Press release

Saudi Arabia Real Estate Market Outlook 2026-2034 Amid Vision 2030 Mega-Project Expansion

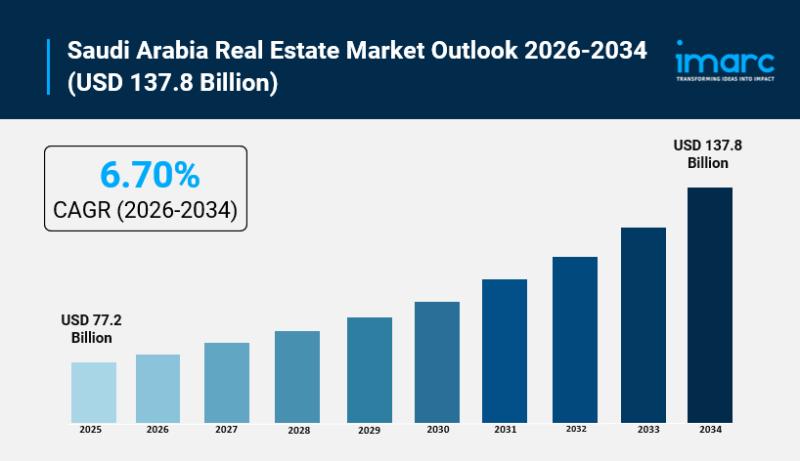

Saudi Arabia Real Estate Market OverviewMarket Size in 2025: USD 77.2 Billion

Market Forecast in 2034: USD 137.8 Billion

Market Growth Rate 2026-2034: 6.70%

According to IMARC Group's latest research publication, "Saudi Arabia Real Estate Market Size, Share, Trends and Forecast by Property Type, and Region, 2026-2034", the Saudi Arabia real estate market size was valued at USD 77.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 137.8 Billion by 2034, exhibiting a CAGR of 6.70% during 2026-2034.

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-real-estate-market/requestsample

How AI is Reshaping the Future of Saudi Arabia Real Estate Market

● AI-powered valuation platforms from the Real Estate General Authority are improving pricing accuracy by around 25%, cutting manual appraisal time and helping banks, brokers, and buyers close deals faster with more confidence.

● Digital rental and leasing tools such as the Ejar platform use AI and automated data checks to verify contracts, contributing to more than 8 million documented leases and sharply reducing disputes between landlords and tenants.

● In giga-projects like NEOM, AI is embedded into planning and building operations, using real-time sensor data to optimize energy consumption in smart buildings and trim operating costs while supporting Saudi sustainability goals.

● Proptech players are rolling out AI-driven search, recommendation, and virtual-tour engines, turning millions of listings and rental records into personalized suggestions that improve lead conversion and cut marketing waste for developers and agents.

● Saudi Arabia is building a national tokenization and AI-enabled property infrastructure, enabling fractional digital ownership, automated asset management, and always-on price discovery that opens real estate investing to a much wider investor base.

Saudi Arabia Real Estate Market Trends & Drivers:

One of the strongest forces behind Saudi Arabia's real estate upswing is the government's housing and urban-transformation push under Vision 2030, which is turning policy into very visible product on the ground. Programs like Sakani have already supported more than 1.4 million Saudi families with housing solutions, and recent updates show tens of thousands of new beneficiaries and handovers in a matter of months, backed by non‐refundable support packages of up to SAR 150,000 per household. Homeownership among Saudi families has climbed to roughly 64%, putting the country within striking distance of its 70% target and keeping residential demand resilient even as prices in prime districts edge higher. For developers and lenders, that creates a broad, stable demand base rather than a purely speculative cycle.

A second big growth engine is the rapid opening of the market to international capital and more sophisticated investment structures, which is reshaping everything from pricing to product design. The new real estate ownership law for non‐Saudis allows foreign individuals and entities to own and invest in designated zones across the Kingdom, with implementation expected to kick in after a short grace period and supported by a streamlined digital approval process measured in days, not months. On top of that, Premium Residency now ties long‐term status to residential assets starting around SAR 4 million, while transaction taxes have been cut from 10% to 5%, materially improving returns for serious buyers. Listed REITs and cross‐border deals in logistics parks, offices, and mixed‐use schemes are also deepening institutional participation, adding liquidity and transparency to what used to be a very locally held asset class.

The third major driver is the wave of giga‐projects and smart, sustainable city initiatives that are redefining what "prime" real estate looks like in Saudi Arabia. NEOM, the Red Sea destination, Qiddiya, Diriyah Gate, and other Vision 2030 flagships involve investments running into the hundreds of billions of dollars, with Qiddiya alone targeted to add thousands of housing units and tens of thousands of new jobs as its leisure and entertainment clusters ramp up. These projects are being built as fully integrated, tech‐enabled communities, with AI‐driven planning, digital land registries, and smart building systems that cut operating costs and energy use, aligning closely with the Saudi Green Initiative. For investors, that means high‐profile districts where tourism, entertainment, logistics, and residential demand stack on top of each other, creating durable rental streams and strong end‐user appetite for both luxury and mid‐market product.

Buy the Latest 2026 Edition: https://www.imarcgroup.com/checkout?id=16117&method=1315

Saudi Arabia Real Estate Industry Segmentation:

The report has segmented the market into the following categories:

Analysis by Property Type:

● Residential Real Estate

● Apartments

● Villas

● Others

● Commercial Real Estate

● Offices

● Retail

● Hospitality

● Others

Regional Insights:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Competitive Landscape:

● Abdul Latif Jameel

● Dar Ar Alkan

● Emaar

● Jabal Omar Development Company

● Jenan Real Estate Company

● Kingdom Holdings Company

● SEDCO Development (SEDCO Holding)

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=16117&flag=E

Recent News and Developments in Saudi Arabia Real Estate Market

● December 2025: Saudi regulators highlight a "new phase" of advanced digital governance and AI-enabled oversight, tightening rules while boosting transparency and investor confidence across the real estate sector.

● August 2025: Saudi Arabia approves a landmark foreign ownership law, allowing non-Saudis to buy property in designated zones, capping related fees at about 5% and expanding investment opportunities.

● July 2025: REGA confirms Ejar has documented over 8 million rental contracts, including 6.6 million residential agreements, signaling rapid adoption of digital leasing and stronger landlord-tenant protections.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Real Estate Market Outlook 2026-2034 Amid Vision 2030 Mega-Project Expansion here

News-ID: 4318356 • Views: …

More Releases from IMARC Group

United States Digital Pathology Market : Trends, Drivers, and Growth Opportuniti …

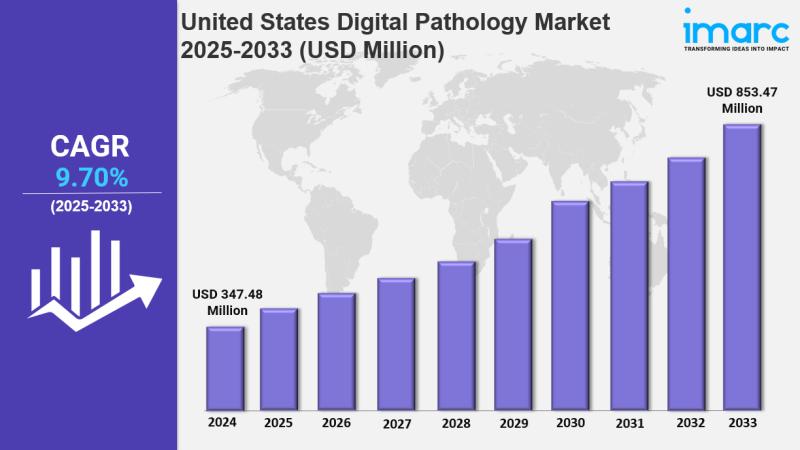

IMARC Group has recently released a new research study titled "United States Digital Pathology Market Size, Share, Trends and Forecast by Product, Type, Delivery Model, Application, End User, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The United States digital pathology market size was valued at USD 347.48 Million in 2024…

North America Flexible Packaging Market Share, Size, In-Depth Insights, Trends a …

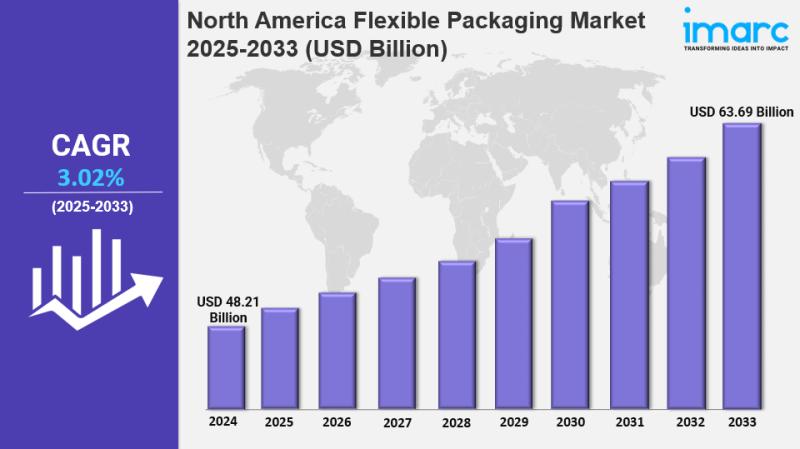

IMARC Group has recently released a new research study titled "North America Flexible Packaging Market Size, Share, Trends and Forecast by Product Type, Raw Material, Printing Technology, Application, and Country, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The North America flexible packaging market was valued at USD 48.21 Billion in 2024 and is…

Mexico Catheters Market Size, Growth, Latest Trends and Forecast 2026-2034

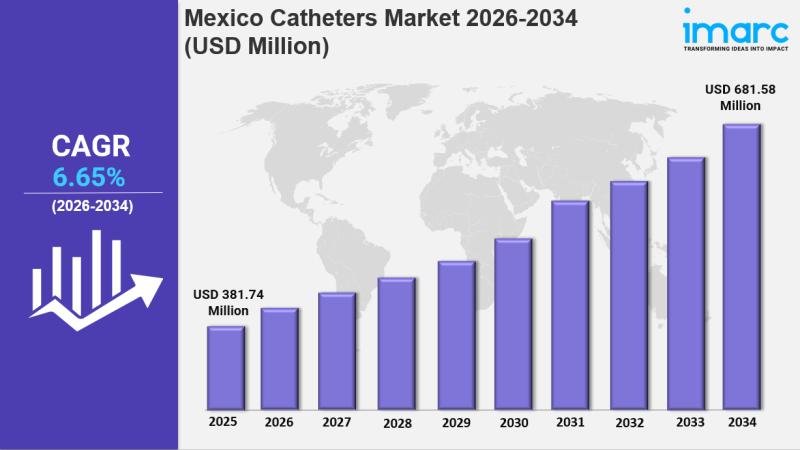

IMARC Group has recently released a new research study titled "Mexico Catheters Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2026-2034" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico catheters market size was valued at USD 381.74 Million in 2025 and is projected to reach USD 681.58…

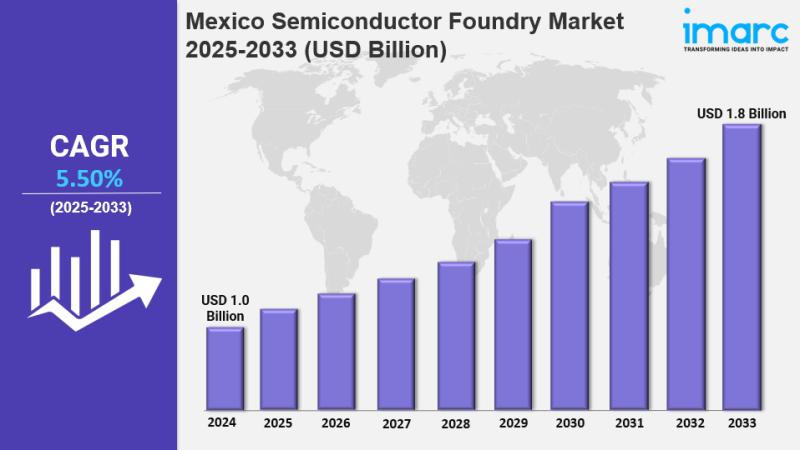

Mexico Semiconductor Foundry Market Size, Share, Latest Insights and Forecast 20 …

IMARC Group has recently released a new research study titled "Mexico Semiconductor Foundry Market Size, Share, Trends and Forecast by Technology Node, Foundry Type, Application, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico semiconductor foundry market size reached USD 1.0 Billion in 2024. It is projected to grow to USD…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…