Press release

Top 30 Indonesian Beverages Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)PT Multi Bintang Indonesia Tbk (MLBI) Beer & alcoholic beverages

PT Delta Djakarta Tbk (DLTA) Beer brands like Anker & Carlsberg

PT Sariguna Primatirta Tbk (CLEO) Non-alcoholic beverages

PT Akasha Wira International Tbk (ADES) Beverage producer including water & drinks

PT Ultrajaya Milk Industry & Trading Company Tbk (ULTJ) Milk products, juices & drinks

PT Mayora Indah Tbk (MYOR) Coffee, tea, instant beverages (listed)

PT Indofood CBP Sukses Makmur Tbk (ICBP) Beverage segment via noodles & drinks mix

PT Indofood Sukses Makmur Tbk (INDF) Parent with beverage exposure via affiliates

PT Garudafood Putra Putri Jaya Tbk (GOOD) Beverage & snacks

PT Sari Enesis Tbk (ENESIS) Beverage manufacturer

PT Buyung Poetra Sembada Tbk (HOKI) Drink & beverage product segments

PT Prima Cakrawala Abadi Tbk (PCAR) Beverage & related distribution

PT Prasidha Aneka Niaga Tbk (PSDN) Beverage distribution business

PT Akasha Wira International Tbk (ADES) Beverage and other consumer lines

PT Akasha Wira International Tbk Also on multiple food/beverage lists

PT Tiga Pilar Sejahtera Food Tbk (AISA) Food & beverage products

PT Tri Banyan Tirta Tbk (ALTO) Beverage & beverage inputs

PT Budi Starch & Sweetener Tbk (BUDI) Sweetener inputs for beverages

PT Campina Ice Cream Industry Tbk (CAMP) Frozen desserts & drinks

PT Wilmar Cahaya Indonesia Tbk (CEKA) Beverage ingredient supply

PT Diamond Food Indonesia Tbk (DMND) Beverage related segments

PT Sentra Food Indonesia Tbk (FOOD) Drink products among others

PT Nippon Indosari Corpindo Tbk (ROTI) Some beverage component operations

PT Tunas Baru Lampung Tbk (TBLA) Beverage raw material exposure

PT Buyung Poetra Sembada Tbk (HOKI) Additional beverage lines.

PT Kalbe Farma Tbk (KLBF) Energy/functional drinks via healthcare & nutrition portfolios.

PT Coca-Cola Pan Java Bottling Co. Beverage bottling.

PT Aqua Golden Mississippi Tbk Mineral water & drinks.

PT Sinar Sosro Tea beverages.

PT Yakult Indonesia Persada Fermented beverages.

2) Revenue results of major public companies in Indonesia summarized (per company)

Multi Bintang Indonesia Tbk (MLBI) - Net profit (through 9M25): ~Rp724.19 billion (~USD 43.5M). Profit margin was pressured by higher operating and general & administrative costs. Net sales were modestly up, but profitability compressed compared with prior years.

Delta Djakarta Tbk (DLTA) - Net profit ~Rp101.23 billion (~USD 6.1M). Revenue grew slightly, but margin pressures from expenses persisted.

Unilever Indonesia Tbk (UNVR) - Net sales ~IDR 9.4T, Net profit ~IDR 1.2T (~USD 71M). YoY and QoQ profit increases with improved margins and consumer demand.

PT Indofood CBP Sukses Makmur Tbk (ICBP) - 9M25 Net income Rp11.37T (~USD 683M) with beverage contribution part of overall processed food portfolio. Gross profit and operating income improved, though net was slightly lower than prior year.

Mayora Indah Tbk (MYOR) - generates multitrillion-rupiah revenue from coffee/RTD/packaged drinks.

PT Kino Indonesia Tbk (KINO) - Produces beverages among other CPG segments.

Kalbe Farma Tbk (KLBF) - Significant nutrition and energy drink portfolio.

Ultra Prima Abadi Group - Involved in dairy/RTD.

Sari Enesis Tbk - Local beverage producer.

GarudaFood Putra Putri Jaya Tbk - Diversified food/beverage entity.

3) Key trends & insights from Q3 2025

1. Profitability Squeeze in Brewer Segment

Breweries like Multi Bintang and Delta Djakarta saw profits flat to mildly lower due to higher costs and subdued consumer upswing in premium alcoholic segments.

2. Resilience Among Consumer Staples

Consumer staples companies with beverage lines (e.g., UNVR, ICBP) showed top-line growth and margin improvement, underpinned by diversified product mixes and stronger brand equity.

3. Diversification Helps Offset Volatility

Companies with a broad F&B portfolio tend to deliver more stable earnings, as beverages represent just one part of extensive FMCG offerings (e.g., Mayora, Kino).

4. Disclosure Variability Across Companies

Many mid-tier beverage players do not yet publicize detailed Q3 2025 segment results, making comprehensive sector analysis partly reliant on 9M disclosures and investor reports.

4) Outlook for Q4 2025 and beyond

Consumer Demand Remains Central

Indonesian consumer sentiment and demand elasticity for beverage products will shape growth heading into Q4 2025 with RTD beverages and healthier options expected to outperform traditional alcohol segments.

Cost & Input Price Dynamics

Raw material and logistics cost pressures continue companies with better supply chain hedging likely to protect margins.

Innovation & Premiumization

Innovation (new flavors, functional beverages) may drive premium segment growth, especially in non-alcoholic categories.

Macroeconomic Context

Slower GDP growth compared with forecasts could temper discretionary beverage spending, but staple and functional drinks segments may remain resilient.

5) Conclusion

The Indonesian beverages sector in Q3 2025 shows a divided yet dynamic picture:

Traditional breweries faced margin compression, while consumer staples companies with beverage portfolios delivered more stable results.

Some key players (e.g., Mayora, Kino) are significant industry contributors but lack fully released Q3 figures as of early 2026.

Future growth hinges on adapting to shifting consumer preferences, cost pressures, and broader economic conditions.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top 30 Indonesian Beverages Public Companies Q3 2025 Revenue & Performance here

News-ID: 4348459 • Views: …

More Releases from QY Research

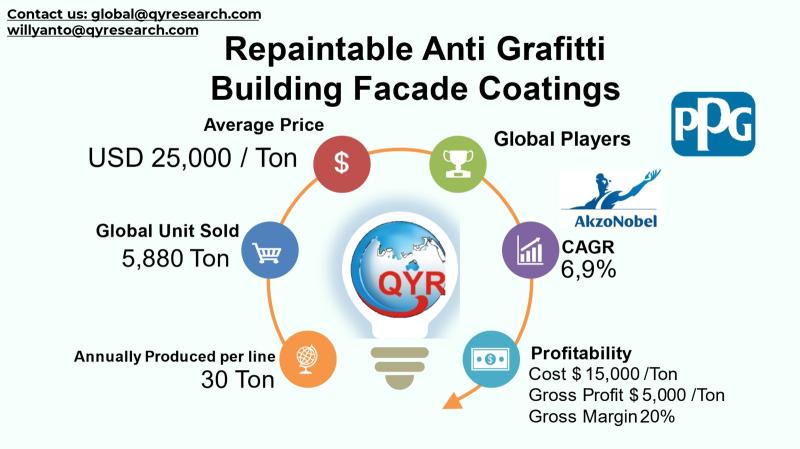

Behind the Paint: Cost Structures, Technology Trends, and Strategic Growth in An …

The global repaintable anti-graffiti building facade coatings industry is a specialized segment of the broader protective coatings market concentrating on products that protect exterior architectural surfaces from vandalism and urban environmental wear. Repaintable anti-graffiti coatings are engineered to allow repeated graffiti removal and overpainting without degrading the underlying surface, making them critical for durable facade protection in urban environments that demand aesthetic preservation and reduced lifecycle maintenance costs. Against a…

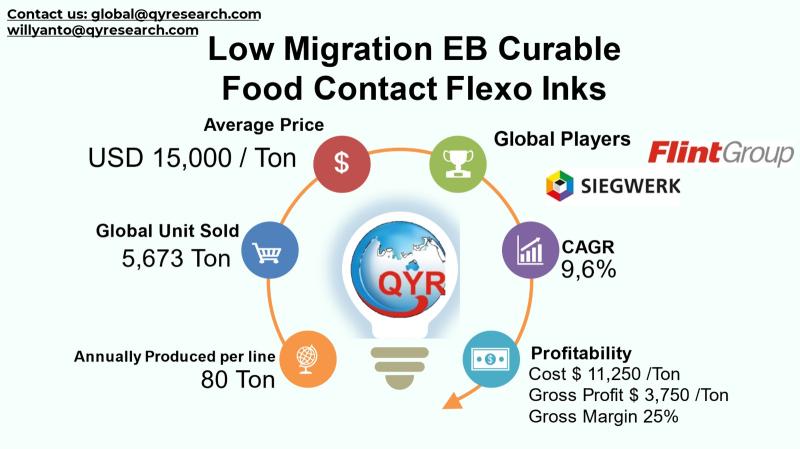

Ensuring Compliance and Growth: Asia Pacifics Role in the Future of Food Contact …

The global Low-Migration Electron Beam (EB) Curable Food Contact Flexo Inks industry encompasses specialized flexographic ink formulations that are designed to minimize chemical migration into food packaging, satisfying stringent regulatory safety standards. These inks cured via electron beam technology eliminate the need for photoinitiators and solvents that could potentially transfer into food or sensitive products, thereby addressing both regulatory and consumer safety concerns. The industry supports a broad range of…

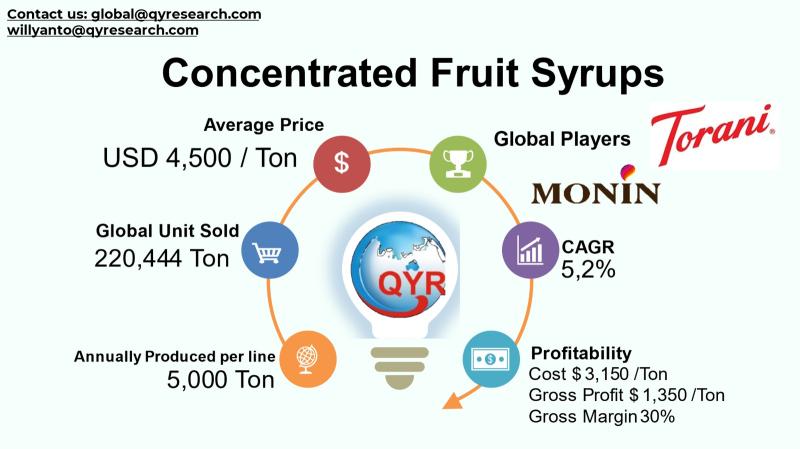

From Flavor to Fortune: Market Dynamics in Global Fruit Syrups Explained

The global concentrated fruit syrups market represents a crucial niche within the broader non-alcoholic concentrated syrup and flavorings industry. These syrups, made by reducing fruit juice to a dense, highly flavorful liquid, serve as key ingredients across beverages, confectionery, bakery, dairy, and sauces, enhancing sweetness, flavor, and product versatility. The industry is influenced by rising consumer demand for natural, clean-label ingredients and the rapid expansion of the global food and…

Silicone Rubber Curing Agents: From Slow Cure to Precision Performance

Problem

Manufacturers using conventional curing systems for silicone rubber often faced slow curing speed, inconsistent crosslinking, and limited control over mechanical properties. Inadequate curing could lead to uneven hardness, poor tensile strength, surface tackiness, or reduced thermal and chemical resistance. These issues increased defect rates, extended production cycles, and constrained performance in demanding applications such as electronics, automotive, medical, and industrial sealing.

Solution

Producers adopted Silicone Rubber Curing Agents, specialized additives designed to…

More Releases for Tbk

Retain in Indonesia Market Size, Dynamics 2031 by Major Companies- PT. Djaru, PT …

USA, New Jersey: According to Verified Market Research analysis, the Retain in Indonesia Market size was valued at USD 48.56 Billion in 2024 and is projected to reach USD 70.67 Billion by 2032, growing at a CAGR of 4.8% from 2026 to 2032.

What is the current market outlook for the retail sector in Indonesia?

The retail sector in Indonesia is experiencing robust growth driven by rising consumer purchasing power, urbanization, and…

Infrastructure Market 2021 Strategic Assessments - PT. Acset Indonusa Tbk.., Pt. …

The Infrastructure Market report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The Infrastructure sector in Indonesia is…

Indonesia Telecom Tower Market Demand, Size, Share, Scope & Forecast To 2025 |To …

The Indonesia telecom tower market accounted to US$ 557.9 Mn in 2017 and is expected to grow at a CAGR of 27.1% during the forecast period 2018 – 2025, to account to US$ 3,695.5 Mn by 2025.

Get Sample Copy of this Indonesia Telecom Tower Market research report at - https://www.businessmarketinsights.com/sample/TIPRE00004113

The Business Market Insights provides you regional research analysis on “Indonesia Telecom Tower Market” and forecast to 2025. The research report…

Coal Mining in Indonesia Market 2022| PT Bumi Resources Tbk, PT Adaro Energy Tbk …

Researchmoz added Most up-to-date research on "Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption" to its huge collection of research reports.

Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption

Summary

GlobalData's "Coal Mining in Indonesia to 2022", provides a comprehensive coverage on Indonesias coal industry. It provides historical and forecast data on coal production by grade, reserves, consumption and exports by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes

Summary

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by type; exports, exports by type and exports by country. Detailed analysis of the…