Press release

Saudi Arabia Consumer Credit Market Is Expected to Reach USD 154.9 Million by 2034, Grow at a CAGR Of 3.27%

Saudi Arabia Consumer Credit Market OverviewMarket Size in 2025: USD 116.0 Million

Market Size in 2034: USD 154.9 Million

Market Growth Rate 2026-2034: 3.27%

According to IMARC Group's latest research publication, "Saudi Arabia Consumer Credit Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia consumer credit market size was valued at USD 116.0 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 154.9 Million by 2034, exhibiting a CAGR of 3.27% during 2026-2034.

How AI is Reshaping the Future of Saudi Arabia Consumer Credit Market

● AI-powered credit scoring models transform lending decisions in Saudi Arabia, utilizing alternative data points like transaction history and spending patterns to evaluate creditworthiness beyond traditional metrics.

● Machine learning algorithms enhance fraud detection systems across consumer credit platforms, identifying suspicious activities and protecting both lenders and borrowers from financial crimes in real-time.

● Intelligent chatbots streamline customer service operations for credit providers, offering instant loan application assistance and personalized financial guidance through mobile applications accessible across the Kingdom.

● Predictive analytics optimize credit risk assessment processes, enabling financial institutions to forecast repayment behaviors and adjust lending strategies for improved portfolio performance.

● AI-driven personalization engines deliver tailored credit product recommendations to Saudi consumers, matching individual financial profiles with suitable loan options and repayment structures.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-consumer-credit-market/requestsample

How Vision 2030 is Transforming Saudi Arabia Consumer Credit Industry

Saudi Arabia's Vision 2030 is revolutionizing the consumer credit industry by prioritizing financial inclusion, digital transformation, and regulatory innovation across the Kingdom's lending landscape. The initiative drives unprecedented growth in fintech adoption through the Saudi Central Bank's progressive licensing framework, which aims to increase fintech companies substantially while fostering competition and strengthening the financial sector. With the Financial Sector Development Program promoting digital payment adoption and targeting a cashless economy, consumer credit services are becoming increasingly accessible through mobile wallets, BNPL platforms, and embedded finance solutions. The government's housing initiatives and support for first-time homebuyers are making mortgage products more accessible, while regulatory reforms are enabling alternative credit scoring models that serve previously underbanked populations. Strategic initiatives like Fintech Saudi, launched by SAMA, are driving innovation and supporting fintech startups through accelerator programs, ecosystem directories, and job portals that collectively help entrepreneurs navigate the evolving landscape. The expansion of digital infrastructure, open banking frameworks, and API-driven platforms are enabling seamless integrations between traditional banks and fintech innovators. Ultimately, Vision 2030 elevates consumer credit as a cornerstone of economic diversification, supporting homeownership aspirations, entrepreneurial growth, and the development of a digitally-driven financial ecosystem that empowers both consumers and merchants while transforming the future of financial services.

Saudi Arabia Consumer Credit Market Trends & Drivers:

Saudi Arabia's consumer credit market is experiencing robust expansion driven by the rising need for financial support to purchase homes and vehicles, along with the increasing shift towards digital purchases that is encouraging financial institutions and fintech companies to offer more credit-based services. With the population steadily increasing, there is a high need for personal mobility and residential space, encouraging people to explore loan options that ease large purchases. Many individuals, especially young professionals and families, are turning to credit to fulfill lifestyle aspirations like owning a car or buying a home sooner. The government's housing initiatives and support for first-time homebuyers is positively influencing the market, making mortgage products more accessible, while auto loans are becoming more attractive as people look to upgrade their vehicles or move from public transport to personal cars for convenience.

The expansion of e-commerce portals is offering a favorable market outlook, with more people turning to online shopping for convenience and variety. Internet users engaging in e-commerce activities have grown substantially, marking significant increases in digital purchasing behavior. With the growing number of digital platforms offering everything from electronics to groceries, people are looking for flexible payment options to manage their spending more comfortably. This increasing shift towards digital purchases is motivating financial institutions and fintech companies to provide more credit-based services like buy now, pay later schemes, digital credit cards, and easy installment plans. As individuals get more comfortable with online payments and trust in digital transactions continues to grow, there is a rising demand for seamless credit facilities that can be accessed instantly during the checkout process.

Saudi Arabia Consumer Credit Industry Segmentation:

The report has segmented the market into the following categories:

Credit Type Insights:

● Revolving Credits

● Non-revolving Credits

Service Type Insights:

● Credit Services

● Software and IT Support Services

Issuer Insights:

● Banks and Finance Companies

● Credit Unions

● Others

Payment Method Insights:

● Direct Deposit

● Debit Card

● Others

Breakup by Region:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Buy the Latest 2026 Edition: https://www.imarcgroup.com/checkout?id=31955&method=1315

Recent News and Developments in Saudi Arabia Consumer Credit Market

● October 2025: Saudi Arabia's embedded finance sector witnessed intensifying competition in payments, BNPL, and API sectors, with non-banks becoming significant financial access points and platforms leading user engagement, making embedded offerings easier to scale compared to standalone products.

● July 2025: Saudi Arabia's fintech regulatory framework continued evolving, with the Saudi Central Bank overseeing digital consumer microfinance, payment service providers, BNPL services, debt-based crowdfunding, and intelligent cash management, ensuring financial services remain secure and transparent.

● March 2025: The Saudi Central Bank issued a license to Tamara Finance, allowing the firm to offer consumer financing and BNPL services within the Kingdom, fostering the development of the financial services sector while providing a safe and regulated space for consumers.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Consumer Credit Market Is Expected to Reach USD 154.9 Million by 2034, Grow at a CAGR Of 3.27% here

News-ID: 4306473 • Views: …

More Releases from IMARC Group

Waste-to-Energy Plant DPR & Unit Setup - 2026: Demand Analysis and Project Cost

Setting up a Waste-to-Energy Plant positions investors in one of the most stable and essential segments of the renewable energy and waste management value chain, backed by sustained global growth driven by rising municipal solid waste generation, sustainable waste management requirements, increasing demand for renewable energy sources, and the dual-benefit advantages of waste reduction with energy production. As urbanization accelerates, waste volumes escalate toward 3.40 billion tons globally by 2050,…

Vegetable Oil Processing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/Op …

Setting up a vegetable oil processing plant positions investors in one of the most stable and essential segments of the food and agro-processing value chain, backed by sustained global growth driven by rising population, increasing consumption of edible oils, growth in packaged food demand, and expanding applications across food, personal care, and industrial sectors. As urbanization accelerates, consumer lifestyles shift toward convenience and packaged foods, and regulatory frameworks increasingly support…

Trinitrotoluene Production Plant DPR & Unit Setup 2026: Demand Analysis and Proj …

Setting up a trinitrotoluene production plant involves strategic planning, substantial capital investment, and a comprehensive understanding of production technologies. This critical explosive compound serves military and defense, mining and quarrying, construction and demolition, and industrial explosives manufacturing applications. Success requires careful site selection, efficient nitration processes, stringent safety protocols for handling hazardous materials, reliable raw material sourcing, and compliance with industrial safety regulations to ensure profitable and sustainable operations.

Market Overview…

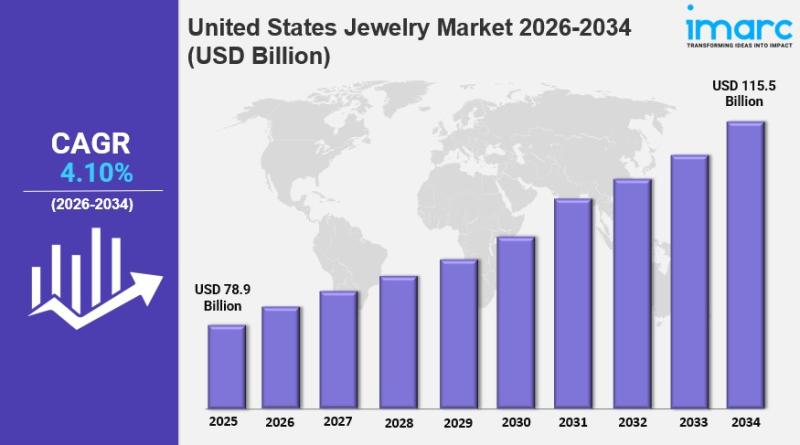

United States Jewelry Market Size, Share, Industry Overview, Growth and Forecast …

IMARC Group has recently released a new research study titled "United States Jewelry Market Report by Product (Necklace, Ring, Earrings, Bracelet, and Others), Material (Gold, Platinum, Diamond, and Others), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Jewelry Market Overview

The United States jewelry market size reached USD 78.9 Billion in 2025.…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…