Press release

Vietnam Insurance Sector - Untapped Potential

Vietnam Insurance Sector: Untapped PotentialNew Delhi, 9th May 2008: In recent years, there has been a significant economic growth in Vietnam of approximately 7.5% per annum. This growth is attributable to the recently adopted strategic and long-term initiatives by the Vietnamese government. These steps have streamlined and improved the economic infrastructure of the country by offering more incentives for foreign investors and implementing a 10 year socio-economic development plan etc. The country has gradually migrated from a planned economy to a market based economy by shifting its focus from agricultural production to industries and services. With all these developments, Vietnam has become one of the fastest-growing economies in the world, averaging around 8% annual gross domestic product (GDP) growth from 1990 to 1997 and 6.5% from 1998-2003. From 2004 to 2007, GDP grew over 8% annually. Vietnam is now able to compete and get counted with regional as well as global economic countries. There has been a significant increase in inflows of foreign direct and private investment.

In the last few years, Vietnamese insurance sector has seen a noticeable growth. Today, despite being very young, Vietnamese life insurance market has already overtaken Indonesia and Philippines in terms of market penetration. This is because Insurance premium forms a larger percentage of the country’s GDP. With opening up of its insurance market since 1996, more and more foreign insurers are getting access to the highly lucrative insurance market in Vietnam. Foreign companies can now easily operate in the country and are forming joint ventures with local companies in order to enter Vietnam and diversify their clientele. In addition, a range of foreign life insurers, including some large Asian-based life insurers (principally from Singapore, Taiwan, China and South Korea), have set up representative offices in Vietnam and are working toward gaining operating licenses. Investors from regions like Asia, US and Europe are also actively lobbying the Vietnamese government for access to the local insurance market. Upon the country's accession to the World Trade Organization, foreign insurers expect to be allowed to establish more wholly owned units and to benefit from progressively declining limitations on their scope of business.

Market Performance & Forecast

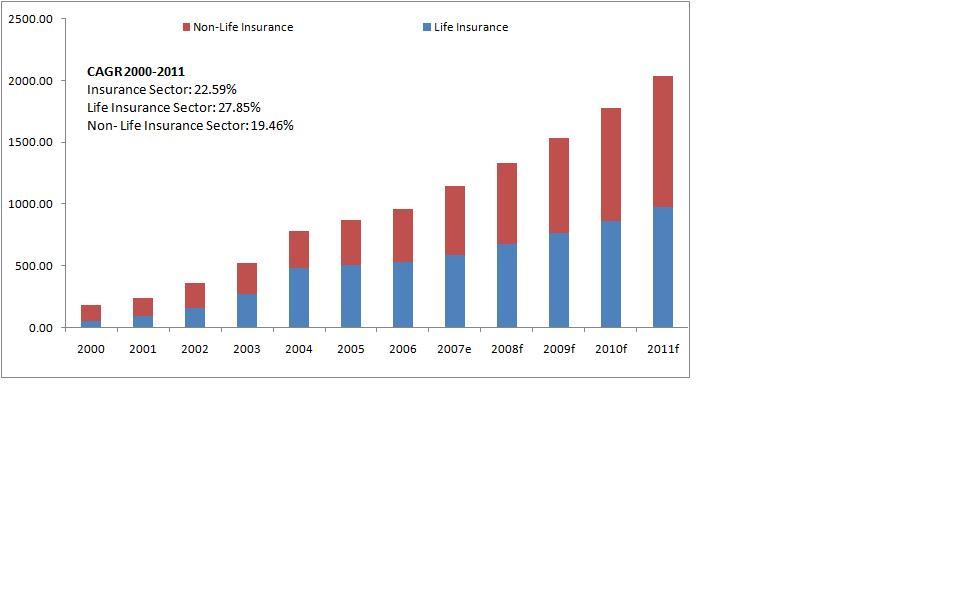

In 2000, Insurance sector was valued to be $177.12 million. Within the next 7 years, the total market size of insurance sector in Vietnam was estimated to be $1141.98 million in 2007; a CAGR growth of 26.23% and an average growth rate of 33.25% during this tenure. Going forward, we are expecting a CAGR growth of around 12.30% in the Vietnamese Insurance Sector between 2007 and 2011. During this time period, the market from $1141.98 million will grow at an average rate of 16.25% and reach $2039.95 million by the end of 2011.

Between 2000 and 2007, Vietnamese life insurance sector increased from $51.12 million to $586.24 million, CAGR growth of 35.65% during this period. We forecast that the life insurance market in Vietnam would grow at a CAGR of 10.71% and an annual average growth rate of 13.21% between 2007 and 2011. From $596.24 million in 2007, the market will increase by approximately $388 million and reach $975.21 million by the end of 2011.

Non-life premiums in Vietnam were estimated to be $555.74 million in 2007, a growth of $429.74 million from the market size of $126.00 million in year 2000. Between 2007 and 2011, we project a CAGR of 13.89% .i.e. from $555.74 million in 2007; the non-life insurance sector in Vietnam will reach $1064.75 million.

According to the Vietnam Insurance Association, there are 120,000 insurance agents and 10,000 employees in the country. There are currently 16 non-life insurers, eight life insurers and seven insurance brokers. Vietnam's life insurers offer about 100 products and generated premium income. Fifteen foreign insurers have established operations and 30 others have representative offices. Foreign-owned insurers dominate the life insurance market. Domestic insurers are more dominant in the non-life insurance market and foreign insurers hold only a 7 percent market share. Some of the top insurance companies in Vietnam are ACE Life Insurance Co., Ltd., AIG General Insurance (Vietnam) Company Limited, Bao Viet Holdings, Bao Minh, Groupama/GAN, Nipponkoa Insurance Co., Ltd., Prudential Vietnam Assurance, Petrolimex Joint Stock Insurance Company (PJICO), Petrovietnam Insurance Company (PVIC), and QBE Insurance (Vietnam) Company Limited etc.

Major Driving Factors

=> Economic growth above 8 percent

=> Entry to the World Trade Organization (WTO)

=> Opening up of insurance market for foreign investments

=> US-Vietnam bilateral trade agreement in 2001

=> Emerging middle class & increasing literacy rate

=> Increasing foreign direct investments

=> And many more…

Major Issues & Trends

=> Foreign investors targeting Vietnamese Insurance Sector

=> Foreign companies trying to capture Vietnamese Market

=> Insurance still in a nascent stage due to traditional mindset

=> Lack of infrastructure and support

=> Setting up of a national export-credit insurance organisation

=> Demand for risk prevention increasing

=> Staffing concerns in insurance companies

=> Establishment of the Laos-Vietnam Insurance Joint Venture (LVI)

=> Recent developments at Bao Viet

=> And many more…

Topics covered in the report

=> Economic performance of Vietnam

=> Recent economic policies of the Communist Party

=> Macroeconomic trends and drivers

=> Focus on increasing Foreign Direct Investments and opening up of insurance market

=> Past and present scenario of Vietnamese Insurance Market & Future Outlook

=> Past and present scenario of Vietnamese Life Insurance Market & Future Outlook

=> Past and present scenario of Vietnamese Non-Life Insurance Market & Future Outlook

=> Driving factors for Vietnamese Insurance Market

=> Entry in WTO

=> Setting up of a national export-credit insurance organisation

=> Establishment of the Laos-Vietnam Insurance Joint Venture (LVI)

=> Government strategic initiatives to strengthen Insurance Market

=> Competitive Landscape & Market Share of foreign and domestic players

=> Recent developments in Bao Viet

=> Company profiles of top players

=> And many more…

Table of Contents

1. VIETNAM

1.1 VIETNAMESE ECONOMY

1.2 GOVERNMENT POLICIES

2. INSURANCE SECTOR

2.1 MARKET OVERVIEW

2.2 MARKET SEGMENTATION & PERFORMANCE

2.2.1 Vietnamese Insurance Market

2.2.1.1 Life Insurance Sector

2.2.1.2 Non-Life Insurance Sector

2.3 DRIVING FACTORS

2.3.1 Recent catalysts

2.3.2 Young and vibrant population

2.3.3 Emerging middles class

2.3.4 Literacy rate

2.3.5 War of talent

2.3.6 Increasing foreign direct investment (FDI)

2.4 TRENDS, ISSUES AND OPPORTUNITIES – AN ANALYSIS

2.4.1 Foreign investors targeting Vietnamese Insurance Sector

2.4.2 Entry in WTO

2.4.3 Foreign companies trying to capture Vietnamese Market

2.4.4 Traditional mindset of the people – Insurance still in a nascent stage

2.4.5 Inadequate basic infrastructure and support

2.4.6 Underselling to capture market

2.4.7 Setting up of a national export-credit insurance organisation

2.4.8 Underlying opportunity for life insurance policies – need for risk prevention

2.4.9 Entry of foreign players & staffing concerns

2.4.10 Historical economic growth trends

2.4.11 Establishment of the Laos-Vietnam Insurance Joint Venture (LVI)

2.4.12 Factors driving investment decisions

2.4.13 Transformation at Bao Viet

2.4.14 HSBC enters strategic relationship with top Vietnam insurer, Bao Viet

2.5 GOVERNMENT REGULATIONS

2.6 COMPETITIVE LANDSCAPE & MARKET SHARE

2.6.1 Company Profiles

2.6.1.1 ACE Life Insurance Co., Ltd.

2.6.1.2 AIG General Insurance (Vietnam) Company Limited

2.6.1.3 Bao Viet Holdings

2.6.1.4 Bao Minh

2.6.1.5 Groupama/GAN

2.6.1.6 Nipponkoa Insurance Co., Ltd.

2.6.1.7 Prudential Vietnam Assurance

2.6.1.8 Petrolimex Joint Stock Insurance Company (PJICO)

2.6.1.9 Petrovietnam Insurance Company (PVIC)

2.6.1.10 QBE Insurance (Vietnam) Company Limited

Pages: 107; Format: PDF

Authors: Akash Rakyan & Nishith Srivastava

List of Charts

Chart 1: Macroeconomic Data: Population (mil.) vs. Nominal GDP ($ billions): 2002-2011

Chart 2: Macroeconomic Data: GDP per capital ($mil.) vs. Real GDP Growth (%): 2002-2011

Chart 3: Vietnam Insurance Market ($million): 2000-2007e

Chart 4: Vietnam Insurance Market Forecast ($million): 2007e-2011f

Chart 5: Vietnam Life Insurance Market Value ($million): 2000-2007e

Chart 6: Vietnam Life Insurance Market Value Forecast ($million): 2007e-2011f

Chart 7: Vietnam Non-Life Insurance Market Value ($million): 2000-2007e

Chart 8: Vietnam Non-Life Insurance Market Value Forecast ($million): 2007e-2011f

Chart 9: Market Share of Life Insurance Companies in Vietnam

Chart 10: Market Share of Non-Life Insurance Companies in Vietnam

List of Tables

Table 1: Macroeconomic Data: Population (mil.) vs. Nominal GDP ($ billions): 2002-2011

Table 2: Macroeconomic Data: GDP per capital ($mil.) vs. Real GDP Growth (%): 2002-2011

Table 3: Vietnam Insurance Market ($million): 2000-2007e

Table 4: Vietnam Insurance Market Forecast ($million): 2007e-2011f

Table 5: Vietnam Life Insurance Market Value ($million): 2000-2007e

Table 6: Vietnam Life Insurance Market Value Forecast ($million): 2007e-2011f

Table 7: Vietnam Non-Life Insurance Market Value ($million): 2000-2007e

Table 8: Vietnam Life Insurance Market Value Forecast ($million): 2007e-2011

To order this industry report, kindly get in touch with:

Renu Dhyani

PR & Communication Executive

The Knowledge Centre – A Sheffield Haworth Company

Tel: +91-11-40601158 (o); +91-9958790353 (m)

Email: dhyani@sheffieldhaworth.com

Web: http://www.sheffieldhaworth.com

About ‘The Knowledge Centre’

Established in 2007, “The Knowledge Centre” caters to clients in Financial Services Sector globally. Its expertise lies in knowledge management, business research & management consulting. It conducts surveys across different regions and creates business and market research reports on all the major sectors and sub-sectors of global financial services market.

The Knowledge Centre is a wholly owned subsidiary of the world’s largest executive search firm in financial services. The parent company undertakes search assignments at top levels. It has offices spread across London, New York, Dubai, Delhi, Hong Kong and Tokyo.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Vietnam Insurance Sector - Untapped Potential here

News-ID: 44167 • Views: …

More Releases from The Knowledge Centre

Asian Insurance Focus: Vietnam & Thailand

Asian Insurance Focus: Vietnam & Thailand

New Delhi, 4th September 2008: Globalization is the key source which is bringing about an "irreversible transformation" in the Asian insurance market. Asia is becoming an important growth engine for global insurers due to the changing socio-economic dynamics. According to a latest research report from HSBC, in order to be long-term winners, life insurance companies in Asia need to diversify their income streams such that…

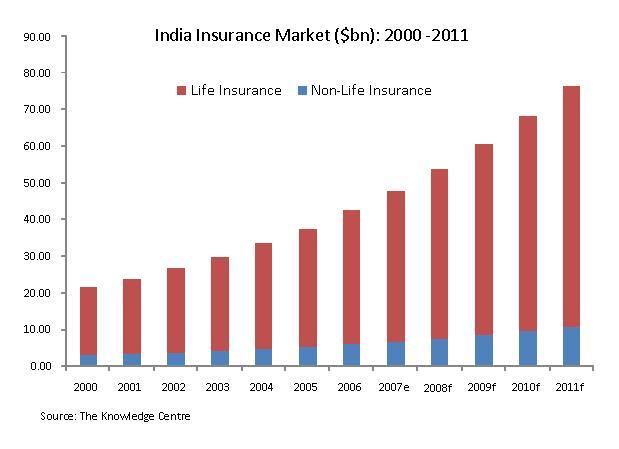

Asian Insurance Focus: India & China

New Delhi, 29th August 2008: Globalization is the key source which is bringing about an "irreversible transformation" in the Asian insurance market. India and China are "dynamically" driving the growth of insurance markets in Asia. This process has been expedited by the "soothing impact" of the Asian financial crisis on reform resistance and its contribution towards acceleration of change, including deregulation, particularly "on the back of gradual opening up of…

Thailand Insurance Sector

New Delhi, 30th May, 2008 - Thailand is the 2nd largest economy in Southeast Asia, after Indonesia. It ranks midway in the wealth spread in South East Asia and is the 4th richest nation per capita, after Singapore, Brunei, and Malaysia. The Thai economy in 2008 is forecasted to grow at 5.6% (in the forecasted range of 5.0-6.0%). This figure is an improvement on 4.8% growth in the previous year…

India: The Next Insurance Giant

New Delhi, May 6th 2008: Indian economy is the 12th largest in the world, with a GDP of $1.25 trillion and 3rd largest in terms of purchasing power parity. With factors like a stable 8-9 per cent annual growth, rising foreign exchange reserves, a booming capital market and a rapidly expanding FDI inflows, it is on the fulcrum of an ever increasing growth curve.

Insurance is one major sector which has…

More Releases for Viet

Mr Viet Leads the Charge in Vietnam's Emerging Global Coffee Movement

The world has long been familiar with the delicate spices of Thai curry and the refined techniques of Japanese sushi. But lately, the vibrant, soul-warming flavors of Vietnamese cuisine have taken center stage on the global culinary stage. From bustling Banh Mi kiosks in Berlin to steaming bowls of Pho in Toronto, Vietnam's food is captivating international taste buds. One of its most underrated yet powerful exports-coffee-is now catching up.

Vietnam…

PLB Viet Nam - Genuine bearing distributor in Vietnam

Image: https://www.abnewswire.com/uploads/493addece835ac5460b19b59a86f104e.jpg

PLB Vietnam distributes bearings, chains, and bearing housings from many famous brands around the world. These include JTEKT (Koyo), Asahi, PBC, Timken, JNS, and MSB. The products are directly imported from Japan, the US, China, etc., to serve the needs of customers throughout Vietnam.

Each product of PLB Vietnam is a useful solution with high precision. Each bearing and chain is imported genuine and goes through a meticulously researched finishing…

Vietnamese Coffee Brand Mr. Viet Expands onto the International Stage!

Ho Chi Minh City, Vietnam - Mr. Viet, a brand capturing the true spirit and tradition of Vietnamese coffee, is now making waves on the international scene. From rich traditional brews to unique flavors like coconut and mango, Mr. Viet aims to offer the world a fresh perspective on coffee and Vietnamese culture.

With a commitment to preserving Vietnam's coffee heritage, Mr. Viet partners closely with local farmers, supporting sustainable practices…

Viet Embassy revolutionizes consular processes for Vietnamese people in America

Today, any Vietnamese person who wants to renew their Vietnamese passport can do so online easily by going to www.vietembassy.com and applying within minutes. Viet Embassy is the only place that lets you sign up for passports, visas, birth certificates, and other lawful papers conveniently. This is the result of years of development from legal experts and technologists. The passport renewal process used to take months but Viet Embassy's online…

Viet Noi Language Centre Offers Free Trials to Learn Vietnamese

Singapore - For those looking to learn Vietnamese, either for business or pleasure, then the Viet Noi Language School Singapore has an excellent track record of helping students faster than other conventional centres.

The key to their success is teaching Vietnamese in small groups, with a maximum of eight students per class. This focused approach helps students pick up the language quicker and speak in everyday situations as soon as…

Advanced Research report of Custard Apple Market by 2019 to 2025 | leading Compa …

The fruits vary in shape, heart-shaped, spherical, oblong or irregular. When ripe, the fruit is brown or yellowish, with red highlights and a varying degree of reticulation, depending again on the variety. The flesh varies from juicy and very aromatic to hard with a repulsive taste. The flavor is sweet and pleasant, akin to the taste of 'traditional' custard. CMFE Insights has recently published an innovative report to its database…