Press release

Top 30 Indonesian Electronics Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)Indonesias electronics sectorspanning electronic manufacturing services (EMS), distribution, components, and systems integration saw mixed performance in Q3 2025. Broadly, established firms with diversified offerings performed steadily, while smaller pure-play electronics names faced variable demand amid global supply chain pressures and moderate domestic demand. Overall revenue and profitability growth was modest with notable outliers outperforming peers thanks to data-center services and enterprise solutions.

PT Metrodata Electronics Tbk (MTDL) hardware & IT systems.

PT DCI Indonesia Tbk (DCII) data centers & digital infrastructure.

PT Multipolar Technology Tbk (MLPT) technology & hardware solutions.

PT Sat Nusapersada Tbk (PTSN) PCB & electronics manufacturing.

PT NFC Indonesia Tbk (NFCX) digital tech & scanning solutions.

PT Zyrexindo Mandiri Buana Tbk (ZYRX) computer assembly & devices.

PT Techno9 Indonesia Tbk (NINE) computer & tech hardware retail.

PT Mastersystem Infotama Tbk (MSTI) hardware products & services.

PT AXIO Tera Data Indonusa Tbk (AXIO) computer hardware & systems.

PT Sentral Mitra Informatika Tbk (LUCK) digital hardware solutions.

PT Pelita Teknologi Global Tbk (CHIP) electronic instrument equipment.

PT Galva Technologies Tbk (GLVA) instrument / sensor tech.

PT Sumber Sinergi Makmur Tbk (IOTF) electronic instrumentation.

PT Menn Teknologi Indonesia Tbk (MENN) instrument tech hardware.

PT Gaya Abadi Sempurna Tbk (SLIS) electronics manufacturing.

PT Sky Energy Indonesia Tbk (JSKY) electronic sector industrial stock.

PT Telefast Indonesia Tbk (TFAS) connectivity & electronic systems.

PT Data Sinergitama Jaya Tbk (ELIT) systems & infrastructure tech.

PT Informasi Teknologi Indonesia Tbk (JATI) tech systems integration.

PT Topindo Solusi Komunika Tbk (TOSK) communication & interface tech.

PT Era Digital Media Tbk (AWAN) digital tech & media.

PT Global Digital Niaga Tbk (BELI) omnichannel digital + hardware ecosystem.

PT Anabatic Technologies Tbk (ATIC) IT tech infrastructure.

PT Indointernet Tbk (EDGE) internet & connectivity tech.

PT ITSEC Asia Tbk (CYBR) cybersecurity & tech services.

PT Digital Mediatama Maxima Tbk (DMMX) digital tech services.

PT Quantum Clovera Investama Tbk (KREN) digital tech services.

PT Dunia Virtual Online Tbk (AREA) virtual & electronic tech services.

PT Mitra Pedagang Indonesia Tbk (MPIX) digital ecosystem tech.

PT Envy Technologies Indonesia Tbk (ENVY) IT & tech solutions.

2) Revenue results of major public companies in Indonesia summarized (per company)

1) PT Metrodata Electronics Tbk (MTDL)

• Revenue (Q3/9M 2025): ~Rp18.8 trillion (~USD 1.16B equivalent). Net Profit (9M/2025): ~Rp469.6 billion (~USD 29M). Growth driven by enterprise solutions, digital transformation services and expanded logistics.

2) PT DCI Indonesia Tbk (DCII)

Net Profit (as of Sept 30, 2025): ~Rp825 billion (~USD 51M), up ~83.5% YoY. Revenue (9M): ~Rp1.9 trillion (~USD 118M). Strong co-location and data-center demand helped margins expand.

3) PT M Cash Integrasi Tbk (MCAS)

Revenue and profitability rising via expanding electronic payment and solutions service offerings.

4) PT Sat Nusapersada Tbk (PTSN)

Key EMS provider; electronics manufacturing remains stable. Historically grows with contract manufacturing demand.

5) PT Electronic City Indonesia Tbk (ECII)

Retailer and distributor of consumer electronics. Q3 financial PDF shows inventory & payable structure; detailed revenue/profit sections pending release. Market focus on channel expansion and online sales.

6) PT Zyrexindo Mandiri Buana Tbk (ZYRX)

Historically small consumer electronics/device assembler; Newer data on Q3 2025 not disclosed, reflecting limited public reporting.

7) PT Indosterling Technomedia Tbk (TECH)

Tech/electronics integrator; performance underpinned by enterprise projects; Q3 data pending formal filings.

8) PT Trimegah Karya Pratama (TFAS)

Business includes tech & instrument sales; Q3 figures are modest with stable earnings.

9) PT NFC Indonesia Tbk (NFCX)

Digital payment and NFC solutions; showcased moderate revenue growth. Detailed Q3 figures pending.

10) PT Multipolar Technology Tbk (MLPT)

Systems & tech solutions; performance tied to IT services demand, with growing revenue streams in mid-enterprise solutions.

3) Key trends & insights from Q3 2025

Resilience Amid Global Slowdown

Manufacturing slowdowns globally impacted supply chain electronics demand, but Indonesias domestic ICT and enterprise segment saw stable growth. Demand for data center capacity and enterprise IT drove DCII and Metrodatas performance.

Shift to Services & Integration

Hardware distribution alone saw lower growth, while value-added services (cloud enablement, solution integration) delivered stronger margins.

Consumer Electronics Retailing

Retail channels such as Electronic City faced competitive pressures from foreign brand online marketplaces but sustained sales via localized logistics.

Valuation & Market Cap Trends

Industry valuations remained mixed with moderate earnings multiples, reflecting investor caution in tech/electronics amidst macro uncertainties.

4) Outlook for Q4 2025 and beyond

Digital Infrastructure Demand

Continued expansion of digital ecosystems (cloud providers, 5G, IoT implementation) is expected to drive revenue for integrators and data center operators.

Government Incentives & Domestic Manufacturing

Policy incentives for local electronics production may attract foreign investment and enhance EMS growth.

Consumer Segment Stabilization

Seasonal demand (holiday sales) could boost consumer electronics distribution revenues in Q4 2025.

Potential Risks

Global supply chain disruptions and currency volatility remain headwinds. Capital investment cycles in tech infrastructure may lag without improved financing conditions.

5) Conclusion

Indonesias electronics industry, while niche compared to larger ASEAN peers, showcased modest yet resilient performance in Q3 2025. Major players like Metrodata and DCII delivered notable revenue and profit growth, reinforcing the importance of enterprise solutions and data infrastructure services. Smaller EMS and retail players continued steady operations even as global uncertainties persist. Looking forward, digital transformation & infrastructure spending remains a core driver for sustained growth into Q4 2025 and beyond. Continued policy support and demand for smart systems can further expand the competitive footprint of Indonesian electronics companies on regional and global stages

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top 30 Indonesian Electronics Public Companies Q3 2025 Revenue & Performance here

News-ID: 4334663 • Views: …

More Releases from QY Research

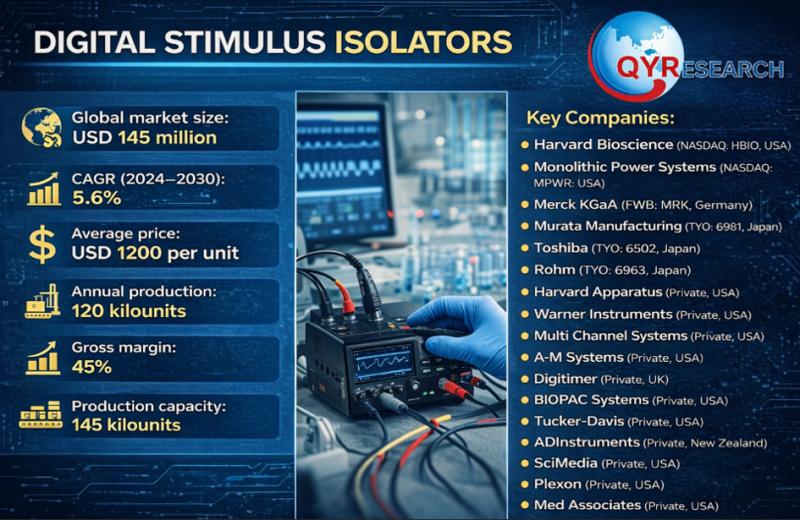

Global and U.S. Digital Stimulus Isolators Market Report, Published by QY Resear …

QY Research has released a comprehensive new market report on Digital Stimulus Isolators, precision electronic instruments designed to deliver electrically isolated, digitally controlled stimulation signals to biological tissues, neural circuits, and excitable cells. By providing accurate pulse timing, amplitude control, and complete galvanic isolation between stimulation and control electronics, digital stimulus isolators are essential in neuroscience research, electrophysiology, cardiac studies, and biomedical engineering. As experimental protocols become more complex and…

Global and U.S. Automotive Test Lights Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Automotive Test Lights, are handheld diagnostic tools used to check the presence of electrical current in a vehicle's circuits. They are commonly used to quickly determine whether a wire, fuse, switch, or component is receiving power. Typically, an automotive test light consists of a probe, a wire with an alligator clip, and a small bulb or LED that illuminates when…

Top 30 Indonesian Ceramic Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Arwana Citramulia Tbk (ARNA) Tile & ceramic producer (IDX).

PT Cahayaputra Asa Keramik Tbk (CAKK) Ceramic tiles (IDX).

PT Intikeramik Alamasri Industri Tbk (IKAI) Porcelain & tiles (IDX).

PT Keramika Indonesia Assosiasi Tbk (KIAS) Ceramic manufacturer (IDX).

PT Mulia Industrindo Tbk (MLIA) Ceramic tiles (via subsidiaries) and glass (IDX).

PT Asahimas Flat Glass Tbk (AMFG) Glass &…

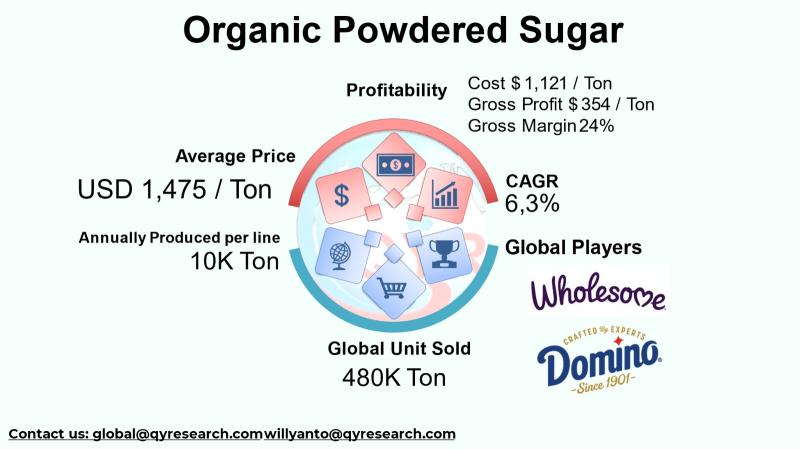

Healthier Sweetening Solutions: A Strategic Look at the Organic Powdered Sugar I …

The global organic powdered sugar industry represents a specialized segment within the broader sweeteners and organic ingredient market, catering to increasing consumer demand for clean-label, sustainable, and health-oriented food products. As shoppers and food manufacturers alike seek alternatives to conventionally produced sugar, organic powdered sugar has emerged as a preferred input for bakery, confectionery, beverage, and specialty food applications. Its positioning as an ingredient free from synthetic pesticides and additives…

More Releases for Tbk

Indonesia Textile Industry Market Valuation Expected to Hit USD 28.57 billion by …

USA, New Jersey: According to Verified Market Research analysis, the global Indonesia Textile Industry Market size was valued at USD 21.7 Billion in 2023 and is projected to reach USD 28.57 Billion by 2031, growing at a CAGR of 3.50% from 2024 to 2031

How AI and Machine Learning Are Redefining the future of Indonesia Textile Industry Market?

AI-powered production planning systems optimize yarn selection, fabric blends, and loom utilization, improving output…

Infrastructure Market 2021 Strategic Assessments - PT. Acset Indonusa Tbk.., Pt. …

The Infrastructure Market report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The Infrastructure sector in Indonesia is…

Indonesia Telecom Tower Market Demand, Size, Share, Scope & Forecast To 2025 |To …

The Indonesia telecom tower market accounted to US$ 557.9 Mn in 2017 and is expected to grow at a CAGR of 27.1% during the forecast period 2018 – 2025, to account to US$ 3,695.5 Mn by 2025.

Get Sample Copy of this Indonesia Telecom Tower Market research report at - https://www.businessmarketinsights.com/sample/TIPRE00004113

The Business Market Insights provides you regional research analysis on “Indonesia Telecom Tower Market” and forecast to 2025. The research report…

Coal Mining in Indonesia Market 2022| PT Bumi Resources Tbk, PT Adaro Energy Tbk …

Researchmoz added Most up-to-date research on "Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption" to its huge collection of research reports.

Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption

Summary

GlobalData's "Coal Mining in Indonesia to 2022", provides a comprehensive coverage on Indonesias coal industry. It provides historical and forecast data on coal production by grade, reserves, consumption and exports by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes

Summary

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by type; exports, exports by type and exports by country. Detailed analysis of the…