Press release

Gastric Cancer Treatment Market Growth 2025: Oncology Trends & Insights, Top Key Players - F. Hoffmann-La Roche, Merck & Co., Bristol Myers Squibb, AstraZeneca/Daiichi Sankyo

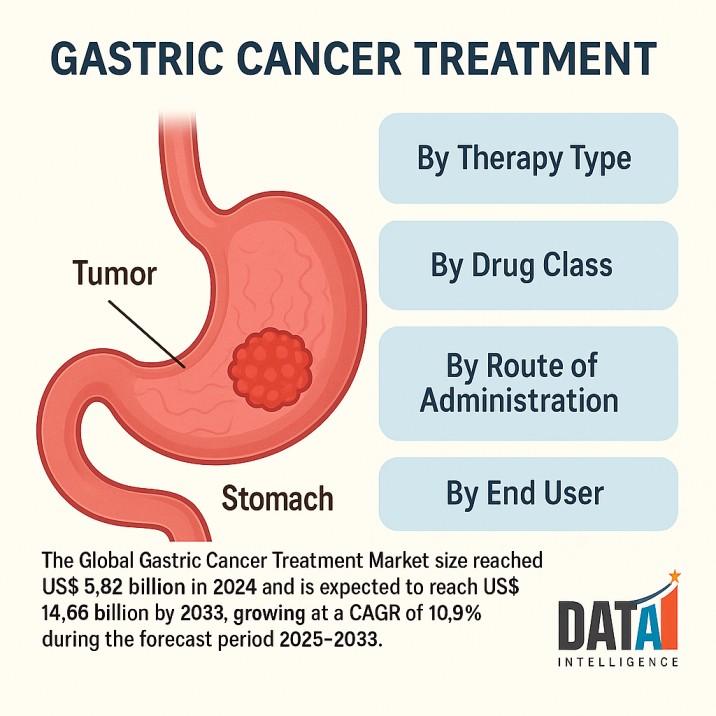

WILMINGTON, DE, UNITED STATES:The global gastric (stomach) cancer treatment market is entering a high-innovation phase as immuno-oncology, antibody-drug conjugates (ADCs), and biomarker-guided regimens move into earlier lines of therapy. The Global Gastric Cancer Treatment Market size reached US$ 5.82 billion in 2024 and is expected to reach US$ 14.66 billion by 2033, growing at a CAGR of 10.9% during the forecast period 2025-2033.

According to DataM Intelligence's latest publication, "Gastric Cancer Treatment Market Size 2025", the study provides an in-depth assessment of epidemiology trends, therapy adoption by line of treatment, competitive landscape, biomarker testing penetration, and access dynamics across major markets in North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Get a Free Sample PDF Of This Report (Corporate Email Gets Higher Priority):- https://www.datamintelligence.com/download-sample/gastric-cancer-treatment-market?lg

Gastric cancer remains one of the most common and deadly solid tumors globally, with over 1.0-1.1 million new cases each year, heavily concentrated in Eastern Asia and high-risk countries such as Japan, China, and Korea.

Treatment has rapidly evolved from fluoropyrimidine-platinum chemotherapy alone to multi-modal regimens that combine surgery, peri-operative chemotherapy, radiotherapy, HER2-directed agents, PD-1/PD-L1 inhibitors, VEGF/VEGFR inhibitors, and novel targets such as CLDN18.2 and FGFR2b.

Rising adoption of biomarker testing (HER2, PD-L1 CPS, CLDN18.2, MSI-H/dMMR), expansion of screening programs in East Asia, and strong clinical outcomes from combination regimens are reshaping the gastric cancer treatment paradigm and creating multi-billion-dollar opportunities for drug developers and diagnostics companies.

United States: Recent Industry Developments

✅ October 2024 - First CLDN18.2-targeted therapy approval:

The U.S. FDA approved zolbetuximab-clzb (Vyloy, Astellas) plus fluoropyrimidine- and platinum-based chemotherapy as first-line therapy for adults with locally advanced unresectable or metastatic HER2-negative, CLDN18.2-positive gastric or GEJ adenocarcinoma, alongside an FDA-approved companion diagnostic assay.

✅ March 2025 - Keytruda gains traditional approval in HER2+ gastric cancer:

The FDA granted traditional approval to pembrolizumab (Keytruda, Merck) in combination with trastuzumab and chemotherapy for first-line treatment of adults with locally advanced unresectable or metastatic HER2-positive gastric/GEJ adenocarcinoma with PD-L1 CPS ≥1, based on mature overall-survival and PFS data from KEYNOTE-811.

✅ Ongoing impact of Opdivo + chemotherapy:

Nivolumab (Opdivo, BMS) plus fluoropyrimidine- and platinum-containing chemotherapy remains an important standard for advanced or metastatic gastric, GEJ, and esophageal adenocarcinoma following its April 2021 FDA approval, built on OS and PFS benefits seen in CheckMate 649. Updated 2024 analyses continue to reinforce this combination as a frontline backbone in appropriate PD-L1-positive populations.

Japan: Recent Industry Developments

✅ High-incidence market with organized screening:

Japan remains one of the highest-incidence gastric cancer countries globally, with age-standardized incidence rates above 30 per 100,000 and a long history of endoscopic screening programs, leading to earlier-stage detection and comparatively better survival outcomes.

✅ Nivolumab across treatment lines:

Japan's Ministry of Health, Labour and Welfare (MHLW) first approved nivolumab for unresectable advanced or recurrent gastric cancer after chemotherapy in 2017 (ATTRACTION-2), then expanded its use to first-line unresectable advanced or recurrent gastric cancer in combination with chemotherapy in 2021, underscoring the central role of PD-1 blockade in Japanese practice.

✅ 2024 - Zolbetuximab first-in-class CLDN18.2 option:

In March 2024, Japan became the first country to approve zolbetuximab for HER2-negative, CLDN18.2-positive unresectable, advanced or recurrent gastric cancer, ahead of U.S. and EU decisions, positioning Japan at the forefront of CLDN18.2-targeted therapy adoption.

Recent M&A Activity

The gastric cancer treatment landscape is being reshaped by broader oncology and GI-focused deal-making:

• Astellas' acquisition of Ganymed Pharmaceuticals (earlier) and subsequent development of zolbetuximab/Vyloy has created the first commercial CLDN18.2-targeted therapy, establishing a new biomarker-defined segment in gastric cancer.

• Amgen is advancing bemarituzumab, an FGFR2b-targeting antibody, which recently showed overall-survival benefit in late-stage gastric cancer trials; strong data increase the asset's partnering and lifecycle-management potential.

• Broader GI-oncology consolidation and licensing deals (e.g., major pharma acquiring early-stage GI and ADC pipelines) are giving health systems access to integrated portfolios covering gastric, colorectal, and other GI malignancies, and pushing smaller biotechs to specialize in niche biomarkers or combination strategies.

Although mega-mergers dedicated purely to gastric cancer are limited, these strategic moves across GI tumors expand treatment choices and accelerate real-world adoption of novel agents in gastric cancer regimens.

Buy Now & Get 30% OFF - (Grab 50% OFF on 2+ Reports) @ https://www.datamintelligence.com/buy-now-page?report=gastric-cancer-treatment-market?lg

Top Industry Players

Key pharmaceutical and biotech companies active in the gastric cancer treatment market include:

✅ F. Hoffmann-La Roche - Longstanding leader with trastuzumab (Herceptin) as foundational HER2-targeted therapy in gastric cancer and combination partner in KEYNOTE-811.

✅ Merck & Co. (MSD) - Developer of pembrolizumab (Keytruda), now with full approval for first-line HER2-positive, PD-L1-expressing gastric/GEJ adenocarcinoma in combination with trastuzumab and chemotherapy.

✅ Bristol Myers Squibb / Ono Pharmaceutical - Co-developers of nivolumab (Opdivo); pivotal CheckMate-649 and ATTRACTION-2 data established PD-1 blockade as a backbone in first-line and later-line gastric cancer, in both U.S. and Japan.

✅ AstraZeneca & Daiichi Sankyo - Partners behind trastuzumab deruxtecan (Enhertu), an ADC indicated for HER2-positive gastric cancer after prior trastuzumab, and now also tumor-agnostic HER2-positive solid tumors, reinforcing ADC momentum in gastric cancer.

✅ Astellas Pharma - Innovator of zolbetuximab/Vyloy, the first CLDN18.2-directed therapy approved in Japan, EU, and the U.S. for CLDN18.2-positive, HER2-negative advanced gastric/GEJ cancer.

✅ Eli Lilly and Company - Markets ramucirumab (Cyramza), a VEGFR-2 inhibitor used in combination with paclitaxel or as monotherapy in second-line gastric/GEJ adenocarcinoma, contributing to anti-angiogenic treatment options.

✅ Amgen - Advancing bemarituzumab, targeting FGFR2b-positive gastric cancer; positive late-stage trial results strengthen its position in biomarker-guided therapy.

✅ Takeda Pharmaceutical - Active across GI oncology with agents such as trifluridine/tipiracil and regional partnerships, leveraging strong presence in Japan and broader Asia to shape gastric cancer treatment access.

Latest News & Industry Trends

• Shift toward biomarker-driven care: Targeted agents against HER2, PD-1/PD-L1, CLDN18.2, FGFR2b and VEGF/VEGFR are rapidly expanding their share of the gastric cancer treatment market, with immunotherapy and targeted therapy already accounting for a major part of revenue in recent analyses.

• Rising incidence but earlier detection in East Asia: Eastern Asia (especially China, Japan, and Korea) continues to contribute >60% of global gastric cancer cases, yet extensive screening programs are enabling earlier detection and better survival in these countries.

• Advent of CLDN18.2-targeted therapy: The approval of zolbetuximab/Vyloy has created a new biomarker segment; approximately one-third of screened patients in SPOTLIGHT and GLOW had CLDN18.2-positive tumors, opening a sizeable new market pool.

• ADC and IO combinations gaining traction: ADCs like Enhertu and novel checkpoint inhibitor combinations (e.g., nivolumab plus chemotherapy, or PD-1 inhibitors with HER2 or CLDN18.2-directed agents) are demonstrating meaningful OS and PFS gains, helping move advanced gastric cancer toward more personalized, durable control.

• Unmet need in early-onset and later-line settings: Emerging data suggest a sizeable future burden of early-onset gastric cancer, particularly in Asia, highlighting opportunities for novel agents, maintenance strategies, and survivorship-oriented care models.

Key Segments

✅ By Therapy Type

• Chemotherapy: Remains a foundational backbone (e.g., fluoropyrimidine-platinum regimens), used alone or in combination with targeted agents and immunotherapies across peri-operative and metastatic settings.

• Targeted Therapy: Includes HER2-directed agents (trastuzumab, trastuzumab deruxtecan), VEGFR-targeted drugs (ramucirumab), FGFR2b-directed (bemarituzumab), and CLDN18.2-directed therapies (zolbetuximab), delivering strong efficacy in biomarker-selected subgroups.

• Immunotherapy: PD-1/PD-L1 inhibitors (nivolumab, pembrolizumab) in first-line and later-line settings, increasingly combined with chemotherapy and targeted agents, particularly in PD-L1 CPS-defined populations.

• Radiation Therapy & Chemoradiation: Used in selected peri-operative and palliative settings, often alongside systemic therapies.

• Surgery & Others: Gastrectomy (partial or total) and lymph-node dissection remain crucial for curative-intent treatment in early and locally advanced disease, supported by neoadjuvant/adjuvant regimens.

✅ By Drug Class

• HER2-targeted therapies - trastuzumab, trastuzumab deruxtecan, and next-generation HER2 agents for HER2-positive gastric/GEJ cancer.

• PD-1/PD-L1 inhibitors - nivolumab, pembrolizumab, and pipeline agents for PD-L1-expressing or MSI-H/dMMR tumors.

• VEGF/VEGFR inhibitors - ramucirumab-based combinations as standard in second-line settings.

• CLDN18.2-targeted therapies - zolbetuximab and competitors for CLDN18.2-positive, HER2-negative tumors.

• Others - emerging classes (e.g., FGFR2b, multi-target TKIs, bispecific antibodies, and cellular therapies) in development.

Get Customization in the Report as per Your Requirements: https://www.datamintelligence.com/customize/gastric-cancer-treatment-market?lg

✅ By Route of Administration

• Intravenous (IV) therapies dominate (chemotherapy, monoclonal antibodies, ADCs, IO agents).

• Oral targeted therapies and chemotherapy agents (e.g., capecitabine, certain TKIs) support chronic and maintenance regimens.

✅ By End User

• Hospitals & Cancer Centers - Largest share, managing surgical, systemic, and radiation treatment for gastric cancer.

• Specialty & Academic Oncology Centers - High uptake of novel biomarker-guided and trial-based regimens.

• Outpatient Clinics & Day-care Centers - Growing role in delivering IV infusions and oral therapy management, particularly in developed markets.

Regional Analysis for Market

• Asia-Pacific accounts for the largest share of gastric cancer incidence and treatment spending, driven by high disease burden in China, Japan, Korea, and parts of Southeast Asia, strong adoption of screening programs, and rapid integration of innovative therapies such as nivolumab, pembrolizumab, trastuzumab deruxtecan, and zolbetuximab.

• North America remains a high-value market, supported by leading academic centers, strong reimbursement for IO and targeted therapies, and rapid regulatory approvals for agents such as Enhertu, Vyloy, Opdivo, and Keytruda combinations.

• Europe is seeing accelerated innovation, with EU approval of zolbetuximab and widespread integration of HER2- and PD-1-directed regimens in national guidelines, though HTA and pricing processes influence speed of uptake by country.

• Latin America and Middle East & Africa show growing demand, but access is constrained by limited biomarker testing capacity and reimbursement; international collaborations and patient-access programs are gradually expanding the reach of new therapies.

Product Launches and Innovations

The gastric cancer treatment market is witnessing an active wave of clinical and commercial launches:

• ADC expansion: Enhertu's gastric indication and tumor-agnostic HER2-positive approval, alongside early-stage ADC pipelines, reflect strong interest in ADCs for difficult-to-treat gastric cancer subgroups.

• First-in-class CLDN18.2 targeting: Vyloy's approvals in Japan, EU, and U.S. make CLDN18.2 testing a new standard in advanced HER2-negative disease, with multiple follow-on candidates in development.

• Novel IO combinations and peri-operative strategies: Trials such as CheckMate-649 and others assessing IO in peri-operative or adjuvant settings are redefining standards of care and broadening eligible patient populations.

• FGFR2b and other biomarker agents: Bemarituzumab's reported OS benefit, alongside other pathway-targeted drugs, illustrates the shift toward multi-biomarker segmentation of gastric cancer.

Partnerships between pharma, diagnostics companies, and academic centers are central to accelerating companion-diagnostic deployment (HER2, PD-L1 CPS, CLDN18.2) and bringing advanced options to high-burden regions. Power your strategic decisions in the Gastric Cancer Treatment Market with real-time tracking of clinical pipelines, regulatory approvals, competitive launches, biomarker-testing adoption, and regional access barriers-all consolidated into DataM Intelligence's integrated oncology intelligence platform.

Have any Enquiry of This Report @ https://www.datamintelligence.com/enquiry/gastric-cancer-treatment-market?lg

Get 2-Day Free Trial + 50% OFF DataM Subscription @ https://www.datamintelligence.com/reports-subscription?lg

Have a look at our Subscription Dashboard:

https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us:

Sai Kiran

DataM Intelligence 4market Research LLP

Phone: +1 877-441-4866

Email: Sai.k@datamintelligence.com

About DataM Intelligence

DataM Intelligence is a renowned provider of market research, delivering deep insights through pricing analysis, market share breakdowns, and competitive intelligence. The company specialises in strategic reports that guide businesses in high-growth sectors such as nutraceuticals and AI-driven health innovations.

To find out more, visit https://www.datamintelligence.com/ or follow us on Twitter, LinkedIn and Facebook.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Gastric Cancer Treatment Market Growth 2025: Oncology Trends & Insights, Top Key Players - F. Hoffmann-La Roche, Merck & Co., Bristol Myers Squibb, AstraZeneca/Daiichi Sankyo here

News-ID: 4275017 • Views: …

More Releases from DataM Intelligence 4market Research LLP

Live Video Streaming Platforms Market to Reach US$ 252.3B by 2030 | Explosive Gr …

Market Size and Growth

The Global Live Video Streaming Platforms Market reached US$ 54.5 billion in 2022 and is expected to reach US$ 252.3 billion by 2030, growing with a CAGR of 27.6% from 2024 to 2031.

Growth is driven by rising mobile video consumption, expanding creator economies, increasing live commerce adoption, and strong demand from gaming, sports, education, and enterprise sectors.

Get a Free Sample PDF Of This Report (Get Higher Priority…

United States Aluminum Composite Panels Market 2026 | Growth Drivers, Key Player …

Market Size and Growth

Global Aluminum Composite Panels Market reached US$ 5.5 billion in 2023 and is expected to reach US$ 8.4 billion by 2031, growing with a CAGR of 5.5% during the forecast period 2024-2031.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):-

https://www.datamintelligence.com/download-sample/aluminum-composite-panels-market?sindhuri

Key Development:

United States: Recent Industry Developments

✅ In January 2026, U.S.-based building material manufacturers expanded the use of fire-retardant aluminum composite panels…

Airway Management Devices Market to Reach USD 3.82B by 2031 | 6.4% CAGR | Rising …

The airways management devices market is US$2.48 billion in 2024 and is estimated to grow at a High 6.4% CAGR from 2025 to 2031 to reach a value of US$3.82 billion in 2031. Airway management devices are essential tools used to secure, maintain, and protect patient airways in clinical, emergency, and surgical settings, driven by the rising prevalence of respiratory diseases, increasing surgical procedures, and advancements in device technology.

These devices…

Internet Search Portals Market to Reach USD 442.3B by 2030 | CAGR 15.3% | AI-Dri …

The Global Internet Search Portals Market reached USD 222.1 billion in 2022 and is expected to reach USD 442.3 billion by 2030, growing with a CAGR of 15.3% from 2023 to 2030. This growth is driven by rapid global internet adoption, proliferation of mobile devices, rising digital advertising spends, and increasing consumer reliance on efficient online search experiences across devices and regions.

Internet search portals enable users to discover information, products,…

More Releases for HER2

HER2-Positive Breast Cancer (HER2+ BC) Clinical Market to Reach USD 21.46 Billio …

Sub-Headline: The global HER2-Positive Breast Cancer Clinical Market is expected to rise from USD 13.82 billion in 2023 to USD 21.46 billion by 2030, registering a CAGR of 6.5%, driven by rapid uptake of antibody-drug conjugates (ADCs), dual-targeted therapies, and AI-enabled precision oncology diagnostics.

Introduction

The HER2-Positive Breast Cancer (HER2+ BC) Clinical Market is undergoing a major transformation fueled by next-generation targeted therapies, breakthrough ADCs, biosimilar expansion, and genomic testing advancements. HER2+…

Evolving Market Trends In The HER2-Positive Breast Cancer Industry: Innovative T …

Our market reports now include the latest updates on global tariffs, trade impacts, and evolving supply chain dynamics.

What Is the Expected HER2-Positive Breast Cancer Market Size During the Forecast Period?

Over the past few years, there has been a noteworthy expansion in the HER2-positive breast cancer market. The market, which is projected to increase from $10.21 billion in 2024 to $10.96 billion in the following year, predicts a compound annual growth…

HER2 Inhibitors: Advancing Breast Cancer Treatments

"The Business Research Company recently released a comprehensive report on the Global HER2 Inhibitors Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

HER2 Positive Breast Cancer Pipeline Drugs 2024

DelveInsight's, "HER2 Positive Breast Cancer Pipeline Insight 2024" report provides comprehensive insights about 60+ companies and 65+ pipeline drugs in HER2 Positive Breast Cancer pipeline landscape. It covers the HER2 Positive Breast Cancer pipeline drug profiles, including clinical and nonclinical stage products. It also covers the HER2 Positive Breast Cancer therapeutics assessment by product type, stage, route of administration, and molecule type. It further highlights the inactive pipeline products in…

HER2 Inhibitors: Targeted Therapies Transforming Cancer Treatment

HER2 inhibitors market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses the market to account to grow at a CAGR of 9% in the above mentioned forecast period.

Global HER2 Inhibitors Market Scope and Market Size

The HER2 inhibitors market is segmented on the basis of treatment, application, end-users and distribution channel. The growth amongst these segments will help you analyze…

ADC Drugs For HER2 Positive Breast Cancer

According to the latest data, breast cancer has overtaken lung cancer to become the most common cancer among women, and the death rate is the second highest among female tumors, seriously affecting the physical and mental health of women around the world. Patients with abnormal expression of human epidermal growth factor receptor (HER2) account for 15%-20% of all breast cancers, which is highly invasive and has poor prognosis.

Although more drug…