Press release

ESG Data Management Platforms Market | Europe's Transparency Mandate - Scope 3 Traceability, Audit-Ready Reporting & AI-Driven Data Integrity Become the New Competitive Edge

ESG Data Management Platforms Market | Europe's Transparency Mandate - Scope 3 Traceability, Audit-Ready Reporting & AI-Driven Dat

The days of ESG reporting as a side-task in Excel sheets are over - especially in Europe.

Global regulation, investor scrutiny, and capital market expectations are forcing companies to treat ESG data like financial data: controlled, traceable, auditable, and machine-readable.

Globally, the ESG Data Management Platforms Market is valued at USD 1.1 billion in 2025 and is projected to reach USD 4.3 billion by 2035, compounding at a 14.5% CAGR.

Get the Detailed Industry Analysis (including the Table of Contents, List of Figures, and List of Tables) - from the ESG Data Management Platforms Market Research Report: https://marketgenics.co/reports/esg-data-management-platforms-market-62552

Behind that global growth, Europe is the regulatory and technical engine: CSRD, ESRS, ISSB alignment, and value-chain disclosure rules are turning ESG data management platforms from "reporting tools" into core enterprise infrastructure.

In Europe, the question has shifted from:

"How do we publish a sustainability report?"

To:

"How do we build an ESG data stack that stands up to auditors, regulators, and investors for the next decade?"

Why Europe Is Becoming Ground Zero for the ESG Data Management Platforms Market

Europe is setting the pace for the global ESG Data Management Platforms Market because it is turning ESG from marketing narrative into regulated disclosure.

Three forces are driving accelerated platform adoption in the region:

• CSRD + ESRS as a structural shock

From 2024 onwards, the EU's Corporate Sustainability Reporting Directive (CSRD) and the European Sustainability Reporting Standards (ESRS) require thousands of European and non-European companies to publish granular, audit-ready sustainability data. That is impossible to do reliably on spreadsheets and email threads.

• ISSB and interoperability expectations

The global baseline defined by IFRS S1 and S2 pushes large European multinationals to ensure that their data pipelines can support both EU and ISSB-aligned reporting - with structured, reusable ESG data at the core.

• Assurance becoming mandatory

Unlike earlier voluntary frameworks, CSRD explicitly brings limited - and eventually reasonable - assurance into scope. That means ESG data management platforms must support internal controls, audit trails, verification workflows, and clear data lineage.

For European corporates and financial institutions, the ESG Data Management Platforms Market is no longer about "telling a sustainability story". It is about surviving and competing in a regulated reporting environment.

To know more about the ESG Data Management Platforms Market - Download our Sample Report: https://marketgenics.co/download-report-sample/esg-data-management-platforms-market-62552

Where ESG Data Management Platforms Matter Most in Europe

Although ESG obligations span all sectors, some European buyers are at the sharpest end of the regulatory and investor pressure curve.

Key demand clusters include:

• Financial services (banks, asset managers, insurers)

Financial services already account for ~36% of the global ESG data management platforms market, driven by financed emissions, portfolio-level climate risk, and stewardship expectations. European financial institutions need platforms that can map PCAF methodologies, drill down to issuer and borrower data, and support green and sustainability-linked finance.

• Large listed corporates under CSRD

Companies in energy, manufacturing, retail, transport, technology, and telecoms are being pulled into CSRD phases. They require systems capable of handling multi-entity, multi-jurisdiction data, linked to ESRS metrics and taxonomy-aligned disclosures.

• Supply-chain intensive industries

Textiles, automotive, food, electronics, and construction need ESG platforms that can ingest supplier data, map Scope 3 emissions, and support due diligence obligations under EU supply-chain and deforestation rules.

• Advisors, auditors, and assurance providers

Consulting and audit firms increasingly rely on the same ESG data management platforms to test controls, validate calculations, and deliver technology-enabled assurance engagements.

In each of these buyer groups, the ESG Data Management Platforms Market is becoming the backbone for risk, compliance, and capital allocation decisions.

The Emerging Architecture of ESG Data Infrastructure in Europe

The modern European ESG tech stack is converging around a set of core components - most of which are directly reflected in how the ESG Data Management Platforms Market is segmented:

• Data ingestion & ETL

Automated collection from ERP, HR, EHS, procurement, IoT devices, supplier portals, and external data providers.

• Data lake / warehouse & storage

Centralized storage where ESG metrics, documents, and unstructured data are mastered, versioned, and permissioned like financial data.

• Normalization & mapping engines

Engines that align raw data to ESRS, GRI, ISSB, CDP, PCAF, and internal KPI definitions, creating a single source of truth.

• Analytics and insight modules

Scenario analysis, risk heatmaps, benchmarking, carbon pathway modeling, and target-tracking dashboards for executives and boards.

• Reporting & disclosure tools

Template-based and taxonomy-aware modules that produce CSRD, CDP, TCFD, ISSB and other aligned reports in both human-readable and machine-readable formats (e.g., XBRL).

• Workflow, collaboration, and audit trail

User roles, approvals, evidence attachment, and immutable logs for auditors and regulators.

• API and integration layer

Connectors into finance, risk, reporting, and investor-relations systems, ensuring ESG is not a silo but a data domain integrated into the enterprise architecture.

In Europe, the winners in the ESG Data Management Platforms Market will be those vendors who treat ESG as a full-stack data domain - not a decorative reporting app.

Buy Now: https://marketgenics.co/buy/esg-data-management-platforms-market-62552

From Fragmented Spreadsheets to Assurance-Grade ESG Data

The biggest constraint in European ESG transformation is not regulation. It is data fragmentation.

Most organizations start from:

• Sustainability metrics scattered across spreadsheets, emails, and PDF reports

• Financial and operational data sitting in ERP and data warehouses with no ESG-specific structure

• Supplier and Scope 3 data coming in inconsistent formats and periodic surveys

• No clear audit trail for who changed what, when, and why

That baseline cannot support limited or reasonable assurance.

As regulators, investors, and lenders tighten expectations, the ESG Data Management Platforms Market in Europe is increasingly about:

• Enforcing data-quality rules and validation checks

• Centralizing and reconciling conflicting data sources

• Documenting methodologies, emission factors, and assumptions

• Providing clear, exportable evidence for auditors and regulators

The shift is from "compile a report once a year" to "run an ESG data system all year".

Growth Opportunities: Supply Chain, Scope 3, and Assurance Tech

The most explosive growth pockets within the ESG Data Management Platforms Market in Europe sit at the intersection of value-chain visibility and verification.

Three opportunity zones stand out:

• Supply-chain disclosure and Scope 3 accounting

EU rules on value-chain emissions and due diligence are pushing companies to onboard suppliers into ESG platforms, integrate with procurement systems, and automate Scope 3 calculations.

• Assurance technology and audit-readiness

Automated audit trails, data lineage graphs, and evidence repositories enable assurance providers to work more efficiently - and give boards confidence under CSRD and ESRS assurance requirements.

• Emerging markets and dual-reporting support

European-headquartered multinationals with operations in Latin America, Asia, and Africa need ESG platforms that operate across jurisdictions, frameworks, and data maturity levels - a key demand driver for globally scalable platforms with strong European compliance logic.

For Europe, these aren't just regulatory headaches. They are market-making opportunities for platforms, advisors, and data providers building the next generation of ESG infrastructure.

AI, Interoperability, and Real-Time Data: The Next Stage of Europe's ESG Data Management Platforms Market

The next chapter for the ESG Data Management Platforms Market in Europe will be written by three reinforcing technology trends:

• AI and NLP-driven automation

Machine learning models estimating emissions where primary data is missing, detecting anomalies, extracting disclosures from documents, and auto-summarizing narrative sections - accelerating reporting and reducing manual work.

• Interoperability and digital taxonomies

XBRL-based ESRS and GRI taxonomies, ISSB digital standards, and API-first platform designs are pushing ESG reporting towards machine-readability, cross-platform comparability, and automated filing with regulators and exchanges.

• Real-time and near-real-time data streams

Sensors, IoT, satellite data, and supplier platforms feed continuous metrics into ESG systems, turning static annual reports into dynamic sustainability dashboards that support decisions throughout the year.

As these capabilities mature, ESG platforms in Europe will look less like reporting forms - and more like risk and performance engines embedded throughout the business.

A Consolidated but Rapidly Evolving Competitive Landscape

The global ESG Data Management Platforms Market is already highly consolidated, with the top five providers holding over 60% share.

In Europe, this consolidation translates into:

• Strong presence of global data and analytics providers with extensive coverage of corporates and financial instruments

• Increasing collaboration between ESG platforms, auditors, and Big Tech cloud and data warehouse providers

• A long tail of specialized vendors focusing on niches like supply-chain traceability, sector-specific metrics, carbon accounting, or AI-driven document extraction

Vendor selection is becoming a strategic decision: European enterprises are effectively choosing the ESG data operating system they will run on for the next decade.

Why ESG Data Platforms Are Now a Board-Level Topic in Europe

ESG data is no longer "non-financial".

For European boards and executive committees, the ESG Data Management Platforms Market is central to:

• Cost of capital

Inability to provide high-quality, consistent ESG metrics can translate into higher financing costs or exclusion from sustainability-linked instruments.

• Regulatory risk

Errors, omissions, or inconsistent disclosures under CSRD, ESRS, SEC, or other emerging rules can carry legal, reputational, and financial consequences.

• Strategic positioning

Sustainability performance is increasingly used by customers, employees, and investors as a sorting mechanism between leaders and laggards.

• Operational performance

ESG data systems reveal inefficiencies in energy, water, waste, health and safety, and supply-chain practices - directly affecting costs and resilience.

The decision to invest in ESG data management platforms in Europe is not only about "compliance". It is about shaping how the company is seen, funded, and held accountable in global markets.

Conclusion: Europe Is Building Its ESG Data Operating System

With global ESG Data Management Platforms Market value expected to nearly quadruple from 2025 to 2035, Europe will remain the regulatory laboratory, test market, and reference customer base for the sector.

The region's combination of:

• Mandatory disclosure and assurance rules

• Investor and lender pressure

• Strong data and analytics ecosystems

means ESG platforms are evolving from optional tools into the data infrastructure layer for sustainable finance and corporate governance.

European companies that treat ESG data as core enterprise infrastructure - not as an annual reporting exercise - will be the ones whose disclosures, risk narratives, and transition stories are believed, financed, and rewarded over the 2026-2035 horizon.

About Us

MarketGenics is a global market research and management consulting company empowering decision makers across healthcare, technology, and policy domains. Our mission is to deliver granular market intelligence combined with strategic foresight to accelerate sustainable growth.

We support clients across strategy development, product innovation, healthcare infrastructure, and digital transformation.

Contact:

Mr. Debashish Roy

MarketGenics Research

800 N King Street, Suite 304 #4208, Wilmington, DE 19801, United States

USA: +1 (302) 303-2617

Email: sales@marketgenics.co

Website: https://marketgenics.co

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release ESG Data Management Platforms Market | Europe's Transparency Mandate - Scope 3 Traceability, Audit-Ready Reporting & AI-Driven Data Integrity Become the New Competitive Edge here

News-ID: 4304480 • Views: …

More Releases from MarketGenics Research

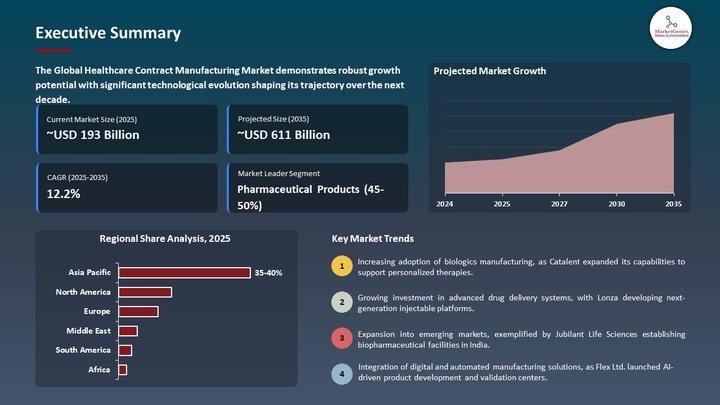

Healthcare Contract Manufacturing Market | Europe's Race for Quality-Centric Man …

Healthcare Contract Manufacturing Market | Europe's High-Precision Manufacturing Pivot Is Reshaping the Future of Therapeutics

The Healthcare Contract Manufacturing Market used to live in the operational shadows - a technical appendix to pharma strategy, an afterthought to medical device roadmaps.

That era is gone.

Europe's push for biologics scale-up, GMP modernization, sterile manufacturing compliance, and resilient supply chains has moved the Healthcare Contract Manufacturing Market from the backroom of operations into the center…

"Aerosol Cans Market in Europe: Sustainability, Aluminum Demand, and Regional Gr …

The world is moving fast on sustainability-biodegradable materials, reusable packaging, and recyclable metals are capturing headlines. Aerosol cans, often overlooked as simple packaging, have quietly evolved into a high-performance, environmentally-conscious solution across personal care, household, healthcare, and industrial sectors.

In 2025, the global Aerosol Cans Market reached USD 14.4 billion, and it is projected to expand to USD 24.0 billion by 2035, growing at a CAGR of 4.7%. For a sector…

Clinical Trial Supplies Market | Europe's New Era of Trial Logistics - Big Pharm …

Clinical Trial Supplies Market | Europe's Supply-Chain Transformation Reshaping the Future of Drug Development

The Clinical Trial Supplies Market used to live in the back rooms of pharma operations - cartons, kits, comparators, storage rooms and shipping labels.

That era is gone.

Europe's pivot toward precision medicine, biologics, decentralized studies, and multi-country regulatory complexity has pushed the Clinical Trial Supplies Market from a logistics afterthought into a strategic pillar of clinical success.

This shift…

Clinical Trial Supplies Market | Europe's Supply-Chain Reinvention - Cold-Chain …

The Clinical Trial Supplies Market used to be a logistics afterthought: labelled vials, dry ice shipments, and predictable pallet runs. That era is gone.

Europe's regulatory complexity, the explosion of biologics and cell & gene therapies, and the rise of decentralized clinical trials (DCTs) have moved the Clinical Trial Supplies Market from a vendor line-item into a strategic capability that determines trial speed, quality and cost. From cryogenic storage in Frankfurt…

More Releases for ESG

CARE ESG Awards 2025 highlights outstanding achievements in sustainability, clim …

Dubai, UAE, 29th November 2025, ZEX PR WIRE, The CARE ESG Awards by Trescon and ESG Mena recognised the region's most outstanding leaders, changemakers, and industry shapers driving sustainability, clean energy, climate resilience, and responsible growth. Held during the inaugural edition of climate action, renewable energy & sustainability forum, CARE 2025, the awards spotlighted high-impact contributions driving measurable progress across environmental stewardship, renewable energy deployment, resource efficiency, social value creation,…

APAC Investor ESG Software Market Rises at 16.5% CAGR Amid Regional Push for ESG …

The Asia Pacific (APAC) Investor ESG Software market is poised for a decade of robust expansion, projected to grow from US$ 214.91 million in 2024 to an estimated US$ 756.92 million by 2031. This represents a significant Compound Annual Growth Rate (CAGR) of 19.7% during the forecast period of 2024-2031, according to a new market research report published by The Insight Partners.

Download PDF Sample Copy @ https://www.theinsightpartners.com/sample/TIPRE00023473/?utm_source=OpenPR&utm_medium=10813

The report, titled "Asia-Pacific…

Global ESG Reporting Software Market Size by Application, Type, and Geography: F …

USA, New Jersey- According to Market Research Intellect, the global ESG Reporting Software market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The growing need for clear and consistent sustainability disclosures is driving the market for ESG (Environmental, Social, and Governance) reporting software, which is expanding…

ZeeDimension Wins ESG Data Company Award at the 5th World ESG Summit in Riyadh

Riyadh, Saudi Arabia - February 12, 2025 - ZeeDimension, a leading provider of ESG, GRC, and data analytics solutions, has been honored with the prestigious ESG Data Company Award at the 5th World ESG Summit, held on February 10-11, 2025, in Riyadh, Saudi Arabia.

The World ESG Summit is one of the most influential global gatherings for sustainability leaders, investors, and policymakers, dedicated to advancing Environmental, Social, and Governance (ESG) initiatives.…

Transforming the Environmental, Social And Governance (ESG) Investment Analytics …

What Is the Expected Size and Growth Rate of the Environmental, Social And Governance (ESG) Investment Analytics Market?

The market size for investment analytics related to environmental, social, and governance (ESG) has been on a rapid surge over the recent years. The market estimation is to rise from $1.7 billion in 2024 to $2.01 billion in 2025 with a compound annual growth rate (CAGR) of 18.1%. Growth in the past can…

Inrate Unveils New ESG Data Platform for Transparent and Traceable ESG Data Insi …

Zurich, Oct 22, 2024 - Inrate, a leading impact rating and ESG data company, is thrilled to announce the release of CLIF, its new ESG data platform, designed to provide transparent and traceable ESG data to simply investment analysis. With expanded features and seamless functionality, CLIF allows investors to gain enhanced visibility into the sustainability performance of over 10,000 companies and 190 sovereigns worldwide.

Empowering Data-Driven ESG Decisions

The CLIF…