.A.

• Abbott Laboratories

• Reckitt Benckiser Group

• Feihe International

• China Mengniu Dairy Company

• FrieslandCampina

These companies serve diverse consumer segments across standard formulas, premium organic products, specialized medical nutrition, and regional market preferences, demonstrating the broad market applicability of baby formula products.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=9750&flag=C

Recent Industry Developments

September 2024: Abbott launched a new premium infant formula range with enhanced DHA and prebiotics designed to support cognitive development and digestive health. The products incorporate advanced nutritional science with ingredients that mimic the composition of breast milk more closely than previous formulations.

July 2024: Nestlé announced expansion of its organic baby formula production facilities in Europe to meet growing consumer demand for certified organic infant nutrition products, investing over USD 150 million in new spray drying capacity and clean room infrastructure.

Conclusion

The baby formula manufacturing sector presents a strategically positioned investment opportunity at the intersection of infant nutrition, food science, and modern parenting needs. With favorable profit margins ranging from 30-45% gross profit and 15-25% net profit, strong market drivers including rising working mother populations, growing demand for premium and specialized formulas, expanding middle-class consumers in developing countries, and supportive government policies promoting infant nutrition and food safety, establishing a baby formula manufacturing plant offers significant potential for long-term business success and sustainable returns. The combination of essential nutritional role, scientific formulation expertise, critical importance in infant health, and import substitution opportunities in emerging economies creates an attractive value proposition for serious food industry investors committed to quality manufacturing, regulatory compliance, and operational excellence.

About IMARC Group

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its clients's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201-971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Baby Formula Manufacturing Plant (DPR) 2026: CapEx/OpEx Analysis with Profitability Forecasts here

News-ID: 4373520 • Views: …

More Releases from IMARC Group

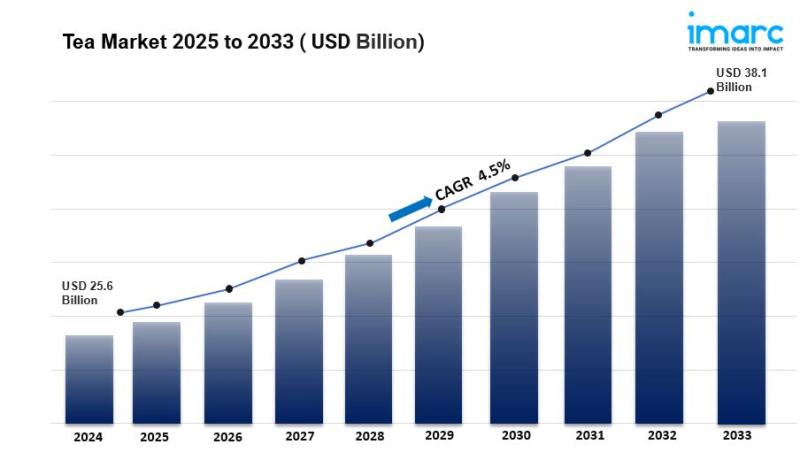

Global Tea Market Size to Surpass USD 39.4 Billion by 2034 | At CAGR 4.40%

Tea Market Overview:

The global tea market size was valued at USD 26.7 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 39.4 Billion by 2034, exhibiting a CAGR of 4.40% from 2026-2034. China currently dominates the market, holding a tea market share of over 14.3% in 2025. Growing consumer awareness about health benefits, rising demand for specialty and premium teas, and expanding café culture are driving…

Fruit Pulp Processing Plant (DPR) 2026: Technical Requirements, Cost Structure a …

The global fruit pulp processing industry is witnessing robust growth driven by the rapidly expanding food and beverage sector and increasing demand for natural, healthy ingredients. At the heart of this expansion lies a critical product: fruit pulp. As consumers transition toward natural ingredients and nutritious food products, establishing a fruit pulp processing plant presents a strategically compelling business opportunity for entrepreneurs and food industry investors seeking to capitalize on…

Explore the Per Diem Nurse Staffing Market: Trends, Drivers, and Forecast 2025-2 …

IMARC Group has recently released a new research study titled "Per Diem Nurse Staffing Market Report by Service (Emergency Department, Home Care Services), End User (Hospitals, Independent Clinics, Nursing Homes), and Region 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The global per diem nurse staffing market reached a size of USD 9.1 Billion…

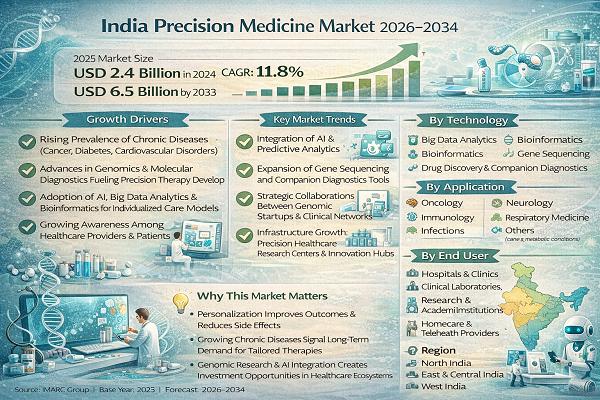

India Precision Medicine Market Expected to Reach USD 6.5 Billion by 2034 at a C …

India Precision Medicine Market Report Introduction

According to IMARC Group's report titled "India Precision Medicine Market Size, Share, Trends and Forecast by Product, Technology, Application, End User, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Request Free Sample Report : https://www.imarcgroup.com/india-precision-medicine-market/requestsample

India Precision Medicine Market Overview

The India precision medicine market size reached USD 2.4 Billion in 2025. Looking forward, IMARC Group…

More Releases for Formula

Novel Ingredients in Infant Formula Market Adoption in Standard, Follow-On and S …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Novel Ingredients in Infant Formula Market"-, By Product Type (Plant-Based Milk, Plant-Based Juices, RTD Tea & Coffee, Others), By Source (Nuts, Grains, Legumes, Fruits & Vegetables, Others), By Distribution Channel (Online, Offline), and Global Forecasts, 2024-2034 And Segment Revenue and Forecast To 2034."

Novel Ingredients in Infant Formula Market Size is predicted to grow at…

Top Trends Transforming the Infant Formula Ingredients Market Landscape in 2025: …

Stay ahead with our updated market reports featuring the latest on tariffs, trade flows, and supply chain transformations.

What Will the Infant Formula Ingredients Industry Market Size Be by 2025?

The market size for ingredients used in infant formulas has seen robust growth in the past few years. The prediction is for it to expand from $23.41 billion in 2024, up to $25.53 billion in 2025, marking a compound annual growth rate…

Advanced Mitochondrial Formula Reviews: The Real Fact About Advanced Mitochondri …

Advanced Mitochondrial Formula Reviews: The Real Fact About Advanced Mitochondrial Formula

It started with small things. Skipping your morning jog because you "didn't sleep well." Grabbing an extra cup of coffee by mid-afternoon just to make it through another Zoom meeting. Forgetting simple names or misplacing your phone more often. Maybe you've brushed it off as stress, getting older, or just the pace of modern life but deep down, you know…

Elemental Formula Market | Key insights provided on elemental formula market are …

Elemental formula sales will continue to be influenced by the ever-evolving demand for high-quality and cost-effective infant formulas. Alongside rising awareness of the interplay between nutrients and physiological well-being, the global demand for elemental formula is estimated to surpass 8,400 tons in 2019, up from 7,881 tons in 2018. Fact.MR’s new research study profiles the evolving landscape of elemental formula market, bringing key insights to the fore.

As per the report, demand of…

Infant Formula Milk PowderMarket – Abbott launched flagship immune system stre …

Abbott is one of the world’s leading healthcare companies. It manufactures products for human health. It is a global healthcare company which conducts innovative researches and creates new solutions that help people to live better lives. Abbott launched flagship immune system strengthening infant formula and plays an important role in babies’ digestive health and immunity. Abbott has been developing science based nutrition products from many years. The company develops products…

Baby Food, Milk Formula And Other Analysis For Infant Formula Market Report: 201 …

"Global Infant Formula Market Report: 2016 Edition" The Report covers current Market Trends, Worldwide Analysis, Global Forecast, Review, Share, Size, Growth, Effect.

Description-

The report “Global Infant Milk Formula Market” provides a comprehensive study of the infant formula market along with a detailed study of its various segments. The major trends, growth drivers as well as issues being faced by the industry are being presented in this report. The four major players…