Press release

Top 30 Indonesian Media Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)The Indonesian media sector continued to demonstrate mixed performance in Q3 2025 amid shifting advertising demand, digital transformation, and content monetization strategies.

PT Media Nusantara Citra Tbk (MNCN) Integrated TV & digital media broadcaster

PT Surya Citra Media Tbk (SCMA) TV + streaming/entertainment platforms

PT Visi Media Asia Tbk (VIVA) TV broadcasting group

PT Intermedia Capital Tbk (MDIA) TV & media services

PT MD Pictures Tbk (FILM) Film/animation production/media content

PT MNC Digital Entertainment Tbk (MSIN) Content, production & digital media

PT MNC Vision Networks Tbk (IPTV) Pay-TV & digital broadcasting

PT Mahaka Media Tbk (ABBA) Publishing, radio & TV media

PT Mahaka Radio Integra Tbk (MARI) Radio & digital audio media

PT Net Visi Media Tbk (NETV) TV network & content production

PT Graha Layar Prima Tbk (BLTZ) Advertising media & outdoor platforms

PT Digital Mediatama Maxima Tbk (DMMX) Digital advertising & media

PT Era Media Sejahtera Tbk (DOOH) Ad services & media

PT Fortune Indonesia Tbk (FORU) Media services/ad solutions

PT Jasuindo Tiga Perkasa Tbk (JTPE) Printing/media services

PT Arkadia Digital Media Tbk (DIGI) Digital portals & media platforms

PT Tripar Multivision Plus Tbk (RAAM) Film & TV production/distribution

PT Verona Indah Pictures Tbk (VERN) Movie/film entertainment

PT Suara Media Nusantara Tbk (SUARA) Digital news & portal platforms (media group)

PT GoTo Gojek Tokopedia Tbk (GOTO) Marketplace with media/content segments

PT Bukalapak.com Tbk (BUKA) Digital commerce & content

PT Link Net Tbk (LINK) Broadband & cable media services

PT MNC Sky Vision Tbk (MSKY) TV services (legacy + digital)

PT Tempo Intimedia Tbk (TMPO) Publishing & online media services

PT Erajaya Swasembada Tbk (ERAA) Telecom & media retail exposure

PT Duta Intidaya Tbk (DAYA) Media-adjacent services

PT Dyandra Media International Tbk (DYAN) Events & media promotions

PT Indoritel Makmur Internasional Tbk (DNET) Digital/portal exposure

PT Distribusi Voucher Nusantara Tbk (DIVA) Digital media vouchers

PT Bintang Mitra Semestaraya Tbk (BMSR) Media service holdings

2) Earnings Call Results Top 10 Indonesian Media Companies (Q3 2025)

1. PT Visi Media Asia Tbk (VIVA)

• Net Profit: ~Rp 1.15 trillion (≈ USD 68.9 million) - VIVA reported a spectacular turnaround from a prior loss (≈ Rp 21.5 billion) to strong profit, driven by operational restructuring and cost efficiencies through digital pivoting.

2. PT Nusantara Sejahtera Raya Tbk (Cinema XXI CNMA)

• Revenue: Rp 4.3 trillion (Q3 2025)

Net Profit: Rp 444.9 billion (~USD 26.6 million) Cinema XXI sustained solid box office and F&B revenues, announcing interim dividends, marking resilience amid evolving mall foot traffic.

3. PT Media Nusantara Citra Tbk (MNCN)

• Revenue: ~Rp 1.78 trillion in Q3-ending (latest quarterly revenue figure reported)

Net Profit (TTM): ~IDR 118.2 billion (~USD 7.1 million) according to financial aggregators; overall 9M profit to Sept 2025 ~Rp 754 billion (~USD 45 million), down ~17.9% YoY.

Brief Insight: Advertising remains the dominant revenue line, although content and subscription segments grew during 9M 2025.

4. PT Surya Citra Media Tbk (SCMA)

• Net Profit 9M 2025: IDR 591.6 billion (~USD 35 million) A ~16 % YoY rise and management announced an interim dividend ~IDR 571 billion, signaling confidence in earnings sustainability.

5. PT MNC Digital Entertainment Tbk (MSIN)

• Q3 2025 Revenue: Rp 1.018 billion (~USD 61 million) reported ~53 % YoY growth in Q3 revenues, reflecting rising content monetization and digital expansion (9M digital revenue up 26 % YoY).

6. PT Link Net Tbk (LINK)

• Profit Trend Q3 2025: Reported net loss ~Rp 1.03 trillion (~USD 60 million) in quarterly filings, with pressure from elevated finance costs and legacy cable monetization challenges cited.

7. PT Mahaka Radio Integra Tbk (MARI)

Financial details for Q3 2025 are not yet fully published but historically operates radio networks and print/digital media channels as classified IDX media category.

8. PT Intermedia Capital Tbk (MDIA)

Complete earnings for Q3 2025 not publicly reported online yet; the company runs television production and advertising services.

9. PT Intermedia Capital Tbk (MDIA)

For Q3 2025, MDIAs overall revenue slightly declined year-on-year while operational performance improved (higher operating profit and reduced expenses), but the company still reported a small net loss due to non-operating costs and net other expenses. This follows a trend of profit improvement via restructuring, reduced interest burdens, and higher EBITDA margins, even while media ad revenue remains challenging

10. PT MDTV Media Technologies Tbk (NETV)

NETV (now rebranded as PT MDTV Media Technologies Tbk) reported a significant net loss in Q3 2025, with steeply negative gross margins and EBITDA, indicating ongoing operational challenges. Revenue was modest and down strongly compared to prior periods, reflecting pressure on traditional broadcast advertising and the costs of strategic transition. This follows broader industry trends where free-to-air broadcasters struggle to monetize audiences amid digital shifts.

3) Key Trends & Insights from Q3 2025

1. Digital Acceleration & Content Monetization

Media conglomerates are increasingly shifting ad dollars from traditional TV to digital and OTT platforms. For instance, MSIN saw strong digital content revenue growth in Q3 2025.

2. Profitability Bifurcation

Standalone broadcasters (e.g., LINK) struggled with legacy cost structures, while integrated media players with diversified revenues (VIVA, MNCN digital & content segments) posted profitability improvements.

3. Dividend Signals

Interim dividends from SCMA and Cinema XXI highlight shareholder returns amid stable core cash generation in top media players.

4) Outlook for Q4 2025 and Beyond

Advertising Demand Recovery As consumer engagements rebound post-holiday season, media companies expect Q4 advertising upticksespecially with year-end campaigns and festive viewership.

Streaming & Digital Content Growth Continued ARPU expansion (average revenue per user) via OTT and subscription models is anticipated to bolster digital revenue share for MNCN, MSIN and similar players.

Cost Efficiency & Platform Integration Profitability in traditional segments will depend on cost optimization and bundling digital offerings across linear, OTT and social platforms.

Regulatory Environment The shift to digital broadcasting standards and content distribution regulations could recalibrate competitive dynamics through 2026.

5) Conclusion

The Indonesian media sector in Q3 2025 presents a landscape where content diversification and digital monetization increasingly define winners. While some legacy broadcasters and cable providers still face profit challenges, a group of strong performers (VIVA, Cinema XXI, SCMA, MNCN digital segments) demonstrate resilience and strategic growth. With advertising demand poised to stabilize toward year-end and digital revenue streams expanding, the industry outlook heading into Q4 2025 is cautiously optimistic.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top 30 Indonesian Media Public Companies Q3 2025 Revenue & Performance here

News-ID: 4323375 • Views: …

More Releases from QY Research

Top 30 Indonesian Electronics Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

Indonesias electronics sectorspanning electronic manufacturing services (EMS), distribution, components, and systems integration saw mixed performance in Q3 2025. Broadly, established firms with diversified offerings performed steadily, while smaller pure-play electronics names faced variable demand amid global supply chain pressures and moderate domestic demand. Overall revenue and profitability growth was modest with notable outliers outperforming peers thanks to data-center services and enterprise solutions.

PT Metrodata Electronics…

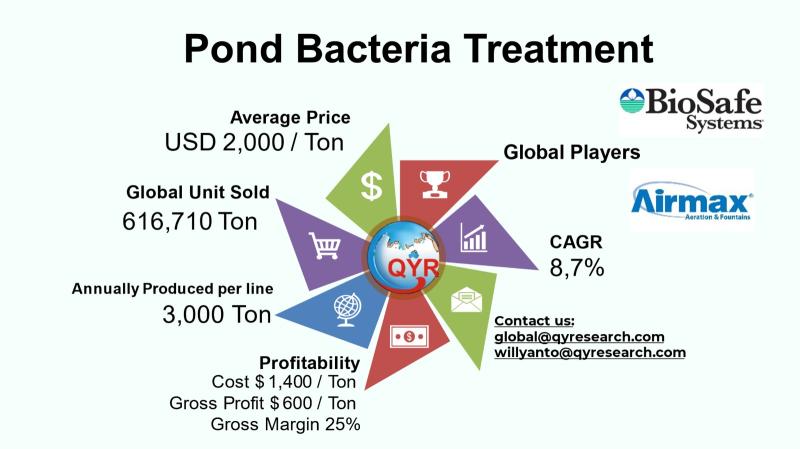

Biological Water Solutions Surge: Inside the Pond Bacteria Treatment Industrys F …

The global pond bacteria treatment market represents a specialized segment of the biological water treatment industry dedicated to improving water quality in ponds through the use of microbial products. These bacterial treatments are designed to support nutrient cycling, reduce organic waste and sludge buildup, control harmful pathogens, and enhance ecological balance in aquaculture ponds, ornamental water bodies, agricultural retention ponds, and industrial water systems. The sector has gained prominence as…

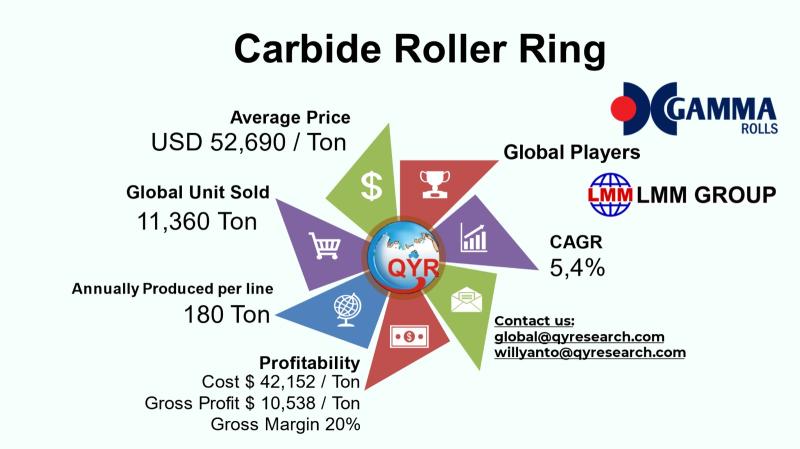

Why 2024-2031 Is a Defining Era for Carbide Roller Rings: Market Size, Trends & …

The carbide roller ring market comprises highly durable and wear-resistant ring components manufactured predominantly from tungsten carbide and similar hard materials, used in heavy machinery, industrial equipment, and precision processing systems where extreme performance is demanded. These products are a critical part of roller assemblies in metal rolling, mining, cement, and materials processing sectors, offering superior hardness, abrasion resistance, and longevity compared to traditional steel counterparts. Emerging industrial development, coupled…

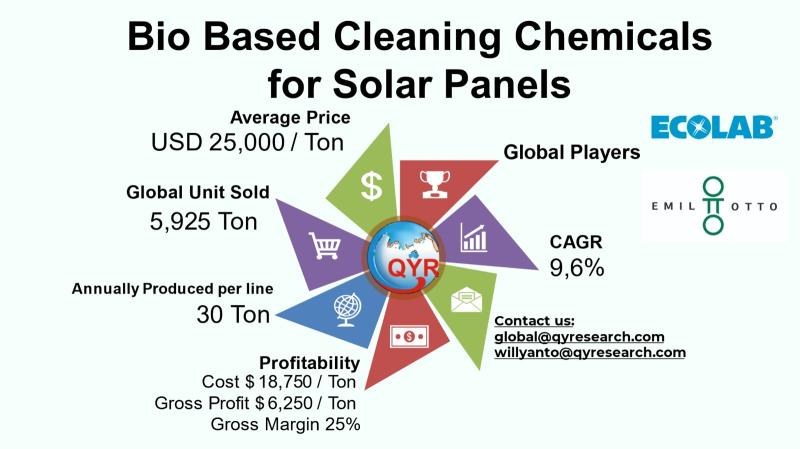

Investing in Solar Sustainability: A Deep Dive into Bio-Based Cleaning Chemicals …

The global market for bio-based cleaning chemicals designed for solar panels represents an essential and rapidly growing segment of the broader solar maintenance ecosystem, driven by the global expansion of photovoltaic installations and the increasing imperative to maintain optimal energy output while minimizing environmental impact. Globally, the bio-based cleaning chemicals market is developing in tandem with exponential solar PV capacity expansion across regions including North America, Europe, East Asia, South…

More Releases for Tbk

Retain in Indonesia Market Size, Dynamics 2031 by Major Companies- PT. Djaru, PT …

USA, New Jersey: According to Verified Market Research analysis, the Retain in Indonesia Market size was valued at USD 48.56 Billion in 2024 and is projected to reach USD 70.67 Billion by 2032, growing at a CAGR of 4.8% from 2026 to 2032.

What is the current market outlook for the retail sector in Indonesia?

The retail sector in Indonesia is experiencing robust growth driven by rising consumer purchasing power, urbanization, and…

Infrastructure Market 2021 Strategic Assessments - PT. Acset Indonusa Tbk.., Pt. …

The Infrastructure Market report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The Infrastructure sector in Indonesia is…

Indonesia Telecom Tower Market Demand, Size, Share, Scope & Forecast To 2025 |To …

The Indonesia telecom tower market accounted to US$ 557.9 Mn in 2017 and is expected to grow at a CAGR of 27.1% during the forecast period 2018 – 2025, to account to US$ 3,695.5 Mn by 2025.

Get Sample Copy of this Indonesia Telecom Tower Market research report at - https://www.businessmarketinsights.com/sample/TIPRE00004113

The Business Market Insights provides you regional research analysis on “Indonesia Telecom Tower Market” and forecast to 2025. The research report…

Coal Mining in Indonesia Market 2022| PT Bumi Resources Tbk, PT Adaro Energy Tbk …

Researchmoz added Most up-to-date research on "Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption" to its huge collection of research reports.

Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption

Summary

GlobalData's "Coal Mining in Indonesia to 2022", provides a comprehensive coverage on Indonesias coal industry. It provides historical and forecast data on coal production by grade, reserves, consumption and exports by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes

Summary

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by type; exports, exports by type and exports by country. Detailed analysis of the…