Press release

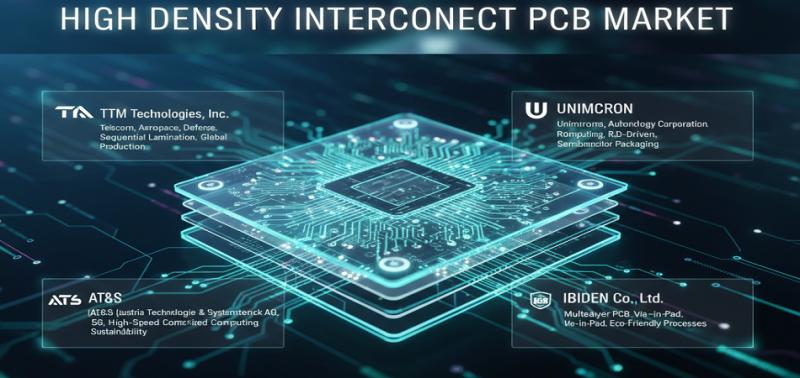

Key Players in the High-density Interconnect PCB Market - TTM Technologies, Inc, Unimicron Technology Corporation, AT&S (Austria Technologie & Systemtechnik AG), Ibiden Co., Ltd., Nippon Mektron Ltd

The high-density interconnect PCB market has become a critical enabler of next-generation electronics, underpinning advancements in mobile devices, automotive systems, aerospace equipment, and data centers. As electronic devices become smaller, faster, and more powerful, HDI PCBs are essential for achieving high component density, superior signal integrity, and enhanced performance reliability. This market is defined by rapid technological innovation, global manufacturing expansion, and strategic investments in multilayer and microvia technologies.The competitive landscape is dominated by established PCB manufacturers and innovative emerging players investing heavily in automation, miniaturization, and advanced interconnect technologies.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-7035

Top Companies & Their Strategies

1. TTM Technologies, Inc.

TTM Technologies is one of the leading global manufacturers in the HDI PCB market, recognized for its broad portfolio across telecommunications, aerospace, and defense sectors. The company's strength lies in its high-mix, low-volume manufacturing capability and technical expertise in sequential lamination and microvia processes. TTM's strategic advantage is its ability to deliver end-to-end solutions, including design, fabrication, and assembly, while maintaining cost efficiency through advanced automation and global production facilities across the U.S. and Asia.

2. Unimicron Technology Corporation

Based in Taiwan, Unimicron Technology is a global leader in HDI and substrate PCBs, catering primarily to smartphone, automotive, and computing industries. The company's competitive edge lies in its high-yield production processes and R&D-driven innovations in build-up substrates and ultra-thin laminates. Unimicron's close partnerships with semiconductor giants have positioned it as a critical supplier in the semiconductor packaging and miniaturization ecosystem. Its regional diversification-spanning Taiwan, China, and Europe-strengthens its market resilience.

3. AT&S (Austria Technologie & Systemtechnik AG)

AT&S is a pioneer in high-performance interconnect solutions with a focus on HDI PCBs and IC substrates. The company's strength lies in its European engineering excellence and heavy investment in manufacturing expansion in Asia, particularly in China and Malaysia. AT&S emphasizes sustainability and precision manufacturing, integrating fine-line technology and advanced substrate solutions for 5G and high-speed computing applications. Its strategic collaborations with automotive and telecom OEMs enhance its global competitive positioning.

4. Ibiden Co., Ltd.

Japan-based Ibiden is known for its deep expertise in multilayer PCB manufacturing and IC packaging substrates. Its strength lies in maintaining high-quality production through automation and cleanroom manufacturing standards. Ibiden's R&D investment in next-generation HDI structures-such as via-in-pad and any-layer interconnect-supports its role as a key supplier to leading semiconductor and mobile device manufacturers. Its integration of eco-friendly processes and material optimization provides both technical and sustainability advantages.

➤ Explore detailed profiles of top players and new entrants in this space - access your free sample report → https://www.researchnester.com/sample-request-7035

5. Nippon Mektron Ltd.

Nippon Mektron, a subsidiary of NOK Corporation, is one of the largest producers of flexible and rigid-flex HDI PCBs. Its specialization in miniaturized, high-reliability PCBs has made it a top-tier supplier to global consumer electronics companies, particularly in smartphones and wearables. The company's cost advantage comes from vertical integration and efficient supply chain management, supported by a strong presence across Japan, China, and Southeast Asia. Nippon Mektron continues to innovate in flex-rigid interconnects that meet the growing demand for compact, high-speed electronics.

6. Zhen Ding Technology Holding Limited (ZDT)

Zhen Ding Technology, another Taiwan-based giant, has built its competitive strength around large-scale HDI PCB manufacturing for mobile devices, networking equipment, and automotive systems. Its adoption of automated optical inspection (AOI) and advanced laser drilling ensures exceptional precision and manufacturing efficiency. ZDT's investments in substrate-like PCBs (SLP) and embedded component technology reflect its strategic vision to stay ahead in next-generation electronic packaging.

7. Advanced Circuits (Tempo/Advanced Circuits Inc.)

Advanced Circuits, a leading U.S.-based HDI PCB manufacturer, differentiates itself through rapid prototyping and quick-turn production capabilities. Its agility and customer-centric model make it a preferred supplier for defense, aerospace, and high-performance computing clients requiring low-volume, high-complexity boards. The company's integration of digital manufacturing workflows and design automation tools enhances its responsiveness and competitive edge in a market dominated by large-scale Asian producers.

8. Tripod Technology Corporation

Tripod Technology, also headquartered in Taiwan, combines high-volume HDI PCB manufacturing with a focus on automotive and networking electronics. Its strategic emphasis on automation, reliability testing, and multilayer HDI structures gives it an advantage in supplying to Tier-1 automotive OEMs. Tripod's global footprint, supported by facilities in China and Thailand, allows it to efficiently meet regional demand fluctuations and maintain competitive pricing.

➤ Gain access to expanded insights on competitive strategies, market size, and regional analysis. View our High Density Interconnect PCB Market Report Overview here: https://www.researchnester.com/reports/high-density-interconnect-pcb-market/7035

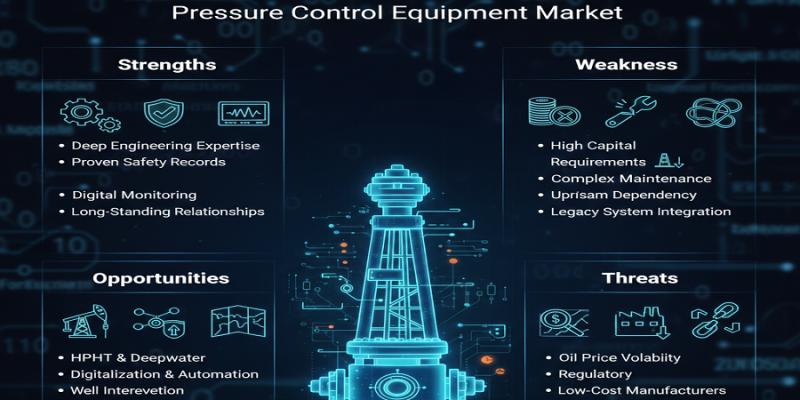

Combined SWOT Analysis for Leading Companies

Strengths

Leading companies in the high-density interconnect PCB market benefit from advanced manufacturing processes, global supply chains, and long-standing relationships with Tier-1 OEMs in consumer electronics, automotive, and telecommunications. Their expertise in microvia technology, fine-line etching, and multilayer design enables them to meet the growing demand for compact, high-speed circuit boards. Many also possess strong R&D and material science capabilities, allowing them to innovate in substrate-like PCBs, embedded components, and flexible circuitry. The global presence of these companies ensures supply chain agility and cost competitiveness.

Weaknesses

Despite technological advancements, the HDI PCB market faces challenges related to capital-intensive production and yield optimization. Complex manufacturing processes require precision equipment and skilled labor, increasing operational costs. Smaller firms often struggle to compete with large-scale manufacturers that enjoy economies of scale. Additionally, the reliance on imported raw materials and limited local sourcing in several regions exposes companies to supply chain disruptions. Fluctuations in demand from consumer electronics, which constitute a major end-use sector, can also impact profitability.

Opportunities

The ongoing shift toward electric vehicles (EVs), 5G networks, and IoT devices presents significant growth opportunities for HDI PCB manufacturers. Emerging sectors like autonomous driving, high-performance computing, and advanced medical devices are increasingly adopting miniaturized circuit solutions that require multilayer and high-reliability HDI designs. The integration of AI and robotics in PCB manufacturing offers avenues for cost reduction and quality improvement. Moreover, regional expansion in Southeast Asia and India is opening new opportunities for both large-scale and mid-tier PCB producers seeking to diversify manufacturing bases and reduce dependency on China.

Threats

The HDI PCB industry is highly competitive, with pricing pressures from mass manufacturers and geopolitical uncertainties affecting trade flows. Stringent environmental regulations, particularly in East Asia and Europe, pose compliance challenges and may increase production costs. Rapid technological evolution can make older PCB technologies obsolete, compelling companies to continuously invest in R&D. Additionally, the shortage of skilled labor in microelectronics manufacturing and the risk of intellectual property leakage in global supply chains remain critical threats to the long-term competitiveness of leading players.

➤ Access a complete SWOT breakdown with company-specific scorecards: Claim your sample report → https://www.researchnester.com/sample-request-7035

Investment Opportunities & Emerging Trends

Technological Integration and Process Innovation

Investment activity in the high-density interconnect PCB market is heavily centered on automation, AI-driven design optimization, and advanced material technologies. Leading manufacturers are investing in laser direct imaging (LDI), additive manufacturing, and hybrid PCB fabrication to improve precision and reduce material waste. Investors are also showing strong interest in companies developing substrate-like PCBs (SLP), which bridge the gap between traditional PCBs and semiconductor packaging. These advancements are expected to play a key role in supporting 5G, AI computing, and EV electronics ecosystems.

Mergers, Acquisitions, and Strategic Partnerships

The HDI PCB market has seen several strategic mergers and acquisitions aimed at capacity expansion and technology transfer. For example, major players in Asia have acquired smaller regional firms to strengthen supply chain integration and access new customer segments. TTM Technologies' continued expansion through strategic acquisitions underscores the push toward vertical integration and cross-sector collaboration. Partnerships between PCB manufacturers and semiconductor foundries are also on the rise, enabling co-development of advanced interconnect solutions for next-generation chipsets.

Regional Investment Hotspots

Asia-Pacific remains the global hub for HDI PCB manufacturing, led by Taiwan, China, Japan, and South Korea. However, significant new investments are being directed toward Southeast Asia and India due to lower production costs, improving infrastructure, and supportive government policies promoting electronics manufacturing. North America and Europe are attracting investment in aerospace, defense, and automotive HDI applications, where stringent reliability and traceability standards require specialized production capabilities.

Sustainability and Material Advancements

Sustainability has become a defining theme in the HDI PCB market. Companies like Ibiden and AT&S are investing in eco-friendly production processes and recyclable laminate materials to comply with global environmental standards. The use of low-loss dielectric materials and lead-free plating technologies is expanding, driven by regulatory mandates and customer preference for sustainable sourcing. Investors are increasingly favoring companies that demonstrate both technical leadership and environmental compliance, as ESG considerations gain traction across global manufacturing sectors.

Recent Product Launches and Industry Developments

In the last 12 months, major companies have introduced next-generation HDI PCB technologies emphasizing higher layer counts and improved reliability. AT&S expanded its production of IC substrates and advanced HDI boards for data center applications. Zhen Ding Technology launched new SLP lines to meet demand from mobile OEMs. Unimicron and Ibiden have announced investments in high-frequency and high-speed PCB production aimed at 5G infrastructure. Meanwhile, North American manufacturers like Advanced Circuits have enhanced digital fabrication capabilities to accelerate prototype-to-production timelines.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-7035

Related News -

https://www.linkedin.com/pulse/what-future-electric-vehicle-motor-controller-wuonf/

https://www.linkedin.com/pulse/what-future-automotive-instrument-cluster-jyv0f/

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Key Players in the High-density Interconnect PCB Market - TTM Technologies, Inc, Unimicron Technology Corporation, AT&S (Austria Technologie & Systemtechnik AG), Ibiden Co., Ltd., Nippon Mektron Ltd here

News-ID: 4257719 • Views: …

More Releases from Research Nester Pvt ltd

Key Players in the Returnable Packaging Market: Share Positioning & Investor Per …

The returnable packaging market is gaining strategic importance as companies across logistics, food & beverage, automotive, and retail industries seek cost efficiency, sustainability, and supply chain resilience. Returnable packaging solutions-such as reusable pallets, crates, containers, drums, and intermediate bulk containers (IBCs)-are increasingly favored over single-use packaging due to regulatory pressure, circular economy goals, and operational efficiency.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8352

Top Companies

1. Brambles (CHEP)

Brambles, through its…

Pressure Control Equipment Market Dominance: Top Companies Strengthening Share & …

Pressure control equipment plays a mission-critical role in ensuring safety, operational integrity, and regulatory compliance across oil & gas exploration, well intervention, drilling, and production activities. From blowout preventers (BOPs) and control heads to manifolds and pressure valves, these systems are essential for managing high-pressure environments in both onshore and offshore operations.

As upstream operators focus on deeper wells, high-pressure high-temperature (HPHT) environments, and complex well architectures, demand for advanced pressure…

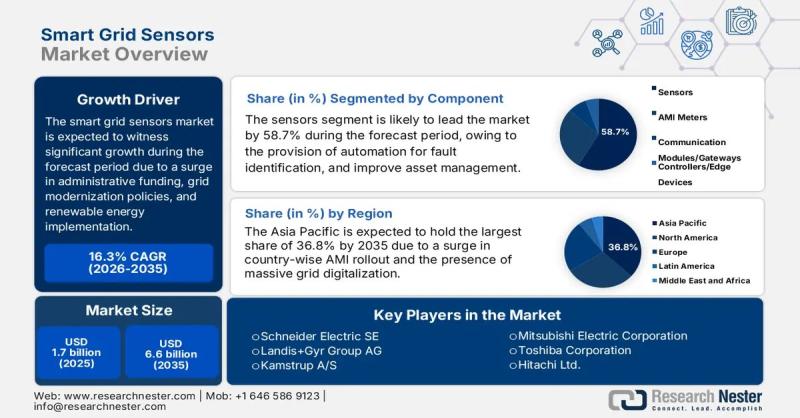

Smart Grid Sensors Market size to exceed $6.6 Billion by 2035 | General Electric …

Market Outlook and Forecast

The smart grid sensors market is emerging as a critical enabler of next-generation power infrastructure, supporting utilities and grid operators in transitioning from conventional, centralized electricity networks to intelligent, data-driven energy systems. Smart grid sensors provide real-time visibility into grid performance, enabling advanced monitoring, predictive maintenance, fault detection, and efficient energy distribution across transmission and distribution networks.

In 2025, the global smart grid sensors market is valued at…

Top Companies in Architectural Lighting Market - Benchmarking Performance & Futu …

The architectural lighting market has evolved into a design-driven, technology-intensive segment of the global lighting industry. Beyond illumination, architectural lighting now plays a critical role in enhancing aesthetics, supporting energy efficiency goals, and enabling smart building environments. Demand is increasingly shaped by urban development, commercial real estate upgrades, hospitality projects, and public infrastructure modernization.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8342

Top Companies & Their Strategies

1. Signify (Philips Lighting)

Signify…

More Releases for PCB

Victory PCB Showcases High-Quality Double-Sided PCB Solutions for Modern Electro …

Victory PCB highlights the performance, flexibility, and cost-effectiveness of its double-sided printed circuit boards, designed to meet the demands of mid-complexity electronic systems.

Victory PCB, a professional printed circuit board manufacturer, continues to support modern electronics development through its high-quality double-sided PCB manufacturing solutions [https://www.victorypcb.com/products-category/double-sided-pcbs.html]. Designed to balance performance, reliability, and cost efficiency, Victory PCB's double-sided printed circuit boards are widely used across industries that require greater circuit density without the…

Victory PCB Expands Global Reach with Industry-Leading PCB Manufacturing & Assem …

Image: https://www.abnewswire.com/upload/2025/06/aa56d146ab76e34a4f335137dad3dd49.jpg

Victory PCB [https://www.victorypcb.com/], a global leader in printed circuit board (PCB) manufacturing and assembly, continues to set new benchmarks in high-quality PCB production, fast delivery, and customer service excellence. With a legacy of 19 years of innovation and precision manufacturing, Victory PCB is powering the next generation of industries, from automotive and medical equipment to aerospace and advanced communication devices.

Located in the heart of Shenzhen's modern Industrial Park, Victory…

Victory PCB: Pioneering Excellence in Global PCB Manufacturing and Assembly

Image: https://www.abnewswire.com/upload/2025/01/fabf105f8930f331e50cb1ca439637fe.jpg

Victory PCB [https://www.victorypcb.com/] is a renowned global manufacturer of PCBs and assembly services, recognized worldwide for its exceptional precision, innovation, and commitment to quality. With a client base exceeding thousands across various sectors, including automotive, aerospace, medical, industrial automation, and communication technologies, PCB solutions are tailored to meet each client's needs.

With centers covering as much as 30,000 square meters, Victory PCB employs over 450 staff dedicated to producing high-quality…

Victory PCB: Redefining Global Excellence in PCB Manufacturing and Assembly

Image: https://www.abnewswire.com/upload/2025/01/986e29984b844645f2a99a0a5e93a4c8.jpg

Having almost 20 years of expertise in producing and assembling printed circuit boards (PCBs), Victory PCB has established a solid reputation for providing high quality products, creative solutions, and consistent customer satisfaction. Victory PCB [https://www.victorypcb.com/], located in a contemporary 30,000-square-meter facility within Shenzhen's tech district, merges deep expertise with cutting-edge technology to manufacture products that bolster top industries worldwide. Relying on more than 1,000 clients and 80% of its…

Victory PCB Emerges as a Global Leader in PCB Manufacturing

Victory PCB has been delivering custom PCB solutions to global customers since 2005.

Image: https://www.abnewswire.com/uploads/3daf3e2d61300e7406f7fb61c56726fc.png

Victory PCB [https://www.victorypcb.com/], a professional printed circuit board (PCB) manufacturer established in 2005, is setting new standards in the global electronics industry with its commitment to top-quality, high-precision, and high-density PCB solutions. The solutions offered by Victory PCB, which exports 80% of its products worldwide, bridge the gap between concept and reality for clients in a variety…

PCB Ceramic Substrate Market Size, Share and Forecast By Key Players-Panda PCB T …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- According to the MRI Team's Market Research Intellect, the global PCB Ceramic Substrate market is anticipated to grow at a compound annual growth rate (CAGR) of 13.62% between 2024 and 2031. The market is expected to grow to USD 21.58 Billion by 2024. The valuation is expected to reach USD 52.73 Billion by 2031.

The PCB ceramic substrate market is experiencing robust growth, fueled by the rising demand…