Press release

Trinitrotoluene Production Plant DPR & Unit Setup 2026: Demand Analysis and Project Cost

Setting up a trinitrotoluene production plant involves strategic planning, substantial capital investment, and a comprehensive understanding of production technologies. This critical explosive compound serves military and defense, mining and quarrying, construction and demolition, and industrial explosives manufacturing applications. Success requires careful site selection, efficient nitration processes, stringent safety protocols for handling hazardous materials, reliable raw material sourcing, and compliance with industrial safety regulations to ensure profitable and sustainable operations.Market Overview and Growth Potential:

The global trinitrotoluene market size was valued at 117 Kilo Tons in 2025. According to IMARC Group estimates, the market is expected to reach 188.63 Kilo Tons by 2034, exhibiting a CAGR of 5.45% from 2026 to 2034. This sustained expansion is driven by increasing military expenditures, the expanding mining industry, growing demolition and construction projects, and rising demand for TNT-based munitions and explosives across defense sectors globally.

Trinitrotoluene (TNT) is a chemical compound primarily used as an explosive. It is synthesized through the nitration of toluene, resulting in a stable and efficient explosive with widespread use in military, mining, and demolition applications. TNT is a yellow crystalline solid favored for its stability, ease of handling, and controlled detonation properties, making it one of the most widely used explosives globally. It is graded and applied across military munitions, demolition charges, blasting in mining operations, and as an intermediate in dye and chemical production.

The trinitrotoluene market is mainly influenced by the rise in defense sector investments and growing mining and quarrying activities. According to the Ministry of Mines, the gross value added (GVA) of the mining and quarrying sector accounts for 2% of the country's GDP, with its contribution in value terms increasing from Rs. 2,90,411 Crores (USD 31.6 Billion) in 2014-15 to Rs. 3,18,302 Crores (USD 34.7 Billion) in 2022-23. The Asia-Pacific region is expected to be the fastest-growing market, with significant investments in military capabilities and mining operations. North America and Europe are also seeing steady growth, owing to strong defense budgets and infrastructure development.

Request for Sample Report: https://www.imarcgroup.com/trinitrotoluene-manufacturing-plant-project-report/requestsample

Plant Capacity and Production Scale:

The proposed trinitrotoluene production facility is designed with an annual production capacity of 20,000 MT, enabling economies of scale while maintaining operational flexibility. This capacity allows manufacturers to cater to diverse market segments-from military ordnance and demolition charges to mining blasting operations and specialty chemical synthesis-ensuring steady demand and consistent revenue streams across multiple industry verticals.

Financial Viability and Profitability Analysis:

The trinitrotoluene production business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

• Gross Profit Margins: 30-50%

• Net Profit Margins: 15-25%

These margins are supported by stable demand across defense, mining, and demolition sectors, value-added specialty explosive positioning, and the critical nature of TNT in high-explosive applications. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established chemical manufacturers looking to diversify their product portfolio in the industrial explosives sector.

Cost of Setting Up a Trinitrotoluene Manufacturing Plant:

The cost of setting up a trinitrotoluene manufacturing plant is a critical consideration for potential investors. Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a trinitrotoluene production plant is primarily driven by:

• Raw Materials: 50-60% of total OpEx

• Utilities: 20-25% of OpEx

• Other Expenses: Including labor, packaging, transportation, maintenance, depreciation, and taxes

Raw materials constitute the largest portion of operating costs, with toluene being the primary input material accounting for approximately 50-60% of total operating expenses (OpEx), along with a nitrating acid mix (HNO3 + H2SO4). Establishing long-term contracts with reliable toluene suppliers helps mitigate price volatility and ensures consistent raw material supply, which is critical given that toluene price fluctuations represent the most significant cost factor in trinitrotoluene production.

Capital Investment Requirements:

Setting up a trinitrotoluene production plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to key raw materials such as toluene and nitrating acid mix. Proximity to target markets will help minimize distribution costs. The site must have robust infrastructure, including reliable transportation, utilities, and waste management systems. Compliance with local zoning laws and environmental regulations must also be ensured.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers specialized production equipment essential for manufacturing. Key machinery includes:

• Nitration reactors for controlled chemical synthesis

• Separation vessels for product isolation

• Washing columns for purification

• Neutralization tanks for acid treatment

• Crystallization units for product solidification

• Filtration systems for product separation

• Drying ovens for moisture removal

• Solidification packaging lines for final product handling

Civil Works: Building construction, factory layout optimization, and infrastructure development designed to enhance workflow efficiency, ensure workplace safety, and minimize material handling complexities throughout the production process. The layout should be optimized with separate areas for raw material storage, production zone, quality control laboratory, finished goods warehouse, utility block, and administrative block.

Other Capital Costs: Pre-operative expenses, machinery installation costs, regulatory compliance certifications, initial working capital requirements, and contingency provisions for unforeseen circumstances during plant establishment.

Buy Now: https://www.imarcgroup.com/checkout?id=10061&method=2175

Major Applications and Market Segments:

Trinitrotoluene products find extensive applications across diverse market segments, demonstrating their critical importance:

Military and Defense: Used as a high-explosive fill and bursting charge for munitions, shells, and demolition applications serving national defense and armament programs worldwide.

Mining and Quarrying: Used for controlled blasting to facilitate rock fragmentation and ore extraction, supporting the growing global mining industry.

Construction and Demolition: Applied in structural demolition, tunneling, and large-scale earthworks where controlled explosive energy is required for precision and safety.

Industrial Explosives Manufacturing: Used in the formulation of cast explosives and explosive blends for specialized industrial uses, including seismic exploration applications.

End-use industries include explosives manufacturing, military ordnance, demolition, mining and quarrying, and specialty chemical synthesis, all of which contribute to sustained market demand.

Why Invest in Trinitrotoluene Production?

Several compelling factors make trinitrotoluene production an attractive investment opportunity:

Essential Explosive for Critical Sectors: TNT is a key component in military, mining, and demolition industries, offering consistent demand from sectors that rely on controlled explosive applications. That is why it has become a regularly used material with constant and dependable market demand.

Significant Entry Barriers: Establishing a TNT production plant requires substantial capital investment, adherence to stringent safety regulations, and expertise in chemical processing, creating significant entry barriers for new players. This limits competition and supports profitability for established producers.

Steady Demand Growth: The defense sector's expansion, increased mining operations, and growing need for demolition projects provide a stable foundation for TNT demand. These sectors are expected to continue driving TNT production and consumption well into the future.

Regulatory Compliance and Competitive Advantage: TNT manufacturing is governed by strict regulations to ensure safety, especially due to its hazardous nature. Compliance with environmental and safety standards provides a competitive advantage to manufacturers operating with the necessary certifications and approvals.

Regional Manufacturing Advantage: Establishing production facilities in proximity to demand centers minimizes the risks linked to the transportation of hazardous materials and guarantees industrial clusters a constant and reliable supply of the product.

Diverse Application Portfolio: The versatility of trinitrotoluene across multiple industries-from military munitions to mining blasting and demolition charges-provides manufacturers with diversified revenue streams and reduced market concentration risk.

Speak to an Analyst for Customized Report: https://www.imarcgroup.com/request?type=report&id=10061&flag=C

Manufacturing Process Excellence:

The trinitrotoluene production process involves several precision-controlled stages using the nitration method:

Ethanol Preparation: High-purity toluene is prepared and conditioned as the primary feedstock for the nitration reaction process.

Nitration: Toluene is reacted with a nitrating acid mix (HNO3 + H2SO4) in specialized nitration reactors under strictly controlled temperature and pressure conditions to produce trinitrotoluene.

Separation: The crude TNT product is separated from the spent acid and reaction byproducts through separation vessels and washing columns to remove impurities.

Purification and Crystallization: The TNT is further purified through neutralization, crystallization, and filtration processes to achieve the desired product specifications and purity levels.

Drying and Packaging: The purified TNT crystals are dried in drying ovens and processed through solidification packaging lines to prepare the final product for storage and distribution.

Industry Leadership:

The global trinitrotoluene industry is led by established chemical and explosives manufacturers with extensive production capabilities and diverse application portfolios. Key industry players include:

• Orica

• Dyno Nobel

• BASF

• General Dynamics

• Huntsman Corporation

These companies serve diverse end-use sectors including explosives manufacturing, military ordnance, demolition, mining and quarrying, and specialty chemical synthesis, demonstrating the broad market applicability of trinitrotoluene products.

About IMARC Group

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers create a lasting impact. We provide a comprehensive suite of market entry and expansion services, including market assessment, feasibility studies, company incorporation, factory setup support, regulatory approvals, branding, marketing strategies, competitive benchmarking, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201-971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Trinitrotoluene Production Plant DPR & Unit Setup 2026: Demand Analysis and Project Cost here

News-ID: 4399044 • Views: …

More Releases from IMARC Group

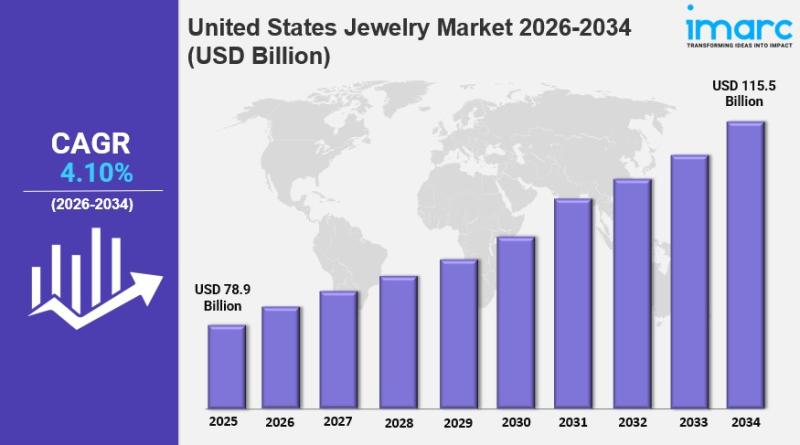

United States Jewelry Market Size, Share, Industry Overview, Growth and Forecast …

IMARC Group has recently released a new research study titled "United States Jewelry Market Report by Product (Necklace, Ring, Earrings, Bracelet, and Others), Material (Gold, Platinum, Diamond, and Others), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Jewelry Market Overview

The United States jewelry market size reached USD 78.9 Billion in 2025.…

United States Air Freight Market Size, Share, Industry Trends, Growth and Foreca …

IMARC Group has recently released a new research study titled "United States Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Air Freight Market Overview

The United States air freight market size was valued at USD 64.06 Billion in 2025.…

Mexico Medical Tourism Market 2026 : Industry Size to Reach USD 10.6 Billion by …

IMARC Group has recently released a new research study titled "Mexico Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Mexico Medical Tourism Market Overview

The Mexico medical tourism market size reached USD 2.1 Billion in 2025. Looking forward, the market is projected…

Saudi Arabia Pilates & Yoga Studios Market Size to Surpass USD 3.6 Billion by 20 …

Saudi Arabia Pilates & Yoga Studios Market Overview

Market Size in 2024: USD 1.6 Billion

Market Forecast in 2033: USD 3.6 Billion

Market Growth Rate 2025-2033: 8.20%

According to IMARC Group's latest research publication, "Saudi Arabia Pilates & Yoga Studios Market Size, Share, Trends and Forecast by Activity Type, Application, and Region, 2025-2033", the Saudi Arabia pilates & yoga studios market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the…

More Releases for TNT

Trinitrotoluene (TNT) Market: An Extensive Analysis Predicts Significant Future …

The Global Trinitrotoluene (TNT) Market Size is estimated at $1.7 Billion in 2025 and is forecast to register an annual growth rate (CAGR) of 3.9% to reach $2.4 Billion by 2034.

The latest study released on the Global Trinitrotoluene (TNT) Market by USD Analytics Market evaluates market size, trend, and forecast to 2034. The Trinitrotoluene (TNT) market study covers significant research data and proofs to be a handy resource document for…

Trinitrotoluene (TNT) Market Research Report 2023 - Valuates reports

The global Trinitrotoluene (TNT) market was valued at US$ million in 2022 and is anticipated to reach US$ million by 2029, witnessing a CAGR of % during the forecast period 2023-2029. The influence of COVID-19 and the Russia-Ukraine War were considered while estimating market sizes.

Get sample report - https://reports.valuates.com/request/sample/QYRE-Auto-1K7990/Global_Trinitrotoluene_TNT_Market_Insights_and_Forecast_to_2028

North American market for Trinitrotoluene (TNT) is estimated to increase from $ million in 2023 to reach $ million by 2029, at…

Trinitrotoluene (TNT) market to witness exponential growth by 2028

Trinitrotoluene (TNT) Market is expected to witness moderate growth registering 6% CAGR during the forecast period (2022-2028)

Trinitrotoluene (TNT) market research report is one of the effective ways to target customers and meet their growing needs as it gathers all the important market data. It allows tracking future business growth for the next period 2022-2028. It also helps categorize business objectives while targeting consumers. It is the main goal of…

Courier Services Market Is Booming Worldwide | TNT, China Post, Maersk, Aramex

HTF MI recently introduced Global Courier Services Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are UPS, FEDEX, DHL, TNT, China Post, Maersk, Aramex, Japan Post Group,…

3PL Market 2017 - TNT, FedEx, UPS, DHL, Maersk, APL

Worldwide 3PL Market 2017 Analysis Report audits a Market Regions, Product Categories, with Sales, Business Revenue, Goods cost, 3PL piece of the overall industry and Growth patterns, concentrating on driving 3PL industry players, showcase size, request and supply examination, utilization volume, Forecast 2017 to 2022.

Get Free Sample Copy of Report Here: https://goo.gl/dGFYuo

Top Manufacturers Analysis of This Report

• TNT

• FedEx

• UPS

• DHL

• Maersk

• APL

• Nippon Express

• Exel

• NOL

• COSCO…

HDMI switch Market Outlook 2017- Ellies, TNT, Kordz, Blustream, KanexPro, C2G

A market study ” Global HDMI switch Market ” examines the performance of the HDMI switch market 2017. It encloses an in-depth Research of the HDMI switch market state and the competitive landscape globally. This report analyzes the potential of HDMI switch market in the present and the future prospects from various angles in detail.

The Global HDMI switch Market 2017 report includes HDMI switch market Revenue, market Share, HDMI switch…