Press release

China: An Insurance Giant

China has been the fastest-growing nation for the past quarter of a century with an average annual GDP growth rate above 10%. Chinese economy is the 4th largest in the world after the US, Japan and Germany, with a nominal GDP of US$3.42 trillion (2007) when measured in exchange-rate terms.China is the world’s largest untapped insurance market. With GDP growth of over 10% per annum, rapid economic development and a burgeoning consumer class, China has the potential to become one of the world’s most significant insurance markets. Driven by a variety of demographic, economic and regulatory factors, this growth should continue at a solid pace for the foreseeable future. As of late 2004, China was fully compliant with its WTO insurance-related accession provisions, giving foreign firms greater market access. While domestic players dominate the market, foreign insurers are gradually attaining greater market share. Challenges remain, however, and include an overall lack of management talent, unsophisticated consumers, poor distribution channels and non-transparent regulatory approval processes.

Several factors are responsible for this astounding level of growth. Some of the most noticeable ones are China’s aging population; high savings rate and poor social security systems as well as an increasing number of wealthy consumers segment that is spurring growth in the property and casualty, auto and health insurance sectors. Compared to its regional peers, the Chinese market is still substantially smaller than Japan and marginally smaller than South Korea. It is, however, the fastest-growing market in both absolute and relative terms, growing by $61.17 billion and 169.63% between 2002 and 2007. This rapid development of the Chinese insurance market is driven by economic growth, but premium growth has outstripped economic growth consistently over the past five years.

Market Performance & Forecast

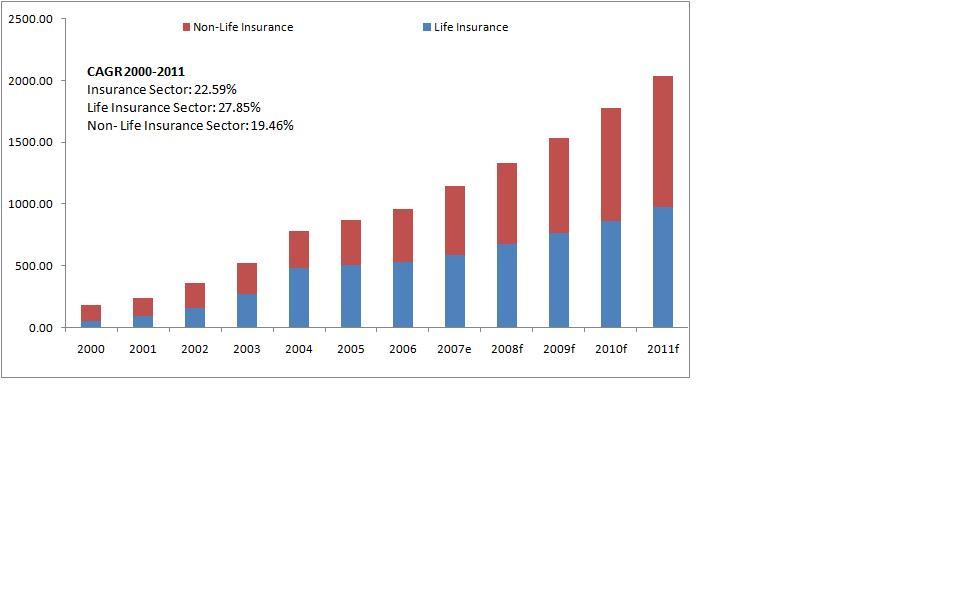

In 1996, total premium .i.e. life insurance and non-life insurance combined was $12.84 billion and in 2007, it was estimated to be $97.23 billion. Between 1996 and 2007, Chinese Insurance sector experienced a CAGR of approximately 20.21%. Between 1996 and 2000, life segment had an increase of $13.11 billion from $7.14 billion to $18.56 billion and between 2002 and 2007, an increase of $37.47 billion from $24.26 billion in 2002 to $61.73 billion. We forecast that life insurance premiums in 2011 will be $108.12 billion. In non-life segment, between 1996 and 2007, a growth of $29.80 billion was seen from $5.70 billion in 1996 and $35.50 billion in 2007. It is expected that non-life premiums in 2011 will be $64.37 billion.

Major Driving Factors

=> Variety of demographic, economic and regulatory factors

=> Demand from Commercial Property Segment

=> Increased risk awareness and demand for sophisticated products

=> Improved expertise of local insurers

=> Guarantee rate reform and many others....

Major Trends & Issues

=> Foreign entrants facing ownership restrictions with respect to joint ventures

=> Regulatory obstacles for foreign companies

=> Use of bank channels by insurance companies to reach out to consumers in non-urban areas.

=> Customer loyalty in China’s insurance market is very thin, and customers are easily poached.

=> The State Council having recently cleared the way for banks to invest in established insurance companies on a pilot basis

=> Focus from price competition has shifted to developing new products and expanding the overall size of the insurance market

=> Low penetration as a result of low customer awareness

=> Need of further capacity and expertise in specialist areas such as MAT, energy, liability insurance

=> And many other....

Emerging Areas

=> Longer-term foreign exchange life insurance policies

=> Cross-sector investment (e.g., investment in banks), and an expansion of investment classifications (asset-backed securities, property, industry funds, offshore markets, etc.) for insurers.

=> Development of a Stock Broker Market

=> Growth of domestic reinsurance capacity

=> And many other....

According to China Insurance Regulatory Commission (CIRC) as of June 30, 2006, there were around 100 insurance companies in China. Out of these 100 companies, there were 56 domestic insurance companies and 44 foreign insurance companies. Domestic insurance companies had a market share of approximately 93.3% and the remaining 6.7% was controlled by the foreign insurance companies. The entire market is quite fragmented and most of these 56 domestic insurance companies are region-centric and are strong in their respective markets. The largest foreign companies are AIU (a subsidiary of AIG), Tokio Marine, and Mitsui Somitomo. As new players have entered the market, competition has intensified significantly, as the existing players fight to maintain their market share.

Topics covered in the report

=>Trend analysis of Chinese economy & macroeconomic factors contributing to the growth of the sector

=>China’s position in the context of emerging countries

Historical growth trends & growth drivers of Insurance & its sub-sectors in China and outlook till 2011.

=>Market size of insurance sector (total, life & non-life) since 2000 till 2007

=>Market forecast of insurance sector (total, life & non-life) between 2007 and 2011

=>Government policies, initiatives, regulations and problems faced by foreign insurers

=>Key issues & challenges, major trends & opportunities

=>Role of stock brokers, banks, domestic reinsurance and bancassurance segments

=>Industry and markets with best prospects for insurance products

=>Government’s initiatives to promote & regulate the insurance market

=>Competitive landscape and market share of top players

=>And many more...

Table of Contents

METHODOLOGY & RESEARCH APPROACH

EXECUTIVE SUMMARY

1. CHINA

1.1. CHINESE ECONOMY

1.1.1. Macroeconomic trends

1.2. GOVERNMENT POLICIES

1.2.1. Three-Step Regional Development Strategy

1.2.2. The 11th Five-Year Program (2006-2010)

1.2.3. Development of Energy-Efficient Society

2. CHINESE INSURANCE SECTOR

2.1. MARKET OVERVIEW

2.1.1. Insurance Sector vs. Macro-Economic Factors

2.1.2. Market Constituents

2.2. MARKET PERFORMANCE & FORECAST (1996-2011)

2.2.1. Chinese Insurance Market

2.2.1.1. Chinese Life Insurance Market

2.2.1.2. Chinese Non-Life Insurance Market

2.3. TRENDS, ISSUES AND OPPORTUNITIES – AN ANALYSIS

2.3.1. Demand from Commercial Property Segment

2.3.2. Increasing Population and Prospective Buyers

2.3.3. Middle-men or Broker Market

2.3.4. Entry of Banks

2.3.5. Increasing risk awareness & demand for innovative products

2.3.6. Guarantee rate reform

2.3.7. Development of domestic reinsurance markets

2.3.8. Regulatory obstacles

2.3.9. Other major issues & trends

2.4. GOVERNMENT REGULATIONS

2.5. COMPETITIVE LANDSCAPE

2.5.1. Market Segmentation

2.5.1.1. Competition in Life Insurance Sector

2.5.1.2. Competition in Non-Life Insurance Sector

2.5.2. Driving Factors

2.5.3. Company Profiles

2.5.3.1. China Life Insurance Company Limited

2.5.3.2. China Pacific

2.5.3.3. Ping An

2.5.3.4. New China Life

Pages: 83; Format: PDF

List of Charts

Chart 1: China’s GDP Growth (1952-2005)

Chart 2: Macroeconomic Data & Factors

Chart 3: Total Premium Growth vs. GDP Growth (%) – 1996-2007e

Chart 4: Growth (%): Life vs. Non-Life vs. Total Premium vs. GDP (%) – 1996-2008f

Chart 5: Chinese Insurance Market: Segment Share

Chart 6: China Insurance Market Value ($billion): 2000-2007e

Chart 7: China Insurance Market Value Forecast ($ billion): 2008-2011f

Chart 8: Growth Trend of Life Insurance and Non-Life Insurance ($billion): 1996-2007e

Chart 9: GDP Growth vs. Total Premium Growth vs. Life Insurance Growth (%) – 1996-2007e

Chart 10: Life Insurance Market in China: 1996-2007e ($ billions)

Chart 11: Life Insurance Market in China: Forecast 2007-2011f ($billions)

Chart 12: GDP Growth vs. Total Premium Growth vs. Non-life Insurance Growth (%) – 1996-2008f

Chart 13: Sub-sector share of Non-life Insurance Market in China

Chart 14: Non-life Insurance Market in China: 1996-2007e ($ billions)

Chart 15: Non-life Insurance Market in China: Forecast 2007-2011f ($billions)

Chart 16: Market Share of Top 3 Domestic Life Insurance Companies

Chart 17: Market Share of Non-life Insurance Companies in China

Chart 18: Market Share of Reinsurers in China (2006)

List of Tables

Table 1: Macroeconomic Data & Factors

Table 2: Chinese GDP vs. US Dollar exchange vs. Inflation Index

Table 3: Total Premium Growth & GDP Growth (%) – 1996-2007e

Table 4: Growth (%): Life vs. Non-Life vs. Total Premium vs. GDP (%) – 1996-2008f

Table 5: China Insurance Market Value & Forecast ($ billion): 1996-2011f

Table 6: Growth Trend of Life Insurance and Non-Life Insurance ($billion): 1996-2007e

Table 7: GDP Growth vs. Total Premium Growth vs. Life Insurance Growth (%) – 1996-2007e

Table 8: Life Insurance Market in China: 1996-2007 ($ billions)

Table 9: Life Insurance Market in China: Forecast 2007-2011 ($billions)

Table 10: GDP Growth vs. Total Premium Growth vs. Non-life Insurance Growth (%) – 1996-2008f

Table 11: Non-life Insurance Market in China: 1996-2007e ($ billions)

Table 12: Non-life Insurance Market in China: Forecast 2007-2011f ($billions)

Table 13: Top Domestic and Foreign-Invested Life Insurance Firms in China

Table 14: Top Domestic and Foreign-Invested Non-Life Insurance Firms in China

For more details on this industry report, kindly get in touch with:

Renu Dhyani

PR & Communication Executive

The Knowledge Centre – A Sheffield Haworth Company

Tel: +91-11-40601158 (o); +91-9958790353 (m)

Email: dhyani@sheffieldhaworth.com

Web: http://www.sheffieldhaworth.com

About ‘The Knowledge Centre’

Established in 2007, “The Knowledge Centre” caters to clients in Financial Services Sector globally. Its expertise lies in knowledge management, business research & management consulting. It conducts surveys across different regions and creates business and market research reports on all the major sectors and sub-sectors of global financial services market.

The Knowledge Centre is a wholly owned subsidiary of the world’s largest executive search firm in financial services. The parent company undertakes search assignments at top levels. It has offices spread across London, New York, Dubai, Delhi, Hong Kong and Tokyo.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release China: An Insurance Giant here

News-ID: 43503 • Views: …

More Releases from The Knowledge Centre

Asian Insurance Focus: Vietnam & Thailand

Asian Insurance Focus: Vietnam & Thailand

New Delhi, 4th September 2008: Globalization is the key source which is bringing about an "irreversible transformation" in the Asian insurance market. Asia is becoming an important growth engine for global insurers due to the changing socio-economic dynamics. According to a latest research report from HSBC, in order to be long-term winners, life insurance companies in Asia need to diversify their income streams such that…

Asian Insurance Focus: India & China

New Delhi, 29th August 2008: Globalization is the key source which is bringing about an "irreversible transformation" in the Asian insurance market. India and China are "dynamically" driving the growth of insurance markets in Asia. This process has been expedited by the "soothing impact" of the Asian financial crisis on reform resistance and its contribution towards acceleration of change, including deregulation, particularly "on the back of gradual opening up of…

Thailand Insurance Sector

New Delhi, 30th May, 2008 - Thailand is the 2nd largest economy in Southeast Asia, after Indonesia. It ranks midway in the wealth spread in South East Asia and is the 4th richest nation per capita, after Singapore, Brunei, and Malaysia. The Thai economy in 2008 is forecasted to grow at 5.6% (in the forecasted range of 5.0-6.0%). This figure is an improvement on 4.8% growth in the previous year…

Vietnam Insurance Sector - Untapped Potential

Vietnam Insurance Sector: Untapped Potential

New Delhi, 9th May 2008: In recent years, there has been a significant economic growth in Vietnam of approximately 7.5% per annum. This growth is attributable to the recently adopted strategic and long-term initiatives by the Vietnamese government. These steps have streamlined and improved the economic infrastructure of the country by offering more incentives for foreign investors and implementing a 10 year socio-economic development plan etc.…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…