Press release

Peanut Butter Manufacturing Plant Setup 2026: Complete DPR with Process Flow, Machinery & Profitability

The global food and beverage industry is experiencing a remarkable transformation driven by rising health consciousness, growing demand for plant-based protein products, and the increasing popularity of nutritional snack foods. At the forefront of this evolution stands peanut butter manufacturing-a dynamic segment that converts raw peanuts into nutrient-dense, protein-rich spreads consumed worldwide. As consumers increasingly seek convenient, healthy, and versatile food options that align with vegan, vegetarian, and gluten-free dietary trends, establishing a peanut butter manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and industrial investors seeking to capitalize on the expanding market for plant-based protein alternatives and convenient food products.IMARC Group's report, "Peanut Butter Manufacturing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," offers a comprehensive guide for establishing a manufacturing plant. The peanut butter manufacturing plant report offers insights into the manufacturing process, financials, capital investment, expenses, ROI, and more for informed business decisions.

Request for Sample Report: https://www.imarcgroup.com/peanut-butter-manufacturing-plant-project-report/requestsample

Market Overview and Growth Potential

The global peanut butter market is on a strong growth path, with the market size valued at USD 4.58 Billion in 2025. According to IMARC Group's comprehensive market analysis in the Peanut Butter Manufacturing Plant Project Report, the market is expected to expand to USD 6.51 Billion by 2034, representing a compound annual growth rate (CAGR) of 4.0 % during 2026-2034. This robust growth is fueled by increasing consumer demand for nutritious, protein-rich spreads, rising health consciousness, and the expanding use of peanut butter in food service, bakery, confectionery and retail segments, making peanut butter manufacturing a promising business opportunity.

Demand is propelled by an emerging need for plant protein items as well as nutritional snack food. With increasing exposure to the virtues of plant-based proteins, peanut butter has become increasingly popular as a high-protein, heart-healthy alternative snack. The emergence of vegan, vegetarian, and gluten-free trends has further augmented demand for natural peanut butter products, unadulterated by additives, preservatives, and artificial sweeteners. Consumers are increasingly interested in products that offer healthy fats, fiber, and crucial vitamins while being sugar-free, low in sodium, or organic. This increasing trend is driving companies to reformulate offerings to provide low-sodium, sugar-free, and organic varieties to meet demand for healthier alternatives.

The industry is dominated by a range of product types, including creamy, crunchy, organic, and flavored products. Market leaders target enhancing product formulation by incorporating ingredients like sweeteners, oils, and stabilizers to improve taste and texture. Packaging innovations, including environmentally friendly packages, also have a major contribution in meeting customer demands for sustainability. The peanut butter market caters to various industries such as retail, foodservice, bakery, confectionery, and health food markets. The snacking trend, which is on an upward rise, especially in developing countries, adds to the continuous growth of the market.

Plant Capacity and Production Scale

The proposed peanut butter manufacturing facility is designed with an annual production capacity ranging between 5,000 - 10,000 MT, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to serve diverse customer segments - from retail and food service applications to bakery and confectionery ingredients - ensuring steady demand and consistent revenue streams across multiple market channels.

Financial Viability and Profitability Analysis

The peanut butter manufacturing business demonstrates healthy profitability potential under normal operating conditions. Profitability depends on several factors including market demand, production efficiency, pricing strategy, raw material cost management, and operational scale. Profit margins typically improve with capacity expansion and increased capacity utilization rates.

• Gross Profit Margins: 30-40%

• Net Profit Margins: 12-15%

The project demonstrates strong returns on investment (ROI) potential with comprehensive financial analysis covering income projections, expenditure projections, break-even points, net present value (NPV), and internal rate of return. Break-even periods typically range from 2 to 4 years, depending on initial investment, production efficiency, and market demand. Strong distribution networks and long-term contracts can accelerate profitability, making it an attractive proposition for both new entrants and established industrial players looking to diversify their product portfolio in the nutritional food sector.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. In the first year of operations, the operating cost for the peanut butter manufacturing plant is projected to be significant, covering raw materials, utilities, depreciation, taxes, packing, transportation, and repairs and maintenance. By the fifth year, the total operational cost is expected to increase substantially due to factors such as inflation, market fluctuations, and potential rises in the cost of key materials. Additional factors, including supply chain disruptions, rising consumer demand, and shifts in the global economy, are expected to contribute to this increase.

• Raw Materials: 70-80% of total OpEx

• Utilities: 5-10% of OpEx

• Other Expenses: Including labor, packaging, transportation, maintenance, depreciation, and taxes

Raw materials are a major part of operating costs. The primary raw materials include peanuts (groundnuts), salt, sugar or sweeteners, stabilizers, emulsifiers, and flavorings. Long-term contracts with reliable suppliers help mitigate price volatility and ensure consistent material supply, which is critical for maintaining production schedules and meeting quality standards in the food manufacturing industry. Minimizing transportation costs by selecting nearby suppliers is essential, while sustainability and supply chain risks must be assessed to ensure reliable operations.

Capital Investment Requirements

Setting up a peanut butter manufacturing plant requires substantial capital investment across several critical categories. The total capital investment depends on plant capacity, technology, and location, covering land acquisition, site preparation, and necessary infrastructure.

Land and Site Development: Selection of an optimal location with strategic proximity to raw material sources and target markets is essential to minimize distribution costs. The location must offer easy access to key raw materials such as peanuts (groundnuts), salt, sugar or sweeteners, stabilizers, emulsifiers, and flavorings. The site must have robust infrastructure, including reliable transportation networks, utilities, and waste management systems. Compliance with local zoning laws and environmental regulations must be ensured to support safe and compliant food manufacturing operations. Cost components include land acquisition, construction, and utilities including electricity, water, and steam. Charges for land registration, boundary development, and other related expenses form a substantial part of the overall investment, ensuring a solid foundation for safe and efficient plant operations.

Machinery and Equipment: Machinery costs account for the largest portion of the total capital expenditure. High-quality, corrosion-resistant machinery tailored for peanut butter production must be selected. Essential equipment includes:

• Roasting machine for peanut roasting operations

• Cooling conveyor for temperature management

• De-skinner for shell removal

• Grading machine for quality sorting

• Mill for grinding peanuts into paste

• Mixing tank for ingredient blending and homogenization

• Filling machine for packaging preparation

• Packaging system for final product handling

Supporting equipment includes blanchers, vacuum deaerators, and quality control systems to ensure food safety and consistency. All machinery must comply with industry standards for safety, efficiency, and reliability. The scale of production and automation level will determine the total cost of machinery.

Civil Works: Building construction and factory layout optimization designed to enhance workflow efficiency, ensure workplace safety, and minimize material handling complexities. The layout should be optimized with separate areas for raw material storage, production, quality control, and finished goods storage. Space for future expansion should be incorporated to accommodate business growth. The facility design must ensure hygienic practices, temperature management, and control of allergens, which are essential in guaranteeing quality and safety of products.

Other Capital Costs: Pre-operative expenses, machinery installation costs, regulatory compliance certifications, initial working capital requirements, and contingency provisions for unforeseen circumstances during plant establishment.

Buy Now: https://www.imarcgroup.com/checkout?id=7625&method=2175

Major Applications and Market Segments

Peanut butter manufacturing outputs find extensive applications across diverse industrial sectors, demonstrating their versatility and critical importance:

Food and Beverages: Peanut butter is used as a food spread and ingredient in processed food products across retail, foodservice, and food manufacturing sectors, serving as a foundational ingredient in numerous applications.

Health and Nutritional Applications: High-protein, nutrient-dense peanut butter serves the growing health food market, providing consumers with plant-based protein alternatives that support vegan, vegetarian, and health-conscious dietary preferences.

Bakery and Confectionery: Peanut butter is extensively utilized in bakery products, confectionery items, and dessert applications, offering unique flavor profiles and nutritional enhancement.

Animal Feed: Peanut butter and related products serve the animal feed industry, providing protein-rich nutrition for various applications.

Industrial Applications: Peanut butter serves various industrial applications beyond direct consumption, demonstrating market versatility.

End-use industries include food and beverages, health and nutritional applications, animal feed, and industrial applications, all of which contribute to sustained market demand and diversified revenue opportunities.

Why Invest in Peanut Butter Manufacturing?

Several compelling factors make peanut butter manufacturing an attractive investment opportunity:

Increased Health Awareness and Plant-Based Food Demand: Consumer trends towards health-oriented and plant-based diets represent a major growth driver. Peanut butter has become increasingly popular as a high-protein, heart-healthy snack alternative. The emergence of vegan, vegetarian, and gluten-free trends has further augmented demand for natural peanut butter products. Consumers seek products offering healthy fats, fiber, and crucial vitamins while being sugar-free, low in sodium, or organic.

Product Innovation and Value Presentations: Ongoing innovation in formulation, texture, and flavors drives market expansion. Manufacturers are diversifying product lines with crunchy, creamy, and mixed peanut butter varieties combined with other nuts and seeds for enhanced nutritional content. Flavored peanut butter-chocolate, honey, or cinnamon-is gaining traction in markets seeking indulgent but healthier alternatives to traditional spreads. Premium products like organic, non-GMO, and fair-trade certified peanut butters are also picking up as consumers pay premiums for products matching their health, environmental, and ethical imperatives.

Growing Market Segments: The peanut butter market serves diverse sectors including retail, foodservice, bakery, confectionery, and health food markets. The snacking trend, particularly in developing countries, adds to continuous market growth, ensuring sustained long-term demand.

Sustainability and Innovation: Packaging innovations, including environmentally friendly packages, meet customer demands for sustainability while enhancing product appeal and market competitiveness.

Sustainable Sourcing Considerations: Environmental factors such as sourcing peanuts in a sustainable manner, along with food allergy management, are shaping production and development processes, creating opportunities for responsible manufacturers with sustainable supply chains.

Speak to an Analyst for Customized Report: https://www.imarcgroup.com/request?type=report&id=7625&flag=C

Manufacturing Process Excellence

The peanut butter manufacturing process is a multi-step operation involving several unit operations, material handling, and quality checks. The main stages include:

• Peanut cleaning and sorting to ensure quality inputs

• Roasting to develop flavor and texture characteristics

• Blanching and cooling for shell removal and temperature control

• Grinding into paste using specialized mills

• Mixing with additives including stabilizers, sweeteners, and flavorings

• Deaeration and homogenization for consistency

• Filling, sealing, and packaging for distribution

The complete process flow encompasses mass balance and raw material requirements, rigorous quality assurance criteria, and technical tests throughout production. Safety protocols must be implemented throughout the manufacturing process, with advanced monitoring systems installed to detect deviations. A comprehensive quality control system should be established using analytical instruments to monitor product concentration, purity, and stability. Documentation for traceability and regulatory compliance must be maintained, ensuring food safety and product consistency.

Industry Leadership

The global peanut butter industry is led by established manufacturers with extensive production capabilities and diverse application portfolios. Key industry players include:

• J.M. Smucker Company

• Kellogg Company

• Conagra Brands Inc.

• Hormel Foods Corporation

• Kraft Foods

• Mars Inc.

• Oetker Group

• The Hershey Company

• Unilever Plc

• Associated British Foods plc

These companies operate large-scale facilities and serve end-use sectors including food and beverages, health and nutritional applications, animal feed, and industrial applications, demonstrating the broad market applicability of peanut butter products across global markets.

Recent Industry Developments

June 2024: Hershey, ONE Brands introduces the new Reese's Peanut Butter Lovers flavor protein bar, bringing the beloved taste of Reese's peanut butter to the protein aisle, allowing consumers to enjoy the familiar smooth and delicious flavor in a healthier format, boasting 18 grams of protein and just 3 grams of sugar.

May 2024: SKIPPY, the iconic American peanut butter brand, has been named the official peanut butter partner of USA Gymnastics. As the official partner, SKIPPY peanut butter will support the upcoming generations of athletes by providing nutritious, protein-rich snacks at major events and national team camps. The SKIPPY team also plans to collaborate with creating engaging content across various media platforms.

April 2024: Tiger Brands, the largest food manufacturer in South Africa, opened its $300 million ($16 million) peanut butter factory with the hopes of reducing expenses and providing customers with greater innovation and affordability.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Peanut Butter Manufacturing Plant Setup 2026: Complete DPR with Process Flow, Machinery & Profitability here

News-ID: 4373425 • Views: …

More Releases from IMARC Group

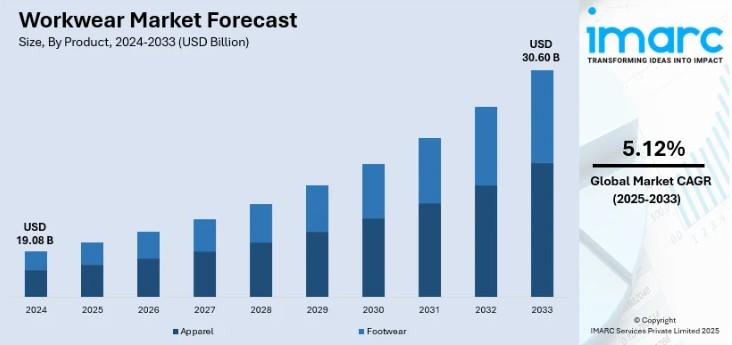

Workwear Market Size Share, Trends, Growth Drivers and Forecast 2034

IMARC Group has recently released a new research study titled "Workwear Market Size, Share, Trends and Forecast by Product, Application, Distribution Channel, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Workwear Market Size Overview

The global workwear market size was valued at USD 19.08 Billion in 2025. Looking forward, IMARC Group estimates…

Turkey Athletic Footwear Market Outlook: Trends, Growth, and Future Opportunitie …

The Turkey Athletic Footwear Market was valued at USD 1.64 Billion in 2024 and is projected to grow to USD 2.81 Billion by 2033. The market is expected to expand at a CAGR of 5.53% during the forecast period 2025-2033. Growing health consciousness, increased participation in sports, and evolving lifestyle trends, including the adoption of sneakers and sports shoes as daily wear, are fueling market growth.

Study Assumption Years

Base Year:…

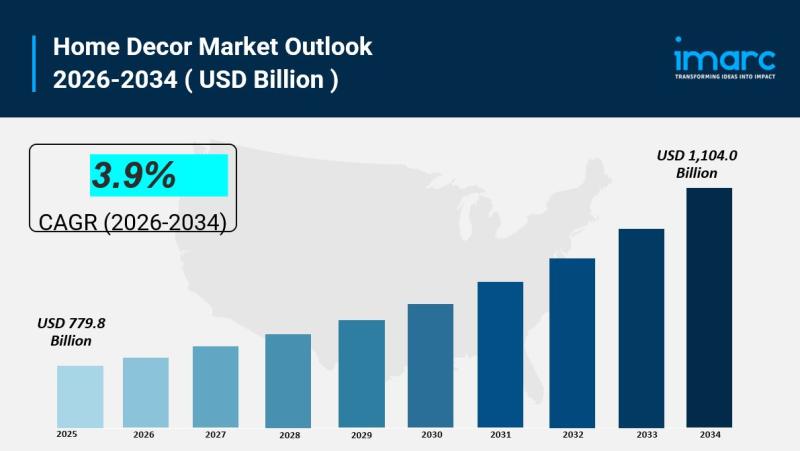

Home Decor Market Size, Trends, Key Players, Growth and Forecast 2026-2033

IMARC Group has recently released a new research study titled "Home Decor Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The global home decor market size reached USD 779.8 Billion in 2025 and is expected to grow to USD 1,104.0…

Tomato Paste Manufacturing Plant Cost DPR 2026: Strategic Planning, and Profit A …

Tomato paste is a concentrated tomato product produced by removing water from fresh tomatoes through pulping and evaporation. It is widely used as a base ingredient in sauces, ketchups, soups, ready-to-eat meals, snacks, and foodservice preparations. Due to its rich flavor, long shelf life, and versatility, tomato paste is a critical raw material in the global food processing industry.

With increasing consumption of processed and convenience foods, expansion of quick-service restaurants,…

More Releases for Peanut

Peanut Butter Market 2020-2027 Advance Study Focusing On Major Product Types- S …

Peanut Butter Market Overview 2020-2027:

Peanut butter market is anticipated to dominate the market with a market value of USD 4.20 billion in 2019 and is expected to grow with a growth rate of 6.10% in the forecast period of 2020 to 2027. The latest Market report by a Data Bridge Market Research with the title [Global Peanut Butter Market – Industry Trends and Forecast to 2027].

Get a PDF Sample copy (including COVID-19 impact analysis and up-to 30% discount ) @

https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-peanut-butter-market

In…

Peanut Butter Manufacturing Unit

Peanut butter is a high calorie, high protein product manufactured by grinding peanuts. It is a good alternative for dairy butter and widely used as a bread spread. Peanut butter is popular amongst Americans, and it is a part of their daily breakfast.

The demand for peanut butter is susceptible to consumer spending. As disposable income increases, the willingness of the people to purchase the peanut butter also increases. On…

Peanut Sauce Market 2019 | Worldwide Forecast 2025 | Major Players – Jif, PBfi …

Peanut Sauce Market research report delivers a close watch on leading competitors with strategic analysis, micro and macro market trend and scenarios, pricing analysis and a holistic overview of the market situations in the forecast period.

Get Exclusive FREE Sample Copy Of this Report @ https://www.upmarketresearch.com/home/requested_sample/85716

UpMarketResearch offers a latest published report on “Global Peanut Sauce Market Analysis and Forecast 2019 - 2025” delivering key insights and providing a competitive advantage…

Drinkable Peanut Powder Market | Top Key Players are Golden Peanut and Tree Nuts …

Peanuts are a high-protein, nutritious food that are ready-to-eat with little preparation or can be eaten raw. Peanut can be processed by roasting and ground into various food products. Peanut shakes and smoothies segments are gaining significant traction in the global drinkable peanut powder market.

Rising demand for the healthy beverages such as drinkable peanut powder products driving the market. In addition, food manufacturers are developing peanut powder which is based…

Hormel Foods, J.M. Smucker Company, Saratoga Peanut Butter Company, Peanut Butte …

The market for Peanut Paste is growing with the expansion of this Industry Sector Worldwide. Market Research Hub (MRH) has added a new report titled “Global Peanut Paste Market Insights, Forecast to 2025” which offer details about the current trends and analysis, as well as scope for the near future. This research study also covers information about the production, consumption and market share based on different active regions. Furthermore, an…

Peanut Butter Market Report 2018: Segmentation by Product (Regular Peanut Butter …

Global Peanut Butter market research report provides company profile for Hormel Foods Corporation, Boulder Brands, Kraft Canada, Algood Food Company, Procter & Gamble, Unilever, The J.M. Smucker Company and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018…