Press release

Waste-to-Energy Plant DPR & Unit Setup - 2026: Demand Analysis and Project Cost

Setting up a Waste-to-Energy Plant positions investors in one of the most stable and essential segments of the renewable energy and waste management value chain, backed by sustained global growth driven by rising municipal solid waste generation, sustainable waste management requirements, increasing demand for renewable energy sources, and the dual-benefit advantages of waste reduction with energy production. As urbanization accelerates, waste volumes escalate toward 3.40 billion tons globally by 2050, and regulatory frameworks increasingly mandate landfill reduction and renewable energy adoption, the global waste-to-energy industry continues to present compelling opportunities for manufacturers and entrepreneurs seeking long-term profitability in a high-demand sector.Market Overview and Growth Potential:

The global waste-to-energy market demonstrates robust growth trajectory, valued at USD 48.77 Billion in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach USD 76.30 Billion by 2034, exhibiting a CAGR of 5.1% from 2026-2034. This sustained expansion is driven by global efforts to decrease landfills, address rising urban waste, produce renewable energy, and respond to environmental issues coupled with rising need for sustainable waste management practices.

Waste-to-energy can be defined as the utilization of municipal solid waste to produce various forms of energy, such as electricity, heat, or biofuels. This is achieved through various processes, including incineration, gasification, pyrolysis, or anaerobic digestion. The main aim of waste-to-energy is waste reduction and energy production. The method entails the burning of chemicals and processing of waste materials to produce energy, hence providing an alternative to the traditional fossil fuel-based energy sources. Waste-to-energy methods can be regarded as environmentally sustainable if proper emission control and efficient energy recovery methods are utilized.

The waste-to-energy market is driven by the global requirement for sustainable waste management practices and the increasing demand for renewable energy resources. According to the World Bank, the global production of municipal solid waste is around 2.01 billion tons per annum and is expected to reach 3.40 billion tons by 2050. The increasing amount of waste indicates the requirement for sustainable waste management practices; hence, waste-to-energy is a vital solution for the management of increasing amounts of waste production. The increasing requirement for sustainable waste management practices, as well as the growing need for the reduction of greenhouse gas emissions and the prevention of climate change, is also propelling the growth of the waste-to-energy market. Moreover, the sector's ability to provide dual benefits of waste reduction and energy generation is positioning it as a key player in sustainable development.

Request for Sample Report: https://www.imarcgroup.com/waste-to-energy-plant-project-report/requestsample

Plant Capacity and Production Scale:

The proposed waste-to-energy facility is designed with an annual production capacity ranging between 100-1,000 TPD (tonnes per day), enabling economies of scale while maintaining operational flexibility. This capacity range allows producers to serve diverse market segments across power generation, waste management, industrial applications, and residential & commercial sectors-ensuring steady demand and consistent revenue streams driven by expanding urbanization, growing waste generation rates, increasing renewable energy adoption, and rising requirements for sustainable waste disposal solutions that simultaneously reduce landfill dependency and generate clean energy for grid supply, district heating systems, biofuel production, and industrial steam applications.

Financial Viability and Profitability Analysis:

The waste-to-energy business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

• Gross Profit Margins: 25-40%

• Net Profit Margins: 10-25%

These margins are supported by stable demand across power generation, waste management, industrial, and residential & commercial sectors, value-added processing through advanced energy conversion technologies, and the critical importance of waste-to-energy solutions addressing both environmental challenges and energy security requirements. The project demonstrates strong return on investment (ROI) potential with comprehensive financial analysis covering income projections, expenditure projections, break-even points, net present value (NPV), internal rate of return, and detailed profitability analysis, making it an attractive proposition for both new renewable energy entrepreneurs and established waste management operators diversifying into energy generation segments.

Cost of Setting Up a Waste-to-Energy Plant:

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a waste-to-energy plant is primarily driven by:

Operating Cost Structure:

The cost structure for a waste-to-energy plant is primarily driven by:

• Raw Materials: 20-30% of total OpEx

• Utilities: 15-25% of OpEx

• Other Expenses: Including labor, packaging, transportation, maintenance, depreciation, and taxes

Raw materials constitute approximately 20-30% of operating costs, with municipal solid waste (MSW) serving as the primary feedstock, along with auxiliary fuel (if needed) for process support. Utilities represent 15-25% of OpEx, covering electricity for plant operations, water for cooling systems, and steam for processing requirements. In the first year of operations, operating costs are projected to be significant, covering raw materials, utilities, depreciation, taxes, packing, transportation, and repairs and maintenance. By the fifth year, total operational cost is expected to increase substantially due to inflation, market fluctuations, and potential rises in key material costs. Long-term contracts with reliable municipal waste suppliers help ensure consistent material supply and operational stability. Additional factors including supply chain disruptions, rising demand, and shifts in the global economy are expected to contribute to cost increases. Optimizing processes and providing staff training can help control these operational costs.

Capital Investment Requirements:

Setting up a waste-to-energy plant requires substantial capital investment across several critical categories. The total capital investment depends on plant capacity, technology, and location, covering land acquisition, site preparation, and necessary infrastructure.

Land and Site Development: Selection of an optimal location with strategic proximity to municipal solid waste sources and energy distribution networks is essential to minimize waste transportation costs and maximize energy delivery efficiency. The location must offer easy access to key raw materials such as municipal solid waste (MSW) and auxiliary fuel (if needed). The site must have robust infrastructure, including reliable transportation networks, utilities, and waste management systems. Compliance with local zoning laws and environmental regulations must be ensured. The cost of land and site development, including charges for land registration, boundary development, and other related expenses, forms a substantial part of the overall investment, ensuring a solid foundation for safe and efficient plant operations.

Machinery and Equipment: Machinery costs account for the largest portion of the total capital expenditure. High-quality, corrosion-resistant machinery tailored for waste-to-energy production must be selected. Essential equipment includes:

• Incinerators for waste combustion

• Gasification units for syngas production

• Pyrolysis units for thermal decomposition

• Anaerobic digesters for biogas generation

• Energy recovery systems for electricity/heat generation

• Emission control systems for environmental compliance

All machinery must comply with industry standards for safety, efficiency, and reliability. The scale of production and automation level will determine the total cost of machinery.

Civil Works: Building construction and factory layout optimization designed to enhance workflow efficiency, ensure workplace safety, and minimize material handling complexities. The layout should be optimized with separate areas for raw material storage, production, quality control, and finished goods storage. Space for future expansion should be incorporated to accommodate business growth.

Other Capital Costs: Costs associated with land acquisition, construction, and utilities including electricity, water, and steam must be considered in the financial plan. Pre-operative expenses, machinery installation costs, environmental clearances, regulatory approvals, initial working capital requirements, and contingency provisions for unforeseen circumstances during plant establishment.

Buy Now: https://www.imarcgroup.com/checkout?id=39365&method=2175

Major Applications and Market Segments:

Waste-to-energy production outputs serve extensive applications across diverse sectors:

Power Generation: Waste-to-energy plants are usually linked to a country or region's power grid, where electricity is produced using steam turbines driven by the heat generated from the combustion of waste. This helps to decrease the use of coal and other fossil fuels for energy production.

Waste Management: Waste-to-energy is an important component in the reduction of the amount of waste that is directed to landfills, thus helping to achieve the zero-waste strategy. The energy recovery component makes waste-to-energy a sustainable waste management strategy for cities.

Industrial Applications: Waste-to-energy is an alternative source of energy for industries that consume large amounts of steam or heat. The paper, cement, and textile industries can benefit from the use of energy from waste.

Biofuels Production: Organic waste can be turned into biofuels through anaerobic digestion and pyrolysis processes, which are then used as alternative renewable energy sources for transportation and other energy demands.

The production process involves collection & sorting of waste, energy conversion through gasification or pyrolysis, energy generation, and emission control. Applications span electricity production, district heating, biofuels, and industrial steam across diverse sectors.

Why Invest in Waste-to-Energy Manufacturing?

Several compelling factors make waste-to-energy production an attractive investment opportunity:

Environmental Impact Reduction: Waste-to-energy is a solution for both waste and energy, thereby solving the problem of waste disposal and generating clean energy. This will minimize the use of landfills and incineration without energy recovery.

Sustainability and Renewable Energy Generation: Waste-to-energy is an integral part of the renewable energy shift, as it is a reliable source of energy. Unlike solar or wind energy, it is not affected by weather conditions, making it a stable source of baseload power.

Government Incentives and Regulations: Governments worldwide are increasingly requiring waste reduction, recycling, and the production of renewable energy. Waste-to-energy can help achieve environmental objectives while taking advantage of incentives such as tax credits, subsidies, and emissions trading.

Increasing Urban Waste: With the growing global population, urban waste is rising at a very fast pace. According to the World Bank, global municipal solid waste production is around 2.01 billion tons per annum and is expected to reach 3.40 billion tons by 2050. Waste-to-energy is an efficient method for handling this waste while producing energy and minimizing environmental problems.

Diversification in Energy Production: Waste-to-energy diversifies the energy portfolio, thereby assisting nations in reducing their reliance on fossil fuels and achieving energy security.

Manufacturing Process Excellence:

The waste-to-energy manufacturing process is a multi-step operation involving several unit operations, material handling, and quality checks. The process involves collection & sorting of waste, energy conversion (gasification/pyrolysis), energy generation, and emission control. The main production steps include:

• Collection and sorting of municipal solid waste

• Waste preprocessing and size reduction

• Energy conversion through incineration, gasification, pyrolysis, or anaerobic digestion

• Heat recovery and steam generation

• Electricity generation through steam turbines

• Emission control and air quality management

• Ash handling and residue management

• Quality testing and environmental monitoring

The complete process flow encompasses unit operations involved, mass balance and raw material requirements, rigorous quality assurance criteria, and technical tests throughout production. Safety protocols must be implemented throughout the manufacturing process, with advanced monitoring systems installed to detect leaks or deviations. Effluent treatment systems are necessary to minimize environmental impact and ensure compliance with emission standards. A comprehensive quality control system should be established using analytical instruments to monitor product concentration, purity, and stability. Documentation for traceability and regulatory compliance must be maintained.

Speak to an Analyst for Customized Report: https://www.imarcgroup.com/request?type=report&id=39365&flag=C

Industry Leadership:

The global waste-to-energy industry features established producers with extensive production capabilities and diverse application portfolios. Key industry players include:

• Veolia

• Huawei Enterprise

• China Everbright Limited

• Wheelabrator Technologies Inc.

• SUEZ

• Covanta

These companies serve diverse end-use sectors including power generation, waste management, industrial, and residential & commercial applications, demonstrating the broad market applicability of waste-to-energy solutions across global energy and environmental management markets.

Recent Industry Developments:

December 2025: Mitsubishi Heavy Industries Environmental & Chemical Engineering Co. (MHIEC) signed a contract to supply key equipment for a waste-to-energy plant in Taichung City, Taiwan. MHIEC will provide the facility's core technologies, including incineration systems and energy recovery boilers. The project aligns with Taiwan's commitment to reducing landfill waste and advancing sustainable energy solutions.

July 2025: Vanya Steels invested INR 100 crore to set up a 10 MW waste-to-energy plant at its Koppal facility in Karnataka, India. The plant will use waste heat recovery boiler (WHRB) technology to convert industrial waste heat into clean electricity. This initiative will help reduce dependence on grid electricity, lower operational costs, and cut carbon emissions.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Waste-to-Energy Plant DPR & Unit Setup - 2026: Demand Analysis and Project Cost here

News-ID: 4399101 • Views: …

More Releases from IMARC Group

Vegetable Oil Processing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/Op …

Setting up a vegetable oil processing plant positions investors in one of the most stable and essential segments of the food and agro-processing value chain, backed by sustained global growth driven by rising population, increasing consumption of edible oils, growth in packaged food demand, and expanding applications across food, personal care, and industrial sectors. As urbanization accelerates, consumer lifestyles shift toward convenience and packaged foods, and regulatory frameworks increasingly support…

Trinitrotoluene Production Plant DPR & Unit Setup 2026: Demand Analysis and Proj …

Setting up a trinitrotoluene production plant involves strategic planning, substantial capital investment, and a comprehensive understanding of production technologies. This critical explosive compound serves military and defense, mining and quarrying, construction and demolition, and industrial explosives manufacturing applications. Success requires careful site selection, efficient nitration processes, stringent safety protocols for handling hazardous materials, reliable raw material sourcing, and compliance with industrial safety regulations to ensure profitable and sustainable operations.

Market Overview…

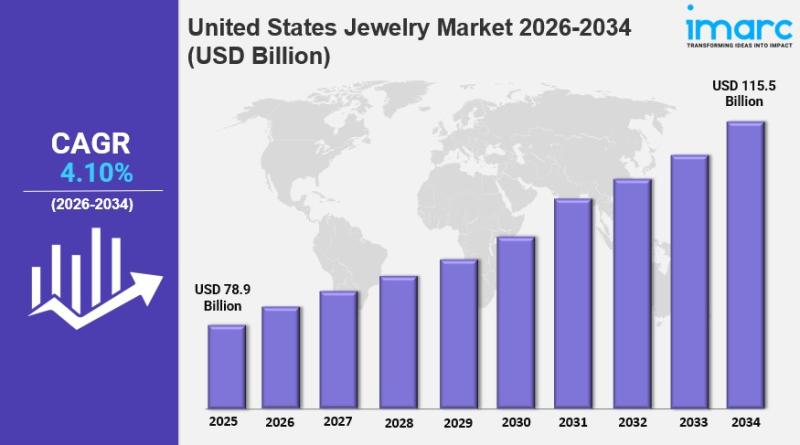

United States Jewelry Market Size, Share, Industry Overview, Growth and Forecast …

IMARC Group has recently released a new research study titled "United States Jewelry Market Report by Product (Necklace, Ring, Earrings, Bracelet, and Others), Material (Gold, Platinum, Diamond, and Others), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Jewelry Market Overview

The United States jewelry market size reached USD 78.9 Billion in 2025.…

United States Air Freight Market Size, Share, Industry Trends, Growth and Foreca …

IMARC Group has recently released a new research study titled "United States Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Air Freight Market Overview

The United States air freight market size was valued at USD 64.06 Billion in 2025.…

More Releases for Waste

Waste King Women's Perspectives on Waste Management

While working in waste management may be, traditionally, considered a role for men, a growing proportion - currently some 27% - of the UK's waste management workforce are female.

According to the international network of waste professionals and experts, The International Solid Waste Association (ISWA), "Women make a strong contribution to the waste management sector. Women are out there but are just not very visible."

The ISWA adds, "But women…

Global Solid Waste Management Market By Waste Type: Industrial Waste, Municipal …

According to the latest research by SkyQuest Technology, the Global Solid Waste Management Market was valued at USD 285.16 Billion in 2021, and it is expected to reach USD 392.14 Billion by 2028, with a CAGR of 3.3% during the forecast period of 2022 -2028. The research provides up-to-date Solid Waste Management market analysis of the current market landscape, latest trends, drivers, and overall market environment.

Unwanted solid material produced as…

Pharmaceutical Waste Management Market Is Thriving Worldwide | Waste Management, …

A new market study is released on Global Pharmaceutical Waste Management Market with data Tables for historical and forecast years represented with Chats & Graphs spread through 101 Pages with easy to understand detailed analysis. The study highlights detailed assessment of the Market and display market sizing trend by revenue & volume (if applicable), current growth factors, expert opinions, facts, and industry validated market development data. The research study provides…

Global Waste Paper Recycling Market Forecast 2019-2026 Miami Waste Paper, Dixie …

Market study on Global Waste Paper Recycling 2019 Research Report presents a professional and complete analysis of Global Waste Paper Recycling Market on the current market situation.

Report provides a general overview of the Waste Paper Recycling industry 2019 including definitions, classifications, Waste Paper Recycling market analysis, a wide range of applications and Waste Paper Recycling industry chain structure. The 2019's report on Waste Paper Recycling industry offers the global…

E-Waste Market In India- -Waste Management Flowchart And E-Waste Recycling Proce …

Big Market Researchs latest market research report titled E-Waste Market in India 2014 describes the dynamics of e-waste recycling in India. E-waste is generated when electronic products reach the end of their lifecycle or utility to the consumer, and needs to be properly recycled to minimize environmental risks.

Get Sample Report : http://bit.ly/2Jc9Vyz

Televisions, personal computers and refrigerators are the largest contributors to e-waste generation in India. Large volume of e-waste…

Industrial Waste Management Market: Waste Management, Republic Services, Clean H …

MarketResearchReports.Biz has recently announced the Latest industry research report on: "Global Industrial Waste Management Market" : Industry Size, Share, Research, Reviews, Analysis, Strategies, Demand, Growth, Segmentation, Parameters, Forecasts.

This report presents the worldwide Industrial Waste Management market size (value, production and consumption), splits the breakdown (data status 2013-2018 and forecast to 2025), by manufacturers, region, type and application.

This study also analyzes the market status, market share, growth rate, future trends, market…