Press release

Dark web price index: $30 for ID, $300 for a verified crypto account

On dark web marketplaces, identity has just been another commodity since the days of the infamous Silk Road, if not before. But a recent review of 25 easily accessible dark web markets and forums by analysts at AMLTRIX [https://amltrix.com], an open-source anti-money laundering framework, shows just how far this trade has expanded, and how easy and cheap it has become to attempt defeating the biometric algorithms used by major fintechs and traditional banks.Bypassing the Know Your Customer (KYC) process became the simple question of spending $30

Verification bypassing became industrialised. For roughly $30, criminals can purchase a "verified" existence: a high-resolution ID scan, a matching selfie, and a dossier of personal data. Although a lot of verification systems now require a live video with an ID or passport, such data can be fed into camera emulators that bypass at least some standard live checks.

"A full identity pack with ID scan and selfie is now cheap enough and accessible for criminals to buy in bulk, and if that is not enough, the dark web offers other, more reliable, although more expensive options," says AMLTRIX co-founder Gabrielius Erikas Bilkštys. "That reflects how often the same personal data is stolen and resold, and how industrialised this market has become."

Once online, the same identity can be used repeatedly to open bank accounts, crypto wallets, or payment app profiles, with the original victim often unaware until debt collectors or law enforcement become involved.

The consequences for victims extend beyond a damaged credit score. Because these "Full Identity Packages" are specifically used to build mule accounts for laundering, victims whose faces and IDs are sold may find themselves flagged not just by debt collectors, but by criminal investigators.

While a stolen credit card offers a one-time payout, a full identity package allows criminal syndicates to open mule accounts, laundering huge sums through a legitimate banking infrastructure before the fraud is detected. In its September 2025 report, UNODC notes that in organised fraud schemes, "bank accounts are commonly registered to fake, stolen, or borrowed identities".

Prices of identifying document sets are dictated by how rigorous the target country's banking compliance is. According to the analysis:

● US Profiles: $45 - $100.

● Polish/Danish Profiles: $30 - $40.

● UK Profiles: $30 - $35.

● Russian/French/Australian Profiles: $20 - $30.

Dark web marketplaces are also full of high-priced promises. Listings for physical documents such as an Irish passport for $2,500 or a UK "frequent traveller" passport for $2,600 suggest a trade in border-crossing capabilities.

However, analysts note that these high-ticket items are often "honey pots" or frauds targeting other criminals. This dynamic has forced the trade downstream, and the reliable trade has consolidated around low-cost digital goods.

The black market is no longer driven solely by one-off thefts, but by the demand for components used to build synthetic identities. When vendors list verified crypto accounts for $200 - $400, they are effectively selling an easy solution for money laundering.

The steep markup for a pre-verified account, jumping from $30 for raw data to $300 for a functioning crypto account, indicates a high failure rate for criminals attempting to do the verification themselves. Criminals are paying a premium to outsource the risk of getting caught by biometric filters, suggesting that while the "entry fee" for fraud has dropped, the technical barrier to success remains significant.

For organisations, one of the key misunderstandings is seeing the dark web as a completely separate world. "Many organisations still think of the dark web as a distant, exotic threat," says Gabrielius Erikas Bilkštys. "In reality, it is tightly connected to everyday phishing campaigns, large data breaches, account takeovers, and money laundering cases that compliance teams are already dealing with."

For financial institutions, simply collecting more documents or selfies is not enough. They need to assess how plausible those identities are over time, and to spot behavioural patterns that suggest accounts are being controlled by criminal networks rather than genuine customers.

As the barrier to entry for identity fraud drops, the defence can no longer rely on static documents. The challenge for 2025 is not just verifying who a customer is, but verifying that the person behind the screen isn't coming from the marketplaces of the dark web.

Methodology

Data collection was conducted over a five-day period from 28th November to 2nd December, 2025. Sources included a representative selection of prominent dark web marketplaces and forums, identified through a systematic review of major and easily accessible dark web directories and search engines. Selection was determined through a reputation-based verification process. Only marketplaces and forums explicitly indexed on major navigational directories and mentioned by positive feedback threads on independent discussion hubs were included. This method minimised the risk of including phishing sites or 'honey pots' in the dataset.

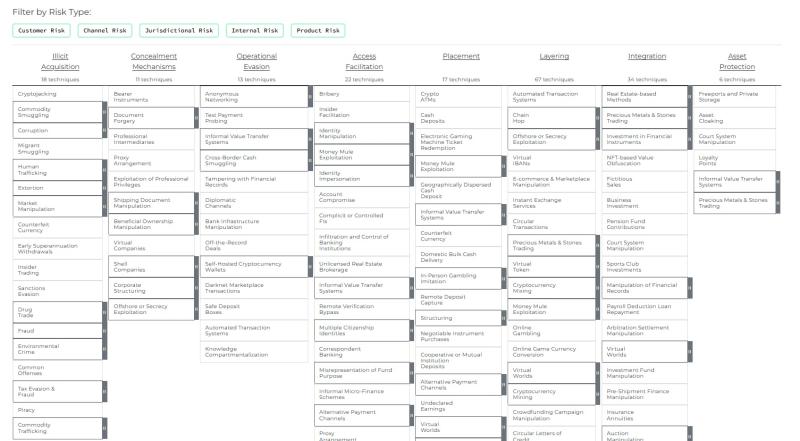

These activities fall under AMLTRIX's "Identity Impersonation" technique, part of the Access Facilitation tactic. This technique captures how adversaries leverage stolen or fabricated identities to open mule accounts, bypass onboarding controls, and create synthetic customers. For full details, see: T0140.001 - Identity Impersonation [https://framework.amltrix.com/techniques/T0140.001].

AMLTRIX

Žalgirio g. 90, LT-09303 Vilnius, Lithuania

Erik Murin

AMLTRIX PR consultant

Tel: +37063359035

Email: erik@amltrix.com

AMLTRIX was founded and created by enthusiasts from the regtech company AMLYZE. AMLTRIX is the world's first open-source knowledge initiative dedicated to standardising the fight against financial crime. It provides a structured, collaborative knowledge graph of money laundering tactics, techniques, and risk indicators. By creating a universal language for the AML/CFT community, AMLTRIX aims to enhance transparency, improve AI detection, and foster unprecedented collaboration among financial institutions, regulators, and technology providers to build a safer global financial system.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Dark web price index: $30 for ID, $300 for a verified crypto account here

News-ID: 4311126 • Views: …

More Releases from AMLTRIX

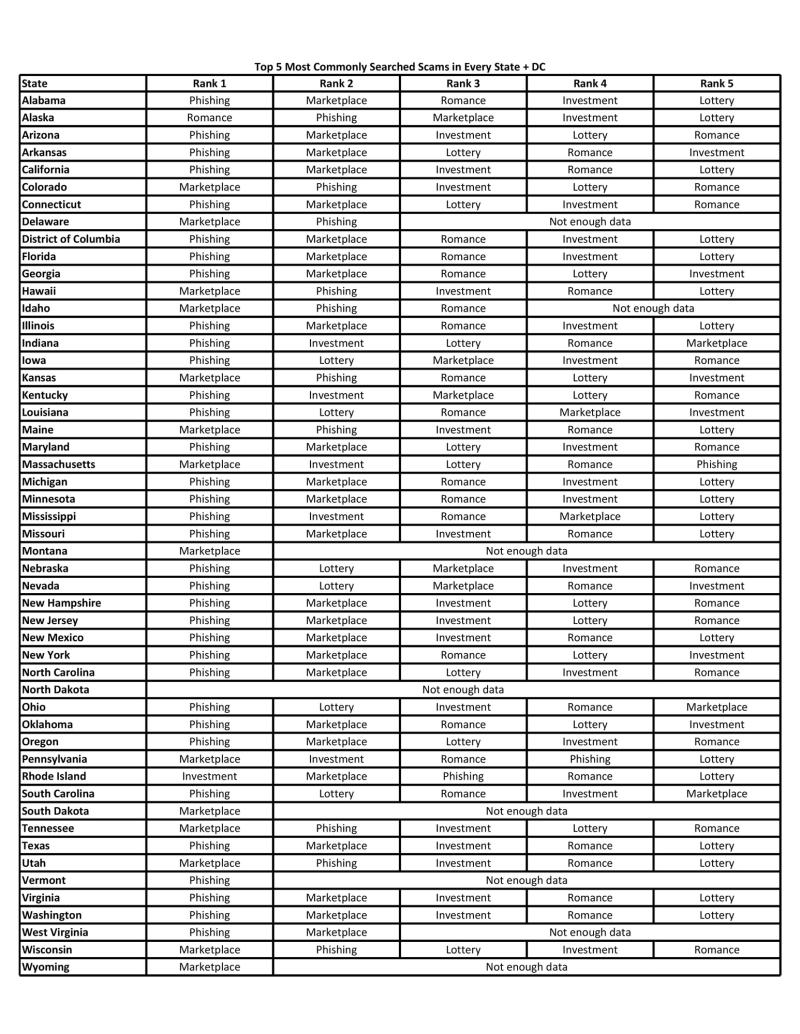

New Analysis Reveals America's Most Searched-For Frauds

● Phishing is the most commonly searched fraud nationally, with 34 jurisdictions reporting the highest number of inquiries about this type of fraud.

● Marketplace frauds follow, ranking as the top searched fraud in 14 states, showing significant search volume nationwide, with investment schemes in third place.

● At least 2.6 million people are defrauded every year in the US; however, this figure reflects only those who have actually reported incidents.

A new analysis of…

This new open-source 'periodic table of financial crime' could stop terrorists f …

A new open-source initiative, AMLTRIX, has been launched to create a universal standard in the global fight against money laundering, a criminal enterprise the United Nations estimates drains up to $2 trillion, or 5% of global GDP each year from the world's economy.

AMLTRIX has introduced the world's first open and free-to-access AML knowledge graph, currently defining over 250 adversarial techniques, over 1,950 defensive mappings, and more than 2,500 risk indicators…

More Releases for Profiles:

Vermouth Market Analysis, Key Company Profiles, Types

Vermouth Market: Growth

Drinks with low alcohol content are becoming more popular among adults and the millennial population worldwide as awareness of the various negative effects of alcohol consumption grows. The market for vermouth is being supported by this aspect. Additionally, a rise in the number of bars and eateries across many developed and developing countries worldwide is anticipated to fuel the global vermouth market's sales growth during the forecast period.

Among…

Morocco Life Insurance Market Report-Key Company Profiles, Types, Applications | …

Morocco Life Insurance Market Report study provides detailed information to understand the imperative market parts that align with the business decision related to raw materials, demand, and production capacity. In addition, Morocco Life Insurance Market analysis provides demands for the future, besides the available opportunities for the individuals. This helps manufacturers and clients understand the past trends and analyze the future trend.

Get FREE PDF Sample of the Report @ https://www.reportsnreports.com/contacts/requestsample.aspx?name=4763416

Morocco…

Photoinitiators Market Company Profiles, Financial Perspective 2026

"

Photoinitiators Market Trends, Size, Shares, Growth, Top Companies, Development, Application, Importance, Overview with Detailed Analysis, Production, Supply, Revenue, Regional Outlook, Status, Competitive Landscape, Future Forecast, Type and End-User, Opportunity, Demand, Historical Data, Business Insights, Research Methodology and many more...

Due to the pandemic, we have included a special section on the Impact of COVID 19 on the Photoinitiators Market which would mention How the Covid-19 is Affecting the Photoinitiators Industry, Market…

Introducing Company Profiles

Introducing ‘Company Profiles’. Company profiles is part of our Business Solutions for Startups.

Company profiles allow you to search companies that you are interested in and get latest industry news.

You can explore a high-level summary of the company including information like industry, team size, website, social, blog, RSS links and more.

You get access to their internet and social media growth stats with our proprietary growth score to assess the companies progress.

By…

Biggest profiles lose interactions on Twitter

The social media analytics provider quintly published a Twitter study analyzing 30,000 Twitter profiles during the first half of 2016. The analytics company reveals changes that are relevant for businesses which market on the micro-blogging service. While interactions for the biggest profiles analyzed dropped by 58% comparing H1 of 2015 with the present year, smaller profiles tend to receive more interactions than they used to.

"The different aspects analyzed such as…

Viraj Profiles Ltd - investing in excellence

Viraj Profiles Ltd: investing in excellence

Viraj Profiles Ltd. is one of the largest manufacturers and exporters of stainless steel engineering products in India, manufacturing over 50,000 items across various product verticals. This variety enables the company to operate as one-stop solution provider for stainless steel engineering products. With over 90 approvals and certifications across various global norms, the company has a keen focus on quality and supplies to some…