Press release

Saudi Arabia Fintech Market Size to Reach USD 4.8 Billion by 2034: Growth Drivers, Market Share & Strategic Outlook

Saudi Arabia Fintech Market OverviewMarket Size in 2025: USD 2.1 Billion

Market Forecast in 2034: USD 4.8 Billion

Market Growth Rate 2026-2034: 9.76%

According to IMARC Group's latest research publication, "Saudi Arabia Fintech Market Size, Share, Trends and Forecast by Service Proposition, and Region, 2026-2034", the Saudi Arabia fintech market size was valued at USD 2.1 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 4.8 Billion by 2034, exhibiting a CAGR of 9.76% from 2026-2034.

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-fintech-market/requestsample

How AI and Digital Transformation are Reshaping the Future of Saudi Arabia Fintech Market

● AI is automating credit decisions and fraud detection, letting banks serve more people with greater speed and security; 70% of Saudi banks report better customer satisfaction from these personalized, AI-driven services.

● It's moving beyond chatbots to "Agentic AI," where autonomous systems manage entire financial processes, a trend highlighted at major industry events as a key operational revolution for local institutions.

● Regulators are actively enabling this through supervised testing grounds; over 50 fintechs have piloted AI solutions in the Saudi Central Bank's sandbox, creating a safe space for innovation.

● AI is unlocking credit for the underserved by analyzing alternative data, helping gig workers and SMEs prove creditworthiness where traditional scores fall short.

● This transformation is backed by solid investment, with the financial sector projected to inject tens of millions into AI technologies to fuel its economic contribution.

Buy the Latest 2026 Edition: https://www.imarcgroup.com/checkout?id=13887&method=1315

Saudi Arabia Fintech Market Trends & Drivers:

A key factor pushing fintech forward is the government's powerful and strategic support, making it a true national project rather than just a market trend. The central government agencies have set clear, ambitious targets, like achieving 70% non-cash retail transactions, a goal the country actually hit two years early with e-payments reaching 79% of transactions. This is backed by significant government funding and practical initiatives. Agencies like the Saudi Central Bank and the Capital Market Authority run programs like "FinTech Saudi" and operate a dedicated Regulatory Sandbox. This sandbox has allowed over 70 fintech firms to test their ideas safely, with more than 25 graduating to become fully licensed companies, which de-risks innovation for both startups and investors. The results speak volumes: the number of active fintech companies has skyrocketed from just over 80 at the end of 2022 to more than 280, and the sector has attracted cumulative funding of around $2.4 billion.

Another major driver is the kingdom's exceptionally tech-ready population and digital backbone, which creates instant market scale for new solutions. You have a young demographic where 71% of people are under 35, and they are extremely connected with smartphone penetration at 97% and internet penetration at 99%. This isn't just about having phones; it's about usage. Around 90% of consumers used emerging payment methods like digital wallets or money transfer apps in a recent period, showing a deep comfort with digital finance. The infrastructure keeps pace, too. The national payment network, Mada, is being integrated with global platforms like Google Pay, and Alipay+ is set to join, which will make the system even more versatile for locals and international visitors alike. This combination of a digitally native user base and robust, modern infrastructure means new fintech products can achieve widespread adoption incredibly quickly.

Looking at emerging trends, the focus is shifting from broad digitization to building deep, integrated, and specialized financial ecosystems. Open banking, which began with a framework for data sharing, is now expanding to include payment initiation services, allowing fintechs to build much more seamless and embedded financial experiences directly within other apps and platforms. There's also a strong move toward creating local champions and serving specific market needs. For example, buy-now-pay-latter leader Tamara, the country's first fintech unicorn, recently secured a massive $2.4 billion financing facility to expand into a full financial super-app. Furthermore, there's a growing emphasis on using alternative data and technology to serve underserved segments like small and medium-sized enterprises and gig workers, moving beyond traditional credit scores to provide access to capital. This signals a market that is maturing from basic adoption to sophisticated, value-driven innovation.

Ask analyst for customized report: https://www.imarcgroup.com/request?type=report&id=13887&flag=E

Saudi Arabia Fintech Industry Segmentation:

The report has segmented the market into the following categories:

Analysis by Service Proposition:

● Money Transfer and Payments

● Savings and Investments

● Digital Lending and Lending Marketplaces

● Online Insurance and Insurance Marketplaces

● Others

Breakup by Region:

● Eastern Region

● Central Region

● Western Region

● Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in the Saudi Arabia Fintech Market

● October 2025: Saudi fintech ecosystem tops 280 firms, with 79% digital payments rate smashing targets early via Vision 2030 and SAMA sandbox innovations.

● September 2025: CMA grants 68 experimental permits, 36 active in Fintech Lab, accelerating crowdfunding and payments under strategy 2024-2026.

● July 2025: SAMA launches e-commerce payments interface, standardizing MADA integrations and tokenization for seamless merchant onboarding.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Fintech Market Size to Reach USD 4.8 Billion by 2034: Growth Drivers, Market Share & Strategic Outlook here

News-ID: 4324091 • Views: …

More Releases from IMARC Group

South Africa Hospitality Market to Grow Worth USD 15,189.644 Million by 2033 | E …

South Africa Hospitality Market Overview

Market Size in 2024: USD 7,823.86 Million

Market Size in 2033: USD 15,189.644 Million

Market Growth Rate 2025-2033: 7.65%

According to IMARC Group's latest research publication, "South Africa Hospitality Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The South Africa hospitality market size was valued at USD 7,823.86 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 15,189.644 Million by 2033, exhibiting a…

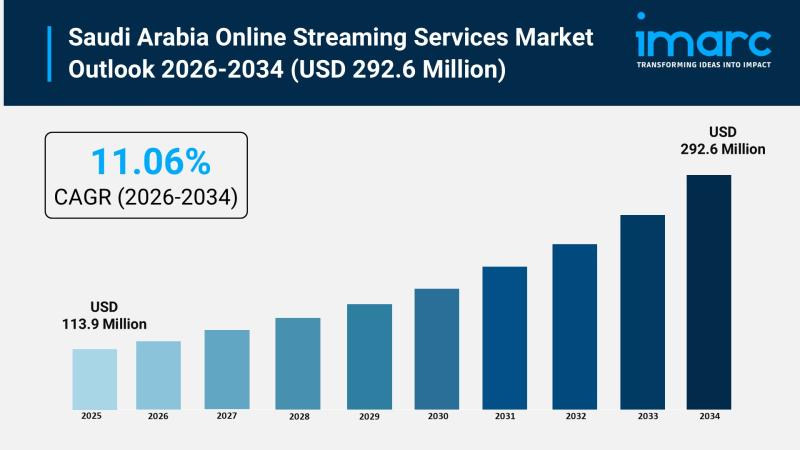

Saudi Arabia Online Streaming Services Market Expected to Rise at 11.06% CAGR Du …

Saudi Arabia Online Streaming Services Market Overview

Market Size in 2025: USD 113.9 Million

Market Size in 2034: USD 292.6 Million

Market Growth Rate 2026-2034: 11.06%

According to IMARC Group's latest research publication, "Saudi Arabia Online Streaming Services Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia online streaming services market size was valued at USD 113.9 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD…

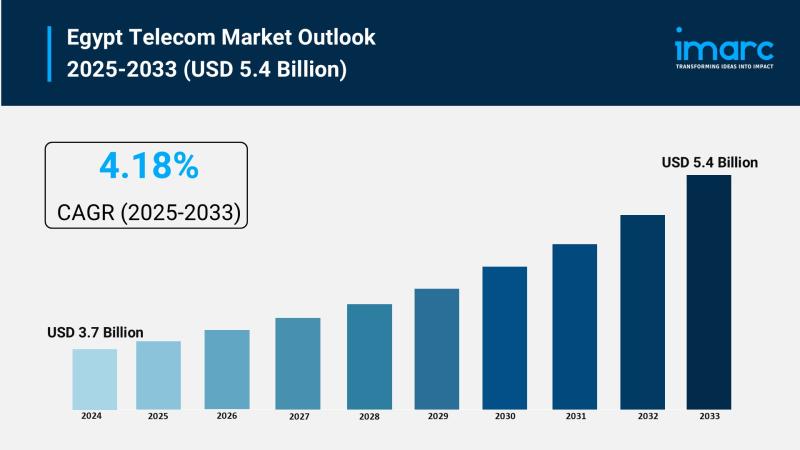

Egypt Telecom Market Size to Reach USD 5.4 Billion by 2033 | With a 4.18% CAGR

Egypt Telecom Market Overview

Market Size in 2024: USD 3.7 Billion

Market Size in 2033: USD 5.4 Billion

Market Growth Rate 2025-2033: 4.18%

According to IMARC Group's latest research publication, "Egypt Telecom Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the Egypt telecom market size reached USD 3.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.4 Billion by 2033, exhibiting a growth rate (CAGR) of 4.18%…

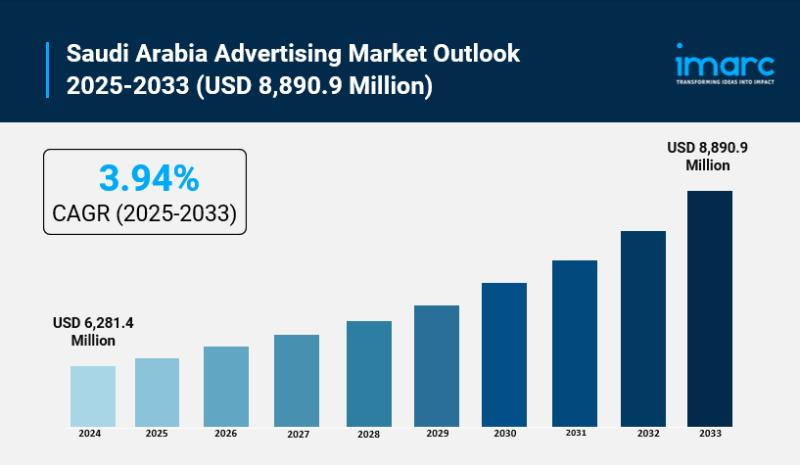

Saudi Arabia Advertising Market Size to Surpass USD 8,890.9 Million by 2033 At C …

Saudi Arabia Advertising Market Overview

Market Size in 2024: USD 6,281.4 Million

Market Forecast in 2033: USD 8,890.9 Million

Market Growth Rate 2025-2033: 3.94%

According to IMARC Group's latest research publication, "Saudi Arabia Advertising Market Report by Type (Television Advertising, Print Advertising, Radio Advertising, Outdoor Advertising, Internet Advertising, Mobile Advertising, Cinema Advertising), and Region 2025-2033", the Saudi Arabia advertising market size reached USD 6,281.4 Million in 2024. The market is projected to reach USD…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…