Press release

MDF Board Manufacturing Plant Project Report 2026: Cost Structure, Production Process & ROI

The global construction and furniture manufacturing industries are experiencing a transformative shift driven by rapid urbanization, expansion of commercial real estate, and increasing demand for engineered wood products. At the core of these developments lies a critical building material-medium-density fiberboard (MDF). As industries demand more versatile, cost-effective, and eco-friendly wood alternatives, establishing an MDF board manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and industrial investors seeking to capitalize on this steadily expanding market.IMARC Group's report, "MDF Board Manufacturing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," offers a comprehensive guide for establishing a manufacturing plant. The mdf board manufacturing plant setup cost report offers insights into the manufacturing process, financials, capital investment, expenses, ROI, and more for informed business decisions.

Request for a Sample Report: https://www.imarcgroup.com/mdf-board-manufacturing-plant-project-report/requestsample

Market Overview and Growth Potential

The global MDF board market demonstrates solid growth trajectory, valued at USD 28.83 Billion in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach USD 47.12 Billion by 2034, exhibiting a steady CAGR of 5.6% from 2026-2034. This sustained expansion is driven by increasing demand for easy and quick furniture solutions, rise in home improvement projects, expansion of construction activities, and growing consumer preference for standardized engineered wood products.

Medium-density fiberboard is an artificial wood material manufactured by processing wood fibers mixed with resin adhesives, then subjecting the composite to high temperature and pressure. MDF provides smooth finished surfaces, uniform density, and exceptional machinability for furniture, cabinets, wall panels, doors, flooring underlay, and decorative applications. Available in varying thicknesses, densities, and finishes-including laminated, veneered, and melamine-coated variants-MDF offers superior dimensional stability, cost-effectiveness, and ease of cutting, shaping, and painting compared to natural wood. Its uniform manufacturing process ensures consistent quality across batches, minimizing material waste and providing economically viable solutions for both large-scale industrial and residential applications.

According to the Food and Agriculture Organization of the United Nations, global wood-based panel production rose approximately 5% to approximately 393 million cubic meters, with notable gains in regions like the Asia-Pacific. This surge in overall panel output is fueling demand for engineered products such as MDF boards, driving their growth in furniture and construction sectors. Environmental awareness is accelerating the preference for MDF over traditional timber by manufacturers and consumers due to efficient wood utilization and lower ecological impact, creating sustained long-term demand momentum.

Plant Capacity and Production Scale

The proposed MDF board manufacturing facility is designed with an annual production capacity ranging between 100,000-200,000 cubic meters per year, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to serve diverse market segments-from furniture manufacturing and interior décor applications to construction projects and retail DIY markets-ensuring steady demand and consistent revenue streams across multiple industry verticals.

Financial Viability and Profitability Analysis

The MDF board manufacturing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal attractive margins supported by consistent market demand and value-added product capabilities:

• Gross Profit Margins: 25-35%

• Net Profit Margins: 10-15%

These margins are supported by stable demand across construction, furniture manufacturing, and interior design sectors, standardized production processes ensuring consistent quality, and the critical nature of MDF boards in cost-effective building and furniture applications. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established industrial players looking to diversify their product portfolio in the engineered wood products sector.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for an MDF board manufacturing plant is characterized by moderate raw material intensity:

• Raw Materials: 50-60% of total OpEx

• Utilities: 20-25% of OpEx

• Other Expenses: Including labor, packaging, transportation, maintenance, depreciation, and taxes

Wood chips constitute the primary raw material input, along with resin adhesives that bind the wood fibers together during the manufacturing process. The significant utilities component reflects the energy-intensive nature of fiber processing, hot pressing operations, and finishing activities. Establishing long-term contracts with reliable wood chip suppliers and resin manufacturers helps mitigate price volatility and ensures consistent material supply. The balanced cost structure provides operational resilience against input cost fluctuations while maintaining competitive pricing flexibility.

Buy Now: https://www.imarcgroup.com/checkout?id=14003&method=2175

Capital Investment Requirements

Setting up an MDF board manufacturing plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to wood chip suppliers, target construction and furniture markets, and robust infrastructure including reliable transportation networks, utilities, and waste management systems. The site selection process must consider environmental impact assessments, regulatory compliance requirements, and adequate space for future expansion.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers specialized manufacturing equipment essential for efficient production. Key machinery includes:

• Chippers for wood size reduction

• Refiners for fiber preparation

• Blowline systems for fiber handling

• Resin mixers for adhesive blending

• Forming lines for mat formation

• Hot presses for board consolidation

• Sanding machines for surface finishing

• Trimming units for dimensional accuracy

• Packing machines for finished product handling

Civil Works: Building construction, factory layout optimization, and infrastructure development designed to enhance workflow efficiency, ensure workplace safety, and minimize material handling complexities throughout the manufacturing process.

Other Capital Costs: Pre-operative expenses, machinery installation costs, regulatory compliance certifications, initial working capital requirements, and contingency provisions for unforeseen circumstances during plant establishment.

Major Applications and Market Segments

MDF boards find extensive applications across diverse industrial sectors, demonstrating their versatility and critical importance:

Furniture Manufacturing: MDF offers stable surfaces that are easily finished and machined, making it ideal for manufacturing cabinets, tables, chairs, and modular furniture components with consistent quality and cost-effectiveness.

Interior Décor and Paneling: MDF panels provide smooth surfaces suitable for various decorative applications, ceiling installations, and wall partitions, offering design flexibility and ease of customization.

Construction Industry: MDF is utilized in building components as an eco-friendly substitute for plywood and solid wood, particularly in non-structural applications requiring dimensional stability and workability.

Retail and DIY Segment: MDF boards provide consumers and small businesses with affordable, standardized wood panels for home improvement projects, enabling widespread accessibility to quality engineered wood products.

End-use industries encompass furniture manufacturers, interior designers, construction contractors, and retail home improvement outlets, all contributing to sustained market demand across residential, commercial, and industrial applications.

Why Invest in MDF Board Manufacturing?

Several compelling factors make MDF board manufacturing an attractive investment opportunity:

Growing Demand for Engineered Wood Products: Rising urbanization, expanding housing development, and increasing commercial construction projects drive consistent MDF board consumption. The shift toward engineered wood alternatives over natural timber ensures sustained demand momentum.

Consistency and Quality Control: Standardized production processes ensure uniform density, surface smoothness, and dimensional accuracy across all batches. This consistency enables manufacturers to serve quality-conscious furniture and construction industries with reliable product specifications.

Expanding Furniture and Interior Decor Sector: Increased demand for modular furniture, contemporary interior designs, and decorative panels creates substantial opportunities for MDF board producers. Growing consumer preference for affordable yet aesthetically appealing furniture solutions supports market expansion.

Customization Opportunities: Manufacturing facilities can produce specialized boards including laminated, melamine-coated, fire-resistant, and moisture-resistant variants, enabling premium pricing and targeted market positioning for niche applications.

Scalable and Cost-Efficient Production: The investment requirements for MDF production are moderate compared to other wood processing operations, while production scalability and efficient inventory management provide operational advantages for capacity expansion aligned with market growth.

Environmental Sustainability: MDF manufacturing utilizes wood processing residues and fast-growing plantation wood, minimizing deforestation impacts compared to solid wood consumption. This environmental positioning resonates with sustainability-conscious customers and regulatory frameworks.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=14003&flag=C

Manufacturing Process Excellence

The MDF board manufacturing process involves several precision-controlled stages ensuring optimal product quality and performance characteristics:

• Raw Material Preparation: Wood chips and fibers undergo sorting and cleaning to remove contaminants and ensure feedstock quality

• Fiber Refining: Wood material is processed through refiners to separate individual wood fibers with desired characteristics

• Blending with Resin: Refined fibers are thoroughly mixed with resin adhesives and additives to ensure uniform distribution

• Mat Forming: The fiber-resin mixture is formed into continuous mats with controlled density and thickness distribution

• Hot Pressing: Formed mats undergo high-temperature and high-pressure consolidation to cure the resin and achieve final board properties

• Sanding: Pressed boards are sanded to achieve smooth surfaces and precise thickness tolerances

• Trimming: Boards are cut to standard dimensions and edge quality specifications

• Finishing: Optional surface treatments including lamination, veneering, or coating are applied based on product specifications

• Packaging: Finished boards are carefully packaged to protect against moisture and physical damage during storage and transportation

Industry Leadership

The global MDF board industry is led by established manufacturers with extensive production capabilities and diverse application portfolios. Key industry players include:

• Dongwha Malaysia Holdings Sdn. Bhd.

• Kronospan Limited

• Dare Panel Group Co., Ltd.

• EGGER Group

• Norbord Inc.

These companies serve diverse end-use sectors including furniture manufacturers, interior designers, construction projects, and retail DIY markets, demonstrating the broad market applicability of MDF board manufacturing capabilities.

Recent Industry Developments

May 2025: Homanit, a German MDF board manufacturer, revealed plans to establish its U.S. production facility in Alcolu, South Carolina. The company committed USD 250 million to the greenfield project, targeting operations by 2028.

January 2025: The Indian government implemented Quality Control Orders (QCO) for plywood and MDF boards, receiving industry acceptance for enhancing product standards. The regulatory initiative strengthens the Indian MDF board market by boosting consumer confidence, driving demand for compliant products, and supporting growth across organized sectors, creating a more structured and quality-focused industry landscape.

Browse Related Reports:

• Muesli Manufacturing Plant Cost: https://industrytoday.co.uk/manufacturing/muesli-manufacturing-plant-cost-2025-feasibility-and-profitability-roadmap-for-investors

• Veterinary Gloves Manufacturing Plant Cost: https://industrytoday.co.uk/manufacturing/veterinary-gloves-manufacturing-plant-cost-2025-machinery-raw-materials-and-investment-opportunities

• Metal Fabrication Manufacturing Plant Cost: https://industrytoday.co.uk/manufacturing/metal-fabrication-manufacturing-plant-project-report-2025-setup-details-capital-investments-and-business-plan

• Stretch Film Manufacturing Plant Cost: https://industrytoday.co.uk/manufacturing/stretch-film-manufacturing-plant-setup-cost-2025-industry-trends-machinery-and-raw-materials

• Cream Cheese Manufacturing Plant Cost: https://industrytoday.co.uk/manufacturing/cream-cheese-manufacturing-plant-setup-2025-business-plan-raw-materials-and-industry-trends

Conclusion

The MDF board manufacturing sector presents a strategically positioned investment opportunity at the intersection of urbanization, construction expansion, and sustainable materials development. With healthy profit margins ranging from 25-35% gross profit and 10-15% net profit, establishing an MDF board manufacturing plant offers significant potential for long-term business success and sustainable returns. The combination of moderate entry barriers, proven manufacturing technology, diverse application markets spanning residential and commercial sectors, and growing environmental preference for engineered wood products creates an attractive value proposition for serious industrial investors committed to quality manufacturing and operational excellence in the rapidly evolving construction materials economy.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release MDF Board Manufacturing Plant Project Report 2026: Cost Structure, Production Process & ROI here

News-ID: 4366612 • Views: …

More Releases from IMARC Group

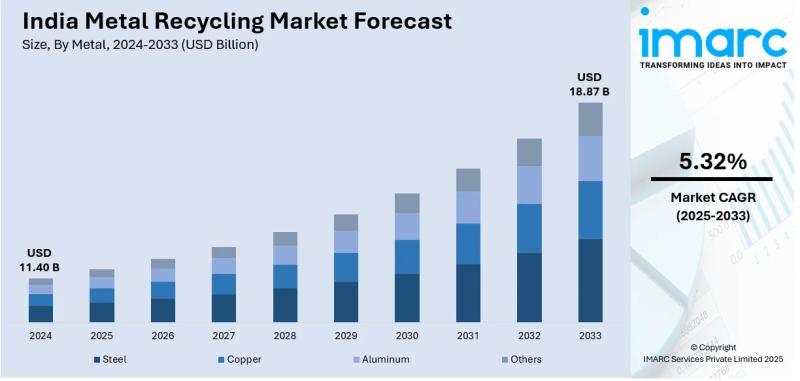

India Metal Recycling Market to Reach USD 18.87 Billion by 2033, Growing at 5.32 …

Source: IMARC Group | Category: Chemical & Materials

Report Introduction

According to IMARC Group's latest report titled "India Metal Recycling Market Size, Share, Trends and Forecast by Metal, Sector, and Region, 2025-2033", the market is growing due to increasing steel production demand, government initiatives promoting sustainable waste management, and the rising adoption of circular economy practices. The study offers a profound analysis of the industry, encompassing market share, size, growth factors, key…

Italy Business Process Management Market Size to Hit USD 552.30 Million by …

Italy Business Process Management Market Overview

Market Size in 2025: USD 267.89 Million

Market Size in 2034: USD 552.30 Million

Market Growth Rate 2026-2034: 8.37%

According to IMARC Group's latest research publication, "Italy Business Process Management Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", the Italy business process management market size was valued at USD 267.89 Million in 2025 and is projected to reach USD 552.30 Million by 2034, growing at a…

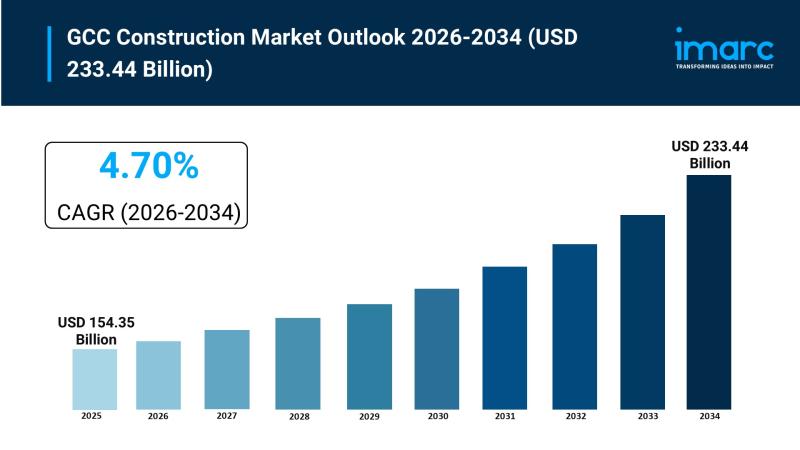

GCC Construction Market Size to Hit USD 233.44 Billion by 2034 | With a 4.70% CA …

GCC Construction Market Overview

Market Size in 2025: USD 154.35 Billion

Market Size in 2034: USD 233.44 Billion

Market Growth Rate 2026-2034: 4.70%

According to IMARC Group's latest research publication, "GCC Construction Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The GCC construction market size was valued at USD 154.35 Billion in 2025 and is projected to reach USD 233.44 Billion by 2034, growing at a compound annual growth rate of 4.70%…

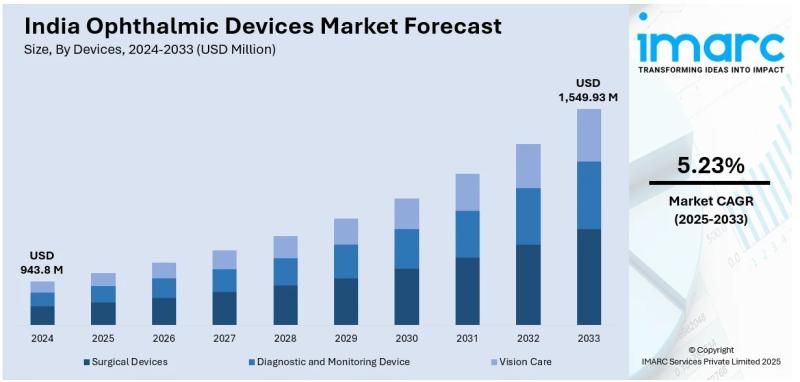

India Ophthalmic Devices Market to Reach USD 1,549.93 Million by 2033, Growing a …

Source: IMARC Group | Category: Healthcare | Author Name: Gaurav

Report Introduction

According to IMARC Group's latest report titled "India Ophthalmic Devices Market Size, Share, Trends and Forecast by Devices, End User, and Region, 2025-2033", the market is growing due to the rising prevalence of age-related eye disorders, increasing awareness of preventive eye care, and technological advancements in diagnostic and surgical equipment. The study offers a profound analysis of the industry, encompassing…

More Releases for MDF

MDF Acoustic Panel Case: Enhancing Acoustic Comfort & Interior Quality

As acoustic performance becomes an essential element in modern interior design, more commercial and professional spaces are turning to reliable sound-control solutions to enhance user experience. In a recently completed interior project, MDF Acoustic Panels [https://www.liantutrade.com/factory-produces-modern-decorative-background-wall-acoustic-soundproof-wall-panels-in-various-colors-product/] were selected to address acoustic challenges while maintaining a clean and contemporary visual style.

Image: https://ecdn6.globalso.com/upload/p/2785/image_other/2026-01/1-1-8.jpg

Project Background

The project involved the renovation of an indoor space where sound clarity and noise control were critical requirements. The…

Driving MDF And Chipboard Market Growth in 2025: The Role of Surge In Constructi …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

MDF And Chipboard Market Size Growth Forecast: What to Expect by 2025?

The mdf and chipboard market has expanded strongly in recent years. It will rise from $69.03 billion in 2024 to $73.88 billion in 2025 at a CAGR of 7.0%. Past growth was supported by availability of panels…

MDF And Chipboard: A Leading Driver Behind Surge In Construction Activities To D …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

What Will the MDF And Chipboard Industry Market Size Be by 2025?

There has been significant growth in the MDF and chipboard market in the past few years. The market, which is projected to rise from $69.03 billion in 2024 to $74.58 billion in 2025, is anticipated to have…

MDF and Chipboard Market to Reach $134.5 Billion, Globally, by 2032: Building a …

Building a Sustainable Future with MDF and Chipboard: A Market Overview

The global MDF and chipboard market is on the rise, offering sustainable alternatives to solid wood in various applications. Allied Market Research recently published a report titled "MDF and Chipboard Market by Product Type, Application, End User Industry, and Region: Global Opportunity Analysis and Industry Forecast, 2023-2032." According to this report, the MDF and chipboard market was valued at…

Setting Up a Successful MDF Manufacturing Plant | Syndicated Analytics

Syndicated Analytics latest report titled "Medium-Density Fiberboard (MDF) Manufacturing Project Report: Industry Trends, Manufacturing Process, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue 2023-2028" covers the details involved in establishing a MDF manufacturing facility. It offers in-depth information about the success and risk factors, manufacturing requirements, project costs and economics, returns on investment, profit margins, etc. The study also covers comprehensive data about the MDF market performance. It…

Global Melamine Faced MDF (MF MDF) Market Growth Data Analysis 2020-2025

This report also researches and evaluates the impact of Covid-19 outbreak on the Melamine Faced MDF (MF MDF) industry, involving potential opportunity and challenges, drivers and risks. We present the impact assessment of Covid-19 effects on Melamine Faced MDF (MF MDF) and market growth forecast based on different scenario (optimistic, pessimistic, very optimistic, most likely etc.).

GLOBAL INFO RESEARCH has lately published a new report titled, *Global and Japan Melamine Faced MDF (MF MDF) Market 2020 by…