Press release

Aluminum Foil Manufacturing Plant Cost Report 2026: CapEx/OpEx Analysis with Profitability Forecast

The global aluminum foil manufacturing industry is experiencing transformative growth driven by rising demand from food packaging and pharmaceutical sectors, growth in ready-to-eat and convenience foods, increasing use in insulation and construction applications, and expanding adoption in household and industrial packaging solutions. At the heart of this expansion lies a versatile, critical material-aluminum foil. As industries demand more reliable, protective, and high-performance packaging solutions, establishing an aluminum foil manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and industrial investors seeking to capitalize on this growing market.IMARC Group's report, "Aluminum Foil Manufacturing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," offers a comprehensive guide for establishing a manufacturing plant. The aluminum foil manufacturing plant report offers insights into the manufacturing process, financials, capital investment, expenses, ROI, and more for informed business decisions.

Request for Sample Report: https://www.imarcgroup.com/aluminum-foil-manufacturing-plant-project-report/requestsample

Market Overview and Growth Potential

The global aluminum foil market demonstrates remarkable growth trajectory, valued at USD 30.03 Billion in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach USD 47.40 Billion by 2034, exhibiting a robust CAGR of 5.2% from 2026-2034. This sustained expansion is driven by rising demand from food packaging and pharmaceutical sectors, growth in ready-to-eat and convenience foods, increasing use in insulation and construction applications, and expanding adoption in household and industrial packaging solutions.

Aluminum foil is a versatile, thin sheet of aluminum produced through rolling processes and widely used in packaging, insulation, and industrial applications. It provides an effective barrier against moisture, light, oxygen, and contaminants, ensuring food preservation, pharmaceutical protection, and extended product shelf life. Available in multiple thicknesses and formats, including household foil, container foil, blister foil, and industrial-grade foil, it caters to diverse end-use requirements. Aluminum foil is lightweight, flexible, and thermally resistant, allowing for easy handling, cooking, and heat transfer applications.

The aluminum foil industry is witnessing robust growth driven by increasing demand from the food and beverage sector for flexible, durable, and hygienic packaging solutions. Rising global pharmaceutical consumption, which requires blister packs and strip packaging, is driving market growth. The rapid expansion in the construction and insulation sector is also augmenting demand for thermal and reflective barrier applications. An industry report reveals that 90% of consumers prefer brands with sustainable packaging. In the last six months, 54% have consciously purchased such products, including 59% of Millennials and 56% of Gen Z. Additionally, 43% are willing to pay extra for eco-friendly packaging, and 39% have switched to brands that offer sustainable alternatives. The ongoing technological advancements in rolling, surface treatment, and coating processes are enhancing product performance and versatility.

Plant Capacity and Production Scale

The proposed aluminum foil manufacturing facility is designed with an annual production capacity ranging between 20,000-50,000 MT per year, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to cater to diverse market segments-from food and beverage packaging to pharmaceutical applications, construction insulation, and household consumer products-ensuring steady demand and consistent revenue streams across multiple industry verticals.

Financial Viability and Profitability Analysis

The aluminum foil manufacturing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

• Gross Profit Margins: 20-30%

• Net Profit Margins: 8-12%

These margins are supported by stable demand across food packaging, pharmaceutical, and construction sectors, value-added manufacturing capabilities, and the critical nature of aluminum foil products in protective packaging and insulation applications. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established industrial players looking to diversify their product portfolio in the packaging materials sector.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for an aluminum foil manufacturing plant is primarily driven by:

• Raw Materials: 70-80% of total OpEx

• Utilities: 10-15% of OpEx

• Other Expenses: Including labor, packaging, transportation, maintenance, depreciation, and taxes

Raw materials constitute the largest portion of operating costs, with aluminum slabs being the primary input material. Establishing long-term contracts with reliable aluminum suppliers helps mitigate price volatility and ensures consistent material supply, which is critical given that aluminum price fluctuations represent the most significant cost factor in foil manufacturing.

Capital Investment Requirements

Setting up an aluminum foil manufacturing plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to aluminum slabs suppliers. Proximity to target markets will help minimize distribution costs. The site must have robust infrastructure, including reliable transportation, utilities, and waste management systems. Compliance with local zoning laws and environmental regulations must also be ensured.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers specialized manufacturing equipment essential for production. Key machinery includes:

• Hot and cold rolling mills for reducing aluminum thickness to desired specifications

• Annealing furnaces for heat treatment to restore ductility and prepare material for further processing

• Foil separators for handling ultra-thin foil materials safely during production

• Slitters for cutting large foil rolls into specified widths for different applications

• Rewinders for winding finished foil into customer-specified roll sizes

• Surface finishing units for coating, laminating, or treating foil surfaces to enhance properties

• Automated packaging machines for wrapping and preparing finished products for shipment

• Advanced monitoring systems for quality control throughout the production process

• Effluent treatment systems for environmental compliance and waste management

Civil Works: Building construction, factory layout optimization, and infrastructure development designed to enhance workflow efficiency, ensure workplace safety, and minimize material handling complexities throughout the production process. The layout should be optimized with separate areas for raw material storage, production, quality control, and finished goods storage.

Other Capital Costs: Pre-operative expenses, machinery installation costs, regulatory compliance certifications, initial working capital requirements, and contingency provisions for unforeseen circumstances during plant establishment.

Buy Now: https://www.imarcgroup.com/checkout?id=7401&method=2175

Major Applications and Market Segments

Aluminum foil products find extensive applications across diverse industrial sectors, demonstrating their versatility and critical importance:

Food and Beverage Packaging Industry: Wrapping, containers, and flexible packaging solutions that preserve freshness, protect against contamination, and extend product shelf life for a wide range of food products.

Pharmaceutical Industry: Blister packs and strip packaging that provide tamper-evident protection, moisture barriers, and precise dosage control for medications and healthcare products.

Construction and Insulation Sector: Thermal insulation and reflective barriers used in building construction, HVAC systems, and energy-efficient applications to reduce heat transfer and improve energy conservation.

Household and Retail Segment: Consumer foil rolls and kitchen applications for cooking, food storage, grilling, and general household use, providing convenient and versatile packaging solutions.

End-use industries include food and beverage packaging, pharmaceutical sector, construction and insulation, and household consumer goods segment, all of which contribute to sustained market demand.

Why Invest in Aluminum Foil Manufacturing?

Several compelling factors make aluminum foil manufacturing an attractive investment opportunity:

Rising Packaging Demand: Growth in packaged food, pharmaceuticals, and consumer goods is increasing foil consumption globally. The shift toward convenient, ready-to-eat meals and single-serve products drives continuous demand for protective packaging materials.

Excellent Barrier Properties: Aluminum foil offers superior protection against moisture, light, and oxygen, making it indispensable for preserving product quality and extending shelf life in food and pharmaceutical applications.

Recyclability and Sustainability: Aluminum can be recycled multiple times without loss of quality. This recyclability, combined with growing consumer preference for sustainable packaging, positions aluminum foil favorably in environmentally conscious markets where substantial numbers of consumers actively seek and pay premium prices for eco-friendly alternatives.

Wide Application Base: Demand spans across food, pharmaceutical, construction, and industrial sectors, providing diversified revenue streams and reducing dependency on any single market segment.

Scalable Production Setup: Capacity can be expanded with additional rolling and finishing lines, allowing manufacturers to grow operations in response to market demand without requiring complete facility redesign.

Technological Advancements: Ongoing improvements in rolling, surface treatment, and coating processes are enhancing product performance and versatility, creating opportunities for premium products and specialized applications.

E-commerce and Retail Growth: Rising e-commerce and retail packaging requirements are creating additional opportunities, as manufacturers increasingly seek convenient, protective, and high-quality foil products to meet changing market needs and logistics demands.

Speak to an Analyst for Customized Report: https://www.imarcgroup.com/request?type=report&id=7401&flag=C

Manufacturing Process Excellence

The aluminum foil manufacturing process involves several precision-controlled stages:

• Aluminum Ingot or Coil Preparation: Selection and preparation of high-purity aluminum raw material for processing

• Hot Rolling: Initial thickness reduction through hot rolling mills at elevated temperatures

• Cold Rolling: Further thickness reduction to achieve ultra-thin foil specifications through multiple cold rolling passes

• Annealing: Heat treatment process to restore material ductility and prepare foil for subsequent operations

• Slitting and Rewinding: Cutting wide foil rolls into specified widths and rewinding into customer-required roll sizes

• Surface Finishing: Application of coatings, treatments, or laminations to enhance specific properties based on end-use requirements

• Quality Inspection: Rigorous testing for thickness uniformity, tensile strength, surface quality, and barrier properties

• Packaging: Wrapping and preparing finished products for safe transportation and storage

Industry Leadership

The global aluminum foil industry is led by established manufacturers with extensive production capabilities and diverse application portfolios. Key industry players include:

• ACM Carcano

• Amcor

• Assan Aluminyum

• Ess Dee Aluminium

• Eurofoil

• Hindalco Industries Limited

• Huawei Aluminium

• Laminazione Sottile

• Shanghai Metal Corporation

• UACJ Foil Corporation

These companies serve diverse end-use sectors including food and beverage packaging, pharmaceutical sector, construction and insulation, and household consumer goods segment, demonstrating the broad market applicability of aluminum foil products.

Recent Industry Developments

November 2025: Yunnan Aluminium acquired a 16.7% stake in Yunnan Aluminum Foil as Chalco invests USD 127.9M to restructure its downstream operations. The deal, involving cash and asset contributions from three subsidiaries, aims to augment foil, sheet, and strip production, enhance efficiency, strengthen the industrial chain, and support China's dual-carbon goals.

March 2025: Hindalco Industries Limited announced plans to invest around ₹45,000 crore in expanding its copper and aluminium upstream businesses, reinforcing its earlier commitment to deploy USD 4-5 billion in these segments. The proposed investments include setting up a new copper smelter, an aluminium smelter, a copper recycling plant, and capacity additions in aluminium foil manufacturing.

Browse Related Reports:

• Silicon Battery Manufacturing Plant Cost: https://industrytoday.co.uk/manufacturing/silicon-battery-manufacturing-plant-project-report-2025-feasibility-study-machinery-and-cost-estimation

• Pharmaceutical Formulation Manufacturing Plant Cost: https://industrytoday.co.uk/pharmaceutical/pharmaceutical-formulation-manufacturing-plant-setup-2025-project-report-and-cost-analysis

• Renewable Lithium Hexafluorophosphate (Lipf6) Manufacturing Plant Cost: https://industrytoday.co.uk/manufacturing/renewable-lithium-hexafluorophosphate-lipf6-manufacturing-plant-setup-report-2025-raw-materials-and-roi-analysis

• Solar Cables Manufacturing Plant Cost: https://industrytoday.co.uk/manufacturing/solar-cables-manufacturing-plant-setup-cost-2025-capexopex-analysis-with-profitability

• Biomass Power Plant Cost: https://industrytoday.co.uk/agriculture/biomass-power-plant-report-2025-project-cost-machinery-requirement-and-setup-details

Conclusion

The aluminum foil manufacturing sector presents a strategically positioned investment opportunity at the intersection of packaging innovation, sustainability trends, and diversified industrial applications. With favorable profit margins ranging from 20-30% gross profit and 8-12% net profit, strong market drivers including rising demand for protective packaging in food and pharmaceuticals, growing consumer preference for recyclable materials, and expanding applications in construction and insulation, establishing an aluminum foil manufacturing plant offers significant potential for long-term business success and sustainable returns. The combination of excellent barrier properties, recyclability advantages, wide application base, and technological advancement opportunities creates an attractive value proposition for serious industrial investors committed to quality manufacturing and operational excellence.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Aluminum Foil Manufacturing Plant Cost Report 2026: CapEx/OpEx Analysis with Profitability Forecast here

News-ID: 4366660 • Views: …

More Releases from IMARC Group

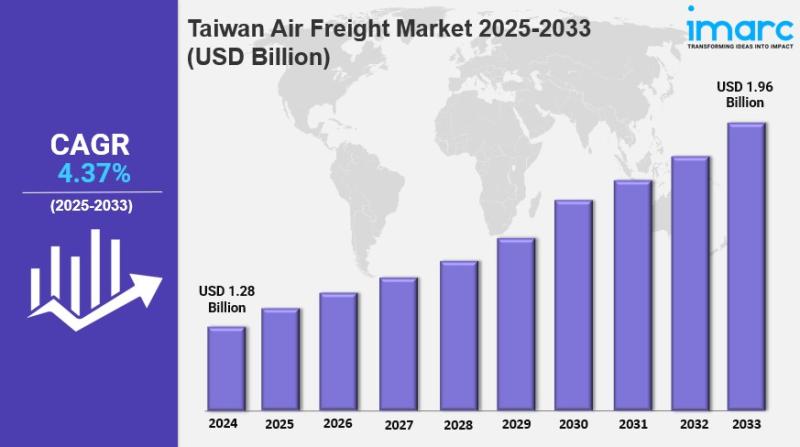

Taiwan Air Freight Market Size, Share, Industry Trends, Growth and Forecast to 2 …

IMARC Group has recently released a new research study titled "Taiwan Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End-User, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Taiwan air freight market size reached USD 1.28 Billion in 2024 and is projected to reach USD 1.96 Billion by…

MDF Board Manufacturing Plant Project Report 2026: Cost Structure, Production Pr …

The global construction and furniture manufacturing industries are experiencing a transformative shift driven by rapid urbanization, expansion of commercial real estate, and increasing demand for engineered wood products. At the core of these developments lies a critical building material-medium-density fiberboard (MDF). As industries demand more versatile, cost-effective, and eco-friendly wood alternatives, establishing an MDF board manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and industrial investors seeking to…

Australia Real Estate Market 2026 | Worth USD 306.07 Billion by 2034 | At a CAGR …

Market Overview

The Australia real estate market was valued at USD 215.34 Billion in 2025 and is expected to grow to USD 306.07 Billion by 2034. The market is projected to expand at a compound annual growth rate of 3.98% over the forecast period from 2026 to 2034. Growth is primarily driven by increasing population, urbanization, favorable government incentives for first-home buyers, infrastructure development, and rising demand for diverse property types…

Soap Manufacturing Plant Setup Report 2026: Machinery Cost, & Investment Insight …

The global soap manufacturing industry is experiencing transformative growth driven by increasing hygiene awareness, rising urbanization, expanding population, growth in healthcare facilities, and growing demand for personal care products. At the heart of this expansion lies a critical consumer product-soap. As industries and households demand more reliable, safe, and high-performance cleansing solutions, establishing a soap manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and industrial investors seeking to…

More Releases for Aluminum

New Aluminum Material-Aluminum Foam Application Summary

Aluminum Foam [https://www.beihaicomposite.com/aluminum-foam-tag/] Characteristics

Ultra-lightness

The density is 0.2~0.4g/cm3, which is about 1/10 of the density of aluminum, 1/20 of the density of titaNium, 1/30 of the density of steel, 1/30 of the density of steel, and 1/3 of the density of wood.

Sound Absorbability

Aluminum foam [https://www.beihaicomposite.com/about-us/] can be used to muffle and reduce noise by absorbing sound energy through the vibration of the pores' walls.

Heat resistance

It has high heat resistance; the general…

5083 medium-thick aluminum plate 5083 marine aluminum plate 5083 automotive alum …

5083 aluminum plate(https://www.mingtai-al.com/5083-Aluminum-Sheet.html) is a typical aluminum-magnesium alloy with light weight and high strength. With its excellent performance, it can be widely used in many industries such as automobile manufacturing, shipbuilding and rail transportation. With the vigorous development of lightweight, the demand for 5083 medium-thick aluminum plate in aluminum tank trucks and marine aluminum plates has increased.

5083 medium-thick aluminum plate-5083 marine aluminum plate-5083 automotive aluminum plate manufacturer introduction

In recent years,…

Yocon Aluminum Announces Availability of 3003 Aluminum Coil

Yocon Aluminum, a leading supplier of aluminum coil products in China, today announced the availability of 3003 aluminum coil. The company's new product is made from high-quality, mill-finished 3003 alloy and features excellent formability, weldability, and corrosion resistance. It is ideally suited for a wide range of applications in the transportation, construction, and industrial markets. With its outstanding properties, 3003 aluminum coil is quickly becoming a preferred choice for customers…

Yocon Aluminum china factory offers 3003 Aluminum Coil

Yocon Aluminum china factory is proud to offer 3003 aluminum coil. This high-quality product is perfect for a variety of applications, and we are confident that you will be satisfied with its performance. We are committed to providing our customers with the best products and services possible, and we look forward to helping you meet your needs. Contact us today to learn more about our 3003 aluminum coil!

In an effort…

Yocon Aluminum Supplies Aluminum Foil Coils for Major Appliances

Yocon Aluminum, a leading manufacturer and supplier of aluminum foil coils, has announced that they are now supplying major appliance manufacturers with their high-quality aluminum foil coils. With over forty years of experience in the industry, Yocon Aluminum is known for their dedication to quality and customer satisfaction. Their products are used in a variety of applications, including air conditioners, refrigerators, and freezers. When it comes to choosing a supplier…

Aluminum Frp Market Size, Status and Global Outlook 2021-Shandong Nanshan Alumin …

The MarketInsightsReports has published the obtainability of a new statistical data to its repository titled as, Aluminum Frp market. The comprehensive report provides useful insights into Market growth, revenue, and market trends, in order to enable readers to gauge market scope more proficiently. Furthermore, the report also sheds light on recent developments and platforms, in addition to distinctive tools, and methodologies that will help to propel the performance of industries.…