Press release

Top Companies in Smartwatch Battery Market - Benchmarking Performance & Future Value Creation

The smartwatch battery market is evolving rapidly, shaped by advancements in wearable technology, growing health-conscious consumers, and rising integration of AI-driven features. As global demand for smartwatches accelerates, battery technology has become the cornerstone of innovation and competitiveness. This article explores the leading players driving advancements in smartwatch battery technology, a detailed SWOT analysis of industry leaders, and the emerging investment opportunities reshaping the market landscape.➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-7605

Top Companies & Their Strategies

1. Samsung SDI Co., Ltd.

Samsung SDI stands as a leading innovator in the smartwatch battery market, leveraging its deep expertise in lithium-ion technology. The company focuses on compact, high-density battery designs tailored for wearables. Its competitive edge lies in high energy efficiency and long cycle life, catering to global smartwatch brands like Samsung Electronics and others. Samsung SDI also invests heavily in solid-state battery R&D, aiming to reduce charging time and enhance safety.

2. LG Energy Solution

LG Energy Solution has built a strong reputation for developing thin, flexible batteries optimized for wearable devices. The company emphasizes materials innovation, focusing on energy-dense lithium polymer batteries. Its strategic collaborations with smartwatch manufacturers and its robust production capacity position LG Energy Solution as a reliable, high-quality supplier. Moreover, LG's global supply chain reach ensures scalability and cost efficiency, enabling it to serve markets across Asia, North America, and Europe.

3. Panasonic Energy Co., Ltd.

Panasonic has a long-standing presence in the wearable and consumer electronics battery sector, emphasizing reliability and miniaturization. Its cylindrical and prismatic lithium-ion batteries are widely adopted in smartwatches for consistent power delivery. Panasonic's strength lies in safety, durability, and advanced thermal management, ensuring stable performance under compact designs. The company's R&D is now centered on higher energy density cells to extend smartwatch battery life without increasing device size.

4. EVE Energy Co., Ltd.

China-based EVE Energy is rapidly emerging as a key player in the smartwatch battery ecosystem, offering cost-effective yet high-performance solutions. The company's portfolio includes lithium-ion and solid-state batteries designed for compact wearables. Its competitive pricing and manufacturing efficiency have enabled it to penetrate markets dominated by established global players. EVE's vertical integration-from materials to cell production-further strengthens its position in supply reliability.

➤ Explore detailed profiles of top players and new entrants in this space - access your free sample report → https://www.researchnester.com/sample-request-7605

5. Murata Manufacturing Co., Ltd.

Murata Manufacturing, a Japanese electronics giant, plays a crucial role in powering smartwatches through its advanced micro battery and lithium-ion solutions. Murata's focus on miniaturization and power density has made it a preferred supplier for premium smartwatch brands. The company's R&D efforts are directed toward enhancing the charging cycle, energy retention, and form flexibility to meet the demands of ultra-slim devices.

6. ATL

ATL, a subsidiary of TDK Corporation, is a global leader in customized lithium polymer batteries for wearables. Its specialization in ultra-thin, curved, and high-capacity cells gives it an edge in premium smartwatch models. ATL's strategic partnerships with major consumer electronics companies enable strong brand integration. The firm's investment in sustainable battery production and recycling technologies also enhances its long-term competitive positioning.

7. Varta AG

Germany's Varta AG continues to innovate in the microbattery segment, supplying premium brands with compact lithium-ion solutions. Known for its precision engineering and quality, Varta emphasizes eco-friendly manufacturing and innovation in button cell batteries. The company's European manufacturing base supports its strategy of catering to high-end wearable brands with stringent performance standards.

8. Enovix Corporation

Enovix, a U.S.-based emerging player, is disrupting the smartwatch battery market with its 3D silicon-anode lithium-ion technology. The company's innovation promises higher energy density, faster charging, and longer lifespan compared to conventional graphite anodes. Enovix's focus on next-generation architectures positions it as a potential game-changer in the wearable technology segment, particularly for high-performance smartwatches.

➤ Gain access to expanded insights on competitive strategies, market size, and regional analysis. View our Smartwatch Battery Market Report Overview here: https://www.researchnester.com/reports/smartwatch-battery-market/7605

SWOT Analysis of Leading Companies

Strengths

Leading players in the smartwatch battery industry benefit from strong R&D ecosystems, vertically integrated supply chains, and established relationships with top smartwatch manufacturers. Companies like Samsung SDI, LG Energy Solution, and ATL excel in technological sophistication and mass production. Their emphasis on high energy density, miniaturization, and safety certifications enhances brand reliability. Moreover, diversified product portfolios allow them to serve multiple end-use applications, including fitness bands and premium wearables.

Weaknesses

Despite technological advances, the industry faces challenges related to production costs and raw material volatility. Lithium, cobalt, and nickel price fluctuations affect profit margins, especially for smaller players. Additionally, manufacturing complexity limits scalability for emerging firms, while established players must continuously invest in R&D to stay competitive. Limited recyclability and environmental concerns also pose challenges to sustainability goals.

Opportunities

Opportunities in the smartwatch battery market are driven by the growing adoption of AI-integrated, health-monitoring smartwatches. Advances in solid-state and graphene-based batteries open new possibilities for longer runtimes and faster charging. Strategic collaborations between battery suppliers and smartwatch OEMs (Original Equipment Manufacturers) are expanding, particularly in Asia-Pacific and North America. Additionally, investments in eco-friendly battery production and recycling technologies are creating new value chains and attracting ESG-focused investors.

Threats

Intense competition and technological disruption remain the most significant threats. Rapid innovation cycles can render existing battery designs obsolete, pressuring companies to accelerate R&D pipelines. Regulatory pressures regarding hazardous materials, environmental compliance, and export restrictions add further complexity. Moreover, geopolitical tensions and supply chain disruptions, especially in Asia, may hinder the availability of key raw materials, affecting cost structures and production continuity.

➤ Access a complete SWOT breakdown with company-specific scorecards: Claim your sample report → https://www.researchnester.com/sample-request-7605

Investment Opportunities & Trends

Emerging Investment Themes

Investment momentum in the smartwatch battery market is centered on technology integration, material innovation, and sustainability. Investors are increasingly targeting startups developing solid-state, silicon-anode, and graphene-based battery technologies. Strategic mergers and partnerships between established players and R&D startups are common, aimed at accelerating the commercialization of next-generation wearable batteries.

Regions such as Asia-Pacific dominate the investment landscape due to the concentration of smartwatch manufacturers and raw material suppliers. Meanwhile, North America and Europe are attracting capital for innovation-driven ventures focused on advanced materials, miniaturization, and circular economy practices.

Key M&A Activity and Collaborations

Over the past year, several strategic collaborations have reshaped the smartwatch battery ecosystem.

• TDK Corporation's ATL has expanded joint ventures with major smartwatch brands for customized flexible battery designs.

• Murata Manufacturing entered strategic alliances with technology firms to co-develop ultra-thin batteries compatible with health sensors and display modules.

• Samsung SDI and LG Energy Solution have invested in expanding production lines dedicated to wearable batteries in South Korea and Vietnam, aiming to strengthen supply reliability.

• Enovix Corporation secured partnerships with consumer electronics leaders to pilot its 3D silicon battery for next-generation smartwatches.

These alliances reflect a broader industry trend toward vertical integration and collaborative R&D as a response to increasing design complexity and performance demands.

Technological Advancements Driving Investments

Investors are particularly interested in technologies that enhance battery life, safety, and sustainability.

• Solid-state batteries promise enhanced stability and higher energy density, reducing the risks of swelling or overheating in compact devices.

• Graphene-enhanced electrodes are being explored for improved conductivity and rapid charging.

• Flexible and curved batteries, designed to fit slim smartwatch contours, are gaining traction among OEMs targeting the premium segment.

These developments are not only redefining the smartwatch user experience but also creating lucrative opportunities for investors focusing on wearable technology innovations.

Regional Expansion and Supply Chain Investments

The Asia-Pacific region, particularly China, South Korea, and Japan, remains a focal point for large-scale investments in smartwatch battery manufacturing. These countries host the most significant supply networks and offer government incentives for clean energy innovation. In contrast, North America is seeing an uptick in venture capital funding for next-generation battery startups, while Europe is investing in sustainability-focused production and recycling initiatives.

Furthermore, the shift toward localized production and supply chain diversification is emerging as a strategic priority following recent global disruptions. Companies are increasingly setting up regional hubs to minimize logistics costs and mitigate supply risks.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-7605

➤ Related News -

https://www.linkedin.com/pulse/how-next-generation-cigarettes-transforming-3bn8c/

https://www.linkedin.com/pulse/what-future-wearable-pregnancy-devices-market-kse9c/

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top Companies in Smartwatch Battery Market - Benchmarking Performance & Future Value Creation here

News-ID: 4257727 • Views: …

More Releases from Research Nester Pvt Ltd

Key Players in the Returnable Packaging Market: Share Positioning & Investor Per …

The returnable packaging market is gaining strategic importance as companies across logistics, food & beverage, automotive, and retail industries seek cost efficiency, sustainability, and supply chain resilience. Returnable packaging solutions-such as reusable pallets, crates, containers, drums, and intermediate bulk containers (IBCs)-are increasingly favored over single-use packaging due to regulatory pressure, circular economy goals, and operational efficiency.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8352

Top Companies

1. Brambles (CHEP)

Brambles, through its…

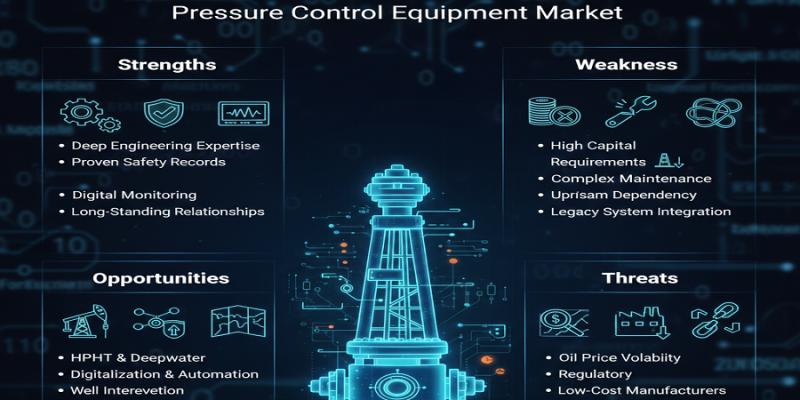

Pressure Control Equipment Market Dominance: Top Companies Strengthening Share & …

Pressure control equipment plays a mission-critical role in ensuring safety, operational integrity, and regulatory compliance across oil & gas exploration, well intervention, drilling, and production activities. From blowout preventers (BOPs) and control heads to manifolds and pressure valves, these systems are essential for managing high-pressure environments in both onshore and offshore operations.

As upstream operators focus on deeper wells, high-pressure high-temperature (HPHT) environments, and complex well architectures, demand for advanced pressure…

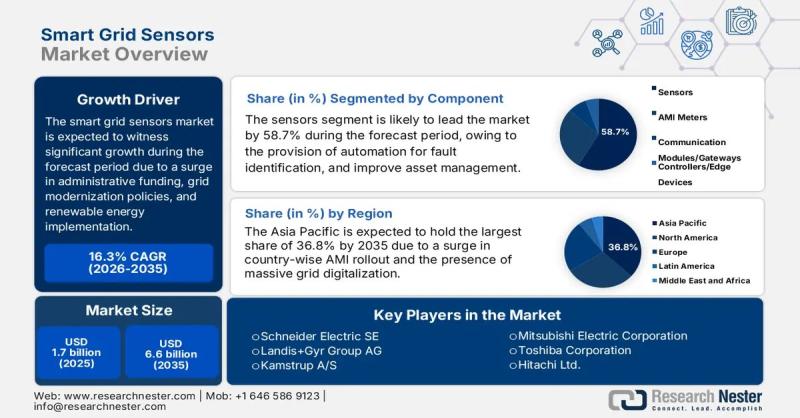

Smart Grid Sensors Market size to exceed $6.6 Billion by 2035 | General Electric …

Market Outlook and Forecast

The smart grid sensors market is emerging as a critical enabler of next-generation power infrastructure, supporting utilities and grid operators in transitioning from conventional, centralized electricity networks to intelligent, data-driven energy systems. Smart grid sensors provide real-time visibility into grid performance, enabling advanced monitoring, predictive maintenance, fault detection, and efficient energy distribution across transmission and distribution networks.

In 2025, the global smart grid sensors market is valued at…

Top Companies in Architectural Lighting Market - Benchmarking Performance & Futu …

The architectural lighting market has evolved into a design-driven, technology-intensive segment of the global lighting industry. Beyond illumination, architectural lighting now plays a critical role in enhancing aesthetics, supporting energy efficiency goals, and enabling smart building environments. Demand is increasingly shaped by urban development, commercial real estate upgrades, hospitality projects, and public infrastructure modernization.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8342

Top Companies & Their Strategies

1. Signify (Philips Lighting)

Signify…

More Releases for R&D

Sales Acceleration Technology Market 2023: Sales and Industry Revenue Forecasts- …

The Sales Acceleration Technology market has witnessed growth from USD XX million to USD XX million from 2017 to 2023. With the CAGR of X.X%, this market is estimated to reach USD XX million in 2029.

The report focuses on the Sales Acceleration Technology market size, segment size (mainly covering product type, application, and geography), competitor landscape, recent status, and development trends. Furthermore, the report provides detailed cost analysis, supply chain.

Technological…

R&D Incentive Services Market is Booming Worldwide | KPMG, R&D Incentives, Deloi …

The latest report released on Global R&D Incentive Services Market analyses areas where there is still room for improvement. Irrespective of industry, organization size, or geographic location, the R&D Incentive Services Market study suggests that advanced technologies are playing a bigger role than ever before. The assessment provides trend, growth factors and estimates for Global R&D Incentive Services Market forecasted till 2028. Some of the key players profiled are KPMG…

Siveco doubles China R&D investment

On July 3, 2019, Siveco China held its half-year management meeting at the prestigious Hellas House in Shanghai, a nod to the company's continuing growth on the Belt & Road. With financial results above target, high customer satisfaction (as shown in the latest audited customer satisfaction survey) and a sales pipeline more promising than ever, the company's management board announced that shareholders have approved its request for additional investment in…

R&D Collaborative Projects by GD Rectifiers

GD Rectifiers have extensive experience in collaborative R&D projects and are proud to work with some of the UK’s pioneering power electronic companies to drive design and innovation forward.

This R&D service helps drive GD Rectifiers forward as a cutting edge manufacturer embracing fundamental technologies that support product development that contribute to next generation products throughout: renewable energy, embedded systems, smart metrering and the rail industry.

Power Assemblies, Controllers and…

Noliac is expanding the R&D team

Noliac is looking for two new colleagues for the R&D team in Prague, Czech Republic: A Precision/Fine Mechanics and an Electroengineer.

Precision/Fine Mechanics

For the R&D team in Prague, Czech Republic, Noliac is looking for a Precision/Fine mechanics to work on modifying existing products and work with developing new. Noliac requires a colleague who:

Is mechanically skilled with a focus on very small machinery.

Holds a technical high school degree or an apprenticeship…

Leiber GmbH further invests in R&D

Since February 2016, Leiber GmbH has been reinforced by Dr med vet Claudia Westfahl - a veterinarian specialized in animal nutrition - as part of the company's strategy to invest in new product developments. With the new position ‘Product Development Animal Nutrition’, Dr Westfahl is responsible for new product development in the field of functional feed ingredients for both pet as well as farm animals. After graduating at the University…