Press release

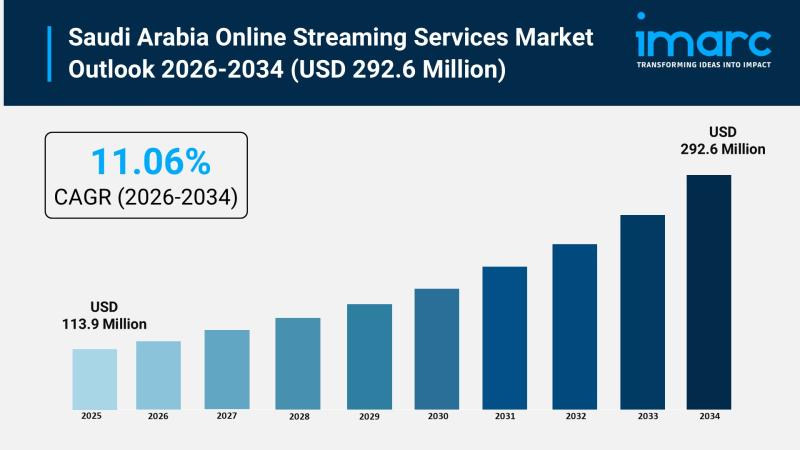

Saudi Arabia Online Streaming Services Market Expected to Rise at 11.06% CAGR During 2026-2034

Saudi Arabia Online Streaming Services Market OverviewMarket Size in 2025: USD 113.9 Million

Market Size in 2034: USD 292.6 Million

Market Growth Rate 2026-2034: 11.06%

According to IMARC Group's latest research publication, "Saudi Arabia Online Streaming Services Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia online streaming services market size was valued at USD 113.9 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 292.6 Million by 2034, exhibiting a CAGR of 11.06% during 2026-2034.

How AI is Reshaping the Future of Saudi Arabia Online Streaming Services Market

● AI-powered recommendation engines analyze Saudi viewer preferences and watching patterns to deliver personalized content suggestions, increasing engagement and subscription retention across streaming platforms operating in the Kingdom.

● Machine learning algorithms optimize video quality and buffering performance in real-time based on network conditions across Saudi Arabia, ensuring smooth streaming experiences even during peak usage periods or bandwidth fluctuations.

● AI-driven content discovery systems help Saudi streaming platforms curate culturally relevant Arabic and international programming, matching regional tastes while introducing viewers to diverse genres that align with local preferences and values.

● Automated subtitle generation and dubbing technologies powered by AI enable streaming services to rapidly localize international content into Arabic, expanding content libraries available to Saudi audiences while reducing production costs and time.

● AI analytics platforms process viewer behavior data across Saudi streaming services, providing insights into consumption trends that guide content acquisition strategies, advertising targeting, and platform development decisions tailored to the Kingdom's unique market dynamics.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-online-streaming-services-market/requestsample

How Vision 2030 is Transforming Saudi Arabia Online Streaming Services Industry

Saudi Arabia's Vision 2030 is rapidly transforming the online streaming services industry by strengthening digital infrastructure, expanding 5G and high-speed internet access, and promoting entertainment sector diversification. The initiative is accelerating demand for streaming through strong youth engagement, improved digital payments, and growing subscription adoption. Simultaneously, major investments in local Arabic content production, creative talent development, and liberalized media regulations are enabling platforms to balance global content with culturally relevant Saudi storytelling, positioning the Kingdom as a rising hub for MENA-focused streaming content.

Saudi Arabia Online Streaming Services Market Trends & Drivers:

Saudi Arabia's online streaming services market is experiencing robust growth driven by rapidly expanding internet penetration and widespread mobile device adoption, particularly through advanced 4G and 5G network infrastructure that enables high-quality video streaming across the Kingdom. The young demographic profile, with a significant portion of the population under 35 years old, creates a natural affinity for digital entertainment platforms and on-demand content consumption that aligns with contemporary lifestyle preferences. Government initiatives to enhance digital infrastructure as part of national modernization efforts are making streaming services more accessible to broader population segments across both urban centers and rural areas. Streaming platforms are responding with mobile-optimized interfaces, offline download capabilities, and features specifically designed for smartphone-first audiences who consume content anywhere, anytime rather than being tethered to traditional television schedules.

The strategic use of free trial periods and promotional offers by streaming platforms is lowering entry barriers and attracting new subscribers who can explore premium content without immediate financial commitment. These promotional strategies, particularly when timed around major events, holidays, and cultural celebrations, are converting casual viewers into long-term subscribers as users experience personalized recommendations and high-quality streaming capabilities. The competitive pricing environment, with platforms offering affordable subscription tiers and family plans, makes streaming services accessible to middle-income households while premium tiers cater to consumers seeking exclusive content and enhanced features. The growing preference for culturally relevant and Arabic-language content is reshaping platform strategies, with local streaming services gaining market share by offering programming that reflects Saudi values, traditions, and contemporary social themes that resonate deeply with domestic audiences.

Saudi Arabia Online Streaming Services Market Industry Segmentation:

The report has segmented the market into the following categories:

Revenue Insights:

● Subscription

● Advertising

● Rental

Type Insights:

● Online Video Streaming

● Online Music Streaming

Breakup by Region:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Purchase the 2026 Comprehensive Updated data: https://www.imarcgroup.com/saudi-arabia-online-streaming-services-market

Recent News and Developments in Saudi Arabia Online Streaming Services Market

● February 2025: A leading media technology company signed a strategic agreement with a major satellite operator at an industry forum in Riyadh to launch an advanced streaming platform, combining cloud-based solutions, AI-powered personalization features, and flexible monetization models to transform digital media distribution across Saudi Arabia and the broader region.

● July 2025: A global streaming giant announced a groundbreaking partnership with Saudi Arabia's largest media group to create a unified entertainment bundle combining multiple streaming platforms and linear television programming, offering subscribers integrated access to international and Arabic content at promotional pricing significantly below standalone subscriptions.

● October 2024: The Saudi Broadcasting Authority formalized a strategic partnership with a telecommunications company to license official network channels for streaming distribution, featuring high-definition content delivery through mobile applications and home devices, significantly expanding accessibility to Saudi-produced programming across the Kingdom.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Online Streaming Services Market Expected to Rise at 11.06% CAGR During 2026-2034 here

News-ID: 4324058 • Views: …

More Releases from IMARC Group

Green Tea Bags Manufacturing Plant DPR 2026: Investment Cost, Market Growth & RO …

Setting up a green tea bags manufacturing plant positions investors within one of the steadily expanding and health-oriented segments of the global beverage industry, driven by increasing consumer awareness of wellness, rising preference for natural antioxidants, and growing demand for convenient herbal drink options. Green tea is widely valued for its perceived health benefits, including metabolism support and antioxidant properties, making it popular among health-conscious urban populations.

The shift toward…

Calcium Acetate Prices Q4 2025: USA Reaches USD 1,165/MT While China Trades at U …

North America Calcium Acetate Price Outlook Q4 2025:

United States Calcium Acetate Price Overview:

In Q4 2025, calcium acetate prices in the United States reached USD 1165 per metric ton. The market remained firm due to steady demand from food processing, pharmaceuticals, and wastewater treatment sectors. Stable consumption patterns and moderate production costs supported pricing levels. Supply chain efficiency and consistent raw material availability helped prevent sharp fluctuations during the quarter.

Get the…

Automotive Radiator Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis …

Setting up an Automotive Radiator manufacturing plant positions investors in one of the most critical and high-demand segments of the global automotive components and thermal management industry, backed by sustained global growth driven by rising vehicle production, increasing regulatory focus on engine efficiency and emission reduction, and the growing adoption of electric and hybrid vehicles requiring advanced cooling solutions. As global automotive production expands across emerging economies, regulatory frameworks continue…

Watch Manufacturing Plant DPR & Unit Setup - 2026: Machinery, CapEx/OpEx, ROI an …

Setting up a watch manufacturing plant positions investors at the convergence of precision engineering, consumer lifestyle, luxury goods, and wearable technology - one of the most dynamic and diversified segments of the global consumer goods industry - driven by rising demand for luxury and premium accessories, increasing adoption of smart and hybrid watches, growing disposable incomes across emerging markets, and expanding e-commerce and organized retail channels enabling access to global…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…