Press release

New Analysis Reveals America's Most Searched-For Frauds

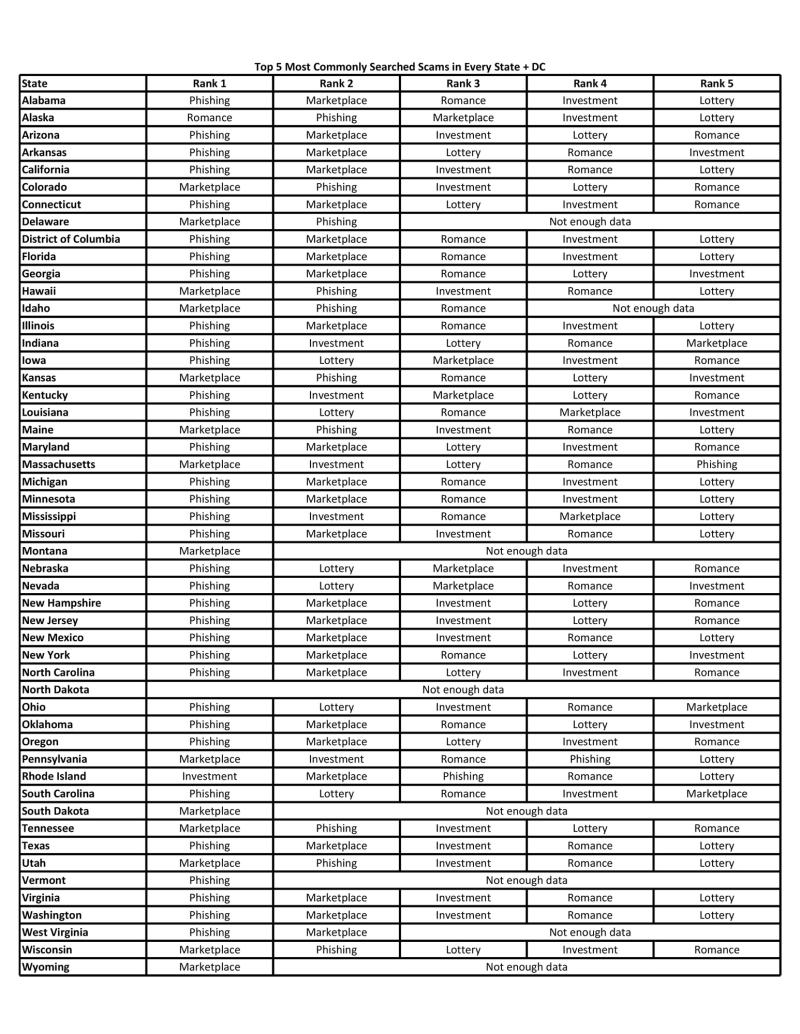

● Phishing is the most commonly searched fraud nationally, with 34 jurisdictions reporting the highest number of inquiries about this type of fraud.● Marketplace frauds follow, ranking as the top searched fraud in 14 states, showing significant search volume nationwide, with investment schemes in third place.

● At least 2.6 million people are defrauded every year in the US; however, this figure reflects only those who have actually reported incidents.

A new analysis of internet search data reveals the most worrying digital threats in each state, with phishing fraud schemes being the most commonly researched across the nation, topping the list in 34 out of 50 jurisdictions (33 states and DC).

Gabrielius Erikas Bilkštys, Anti-Money Laundering (AML) specialist and founder of AMLTRIX [https://amltrix.com], an open-source financial crime knowledge graph, analyzed the FTC's figures. The analysis revealed that at least 2.6 million Americans are getting defrauded every year, with distinct patterns across different regions and demographics. The research discovered the most commonly looked up fraud schemes in each state (and DC) by analyzing key search terms.

The data found that phishing schemes were the most frequently searched in the US, ranking as the top concern in 34 jurisdictions. It's a type of cyberattack where criminals impersonate legitimate organizations such as banks and trick people into providing sensitive data like credit card information, banking details, and passwords. Americans look up this kind of fraud on average 24,100 times every month or over 289,000 times per year.

Marketplace fraud is the second most usual threat. Specifically, Facebook marketplace fraud is searched for the most often, on average, 7,300 times per month or 87,600 yearly. E-commerce schemes are incredibly common because so much shopping has moved online. Criminals create fake storefronts or use real marketplaces to list items that never arrive.

The third most searched threat in America is the investment fraud, with around 5,250 national searches every month. It is also ranked as the top concern in the state of Rhode Island. It is one of the oldest types of schemes that includes common examples such as Ponzi and pyramid schemes, where people are offered high returns based on misleading information, but later, the money simply disappears. Nowadays, these schemes often involve cryptocurrency or real estate.

Romance frauds are the fourth most frequent, ranking as the top concern in Alaska. These schemes are checked out by Americans approximately 3,900 times every month. In these schemes, fraudsters often entice victims with fake investment opportunities in oil rigs or cryptocurrency.

Romance frauds are particularly cruel because they build a fake relationship, sometimes lasting months, just to steal money or recruit the victim as a 'money mule' to move illegal funds.

Finally, the fifth most commonly searched fraud in America is the lottery fraud. The catch is you have to pay a fee to unlock the prize or inheritance, which of course never exists. While searched over 510 times monthly nationally, these frauds appear to be decreasing in frequency as public awareness grows.

Gabrielius Erikas Bilkštys, AML expert and founder of AMLTRIX, commented on the findings, "Phishing and marketplace frauds are common because they are easy. However, it's clear that romance schemes will become more frequent with the evolution of AI, opening many new opportunities for fraudsters. Catching the criminals will fall more on the shoulders of banks, fintechs, and law enforcement agencies worldwide. While these frauds may seem small on their own, they feed a massive river of criminal money that must be laundered. If we can prevent money laundering, it will prevent a lot of frauds, and vice versa."

What Consumers Can Do:

● Be Safe Online: Check reviews and the website's domain age before buying or investing, and use payment methods that offer buyer protection.

● Do Your Research. If you're investing, make sure you choose a reliable broker or partner with many positive online reviews.

● Protect Your Bank Account: Never agree to receive or send money for someone you've only met online, and never share your bank details with them.

Consumers who believe they have been targeted by a fraudster should report it to the Federal Trade Commission (FTC) and their local state Attorney General's office.

Sources: Google Keyword Planner and Ahrefs via AMLTRIX.

Methodology: The data compiled by AMLTRIX analyzed numerous search terms related to various popular fraud schemes across every US state during the period October 2024 - October 2025, to establish the frauds that Americans look up most often.

If you use these insights, please credit https://amltrix.com or htpps://framework.amltrix.com.

AMLTRIX

Žalgirio g. 90, LT-09303 Vilnius, Lithuania

Erik Murin

AMLTRIX PR consultant

Tel: +37063359035

Email: erik@amltrix.com

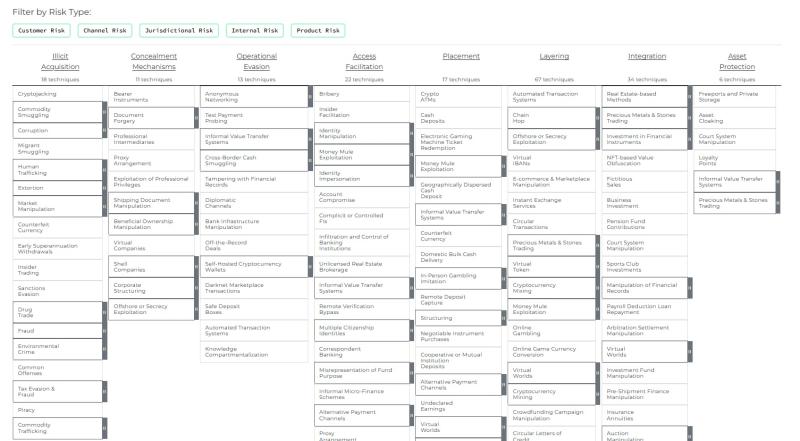

AMLTRIX was founded and created by enthusiasts from the regtech company AMLYZE. AMLTRIX is the world's first open-source knowledge initiative dedicated to standardising the fight against financial crime. It provides a structured, collaborative knowledge graph of money laundering tactics, techniques, and risk indicators. By creating a universal language for the AML/CFT community, AMLTRIX aims to enhance transparency, improve AI detection, and foster unprecedented collaboration among financial institutions, regulators, and technology providers to build a safer global financial system.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release New Analysis Reveals America's Most Searched-For Frauds here

News-ID: 4260770 • Views: …

More Releases from AMLTRIX

Dark web price index: $30 for ID, $300 for a verified crypto account

On dark web marketplaces, identity has just been another commodity since the days of the infamous Silk Road, if not before. But a recent review of 25 easily accessible dark web markets and forums by analysts at AMLTRIX [https://amltrix.com], an open-source anti-money laundering framework, shows just how far this trade has expanded, and how easy and cheap it has become to attempt defeating the biometric algorithms used by major fintechs…

This new open-source 'periodic table of financial crime' could stop terrorists f …

A new open-source initiative, AMLTRIX, has been launched to create a universal standard in the global fight against money laundering, a criminal enterprise the United Nations estimates drains up to $2 trillion, or 5% of global GDP each year from the world's economy.

AMLTRIX has introduced the world's first open and free-to-access AML knowledge graph, currently defining over 250 adversarial techniques, over 1,950 defensive mappings, and more than 2,500 risk indicators…

More Releases for AML

Xepeng Emphasizes AML Screening in Platform Security

Platform details AML measures, including counterparty checks, to support secure conversions for merchants.

Denpasar, Bali, Indonesia, 30th Dec 2025 -- As digital value conversion systems evolve, enterprises like Xepeng recognize that robust anti-money laundering (AML) practices are essential to maintaining trust, safeguarding merchants, and aligning with regulatory expectations. AML encompasses a set of policies and practices intended to prevent, detect, and respond to financial activity that may be linked to illicit…

Top Trends Transforming the Hemato Oncology Testing Market Landscape in 2025: Ne …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

What Will the Hemato Oncology Testing Industry Market Size Be by 2025?

There has been a swift expansion in the hemato oncology testing market in the past few years. The market, which was valued at $3.5 billion in 2024, is predicted to surge to $3.96 billion in 2025, reflecting…

AML BitCoin Founder Asks President Trump to release their AML BITCOIN Classified …

The DOJ and the FBI should practice tough love while also providing financial incentives for government employees that uphold the constitution and obey the law. AG Bondi and Director Patel should ask President Trump for access to some of the billions of dollars that DOGE has saved us and utilize it for pay raises. Their employees need to be taken care of financially, or their hardships will make them the…

Anti-Money Laundering (AML) Software Market Is Booming So Rapidly with Thomson R …

The Latest published market study on Global Anti-Money Laundering (AML) Software Market provides an overview of the current market dynamics in the Anti-Money Laundering (AML) Software space, as well as what our survey respondents all outsourcing decision-makers predict the market will look like in 2032. The study breaks the market by revenue and volume (wherever applicable) and price history to estimate the size and trend analysis and identify gaps and…

Global Anti Money Laundering (AML) Software Market Size, Share and Forecast By K …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- According to the Market Research Intellect, the global Anti Money Laundering (AML) Software market is projected to grow at a robust compound annual growth rate (CAGR) of 14.78% from 2024 to 2031. Starting with a valuation of 7.83 Billion in 2024, the market is expected to reach approximately 17.9 Billion by 2031, driven by factors such as Anti Money Laundering (AML) Software and Anti Money Laundering (AML)…

What is AML Verification? A Detailed Guide

With the rise of cryptocurrencies and the increasing adoption of digital assets, regulatory frameworks have become a critical component for ensuring that the cryptocurrency space remains secure and compliant. One of the most important elements in this regulatory framework is AML verification, which stands for Anti-Money Laundering.

Image: https://revbit.net/wp-content/uploads/2024/10/aml-in-crypto-3-1024x640.png

What is AML Verification?

AML (Anti-Money Laundering) verification [https://revbit.net/] refers to a set of procedures and regulations designed to prevent illegal activities such as…