Press release

Thailand Insurance Sector

New Delhi, 30th May, 2008 - Thailand is the 2nd largest economy in Southeast Asia, after Indonesia. It ranks midway in the wealth spread in South East Asia and is the 4th richest nation per capita, after Singapore, Brunei, and Malaysia. The Thai economy in 2008 is forecasted to grow at 5.6% (in the forecasted range of 5.0-6.0%). This figure is an improvement on 4.8% growth in the previous year according to Fiscal Policy Office (FPO), Ministry of Finance. In 2008 accelerated public sector spending led to recovery in domestic demand which is expected to be far more balanced economic expansion. Government policy would then be forced to stimulate the domestic economy. This happens when external demand is likely to be softened from possible global economic slowdown. External stability in 2008 will remain strong with current account surplus estimated to be 0.5% of GDP (in the range of 0.3-0.8% of GDP). In contrast, internal stability in 2008 may have some risk with increasing headline inflation at 4.5% (in a range of 4.3-4.8%). This is mainly due to rising energy and food prices in the world markets.According to ‘The Economist’, real GDP growth will slow down by 1.15% p.a over the next 4 years (2008-12), as compared to 5.3% p.a in past 3 years since 2007. This sluggishness of GDP can be attributed to various negative factors, such as political uncertainty, instability of foreign exchange rates, and continuous high petroleum prices in 2006.

The Thai insurance industry, along with the wider Thai economy, has now however recovered from the depths of the Asian financial crisis and is experiencing noteworthy growth. The trend is expected to continue as public awareness of the need for insurance increases.

Market Performance and Forecast

Within a span of 7 years (2000 - 2007), Thai Insurance Sector has experienced a growth of 191% currently valuated at $9,434.72 million. The Knowledge Centre predicts, the overall market size will increase by 72.5% further and is expected to touch the highs of $13,012.75 million by 2011.

The life insurance market in Thailand between 2000 and 2007 increased at a CAGR of 16.57%. The Knowledge Centre envisages that this trend would continue and the market will see CAGR of 5.75% in 5 years and reach $8,306.21 million in 2011.

The non-life insurance market in Thailand between 2000 and 2007 increased at a CAGR of 10.73%. The Knowledge Centre also forecasts that the growth will continue and the market will see CAGR of 8.34% in the next 5 years with the premiums reaching $4,706 million by 2011.

Competitive Landscape

Some of the top foreign insurance companies in Thailand are ACE, AIG, Allianz, AXA, Generali, ING, Millea Holdings, Manulife, New York Life and Prudential (UK). The market is dominated by AIA, the local name of AIG that accounted for approx. 29% of all of gross premiums in 2007. Thai Life (TLI) is considered to be the second largest player overall with a market share of approx. 14%. The next largest group is considered to be a joint venture between non-life insurer Ayudhya, local conglomerate Charoen Pokphand and Allianz (AACP) with a market share of approx. 14%. Other major players in this market are Ocean Life, Finansa, local associates of AXA (Krungthai) and ING.

Non-life insurance sector in Thailand is further sub-categorized under Fire, Marine & Transportation, Hull, Cargo, Automobile, Compulsory, Voluntary, Miscellaneous, Industrial All Risks, Public Liability, Engineering Insurance, Aviation Insurance, Personal Accident, Health Insurance, Crop Insurance and Other Insurance. Some of the top companies in this sector are Bangkok Insurance, Dhipaya Insurance, Phatra Insurance, New Hampshire Insurance, Ayudhya Insurance, Mitsui Sumitomo Insurance, MSIG Insurance, Sri Muang Insurance, Siam Commercial Samaggi, South East Insurance, Viriyah Insurance, Synmunkong Insurance, Krungthai Panich etc.

Driving factors

=> Balanced economic expansion and supporting role of the government

=> Recent reforms and government’s regulatory initiatives

=> Re-defined financial practices and strengthening of corporate governance

=> Relaxation of restrictions on directors and senior executives of insurance companies

=> Amendment of clauses governing the evaluation of assets & debts of a life insurance company

=> Merger or consolidation of the large number of local insurers

=> Middle income industrial developing nation

=> Growing interest in Bancassurance

=> Adoption of THBFix and Bibor

=> Establishment of Insurance Commission

Major trends, issues and opportunities

=> Mergers and acquisitions in Thailand's insurance industry are likely to drop off

=> Thailand's economy is slowing as the effects of high oil prices, rising interest rates and long-running political uncertainty take their toll.

=> Political uncertainty and instability of foreign exchange rates

=> Bullish trend in fixed deposit rates

=> Government regulations laying a strong foundation for future growth

=> Increase in foreign ownership limits

=> Move towards a knowledge economy through skills development

=> Issues in Health Insurance Systems

Topics covered in the report

=> Thai economy, its performance, future outlook for 2008-09

=> Government’s economic policies, macroeconomic factors, trends and analysis

=> Economic and Insurance environment in Thailand

=> Market performance and forecast for Thai Insurance Sector between 2000, 2007 and 2011

=> Market performance and forecast for Thai Life Insurance Sector between 2000, 2007 & 2011

=> Market performance and forecast for Thai Non-Life Insurance Sector between 2000, 2007 & 2011

=> Recent reorganization of financial institutions and setting up of Insurance Commission

=> Corporate Finance Legislation and other major regulatory developments

=> Role of Bancassurance

=> Specific regulations and norms by the Thai Government for insurance sector.

=> Sub-categorization of life and non-life insurance sector

=> Competitive landscape & market share of companies in life and non-life insurance sector

=> Company profiles of top players in life and non-life insurance sector

Table of Contents

1. THAILAND

1.1. THAI ECONOMY

1.2. GOVERNMENT POLICIES

2. THAI INSURANCE SECTOR

2.1. MARKET OVERVIEW

2.2. MARKET PERFORMANCE & FORECAST

2.2.1. Thailand Insurance Market

2.2.1.1. Thailand – Life Insurance Market

2.2.1.2. Thailand – Non-Life Market

2.3. DRIVING FACTORS

2.3.1. Recent Reforms

2.3.2. M&A or transfer of the business of an Insurance Company

2.3.3. Thai Corporate Finance Legislation

2.3.4. Role of Bancassurance

2.3.5. Recent Regulatory Developments

2.3.6. Insurance Commission replaced Department of Insurance

2.4. TRENDS, ISSUES AND OPPORTUNITIES – AN ANALYSIS

2.4.1. Insurance M&A likely to drop

2.4.2. Pending Legislations

2.4.3. Implications for Foreign Insurers

2.4.4. Skills development remains a key

2.4.5. Issues in Health Insurance Systems in Thailand

2.5. GOVERNMENT REGULATIONS

2.6. COMPETITIVE LANDSCAPE

2.6.1. Life Insurance

2.6.1.1. Life Insurance Renewal Market

2.6.1.2. Single Premium Market

2.6.2. Non-Life Insurance Market

2.6.2.1. Fire Insurance Market

2.6.2.2. Marine and Transportation Market

2.6.2.3. Cargo & Hull Market

2.6.2.4. Automobile Sector

2.6.2.5. Miscellaneous Insurance

2.6.2.6. Industrial All Risks Insurance

2.6.2.7. Public Liability Insurance

2.6.2.8. Engineering Insurance

2.6.2.9. Aviation Insurance

2.6.2.10. Health Insurance

2.6.2.11. Personal Accident Insurance

2.6.2.12. Other Insurance

2.6.3. Company Profiles

2.6.3.1. American International Assurance company (AIA), Thailand

2.6.3.2. ACE INA Overseas Insurance Company Limited

2.6.3.3. Ayudhya Insurance Public Company Limited

2.6.3.4. Ayudhya Allianz C.P. Life Public Company Limited

2.6.3.5. Bangkok Insurance Public Company Limited

2.6.3.6. Bangkok Union Insurance

2.6.3.7. Charan Insurance

2.6.3.8. Deves Insurance

2.6.3.9. ING Life Limited

2.6.3.10. Indara Insurance

2.6.3.11. Manulife Insurance (Thailand) Public Company Limited

2.6.3.12. MSIG Insurance

2.6.3.13. QBE Insurance (Thailand) Company Limited

2.6.3.14. Sri Muang Insurance

2.6.3.15. The Viriyah Insurance Co., Ltd.

Pages: 163; Format: PDF

Authors: Jasvita Anand, Akash Rakyan & Nishith Srivastava

List of Tables

Table 1: Macroeconomic Trends: Population (mil.) vs. Nominal GDP ($ bil.) – 2002-2011f

Table 2: Macroeconomic Trends: GDP per capital ($ bil.) vs. Real GDP Growth (%) – 2003-2011f

Table 3: Growth Trends: Inflation (2002-2008f)

Table 4: Key Economic Indicators Forecast – 2007-2012f

Table 5: Growth Trend Comparison: GDP Growth vs. Insurance Growth (%) – 2000-2011

Table 6: Thailand Insurance Market Value ($million): 2000-2007

Table 7: Thailand Insurance Market Value Forecast ($million): 2007-2011f

Table 8 : Insurance Density: Premiums Per Capita in USD

Table 9: Insurance Premium in % of GDP (2001-2011f)

Table 10: Growth Trend of Life Insurance and Non-Life Insurance ($Million): 2000-2011f

Table 11: Thailand Life Insurance Market Value ($million): 2000-2007

Table 12: Thailand Life Insurance Market Value Forecast ($million): 2007-2011f

Table 13: Thailand Non-Life Insurance Market Value ($million): 2000-2007

Table 14: Thailand Non-Life Insurance Market Value Forecast ($million): 2007-2011f

Table 15: Thailand Insurance Sector: Projections of Macroeconomic Drivers (2006-2010f)

Table 16: Market Share of Top Players in Life Insurance Sector: Comparison between 2006 & 2007 (Million Baht) and their Growth (%)

Table 17: Life Insurance Total Premium Growth Year on Year by Company 2006-2007 (%)

Table 18: Life Insurance Market Growth by First Year Premium of Top Companies: Comparison between 2006 & 2007 (mn Baht)

Table 19: Life Insurance Market Growth by First Year Premium of Top Companies: Comparison between 2006 & 2007 (%)

Table 20: Life Insurance Premium Renewal (million Baht) and Growth (%) Year on Year for Top Companies (2006-2007)

Table 21: Life Insurance Renewal Market Share of Top Companies in 2007 (mn Baht)

Table 22: Life Insurance Single Premium Market Share of Top Companies in 2007 (mn Baht & % growth)

Table 23: Loss Ratio of Non - Life Insurance Business (2007)

Table 24: Marine and Transportation Companies: Markey Share by Direct Premium (Unit: 1,000 Baht)

Table 25: Automobile Insurance Top companies by Direct Premium (2007)

Table 26: Top Miscellaneous Non-Life Insurance Companies: Market Share by Direct Premium (%) – 2007

Table 27: Top Industrial All Risk Non-Life Insurance Companies: Market Share by Direct Premium – 2007

Table 28: Top Public Liability Non-Life Insurance Companies: Market Share by Direct Premium – 2007

Table 29: Top Engineering Non-Life Insurance Companies: Market Share by Direct Premium (%) – 2007

Table 30: Top Aviation Non-Life Insurance Companies: Market Share by Direct Premium – 2007

Table 31: Top Health Insurance Companies: Market Share by Direct Premium – 2007

Table 32: Top Personal Accident Insurance Companies: Market Share by Direct Premium – 2007

Table 33: Top Other Non-Life Insurance Companies: Market Share by Direct Premium – 2007

List of Charts

Chart 1: Macroeconomic Trends: Population (mil.) vs. Nominal GDP ($ bil.) – 2002-2011f

Chart 2: Macroeconomic Trends: GDP per capital ($ bil.) vs. Real GDP Growth (%) – 2003-2011f

Chart 3: Growth Trends: Inflation (2002-2008f)

Chart 4: Key Economic Indicators Forecast (2007-2012f)

Chart 5: Growth Trend Comparison: GDP Growth vs. Insurance Growth (%) – 2000-2011f

Chart 6: Thailand Insurance Market Value ($billion): 2000-2007

Chart 7: Thailand Insurance Market Value Forecast ($million): 2007-2011f

Chart 8: Insurance Density: Premiums Per Capita in USD

Chart 9: Insurance Premium in % of GDP (2001-2011f)

Chart 10: Thailand Insurance Market: Segment Share 2007

Chart 11: Growth Trend of Life Insurance and Non-Life Insurance ($Million): 2000-2011f

Chart 12: Thailand Life Insurance Market Value ($million): 2000-2007

Chart 13: Thailand Life Insurance Market Value Forecast ($million): 2007-2011f

Chart 14: Thailand Non-Life Insurance Market Value ($million): 2000-2007

Chart 15: Thailand Non-Life Insurance Market Value Forecast ($million): 2007-2011f

Chart 16: Market Segmentation of Non-Life Insurance (%): 2007

Chart 17: Market Segmentation of Non-Life Companies by Ownership 2007 (%)

Chart 18: Comparison of Direct Premiums of Non - Life Insurance Business (2007 & 2006)

Chart 19: Direct Premium per Insurance Policy for 2007-2006 (Baht)

Chart 20: Comparison of Sum Insured Per Premium of Non - Life Insurance Business Segments (2007 & 2006)

Chart 21: Loss Ratio of Non - Life Insurance Business (2007)

Chart 22: Market Share of Top Life Insurance Companies by Total Premium in 2007 (%)

Chart 23: Life Insurance First Year Premium Market Segment in 2007 by Top Companies(%)

Chart 24: Life Insurance Premium Renewal (million Baht) and Growth (%) Year on Year for Top Companies (2006-2007)

Chart 25: Life Insurance Renewal Market Share of Top Companies in 2007 (%)

Chart 26: Single Insurance Premium Company Segmentation 2007

Chart 27: Fire Insurance Companies – Market Share (%): 2007

Chart 28: Marine & Transport Insurance Segment Share (%): 2007

Chart 29: Cargo and Hull Market: Direct Premium Share (%) in 2006-2007

Chart 30: Marine and Transportation Companies: Markey Share by Direct Premium (Unit: 1,000 Baht)

Chart 31: Market Share of Automobile Insurance Sub Sector 2007

Chart 32: Automobile Insurance Top Companies – Market Share by Direct Premium (%) – 2007

Chart 33: Market Share of Miscellaneous Non-Life Sector (%) – 2007

Chart 34: Top Miscellaneous Non-Life Insurance Companies: Market Share by Direct Premium (%) – 2007

Chart 35: Top Industrial All Risk Non-Life Insurance Companies: Market Share by Direct Premium (%) – 2007

Chart 36: Top Public Liability Non-Life Insurance Companies: Market Share by Direct Premium (%) – 2007

Chart 37: Top Engineering Non-Life Insurance Companies: Market Share by Direct Premium (%) – 2007

Chart 38: Top Aviation Non-Life Insurance Companies: Market Share by Direct Premium (%) – 2007

Chart 39: Top Health Insurance Companies: Market Share by Direct Premium (%) – 2007

Chart 40: Top Personal Accident Insurance Companies: Market Share by Direct Premium (%) – 2007

Chart 41: Top Other Non-Life Insurance Companies: Market Share by Direct Premium (%) – 2007

To order this industry report, kindly get in touch with:

Renu Dhyani

PR & Communication Executive

The Knowledge Centre – A Sheffield Haworth Company

Tel: +91-11-40601158 (o); +91-9958790353 (m)

Email: dhyani@sheffieldhaworth.com

Web: http://www.sheffieldhaworth.com

About ‘The Knowledge Centre’

Established in 2007, “The Knowledge Centre” caters to clients in Financial Services Sector globally. Its expertise lies in knowledge management, business research & management consulting. It conducts surveys across different regions and creates business and market research reports on all the major sectors and sub-sectors of global financial services market.

The Knowledge Centre is a wholly owned subsidiary of the world’s largest executive search firm in financial services. The parent company undertakes search assignments at top levels. It has offices spread across London, New York, Dubai, Delhi, Hong Kong and Tokyo.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Thailand Insurance Sector here

News-ID: 45849 • Views: …

More Releases from The Knowledge Centre

Asian Insurance Focus: Vietnam & Thailand

Asian Insurance Focus: Vietnam & Thailand

New Delhi, 4th September 2008: Globalization is the key source which is bringing about an "irreversible transformation" in the Asian insurance market. Asia is becoming an important growth engine for global insurers due to the changing socio-economic dynamics. According to a latest research report from HSBC, in order to be long-term winners, life insurance companies in Asia need to diversify their income streams such that…

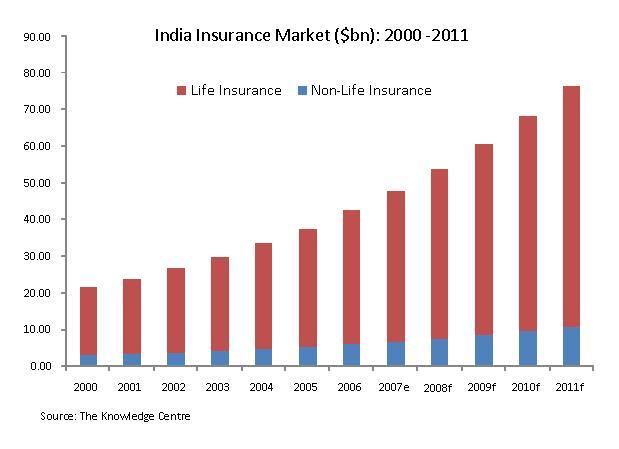

Asian Insurance Focus: India & China

New Delhi, 29th August 2008: Globalization is the key source which is bringing about an "irreversible transformation" in the Asian insurance market. India and China are "dynamically" driving the growth of insurance markets in Asia. This process has been expedited by the "soothing impact" of the Asian financial crisis on reform resistance and its contribution towards acceleration of change, including deregulation, particularly "on the back of gradual opening up of…

Vietnam Insurance Sector - Untapped Potential

Vietnam Insurance Sector: Untapped Potential

New Delhi, 9th May 2008: In recent years, there has been a significant economic growth in Vietnam of approximately 7.5% per annum. This growth is attributable to the recently adopted strategic and long-term initiatives by the Vietnamese government. These steps have streamlined and improved the economic infrastructure of the country by offering more incentives for foreign investors and implementing a 10 year socio-economic development plan etc.…

India: The Next Insurance Giant

New Delhi, May 6th 2008: Indian economy is the 12th largest in the world, with a GDP of $1.25 trillion and 3rd largest in terms of purchasing power parity. With factors like a stable 8-9 per cent annual growth, rising foreign exchange reserves, a booming capital market and a rapidly expanding FDI inflows, it is on the fulcrum of an ever increasing growth curve.

Insurance is one major sector which has…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…