Press release

Top 30 Indonesian Public Companies in the Technology Industry Q3 2025 Snapshot

1) Overall: Top-30 tech companies Q3 2025 performance summaryThe Indonesia SE Technology index continued to show a broad mix of outcomes in Q3 2025: established telecom and infrastructure names delivered steady revenue and healthy EBITDA, while digital platform and fintech names showed a mix of recovering profitability and still-patchy cash flow; smaller systems integrators and specialty tech firms generally reported modest but stable results. Market leadership remains split between large telco-infrastructure incumbents (e.g., PT Telkom Indonesia) and a cluster of listed digital platforms and software/infrastructure players (GoTo, Bukalapak, Metrodata, Link Net, DCI and others). The Investing.com components list provides the up-to-date roster of the index constituents used as the source for the top 30 universe for this article.

2) Q3 2025 earnings call / results summarized (top 10 Indonesian public technology companies)

Below are the Q3 2025 / 9M25 headline reported numbers (the exact item stated is shown), followed by a very short explanation of the result and what management highlighted in investor materials or press coverage.

Note: where companies report 9M (nine-month) results together with Q3 breakouts, I reference the published figure in the official interim financial statements or company press release for Q3/9M2025; citations follow each company item.

1. PT Telkom Indonesia Tbk (TLKM)

Headline (9M/ Q3 2025 as reported): consolidated revenue reported ~Rp109.6 trillion (9M25), EBITDA Rp54.4 trillion and net profit Rp15.78 trillion (reported for Q3/9M disclosures). Telkom highlighted continuing core fixed-broadband and enterprise demand and strong EBITDA margins.

Takeaway: Telkoms results reflect resilient core telco cash flows revenue scale remains dominant and profitability remains strong despite macro pressure.

2. PT Indosat Ooredoo Hutchison Tbk (ISAT)

Headline (Q3 2025 / 9M25 as reported): Q3 revenue growth reported (3.8% QoQ for Q3) and 9M revenue/EBITDA showing material improvement the investor memo and analyst notes show revenue in the IDR5056 trillion range for 9M/estimates and a materially higher normalized EBITDA (Indosat reported EBITDA growth and improved margins in investor materials). Management called out cellular, data and media segments as drivers and continued cost synergy gains.

Takeaway: Indosats Q3 showed margin recovery and continued revenue growth across mobile and data; cost synergies from previous corporate actions supported EBITDA improvement.

3. XL Axiata (XLSMART / EXCL)

Headline (Q3 2025): XL Axiata reported a strong Q3 with revenue cited around IDR ~11.5 trillion for the quarter (reporting double-digit YoY growth in many local write-ups) and management commentary emphasized ARPU improvement and operational execution. (Earnings call transcript & press coverage).

Takeaway: XLs Q3 was an execution quarter revenue growth and ARPU improvement were highlighted, though market reaction was mixed as investors priced future competition and capex.

4. PT GoTo Gojek Tokopedia Tbk (GOTO)

Headline (Q3 2025): GoTo reported its Q3 2025 results showing material improvement toward profitability: consolidated figures published show the group recorded an adjusted pre-tax profit for Q3 2025 (company press release), and IndoPremier reported a Q3 net loss of ~Rp775.6 billion a significant narrowing versus the large losses seen in prior periods. Management raised full-year guidance after the quarter.

Takeaway: GoTos Q3 was notable for the move toward adjusted pre-tax profit and a much smaller reported net loss compared with prior periods; management moved to raise guidance, signaling momentum in core marketplace, logistics and fintech segments.

5. PT Bukalapak.com Tbk (BUKA)

Headline (Q3 2025): Bukalapak reported revenue for Q3 2025 of ~Rp1.64 trillion and a net profit in the quarter of ~Rp2.9 trillion (reported in company filings and local market reporting a strong profit reversal vs prior year). Bukalapak highlighted gaming and investments as contributors during the quarter.

Takeaway: Bukalapak posted a strong profit swing in Q3 driven by non-operating investment gains alongside operational stability in key segments; management framed the result as evidence of diversification benefits.

6. PT Link Net Tbk (LINK)

Headline (Q3 2025): Link Nets interim financials show the group recorded a net loss for Q3 2025 of ~Rp1.03 trillion (IndoPremier reporting of the Q3 interim financial statement). The groups consolidated statement and limited-review filings are available on the company site.

Takeaway: Link Nets Q3 reflected continued pressure on profitability; management commentary and the filed statements indicate elevated financing and operating costs impacted bottom-line performance.

7. PT Metrodata Electronics Tbk (MTDL)

Headline (9M / Q3 2025): Metrodata reported 9M/ Q3 revenue of ~Rp18.8 trillion and net profit ~Rp469.6 billion for Q3/9M, a year-on-year rise (company filings and market reports). Management cited growth in digital solutions and logistics/warehouse expansion.

Takeaway: Metrodatas revenue growth (mid-single digits) and higher profit reflect continued demand for enterprise IT solutions and software/services expansion.

8. PT DCI Indonesia Tbk (DCII)

Headline (Q3 / 9M 2025): DCI reported robust growth to 9M revenue ~Rp1.92 trillion and net profit of ~Rp825 billion (reported as Rp824.98bn for 9M25), an ~83.5% YoY increase. Management attributed this to higher co-location revenues and strong operating leverage.

Takeaway: DCIs strong margin expansion and revenue growth underline healthy demand for data-center services and colocation in Indonesia.

9. PT M Cash Integrasi Tbk (MCAS)

Headline (Q3 2025): MCashs Q3 2025 disclosure shows a consolidated net loss for the quarter of ~Rp31.4 billion (company filings / market summary). Company financial reports are hosted on its IR page.

Takeaway: MCash remains in a modest loss position in Q3 as it scales its payment and merchant services businesses; management is focused on improving margins and scaling transaction volumes.

10. PT NFC Indonesia Tbk (NFCX)

Headline (Q3 2025): NFC Indonesia reported a small net loss in Q3 2025 the interim filing shows a Q3 net loss of approximately Rp4.6 billion (indicated in the companys Q3 disclosure).

Takeaway: NFCXs result signaled improving operating performance (smaller losses YoY), with management emphasizing revenue diversification and restructured cost bases.

3) Key trends & insights from Q3 2025 (technology sector in Indonesia)

Telco / infrastructure resilience: Large incumbent telcos and data-center players continued to generate predictable cash flow and healthy EBITDA margins in Q3, supporting overall sector stability. Telkoms consolidated 9M revenue/EBITDA shows that core fixed and enterprise services remain defensive.

Digital platforms moving toward profitability: Several large digital platforms reported materially smaller losses or even adjusted pre-tax profits (GoTos Q3 adjusted pre-tax profit is a key inflection). That shift was the quarters headline and prompted upward revisions to guidance for some groups.

Enterprise IT & data-center demand rising: Systems integrators and data-center companies (Metrodata, DCI) reported revenue growth and margin expansion as enterprise IT spending and colocation demand accelerated. This lifted profitability at mid-cap tech names.

Mixed outcomes for fintech & payments: Specialist fintech/payment network firms (e.g., M Cash, NFCX) continued to show uneven profitability while scaling transaction volumes; some reported small losses while focusing on growth investments and cost rationalization.

Investor focus on cash generation & guidance: Market reaction in Q3 centered on evidence of durable cash generation companies that demonstrated operating leverage, improved ARPU, or structural cost savings were rewarded and in some cases raised guidance. The EY IPO review and broader market commentary showed selective capital formation in 2025, favoring higher-quality, cash-generative stories.

4) Outlook for Q4 2025 and beyond

Consolidation of profitability among leaders: Expect telco incumbents and differentiated platform players to continue to consolidate market share while expanding high-margin enterprise services (cloud, data center, managed services). Companies like Telkom, Indosat and XL are likely to keep capital-intensive but high-return investments, supporting steady top-line and EBITDA.

Platform monetization to be the market driver: If digital platforms maintain the momentum seen in Q3 lower adjusted losses or adjusted profits we can expect more positive investor sentiment and potentially renewed M&A or capital markets activity for stronger platforms. GoTos guidance raise after Q3 2025 is an early indicator of this dynamic.

Enterprise IT & data center to keep growing: Demand for colocation and cybersecurity/managed services should drive further growth at specialist listed players (DCI, Metrodata). That trend will likely hold through 2026 as Indonesian corporates accelerate digital transformation.

Fintech/payments path to scale & break-even remains uneven: Payment and merchant platform companies will pursue volumes and product breadth, but investors will scrutinize cash conversion and sustainable unit economics before re-rating. Some listed fintechs may remain loss-making while reinvesting; others may need strategic restructuring or funding to reach scale.

Macro & capital markets risk: External factorsglobal macro volatility and local capital market appetitewill influence valuations and IPO/dealflow. The EY review noted a Q3 shift toward higher-quality IPO proceeds in 2025; similar selectivity may shape capital access for tech firms in Q4 and 2026.

5) Conclusion

Q3 2025 represented a meaningful pivot quarter for Indonesias listed technology universe: large telcos and infrastructure players delivered steady cash flows, systems integrators and data-center providers posted strong demand-led growth, and several digital platforms showed measurable progress toward profitability. The combined pattern is constructive for the sector: market participants are increasingly rewarding demonstrable cash generation and path-to-profit metrics. Looking into Q4 and 2026, expect selective capital flows toward cash-generative platforms and continued expansion in enterprise IT and data center services while fintech/payments names will be watched closely for durable unit economics.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top 30 Indonesian Public Companies in the Technology Industry Q3 2025 Snapshot here

News-ID: 4293661 • Views: …

More Releases from QY Research

Top 30 Indonesian Electronics Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

Indonesias electronics sectorspanning electronic manufacturing services (EMS), distribution, components, and systems integration saw mixed performance in Q3 2025. Broadly, established firms with diversified offerings performed steadily, while smaller pure-play electronics names faced variable demand amid global supply chain pressures and moderate domestic demand. Overall revenue and profitability growth was modest with notable outliers outperforming peers thanks to data-center services and enterprise solutions.

PT Metrodata Electronics…

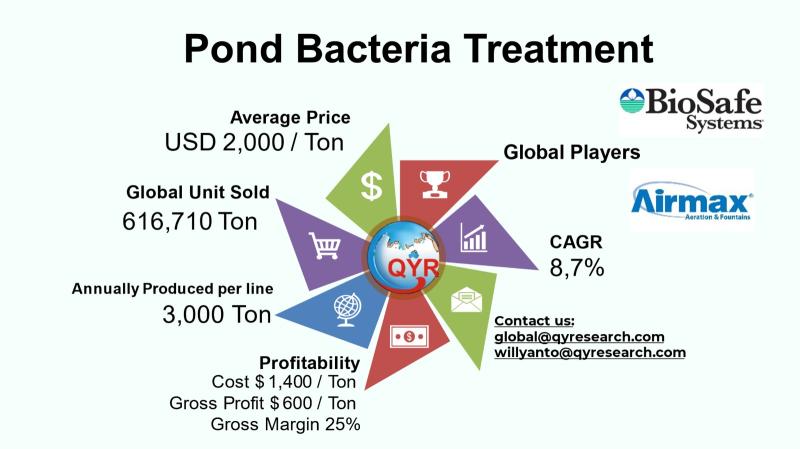

Biological Water Solutions Surge: Inside the Pond Bacteria Treatment Industrys F …

The global pond bacteria treatment market represents a specialized segment of the biological water treatment industry dedicated to improving water quality in ponds through the use of microbial products. These bacterial treatments are designed to support nutrient cycling, reduce organic waste and sludge buildup, control harmful pathogens, and enhance ecological balance in aquaculture ponds, ornamental water bodies, agricultural retention ponds, and industrial water systems. The sector has gained prominence as…

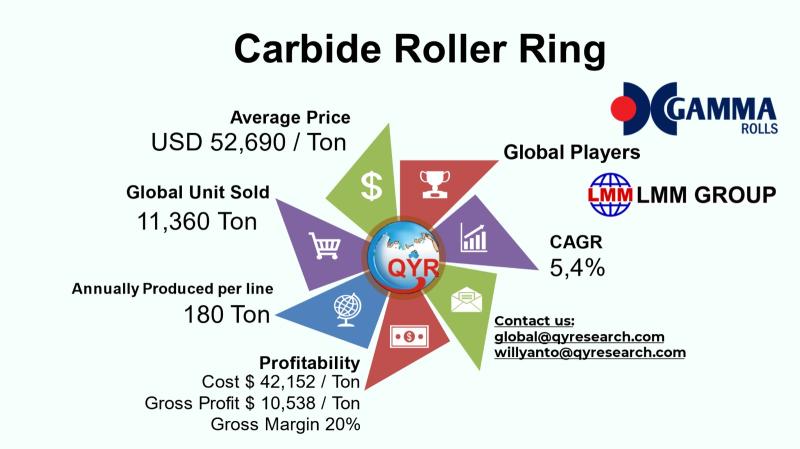

Why 2024-2031 Is a Defining Era for Carbide Roller Rings: Market Size, Trends & …

The carbide roller ring market comprises highly durable and wear-resistant ring components manufactured predominantly from tungsten carbide and similar hard materials, used in heavy machinery, industrial equipment, and precision processing systems where extreme performance is demanded. These products are a critical part of roller assemblies in metal rolling, mining, cement, and materials processing sectors, offering superior hardness, abrasion resistance, and longevity compared to traditional steel counterparts. Emerging industrial development, coupled…

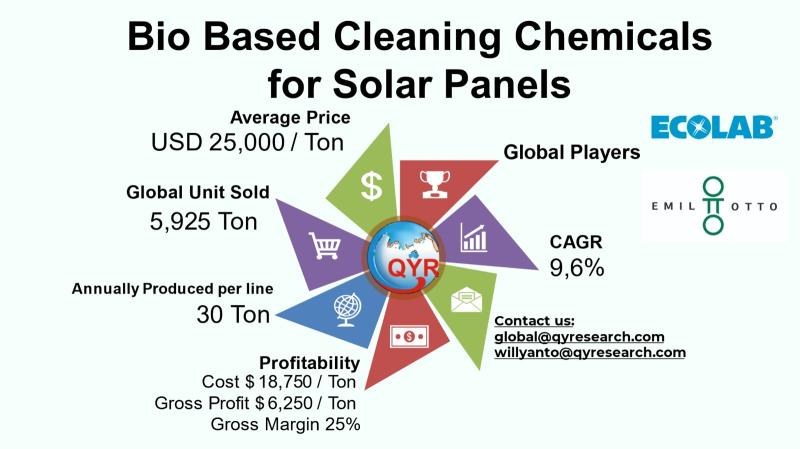

Investing in Solar Sustainability: A Deep Dive into Bio-Based Cleaning Chemicals …

The global market for bio-based cleaning chemicals designed for solar panels represents an essential and rapidly growing segment of the broader solar maintenance ecosystem, driven by the global expansion of photovoltaic installations and the increasing imperative to maintain optimal energy output while minimizing environmental impact. Globally, the bio-based cleaning chemicals market is developing in tandem with exponential solar PV capacity expansion across regions including North America, Europe, East Asia, South…

More Releases for Indonesia

Indonesia Oil and Gas Market Size, Share Projections 2031 by Key Manufacturer- P …

USA, New Jersey: According to Verified Market Research analysis, the global Indonesia Oil and Gas Market size was valued at USD 281.50 Billion in 2024 and is projected to reach USD 499.94 Billion by 2032, growing at a CAGR of 7.66% during the forecast period 2026-2032.

What is the current outlook and growth potential of the Indonesia Oil and Gas Market?

The Indonesia Oil and Gas Market is showing signs of gradual…

Indonesia Amino Acid Fertilizer Market Anticipated for Positive Growth by 2031 | …

Indonesia Amino Acid Fertilizer Market Research Report By DataM Intelligence: A comprehensive analysis of current and emerging trends provides clarity on the dynamics of the Indonesia Amino Acid Fertilizer market. The report employs Porter's Five Forces model to assess key factors such as the influence of suppliers and customers, risks posed by different entities, competitive intensity, and the potential of emerging entrepreneurs, offering valuable insights. Additionally, the report presents research…

MICE Market to Witness Massive Growth with PT Pamerindo Indonesia, GEM INDONESIA

HTF MI Published the Latest Global MICE Market Study that provides by in-depth analysis of the current scenario, the Market size, demand, growth pattern, trends, and forecast. Revenue for MICE Market has grown substantially over the six years to 2022 as a result of strengthening macroeconomic conditions and healthier demand, however with current economic slowdown Industry Players are seeing the big impact in operations and identifying ways to keep momentum.…

Overview of Indonesia MICE Market | SHIFTinc, Venuerific Indonesia, Werkudara Gr …

Astute Analytica, a leading provider of market research and analysis, released its highly anticipated Market Analysis Report on the Indonesia MICE Market. This comprehensive report aims to equip businesses with invaluable insights and data, enabling them to make informed decisions and stay one step ahead of the competition.

Access the Comprehensive PDF Market Research Analysis Report Here: https://www.astuteanalytica.com/request-sample/indonesia-mice-market

Indonesia MICE Market was valued at US$ 2,095.95 million in 2022 and is…

Clinical Laboratory Market in Indonesia, Clinical Laboratory Industry in Indones …

"Increase in healthcare expenditure from the Indonesian government has driven the growth of clinical laboratory market in Indonesia."

Increase in Healthcare Awareness: Largely driven by increase in healthcare spending by aging population (~$ 260 per person by 2050), rising income levels, rising awareness for preventive testing, advanced healthcare diagnostic tests offerings, and central government's healthcare measures.

Developments in Testing and Preference for Evidence based testing: There is also a rising number…

Baby Food Sector in Indonesia Market 2019 By PT Nestlé Indonesia, Danone, PT Ka …

"The Baby Food Sector in Indonesia, 2018", is an analytical report by GlobalData which provides extensive and highly detailed current and future market trends in the Indonesian market.

Dietary habits have inhibited sales of commercially prepared baby foods in Indonesia. With the exception of Jakarta, many Indonesians have a traditional diet, based on rice, fresh fruit, and vegetables, supplemented with meat, although, 80% of the population is Muslim, and do not…